Oregon Sample Letter for Debt Collection

Description

How to fill out Sample Letter For Debt Collection?

Are you presently inside a position in which you require documents for either business or specific functions virtually every working day? There are a variety of legitimate file templates available online, but getting kinds you can depend on isn`t effortless. US Legal Forms offers a large number of develop templates, such as the Oregon Sample Letter for Debt Collection, that happen to be created in order to meet federal and state needs.

When you are presently informed about US Legal Forms site and get an account, just log in. Next, it is possible to obtain the Oregon Sample Letter for Debt Collection web template.

Should you not provide an bank account and wish to begin to use US Legal Forms, adopt these measures:

- Obtain the develop you want and make sure it is for that right area/state.

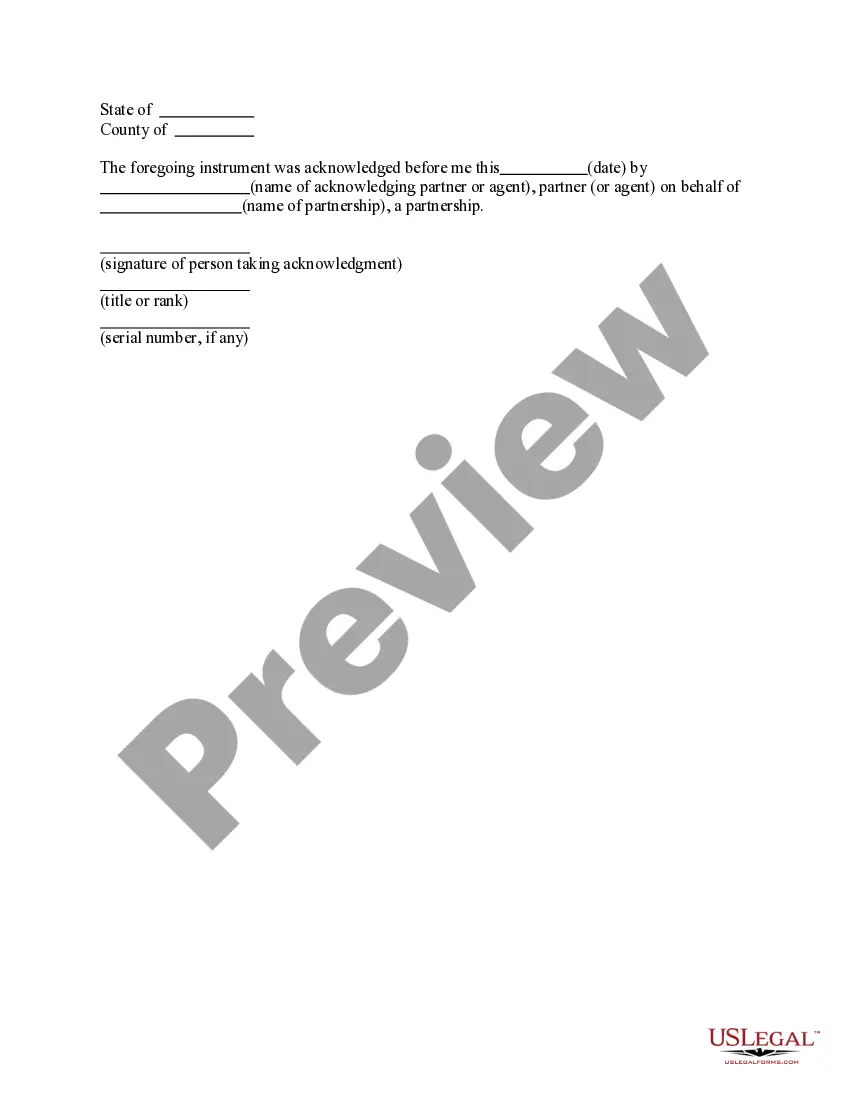

- Make use of the Preview button to check the form.

- Read the outline to ensure that you have chosen the right develop.

- When the develop isn`t what you are trying to find, take advantage of the Look for discipline to find the develop that suits you and needs.

- When you find the right develop, click Buy now.

- Opt for the costs program you desire, fill in the required info to produce your money, and pay for the transaction using your PayPal or charge card.

- Select a hassle-free paper file format and obtain your duplicate.

Find all of the file templates you might have bought in the My Forms menu. You can obtain a additional duplicate of Oregon Sample Letter for Debt Collection at any time, if possible. Just click on the essential develop to obtain or print out the file web template.

Use US Legal Forms, the most considerable selection of legitimate types, to conserve efforts and steer clear of faults. The service offers expertly made legitimate file templates which can be used for a selection of functions. Create an account on US Legal Forms and commence generating your way of life a little easier.

Form popularity

FAQ

This collection letter is another reminder that the amount of [include outstanding amount] due on [include due date] remains unpaid. Please pay this amount as soon as possible / within the stated time frame, X days from the date at the top of this collection letter [include payment instructions].

The letter typically includes the amount of debt, the date it was incurred, and consequences for non-payment like legal action or late fees. Debt collection letters are often the first step in the debt collection process.

Dear [RECIPIENT'S NAME], Despite our previous reminders, the above amount due remains unpaid. As such, we would appreciate you making this payment as soon as possible. We regret to advise that unless payment is received by [DATE] this collection will be passed over to our debt collection agency/lawyer.

Official collections letters. Reminder Collection Letter. Inquiry Collection Letter. Appeal collection Letter. Ultimatum Collection Letter.

If you are struggling with debt and debt collectors, Farmer & Morris Law, PLLC can help. As soon as you use the 11-word phrase ?please cease and desist all calls and contact with me immediately? to stop the harassment, call us for a free consultation about what you can do to resolve your debt problems for good.

An effective debt collection letter should include all of the following: The total amount the client owes you. The original date the balance was due. Instructions detailing how to make the overdue payment. The new due date, whether a specific date or as soon as possible.

A debt collection letter should include elements such as the debt owed, the initial due date and, if necessary, warnings of impending legal action.

I am requesting that you provide verification of this debt. Please send the following information: The name and address of the original creditor, the account number, and the amount owed. Verification that there is a valid basis for claiming I am required to pay the current amount owed.