The Oregon Letter of Notice to Borrower of Assignment of Mortgage is a legal document that informs a borrower about the assignment or transfer of their mortgage loan to another party. It serves as an official notice, outlining the details of the assignment and providing the borrower with essential information regarding the new lender or service. This letter is an important communication in the mortgage loan process, ensuring transparency and adherence to the legal requirements for transferring loans. It is generally sent by the original lender or the new assignee to the borrower following the assignment of the mortgage. The content of the Oregon Letter of Notice to Borrower of Assignment of Mortgage typically includes: 1. Title and Heading: The letter will clearly state "Letter of Notice to Borrower of Assignment of Mortgage" or a similar title to indicate its purpose. 2. Identification Information: The letter will include the name, address, and contact details of the borrower, as well as information about the original lender and the new assignee. 3. Effective Assignment Date: The letter will specify the effective date of the assignment, which is the date when the new assignee takes over as the lender or service. 4. Loan Details: The letter will contain comprehensive information about the mortgage loan, including the loan number, the original loan amount, terms, interest rate, and any other relevant terms and conditions. 5. New Lender/Service Details: The letter will provide the borrower with the name, address, and contact details of the new lender or service who has assumed the responsibility for managing the mortgage. 6. Payment Instructions: The letter will provide clear instructions regarding the future payment process. It will inform the borrower where to send the monthly mortgage payments and provide any new account numbers or payment methods. 7. Assumption of Rights and Obligations: The letter will inform the borrower that the new assignee has acquired all rights and responsibilities associated with the mortgage loan, including the right to collect payments and the obligation to provide assistance and address any concerns. 8. Borrower's Rights: The letter will outline the borrower's rights, including the right to request additional information about the assignment, dispute errors, or make complaints if necessary. 9. Contact Information and Support: The letter will provide contact information for the new lender or service, including phone numbers and email addresses, to facilitate communication and assistance throughout the loan term. Types of Oregon Letters of Notice to Borrower of Assignment of Mortgage: 1. Standard Oregon Letter of Notice to Borrower of Assignment of Mortgage: This is the most common type of letter used to inform borrowers about the transfer of their mortgage. It follows the general format and includes all the necessary information mentioned above. 2. Modified Oregon Letter of Notice to Borrower of Assignment of Mortgage: In certain cases, lenders or services may modify the letter to include additional instructions or details specific to the borrower's situation. These modifications, if any, will be clearly outlined within the letter. Remember, it is important to consult with legal professionals or experts familiar with Oregon state regulations to ensure compliance and accuracy when drafting or using the Oregon Letter of Notice to Borrower of Assignment of Mortgage.

Oregon Letter of Notice to Borrower of Assignment of Mortgage

Description

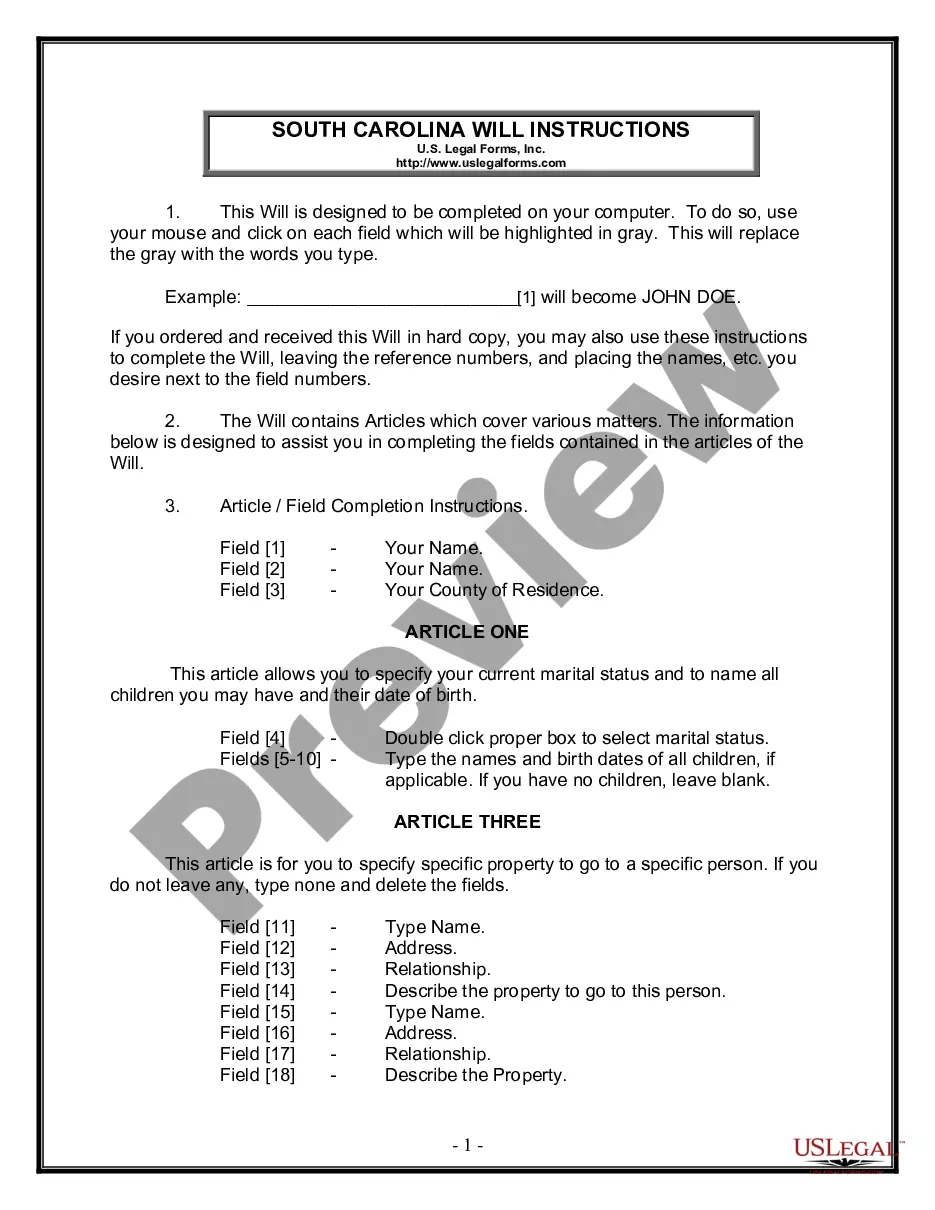

How to fill out Oregon Letter Of Notice To Borrower Of Assignment Of Mortgage?

Choosing the best legitimate file template can be quite a have a problem. Naturally, there are a variety of templates available online, but how would you get the legitimate kind you will need? Use the US Legal Forms internet site. The services delivers 1000s of templates, for example the Oregon Letter of Notice to Borrower of Assignment of Mortgage, which can be used for organization and private needs. Each of the forms are examined by pros and fulfill federal and state requirements.

In case you are already signed up, log in for your profile and click on the Down load key to find the Oregon Letter of Notice to Borrower of Assignment of Mortgage. Use your profile to look throughout the legitimate forms you possess acquired in the past. Go to the My Forms tab of your profile and acquire yet another version of your file you will need.

In case you are a whole new customer of US Legal Forms, listed here are simple guidelines for you to follow:

- Very first, ensure you have selected the proper kind to your metropolis/region. You are able to check out the shape utilizing the Review key and browse the shape outline to ensure this is the best for you.

- In case the kind will not fulfill your needs, utilize the Seach discipline to obtain the right kind.

- When you are positive that the shape is suitable, go through the Buy now key to find the kind.

- Opt for the prices strategy you desire and type in the needed information. Create your profile and pay for the order utilizing your PayPal profile or bank card.

- Select the file format and download the legitimate file template for your device.

- Comprehensive, revise and produce and indicator the received Oregon Letter of Notice to Borrower of Assignment of Mortgage.

US Legal Forms may be the most significant catalogue of legitimate forms for which you will find various file templates. Use the service to download expertly-created files that follow status requirements.

Form popularity

FAQ

An assignment of mortgage is a legal term that refers to the transfer of the security instrument that underlies your mortgage loan ? aka your home. When a lender sells the mortgage on, an investor effectively buys the note, and the mortgage is assigned to them at this time.

A release assignment or satisfaction of mortgage form is a document stating that the lender has released the homeowner from all liability regarding her mortgage.

Mortgages are assigned using a document called an assignment of mortgage. This legally transfers the original lender's interest in the loan to the new company. After doing this, the original lender will no longer receive the payments of principal and interest.

A recorded mortgage must be discharged by a certificate signed by the mortgagee, his personal representatives or assigns, acknowledged or proved and certified as prescribed by the chapter on ?recording transfers,? stating that the mortgage has been paid, satisfied, or discharged.

If it does not have an assignment or failed to record it as required by state law, this may result in the dismissal of the foreclosure action. Recording rules may require that the foreclosing party record the assignment before starting the foreclosure.

An assignment of mortgage gives the loan seller's rights under the mortgage, including the right to foreclose if the borrower doesn't make payments, to the new owner of the loan.

An "assignment" is the document that is the legal record of this transfer from one mortgagee to another. In a typical transaction, when the mortgagee sells the debt to another bank, an assignment is recorded, and the promissory note is endorsed (signed over) to the new bank.