Oregon Irrevocable Trust for Future Benefit of Trustor with Income Payable to Trustor after Specified Time

Description

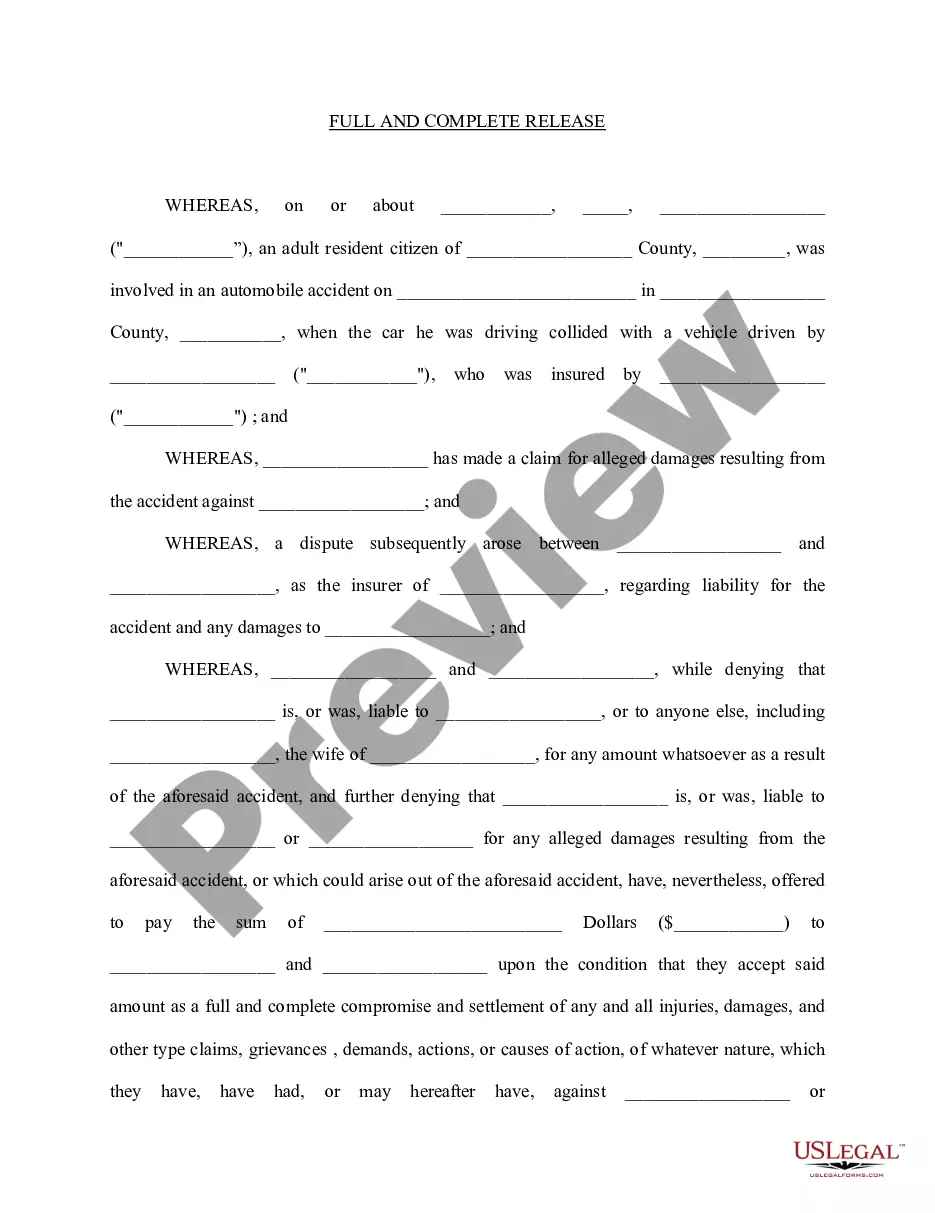

How to fill out Irrevocable Trust For Future Benefit Of Trustor With Income Payable To Trustor After Specified Time?

If you wish to total, obtain, or print out authorized papers web templates, use US Legal Forms, the biggest collection of authorized kinds, that can be found on-line. Utilize the site`s simple and easy handy search to obtain the paperwork you require. A variety of web templates for company and specific functions are categorized by classes and suggests, or search phrases. Use US Legal Forms to obtain the Oregon Irrevocable Trust for Future Benefit of Trustor with Income Payable to Trustor after Specified Time in a few clicks.

In case you are currently a US Legal Forms consumer, log in for your accounts and click the Download option to find the Oregon Irrevocable Trust for Future Benefit of Trustor with Income Payable to Trustor after Specified Time. You can even accessibility kinds you earlier downloaded in the My Forms tab of the accounts.

If you use US Legal Forms for the first time, follow the instructions beneath:

- Step 1. Make sure you have selected the form to the proper town/region.

- Step 2. Make use of the Preview solution to look over the form`s content. Never forget about to see the information.

- Step 3. In case you are not satisfied together with the form, make use of the Lookup area near the top of the screen to get other versions in the authorized form web template.

- Step 4. Upon having identified the form you require, click the Acquire now option. Select the prices prepare you choose and include your references to sign up to have an accounts.

- Step 5. Procedure the transaction. You can use your Мisa or Ьastercard or PayPal accounts to finish the transaction.

- Step 6. Pick the formatting in the authorized form and obtain it in your product.

- Step 7. Complete, modify and print out or sign the Oregon Irrevocable Trust for Future Benefit of Trustor with Income Payable to Trustor after Specified Time.

Every authorized papers web template you purchase is your own for a long time. You have acces to every form you downloaded within your acccount. Go through the My Forms section and choose a form to print out or obtain yet again.

Contend and obtain, and print out the Oregon Irrevocable Trust for Future Benefit of Trustor with Income Payable to Trustor after Specified Time with US Legal Forms. There are millions of professional and condition-particular kinds you may use for your personal company or specific demands.

Form popularity

FAQ

Generally, a trustee is the only person allowed to withdraw money from an irrevocable trust.

When a trust is irrevocable but some or all of the trust can be disbursed to or for the benefit of the individual, the look-back period applying to disbursements which could be made to or for the individual but are made to another person or persons is 36 months.

The trustee of an irrevocable trust can only withdraw money to use for the benefit of the trust according to terms set by the grantor, like disbursing income to beneficiaries or paying maintenance costs, and never for personal use.

Retained Interest Trusts This is a trust where a grantor makes an irrevocable transfer of assets but reserves the right to receive income or enjoyment of those assets for a period of time. When the trust then subsequently terminates, the assets are passed on to others.

The IRS requires that any gifts be made out of a trust be under the beneficiary's full control immediately. This present interest rule means that if a gift is made with conditions and the beneficiary does not have control over it at the time its made then it doesn't qualify for the annual exclusion amount.

To help you get started on understanding the options available, here's an overview the three primary classes of trusts.Revocable Trusts.Irrevocable Trusts.Testamentary Trusts.More items...?

Irrevocable trusts are primarily set up for estate and tax considerations. That's because it removes all incidents of ownership, removing the trust's assets from the grantor's taxable estate. It also relieves the grantor of the tax liability on the income generated by the assets.

The grantor (as an individual or couple) transfers their assets to an irrevocable trust. However, unlike other irrevocable trusts, the grantor can be the income beneficiary. Their children or spouse would be the residual beneficiaries.

The 65-day rule relates to distributions from complex trusts to beneficiaries made after the end of a calendar year. For the first 65 days of the following year, a distribution is considered to have been made in the previous year.

A credit shelter trust, also known as a bypass trust or a family trust, is a trust fund that allows the trustor to grant the recipients an amount of assets or funds up to the estate-tax exemption.