The Oregon Certificate of Borrower is an important document that pertains to commercial loans taken by individuals or businesses in the state of Oregon. This certificate serves as a declaration and verification of the borrower's details, ensuring transparency and trust between the borrower and lender. It is crucial for both parties involved in a commercial loan transaction to understand the various types of Oregon Certificates of Borrower to effectively navigate the loan process. One common type of Oregon Certificate of Borrower is the Individual Borrower Certificate, required when an individual acts as the borrower for a commercial loan. This certificate includes relevant details such as the borrower's legal name, contact information, social security number, and personal financial statements. Lenders use this information to evaluate the borrower's creditworthiness and determine the loan terms. Another type of Oregon Certificate of Borrower is the Corporate Borrower Certificate, which is necessary when a corporation or a limited liability company (LLC) is the borrower. This certificate includes the legal name of the corporation or LLC, its business address, identification numbers (such as a Federal Employer Identification Number), and financial statements. Lenders rely on this information to assess the financial stability and capacity of the corporate borrower. The Oregon Certificate of Borrower may also include additional types, depending on the specific circumstances of the commercial loan. For instance, there might be a Partnership Borrower Certificate for partnerships or a Trust Borrower Certificate for borrowers established as trusts. These certificates similarly request relevant information about the borrowers involved. When completing an Oregon Certificate of Borrower, it is crucial to provide accurate and up-to-date information to avoid any potential legal or financial complications. Moreover, borrowers must understand the terms and conditions outlined in the certificate to ensure compliance with the lender's requirements. In summary, the Oregon Certificate of Borrower regarding Commercial Loan is a vital document that allows lenders to assess an individual or entity's suitability for a commercial loan. Different types of certificates exist depending on the borrower's legal structure, including Individual Borrower Certificate, Corporate Borrower Certificate, Partnership Borrower Certificate, and Trust Borrower Certificate. By completing the appropriate certificate accurately, borrowers can establish transparency and trust in their commercial loan transactions.

Oregon Certificate of Borrower regarding Commercial Loan

Description

How to fill out Oregon Certificate Of Borrower Regarding Commercial Loan?

If you want to comprehensive, download, or print out legal papers web templates, use US Legal Forms, the largest assortment of legal kinds, that can be found on-line. Utilize the site`s simple and easy practical lookup to obtain the files you want. Different web templates for enterprise and personal functions are sorted by groups and suggests, or key phrases. Use US Legal Forms to obtain the Oregon Certificate of Borrower regarding Commercial Loan in just a couple of clicks.

If you are previously a US Legal Forms consumer, log in to your profile and click the Download option to get the Oregon Certificate of Borrower regarding Commercial Loan. Also you can entry kinds you earlier downloaded inside the My Forms tab of your profile.

If you use US Legal Forms for the first time, refer to the instructions listed below:

- Step 1. Ensure you have selected the form for that proper town/country.

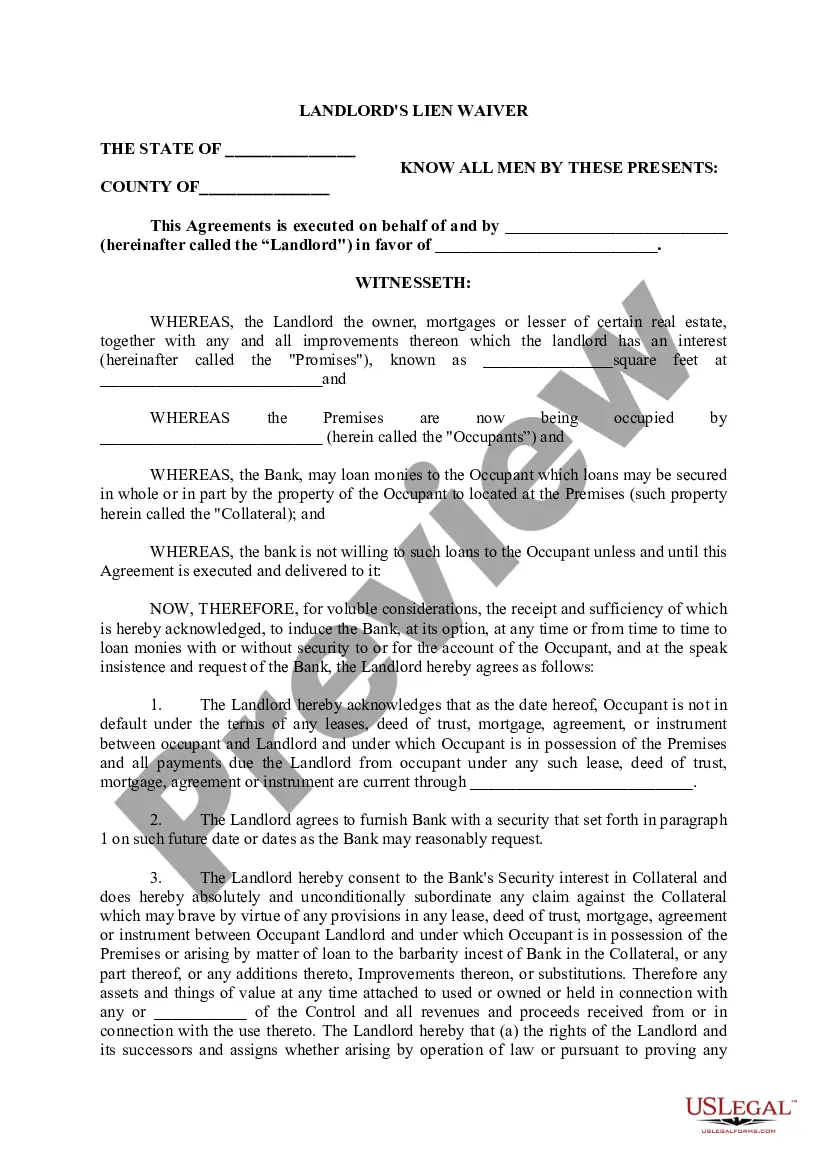

- Step 2. Utilize the Preview method to examine the form`s content. Don`t forget to learn the outline.

- Step 3. If you are not happy with all the form, use the Lookup area near the top of the screen to discover other models of your legal form format.

- Step 4. Upon having identified the form you want, click on the Buy now option. Choose the prices prepare you prefer and add your qualifications to sign up for the profile.

- Step 5. Approach the deal. You may use your credit card or PayPal profile to accomplish the deal.

- Step 6. Pick the file format of your legal form and download it on your system.

- Step 7. Comprehensive, edit and print out or indicator the Oregon Certificate of Borrower regarding Commercial Loan.

Each and every legal papers format you buy is your own property permanently. You might have acces to every form you downloaded inside your acccount. Click on the My Forms portion and select a form to print out or download again.

Compete and download, and print out the Oregon Certificate of Borrower regarding Commercial Loan with US Legal Forms. There are many professional and condition-particular kinds you may use for your enterprise or personal needs.

Form popularity

FAQ

Complete 20 hours of pre-licensure education, including fours hours of Oregon specific education. Pass the national test with uniform state content. Submit an application through NMLS (MU4 form) Have a surety bond or be covered by the company's surety bond using the scale provided for in Oregon law.

The Division of Financial Regulation has regulatory authority over mortgage brokers, lenders, independent processor contractors, and mortgage loan originators conducting business in Oregon. Mortgage brokers and lenders are required to obtain a license as a mortgage lender in Oregon.

The Division of Financial Regulation has regulatory authority over mortgage brokers, lenders, independent processor contractors, and mortgage loan originators conducting business in Oregon. Mortgage brokers and lenders are required to obtain a license as a mortgage lender in Oregon.

Applicant requirements Complete 20 hours of pre-licensure education, including fours hours of Oregon-specific education. Pass the national test with uniform state content. Have a surety bond or be covered by the company's surety bond using the scale provided for in Oregon law. Submit an application through NMLS (MU4 form).

Mortgage lenders can make money in a variety of ways, including origination fees, yield spread premiums, discount points, closing costs, mortgage-backed securities (MBS), and loan servicing. Closing costs fees that lenders may make money from include application, processing, underwriting, loan lock, and other fees.

7 steps to starting your own mortgage company Meet the mortgage licensing requirements. ... Pass the SAFE mortgage loan originator test. ... Create your business plan. ... Register the business entity. ... Obtain your mortgage broker surety bond. ... Set up your office space. ... Market your new business.