The Oregon Business Trust is a legal entity that exists under the laws of Oregon, United States. It is a unique trust arrangement designed specifically for conducting business activities. In this type of structure, individuals or entities can pool their resources and create a cooperative business entity to engage in various ventures. Under the Oregon Revised Statutes, there are primarily two types of Oregon Business Trusts: common law trusts and statutory business trusts. 1. Common Law Trusts: Common law trusts are traditional trusts established under common law principles. They are not specifically designed for business activities but can be used as a legal framework for conducting business operations. Common law trusts provide flexibility in terms of management and distribution of assets but may lack specific provisions for conducting business affairs. 2. Statutory Business Trusts: Statutory business trusts, also known as Oregon Statutory Trusts (OST), are a specialized form of business trust recognized and regulated by the Oregon Revised Statutes, specifically Chapter 128. This type of trust is designed explicitly for conducting business activities and offers more detailed provisions for governance, management, and asset protection. Oregon Statutory Trusts can be further classified based on their purpose and structure, such as: — Real Estate Investment TrustsRestsTs): Formed to hold and manage real estate assets, Rests allow investors to pool their resources for the acquisition, development, and operation of income-generating properties. Rests provide tax advantages and are subject to specific regulations to maintain their status. — Business Development CompaniesBDSCs): BDS are statutory trusts primarily engaged in providing capital and financial support to small and medium-sized businesses. They raise capital through public or private offerings and invest in various sectors, such as technology, manufacturing, healthcare, or financial services. — Investment Funds: Oregon Business Trusts can also be established as investment funds, allowing individuals or entities to contribute funds that are professionally managed to generate profits through diversified investment portfolios. These funds can focus on specific asset classes like equities, bonds, or commodities, or follow a more flexible investment strategy. — Employee Benefit Trusts: Employee Benefit Trusts (Debts) are created to manage and administer employee benefit plans, such as pension funds or stock ownership programs. These trusts provide a vehicle for employers to hold and invest assets earmarked for employee retirement benefits, ensuring compliance with regulatory requirements. In summary, the Oregon Business Trust is a legal entity established under the laws of Oregon, offering a versatile framework for conducting various business activities. Whether as a common law trust or a statutory business trust, it enables individuals and entities to collaborate and pool resources for business ventures, covering areas such as real estate, investment, small business support, and employee benefit administration.

Oregon Business Trust

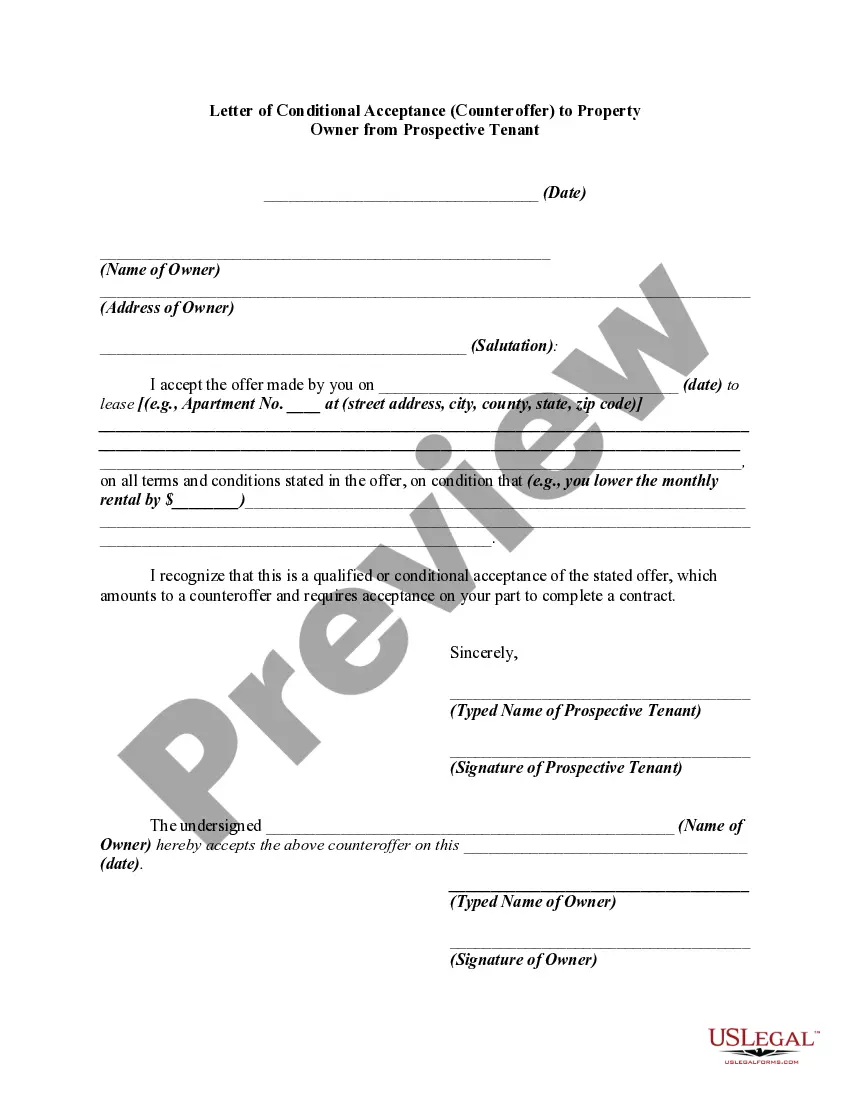

Description

How to fill out Oregon Business Trust?

If you have to complete, obtain, or print authorized file layouts, use US Legal Forms, the biggest assortment of authorized varieties, that can be found on the web. Make use of the site`s basic and handy lookup to obtain the paperwork you will need. A variety of layouts for business and person uses are sorted by categories and suggests, or search phrases. Use US Legal Forms to obtain the Oregon Business Trust in just a couple of mouse clicks.

If you are presently a US Legal Forms consumer, log in to your profile and click the Down load switch to find the Oregon Business Trust. You can also entry varieties you formerly acquired inside the My Forms tab of the profile.

Should you use US Legal Forms for the first time, follow the instructions beneath:

- Step 1. Be sure you have chosen the form for your proper area/land.

- Step 2. Take advantage of the Preview option to look over the form`s content. Don`t forget to read through the information.

- Step 3. If you are not satisfied together with the kind, take advantage of the Search discipline at the top of the display screen to find other variations from the authorized kind format.

- Step 4. Once you have found the form you will need, go through the Get now switch. Choose the pricing program you choose and put your accreditations to register on an profile.

- Step 5. Process the deal. You can utilize your charge card or PayPal profile to perform the deal.

- Step 6. Find the file format from the authorized kind and obtain it in your system.

- Step 7. Full, modify and print or indication the Oregon Business Trust.

Each authorized file format you purchase is the one you have permanently. You possess acces to every single kind you acquired with your acccount. Go through the My Forms area and select a kind to print or obtain once again.

Compete and obtain, and print the Oregon Business Trust with US Legal Forms. There are millions of expert and express-distinct varieties you can utilize for the business or person requirements.