Title: Oregon Joint-Venture Agreement — Speculation in Real Estate: Your Comprehensive Guide Introduction: In the world of real estate investment, joint-venture agreements have emerged as a popular strategy for individuals and businesses to collaborate on profitable ventures. Specifically, in Oregon, joint-venture agreements have gained traction due to the prospects offered by speculative real estate investments. This article aims to provide a detailed description of the Oregon Joint-Venture Agreement — Speculation in Real Estate, highlighting its key aspects, benefits, and types. Key Keywords: Oregon, Joint-Venture Agreement, Speculation, Real Estate, Types 1. Understanding the Oregon Joint-Venture Agreement: A joint-venture agreement in the context of the Oregon real estate market refers to a legally binding contract between two or more parties (individuals or organizations) that outlines the terms and conditions under which they will jointly invest in and profit from a speculative real estate project. 2. Speculation in Real Estate: Speculative real estate investments involve acquiring properties with the expectation of future price appreciation or development potential. These ventures often come with inherent risks but can result in substantial financial gains for investors willing to take calculated risks. 3. Key Aspects of an Oregon Joint-Venture Agreement: a. Investment Contributions: The agreement should clearly define each party's financial and non-financial contributions to the joint venture. This includes capital investment, expertise, resources, or sweat equity. b. Profit Sharing: The percentage of profits each party is entitled to should be detailed, considering factors like initial investment, ongoing expenses, and risks taken. c. Decision-making and Control: Specify how decision-making responsibilities, including property selection, management, and sale, will be allocated among the parties. d. Duration and Exit Strategy: Clearly outline the duration of the joint venture and the process by which parties can exit the agreement, such as through buyout provisions or predetermined timelines. 4. Benefits of an Oregon Joint-Venture Agreement: a. Mitigation of Risks: By pooling resources and expertise, joint ventures can mitigate risks associated with speculative real estate investments. b. Access to Capital: Joint ventures provide participants with increased access to capital by combining their financial resources, enabling them to undertake larger and potentially more lucrative projects. c. Diversification: Working with partners allows investors to diversify their portfolios across various types of real estate projects, reducing the overall risk exposure. d. Enhanced Expertise: Collaboration allows participants to tap into each other's unique skill sets, knowledge, and experience, increasing the likelihood of successful outcomes. 5. Types of Oregon Joint-Venture Agreements — Speculation in Real Estate: a. Land Development Joint Venture: Partners pool resources to purchase and develop undeveloped land, focusing on future appreciation through rezoning or infrastructure development. b. Fix and Flip Joint Venture: Participants jointly invest in distressed properties, coordinate renovation efforts, and sell them for a profit. c. Property Investment Joint Venture: Parties invest in income-generating properties (e.g., rental properties), aiming for cash flow and long-term appreciation. d. Real Estate Development Joint Venture: Collaboration focused on large-scale development projects like commercial complexes, residential communities, or mixed-use properties. Conclusion: Oregon Joint-Venture Agreements for Speculation in Real Estate present lucrative opportunities for investors to harness the potential of speculative real estate investments while mitigating risks. By understanding the key aspects, benefits, and different types of joint ventures specific to Oregon, individuals and businesses can make informed decisions to maximize their profits and succeed in the dynamic real estate market.

70 30 Partnership Agreement Template

Description

How to fill out Oregon Joint-Venture Agreement - Speculation In Real Estate?

If you wish to total, download, or print lawful record themes, use US Legal Forms, the biggest assortment of lawful forms, that can be found on the Internet. Make use of the site`s simple and easy convenient lookup to find the documents you need. Various themes for business and individual reasons are categorized by classes and states, or keywords. Use US Legal Forms to find the Oregon Joint-Venture Agreement - Speculation in Real Estate within a number of mouse clicks.

Should you be currently a US Legal Forms client, log in to your account and then click the Obtain switch to obtain the Oregon Joint-Venture Agreement - Speculation in Real Estate. You can even access forms you formerly downloaded within the My Forms tab of your account.

Should you use US Legal Forms initially, refer to the instructions beneath:

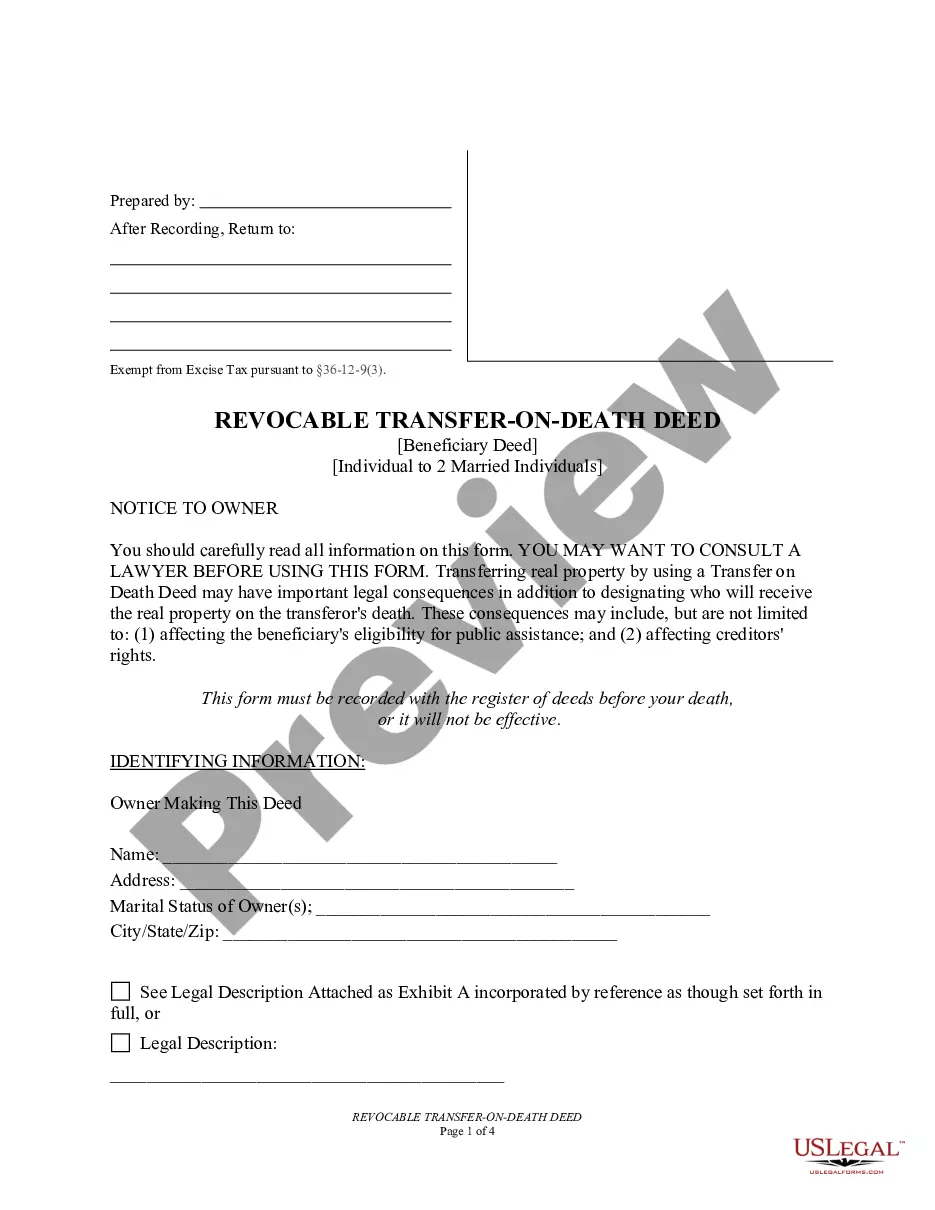

- Step 1. Make sure you have selected the shape to the right area/country.

- Step 2. Take advantage of the Review choice to examine the form`s information. Don`t neglect to read the outline.

- Step 3. Should you be not happy using the kind, take advantage of the Search industry near the top of the screen to discover other types of the lawful kind design.

- Step 4. When you have found the shape you need, click the Get now switch. Opt for the prices program you like and add your accreditations to sign up for an account.

- Step 5. Approach the purchase. You should use your charge card or PayPal account to complete the purchase.

- Step 6. Pick the structure of the lawful kind and download it on your product.

- Step 7. Complete, edit and print or indication the Oregon Joint-Venture Agreement - Speculation in Real Estate.

Each lawful record design you get is the one you have for a long time. You may have acces to each and every kind you downloaded within your acccount. Go through the My Forms area and decide on a kind to print or download once again.

Be competitive and download, and print the Oregon Joint-Venture Agreement - Speculation in Real Estate with US Legal Forms. There are thousands of specialist and condition-particular forms you can utilize for your business or individual needs.

Form popularity

FAQ

Bringing on a joint venture (JV) partner for a real estate investor is a major decision. Partners can infuse capital and help take your business to the next level. In fact, many investors believe that creating a partnership is the best business decision they ever made.

In the property market, a joint venture is a temporary but formalised partnership of builders, finance houses and developers, which contract with each other for a particular development project, such as a housing estate, often through the creation of a temporary subsidiary company called a Special Purpose Vehicle (SPV)

In a joint venture between two corporations, each corporation invents an agreed upon portion of capital or resources to fund the venture. A joint venture may have a 50-50 ownership split, or another split like 60-40 or 70-30.

A joint venture can be structured as a separate business entity or simply grow out of a contract between the parties. Unlike a partnership, a joint venture is typically temporary, dissolving after the task is complete.

The common elements necessary to establish the existence of a joint venture are an express or implied contract, which includes the following elements: (1) a community of interest in the performance of the common purpose; (2) joint control or right of control; (3) a joint proprietary interest in the subject matter; (4)

What is included in a Joint Venture Agreement?Business location.The type of joint venture.Venture details, such as its name, address, purpose, etc.Start and end date of the joint venture.Venture members and their capital contributions.Member duties and obligations.Meeting and voting details.More items...

A joint venture in real estate is when two or more investors combine their resources for a property development or investment. Despite working together, each party maintains their own unique business identity while working together on a deal.

Commercial real estate can be an excellent diversifier to an existing investment portfolio. Investors with significant capital may consider investing in real estate through a joint venture.

Structure of a Real Estate Joint Venture In most cases, the operating member and the capital member of the real estate joint venture set up the Real Estate project as an independent limited liability company (LLC). The parties sign the joint venture agreement, which details the conditions of the joint venture.

A real estate joint venture contract is an agreement between two or more individuals or businesses who have decided to put their money and other resources together to purchase real estate.