Title: Exploring the Oregon Consumer Equity Sheet: A Comprehensive Overview Introduction: The Oregon Consumer Equity Sheet is a valuable financial tool that aims to assess and improve the financial well-being of consumers residing in the state of Oregon. This comprehensive resource encompasses various types and benefits, providing individuals with the means to evaluate their economic health and make informed financial decisions. In this article, we will delve into the key aspects of the Oregon Consumer Equity Sheet and explore its various types and benefits. 1. What is the Oregon Consumer Equity Sheet? The Oregon Consumer Equity Sheet is a document that offers a comprehensive snapshot of an individual's financial equity and resources. It serves as a valuable tool for consumers, empowering them to analyze their financial circumstances, make informed decisions, and plan for a secure future. 2. Types of Oregon Consumer Equity Sheets: a) Personal Consumer Equity Sheet: This type of equity sheet focuses on assessing an individual's personal financial situation. It includes details such as income, expenses, debts, assets, and liabilities. By analyzing this information, individuals can determine their net worth and track progress towards their financial goals. b) Business Consumer Equity Sheet: Designed for entrepreneurs and business owners, this equity sheet evaluates the financial health of a business entity. It includes data on revenues, expenses, assets, liabilities, and equity. This sheet assists in assessing the sustainability and profitability of a business, aiding strategic decision-making. 3. Key Components of the Oregon Consumer Equity Sheet: a) Income Analysis: The equity sheet analyzes the individual's income sources, ensuring a comprehensive evaluation of their financial stability and potential for savings. b) Expense Evaluation: This section assists in tracking the individual's monthly expenditures, identifying potential areas for budgeting and saving. c) Debt Assessment: By thoroughly examining outstanding debts such as loans, credit cards, and mortgages, the equity sheet reveals the individual's level of financial obligations and their impact on overall equity. d) Asset Evaluation: This component focuses on assessing the value of an individual's assets, including properties, investments, and other valuable possessions, aiding in determining net worth. e) Liabilities Identification: This section outlines an individual's financial obligations, including loans and other debts, providing a comprehensive view of their liabilities. 4. Benefits of the Oregon Consumer Equity Sheet: a) Financial Analysis: By analyzing the data within the equity sheet, individuals can gain a deeper understanding of their financial standing, enabling them to make informed decisions and adjust their financial strategies accordingly. b) Goal Planning: The equity sheet helps individuals set realistic financial goals and track their progress over time, facilitating effective planning for future financial milestones. c) Debt Management: By identifying and assessing outstanding debts, individuals can develop repayment strategies and work towards achieving financial freedom. d) Obtain Loans or Credit: Lenders often require detailed financial information to evaluate creditworthiness. An updated equity sheet can be used as a supporting document when seeking loans or credit. Conclusion: The Oregon Consumer Equity Sheet is a powerful financial resource that can significantly improve an individual's understanding of their financial situation. By offering crucial insights into income, expenses, debts, assets, and liabilities, it empowers consumers and businesses alike to make informed decisions and take active steps towards long-term financial security. Regular assessment and utilization of the Oregon Consumer Equity Sheet can lead to better financial planning, debt management, and overall fiscal wellness.

Oregon Consumer Equity Sheet

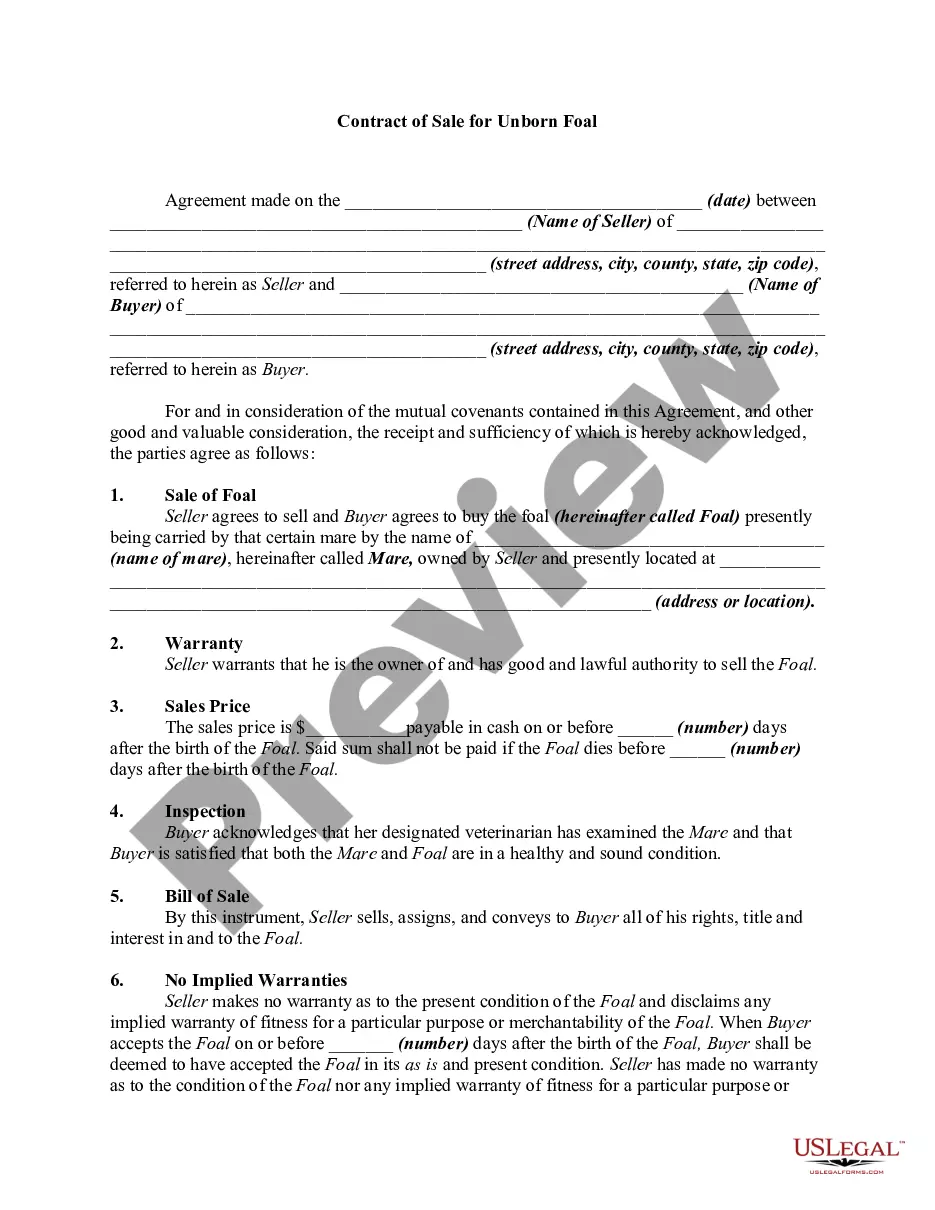

Description

How to fill out Oregon Consumer Equity Sheet?

Are you currently in a position the place you will need documents for sometimes business or specific reasons almost every working day? There are plenty of legitimate record layouts available on the net, but getting kinds you can trust isn`t simple. US Legal Forms provides a large number of develop layouts, just like the Oregon Consumer Equity Sheet, which are composed to satisfy state and federal specifications.

In case you are previously knowledgeable about US Legal Forms site and get your account, simply log in. Next, you can obtain the Oregon Consumer Equity Sheet design.

Should you not come with an account and would like to start using US Legal Forms, abide by these steps:

- Get the develop you want and make sure it is for that correct city/state.

- Make use of the Preview switch to analyze the shape.

- See the information to actually have selected the right develop.

- In case the develop isn`t what you are seeking, take advantage of the Research area to get the develop that meets your needs and specifications.

- Whenever you find the correct develop, click on Buy now.

- Choose the costs plan you desire, fill out the necessary details to produce your account, and buy the order utilizing your PayPal or bank card.

- Choose a handy document structure and obtain your duplicate.

Get every one of the record layouts you might have bought in the My Forms food list. You can get a additional duplicate of Oregon Consumer Equity Sheet any time, if needed. Just go through the essential develop to obtain or produce the record design.

Use US Legal Forms, the most comprehensive collection of legitimate varieties, in order to save time and prevent blunders. The services provides expertly created legitimate record layouts that you can use for an array of reasons. Make your account on US Legal Forms and commence producing your way of life a little easier.