Oregon Challenge to Credit Report of Experian, TransUnion, and/or Equifax is a process where Oregon residents have the right to dispute any errors or inaccuracies they find on their credit reports provided by Experian, TransUnion, and/or Equifax. By exercising this right, individuals are able to correct any discrepancies that may negatively impact their credit scores and overall financial standing. The Oregon Challenge to Credit Report can be initiated for various reasons such as incorrect personal information, erroneous account details, fraudulent activity, or outdated payment history. This process plays a crucial role in ensuring fair credit reporting practices by the major credit bureaus and protecting consumers from potential financial harm. To initiate an Oregon Challenge to Credit Report, individuals must gather relevant documents and evidence to support their claim. This may include copies of bills, bank statements, or any other documentation that can verify their position. It is important to thoroughly review the credit report from Experian, TransUnion, and/or Equifax prior to filing a challenge and make note of any inaccuracies. Once the necessary documentation has been collected, individuals can proceed with the challenge by submitting a written dispute to Experian, TransUnion, and/or Equifax. The dispute should clearly state the details of the error and include any supporting evidence. It is advisable to send the dispute via certified mail with a return receipt to ensure proof of delivery. Upon receiving the dispute, the credit bureaus are obligated to conduct an investigation within a specific timeframe, typically 30 days, as mandated by the Fair Credit Reporting Act (FCRA). During this investigation, they will contact the relevant creditors or lenders to verify the accuracy of the reported information. If the information is found to be inaccurate or unable to be verified, the credit bureaus are legally required to correct or remove the erroneous data from the credit report. In Oregon, there are different types of challenges that individuals can pursue, including: 1. Disputing inaccurate personal information: This type of challenge involves incorrect details such as name misspellings, wrong addresses, or phone numbers. These errors can arise due to clerical mistakes or data entry errors. 2. Challenging incorrect account information: This type of challenge deals with inaccuracies in account balances, payment history, or credit limits. It is essential to ensure that these details accurately reflect an individual's financial history to avoid any negative impact on creditworthiness. 3. Addressing fraudulent activity: If an individual detects fraudulent accounts or unauthorized transactions on their credit report, they should immediately file a challenge. This includes instances of identity theft or accounts opened in the individual's name without their consent. 4. Correcting outdated or obsolete information: Certain negative information, such as late payments or collections, may disappear from a credit report after a set period of time. If such information remains on the report beyond the legally mandated time limit, individuals can challenge its presence and request removal. It is crucial for Oregon residents to exercise their right to challenge their credit reports with Experian, TransUnion, and/or Equifax to ensure the accuracy of their credit information. By doing so, they can maintain a healthy credit profile, increase their chances of obtaining favorable loan terms, and avoid potential financial setbacks.

Oregon Challenge to Credit Report of Experian, TransUnion, and/or Equifax

Description

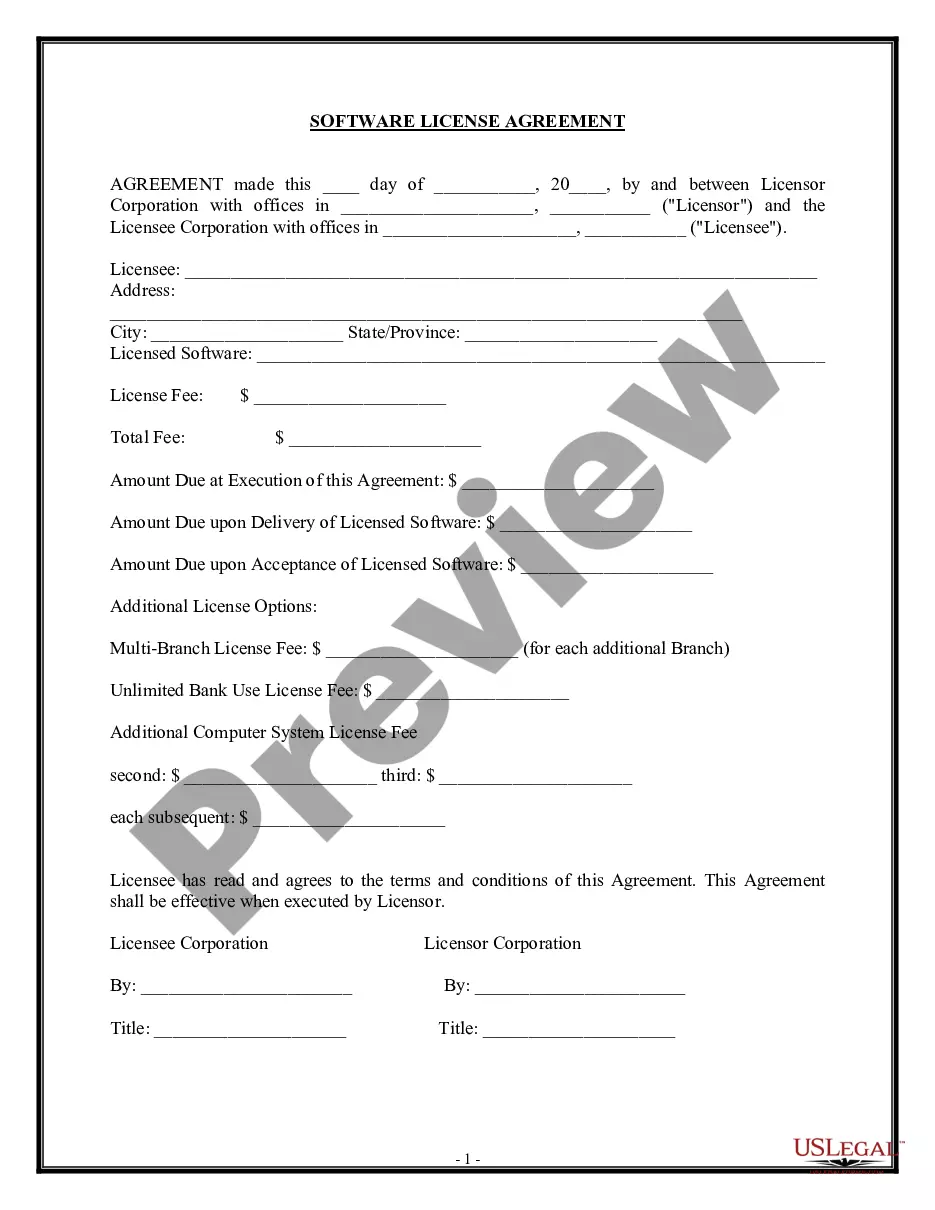

How to fill out Oregon Challenge To Credit Report Of Experian, TransUnion, And/or Equifax?

Choosing the right authorized file web template could be a battle. Naturally, there are plenty of templates available on the Internet, but how can you discover the authorized type you need? Take advantage of the US Legal Forms website. The service gives 1000s of templates, including the Oregon Challenge to Credit Report of Experian, TransUnion, and/or Equifax, that can be used for company and personal requirements. All of the forms are checked by experts and meet state and federal needs.

In case you are currently authorized, log in to your accounts and click on the Obtain button to get the Oregon Challenge to Credit Report of Experian, TransUnion, and/or Equifax. Use your accounts to check with the authorized forms you might have purchased earlier. Visit the My Forms tab of your own accounts and have yet another copy in the file you need.

In case you are a new user of US Legal Forms, here are simple guidelines that you should adhere to:

- Very first, ensure you have chosen the proper type for the area/region. You may check out the form utilizing the Preview button and browse the form description to make sure it will be the right one for you.

- When the type is not going to meet your expectations, make use of the Seach industry to discover the correct type.

- Once you are positive that the form is suitable, click on the Purchase now button to get the type.

- Opt for the costs program you want and enter the needed info. Build your accounts and pay money for an order with your PayPal accounts or Visa or Mastercard.

- Choose the file structure and down load the authorized file web template to your device.

- Comprehensive, revise and printing and sign the received Oregon Challenge to Credit Report of Experian, TransUnion, and/or Equifax.

US Legal Forms will be the most significant collection of authorized forms for which you can see a variety of file templates. Take advantage of the company to down load expertly-manufactured papers that adhere to condition needs.