Oregon Private Annuity Agreement

Description

How to fill out Private Annuity Agreement?

Are you in a situation where you constantly require documents for business or personal purposes nearly every day.

There is an assortment of legitimate document templates available online, but finding reliable versions can be challenging.

US Legal Forms offers a vast collection of form templates, such as the Oregon Private Annuity Agreement, designed to comply with federal and state regulations.

Once you find the correct form, click Purchase now.

Choose the pricing plan you prefer, provide the necessary information to create your account, and pay for your order using PayPal or a credit card. Select a convenient paper format and download your copy. Access all the form templates you've purchased in the My documents menu. You can download a fresh copy of the Oregon Private Annuity Agreement at any time if needed. Just click the desired form to download or print the document template. Use US Legal Forms, the largest repository of legal forms, to save time and avoid mistakes. The service offers professionally crafted legal document templates suitable for various needs. Create an account on US Legal Forms and start making your life a bit easier.

- If you are already acquainted with the US Legal Forms website and have an account, simply Log In.

- After that, you can download the Oregon Private Annuity Agreement template.

- If you do not possess an account and wish to start using US Legal Forms, follow these steps.

- Locate the form you need and ensure it is for the correct city/area.

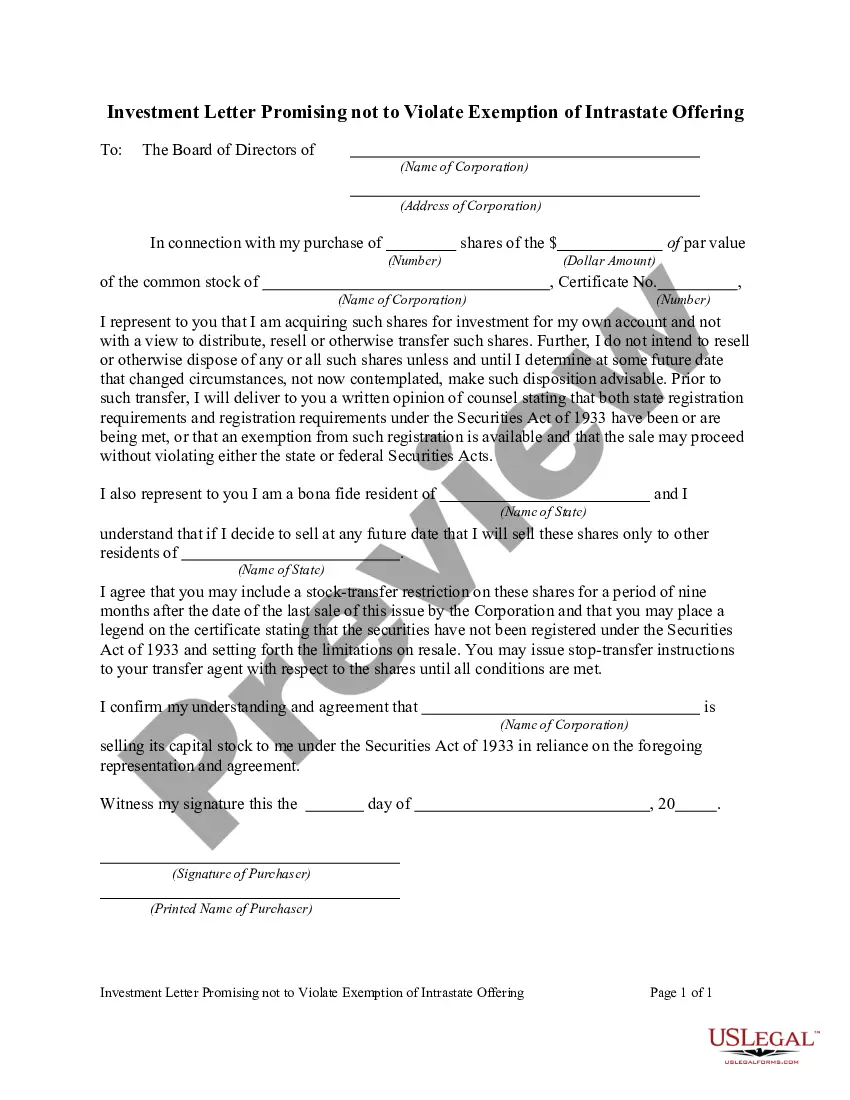

- Utilize the Review button to evaluate the form.

- Examine the description to confirm that you’ve selected the right form.

- If the form doesn’t meet your requirements, use the Lookup field to find a form that aligns with your needs.

Form popularity

FAQ

The monthly payout for a $100,000 annuity can fluctuate based on interest rates and the type of annuity selected. Typically, you might receive somewhere between $400 and $600 per month. If you're examining an Oregon Private Annuity Agreement, this payout can be adjusted to fit your unique financial situation.

The main types of annuities are fixed annuities, fixed indexed annuities and variable annuities.

There are four basic types of annuities to meet your needs: immediate fixed, immediate variable, deferred fixed, and deferred variable annuities. These four types are based on two primary factors: when you want to start receiving payments and how you would like your annuity to grow.

Fixed Annuities (Lowest Risk) Fixed annuities are the least risky annuity product out there. In fact, Fixed annuities are one of the safest investment vehicles in a retirement portfolio. When you sign your contract, you're given a guaranteed rate of return, which remains the same no matter what happens in the market.

High fees A major issue we find with many annuities is they rarely have a single flat fee. Instead, they often have multiple fees that could add up over time to several percentage points, detracting from your money's long-term return potential.

An annuity is a contract between you and an insurance company that requires the insurer to make payments to you, either immediately or in the future. You buy an annuity by making either a single payment or a series of payments.

There are four basic types of annuities to meet your needs: immediate fixed, immediate variable, deferred fixed, and deferred variable annuities. These four types are based on two primary factors: when you want to start receiving payments and how you would like your annuity to grow.