Oregon Breakdown of Savings for Budget and Emergency Fund

Description

How to fill out Breakdown Of Savings For Budget And Emergency Fund?

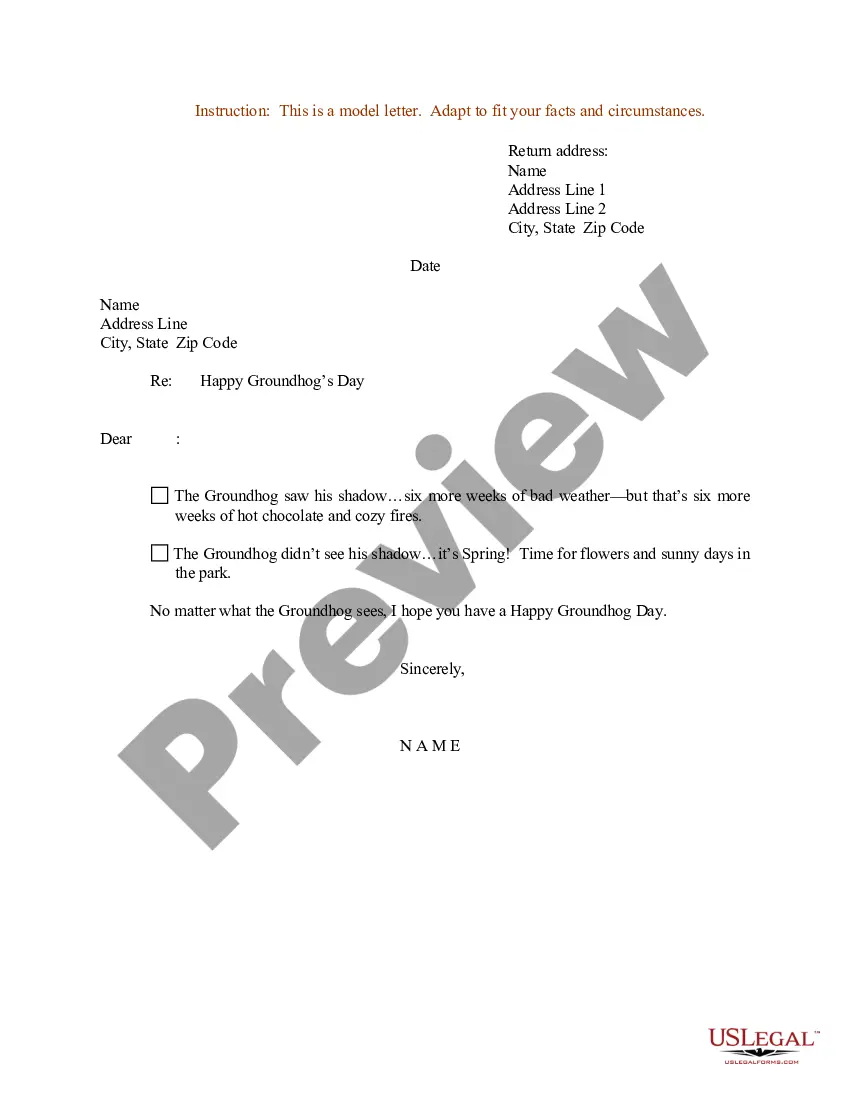

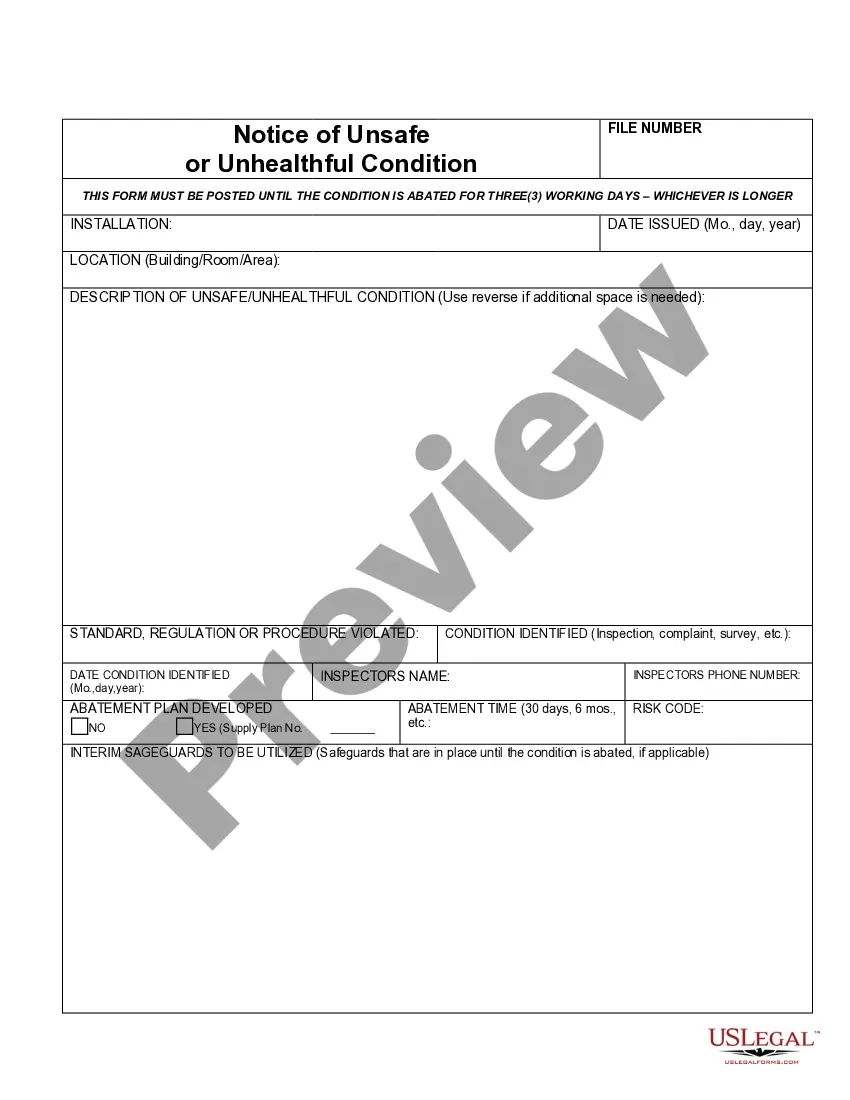

You can invest time online trying to locate the appropriate legal document template that complies with the state and federal standards you require.

US Legal Forms offers a vast array of legal forms that have been vetted by experts.

You are able to obtain or print the Oregon Breakdown of Savings for Budget and Emergency Fund from their platform.

First, ensure you have selected the correct document template for your desired state/city. Review the form description to confirm you have chosen the accurate form. If available, utilize the Preview button to view the document template as well.

- If you already have a US Legal Forms account, you can Log In and click on the Download button.

- After that, you can complete, modify, print, or sign the Oregon Breakdown of Savings for Budget and Emergency Fund.

- Every legal document template you acquire is your property indefinitely.

- To obtain another copy of the acquired form, go to the My documents section and click on the appropriate button.

- If you are using the US Legal Forms site for the first time, follow the simple instructions below.

Form popularity

FAQ

While the size of your emergency fund will vary depending on your lifestyle, monthly costs, income, and dependents, the rule of thumb is to put away at least three to six months' worth of expenses.

Having savings set aside in an emergency fund provides a great source of comfort should something unforeseen like job loss or illness happens.

Aim to save three to six months' worth of expenses in your emergency fund.

It's all about your personal expenses Those include things like rent or mortgage payments, utilities, healthcare expenses, and food. If your monthly essentials come to $2,500 a month, and you're comfortable with a four-month emergency fund, then you should be set with a $10,000 savings account balance.

While the size of your emergency fund will vary depending on your lifestyle, monthly costs, income, and dependents, the rule of thumb is to put away at least three to six months' worth of expenses.

An emergency fund is a cash reserve that's specifically set aside for unplanned expenses or financial emergencies. Some common examples include car repairs, home repairs, medical bills, or a loss of income.

An emergency fund is necessary for peace of mind and smoothing out financial bumps in the road. Let's look at the average emergency fund size by age and how much we should have. According to Federal Reserve data, the average savings amount is $8,863 in America as of 2019.

How much should you save in your emergency fund? Most financial experts recommend that you have somewhere between three months and six months of basic living expenses in your emergency fund. The three-month guideline is generally recommended for those who are in salaried positions and have more secure employment.

An emergency fund is an essential corpus that you must keep aside to tackle emergencies. It is a fund that you can fall back on at the hour of crisis or for unexpected and unplanned scenarios, and not for meeting your routine expenses.

Start an emergency fund with no minimum balance. A high-yield savings account might be the best place to keep your emergency fund. Not only are your funds accessible in this type of bank account, but you'll also earn interest on your deposits.