Oregon Jury Instruction - 10.10.4 Business Loss vs. Hobby Loss

Description

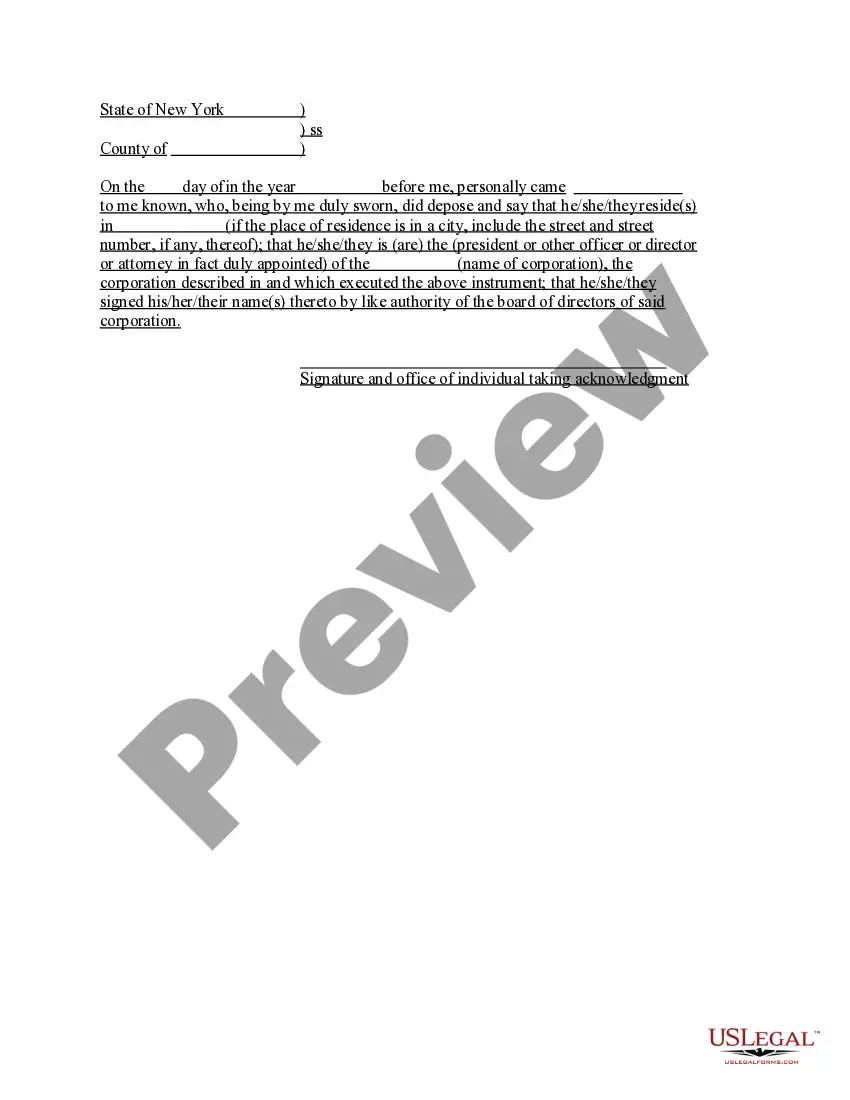

How to fill out Jury Instruction - 10.10.4 Business Loss Vs. Hobby Loss?

US Legal Forms - one of several largest libraries of legitimate types in the USA - offers a variety of legitimate papers themes you are able to download or print. While using site, you can get a huge number of types for business and specific purposes, categorized by types, says, or keywords and phrases.You will discover the newest versions of types just like the Oregon Jury Instruction - 10.10.4 Business Loss vs. Hobby Loss within minutes.

If you already have a monthly subscription, log in and download Oregon Jury Instruction - 10.10.4 Business Loss vs. Hobby Loss from the US Legal Forms catalogue. The Acquire switch can look on every single form you see. You gain access to all earlier delivered electronically types from the My Forms tab of your respective accounts.

If you wish to use US Legal Forms initially, listed here are straightforward directions to help you started:

- Make sure you have selected the correct form to your area/state. Click the Review switch to analyze the form`s content material. Look at the form explanation to actually have chosen the right form.

- When the form doesn`t match your needs, take advantage of the Research industry on top of the screen to discover the one which does.

- If you are content with the shape, confirm your option by visiting the Acquire now switch. Then, pick the costs strategy you want and offer your credentials to register for an accounts.

- Approach the transaction. Utilize your Visa or Mastercard or PayPal accounts to complete the transaction.

- Pick the structure and download the shape in your product.

- Make alterations. Complete, change and print and indicator the delivered electronically Oregon Jury Instruction - 10.10.4 Business Loss vs. Hobby Loss.

Every single design you included with your money lacks an expiration day and is your own for a long time. So, if you want to download or print another duplicate, just visit the My Forms portion and then click on the form you need.

Obtain access to the Oregon Jury Instruction - 10.10.4 Business Loss vs. Hobby Loss with US Legal Forms, by far the most extensive catalogue of legitimate papers themes. Use a huge number of professional and express-certain themes that satisfy your organization or specific demands and needs.