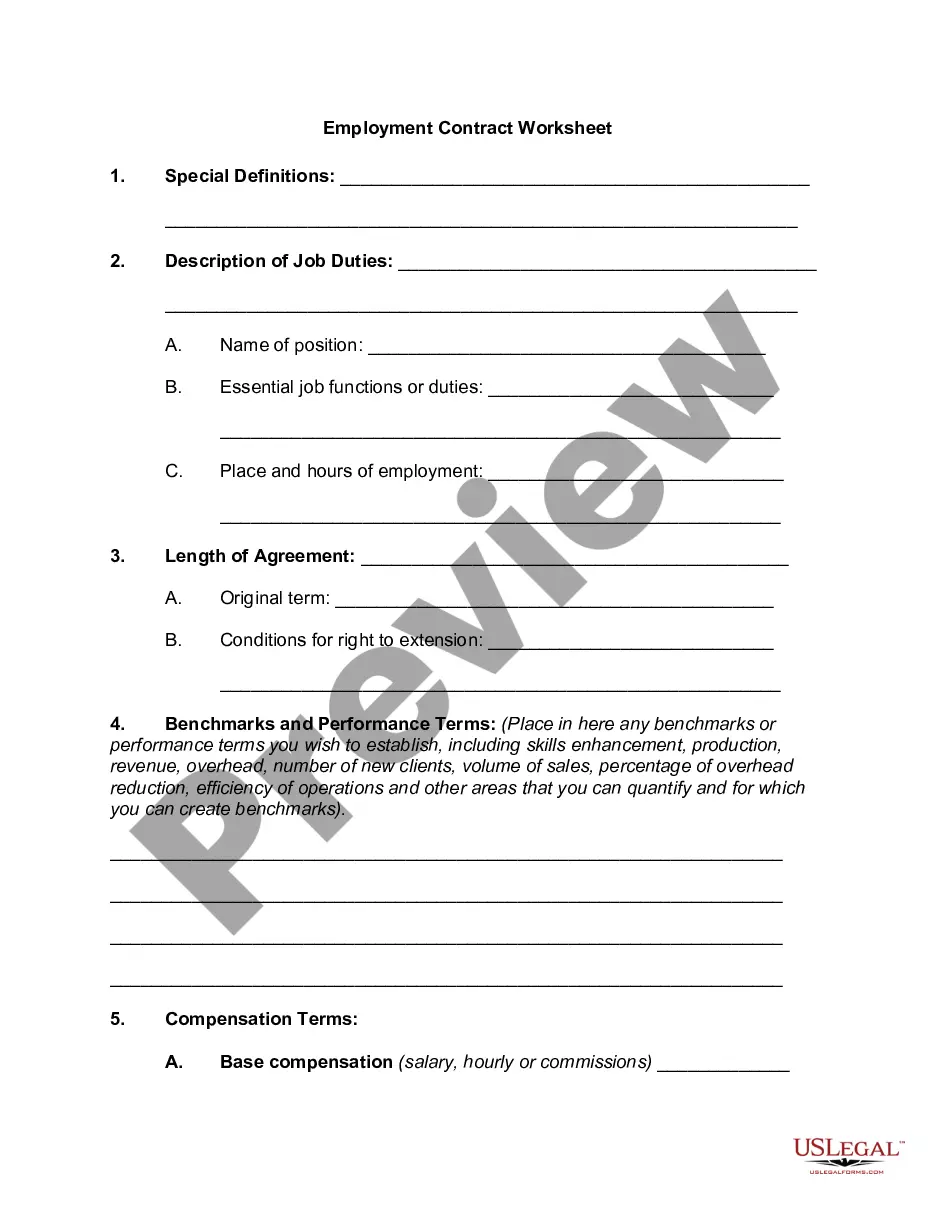

Oregon Worksheet for Job Requirements

Description

How to fill out Worksheet For Job Requirements?

Are you in a situation where you require documents for potential business or personal purposes almost every day.

There are numerous legal document templates accessible online, but finding ones that you can rely on is challenging.

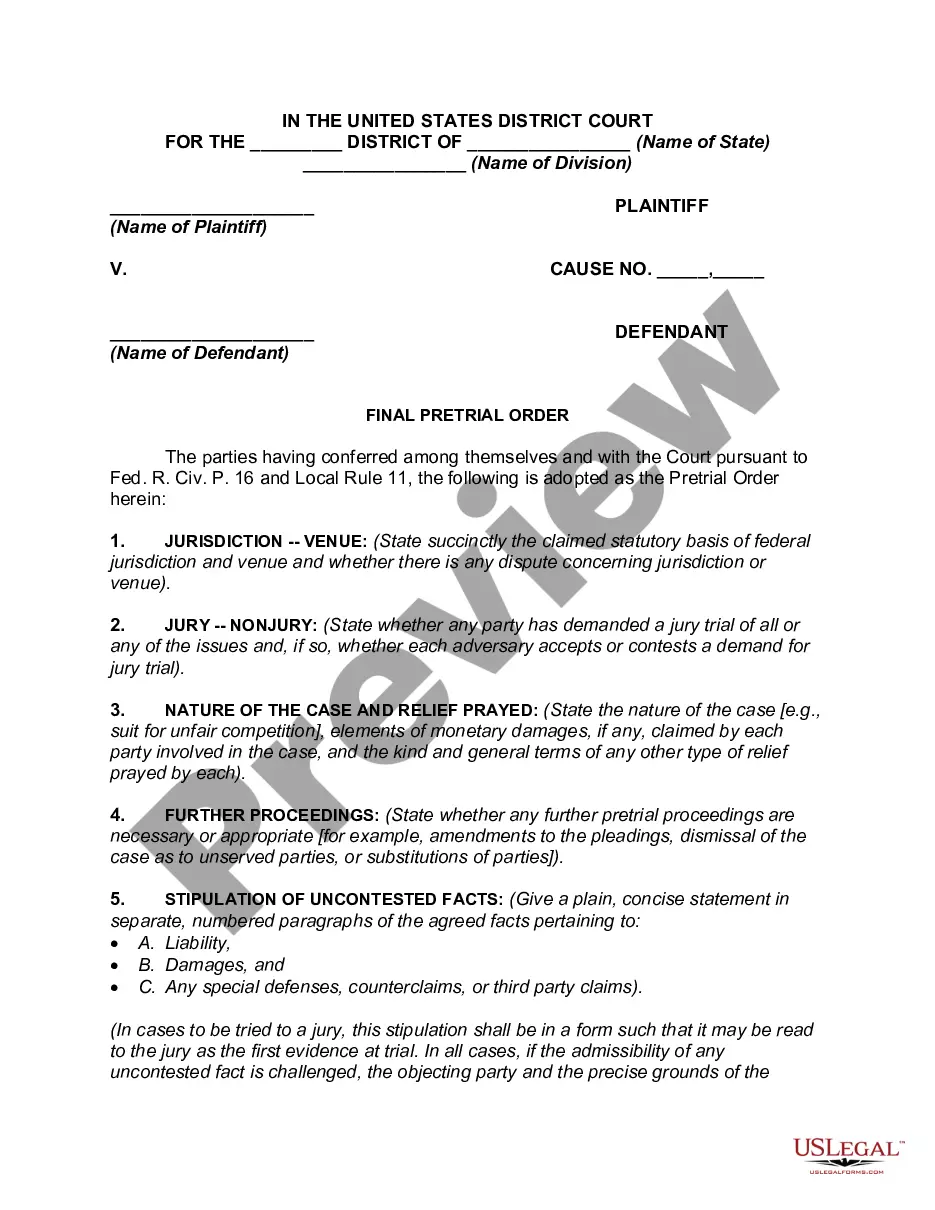

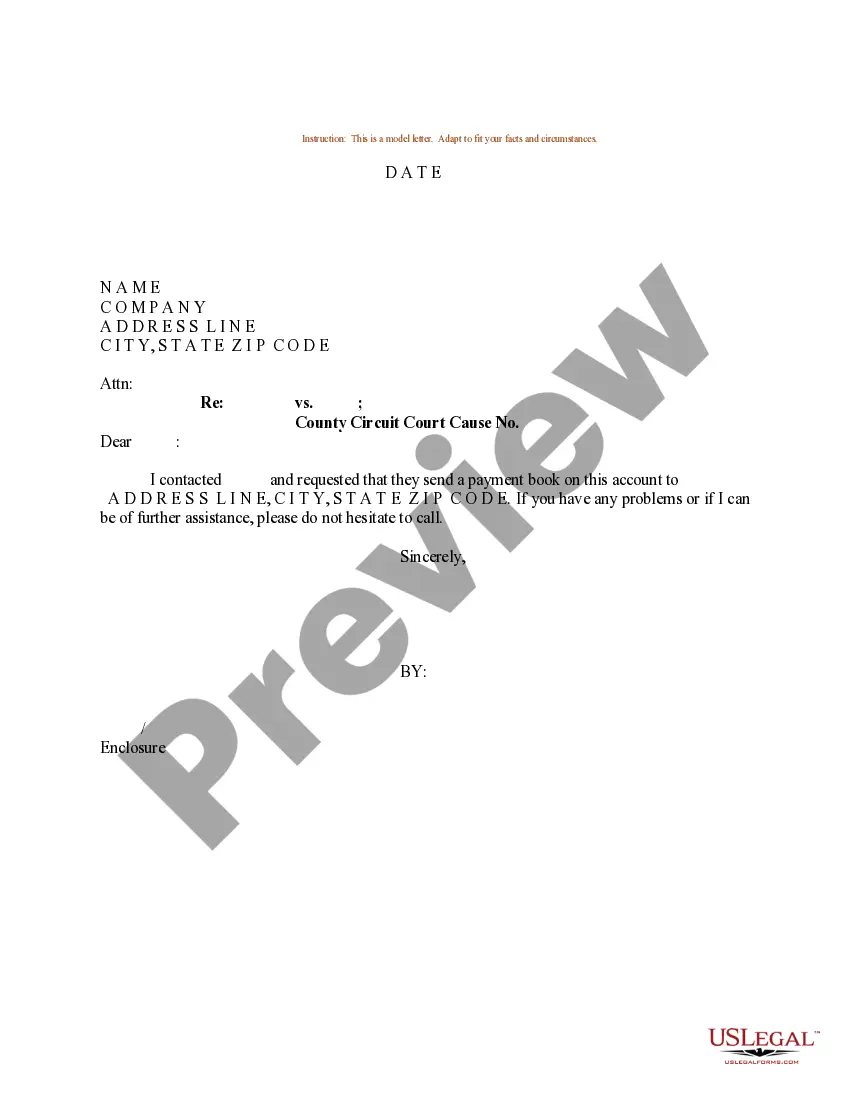

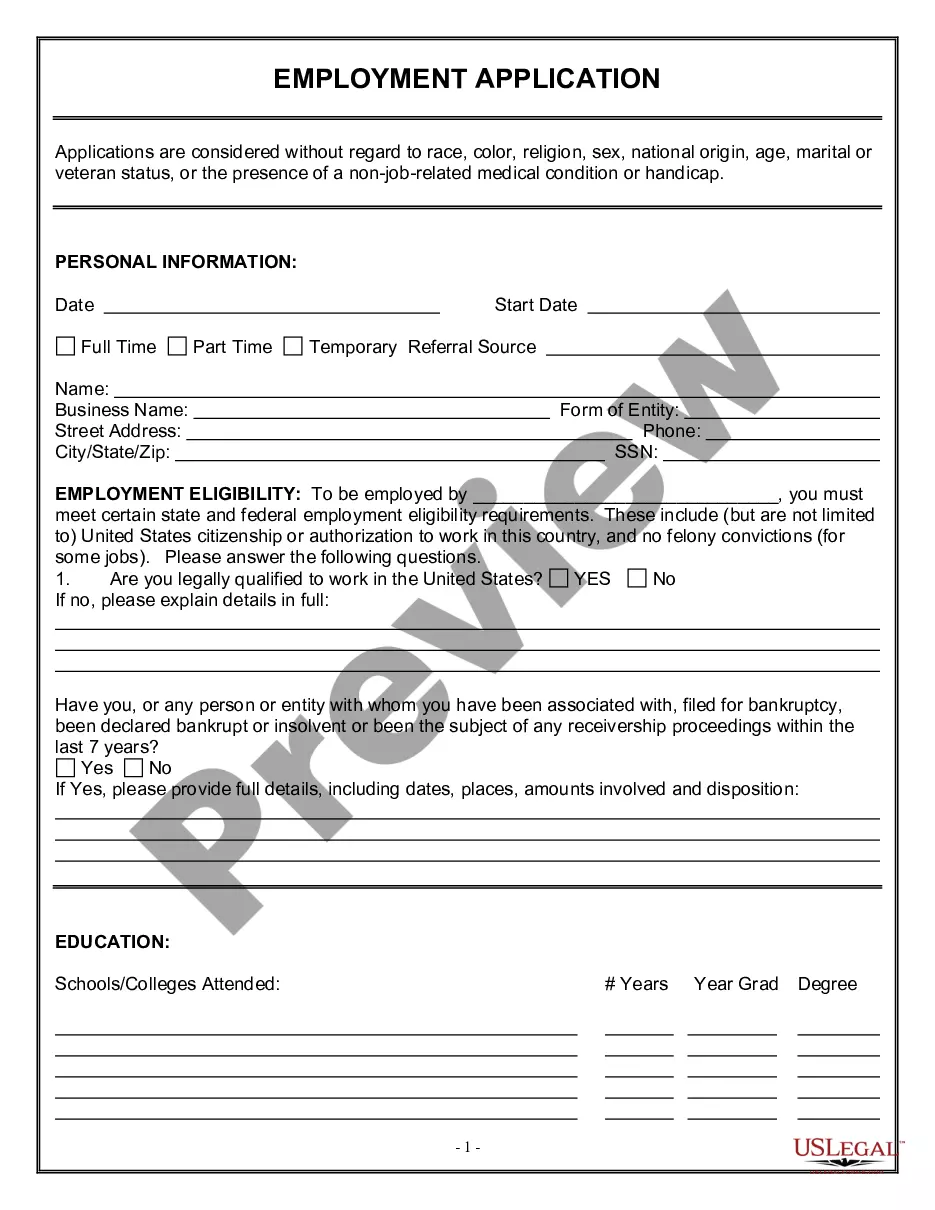

US Legal Forms offers a vast selection of form templates, including the Oregon Worksheet for Employment Requirements, which is designed to comply with state and federal regulations.

Select the pricing plan you want, provide the necessary information to create your account, and complete your purchase using your PayPal or credit card.

Choose a convenient file format and download your copy. You can access all the document templates you have purchased in the My documents menu. You can download another copy of the Oregon Worksheet for Employment Requirements anytime, if needed. Just select the desired form to download or print the document template. Use US Legal Forms, the most comprehensive collection of legal forms, to save time and prevent mistakes. The service offers well-crafted legal document templates that can be utilized for various purposes. Create an account on US Legal Forms and start making your life a bit easier.

- If you are already familiar with the US Legal Forms website and possess an account, simply Log In.

- Then, you can download the Oregon Worksheet for Employment Requirements template.

- If you do not have an account and wish to use US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct city/county.

- Utilize the Preview button to review the form.

- Check the description to confirm that you have selected the correct document.

- If the form is not what you are looking for, use the Search field to find the document that meets your needs.

- When you locate the appropriate form, click Get now.

Form popularity

FAQ

How to file a W-4 form in 5 StepsStep 1: Enter your personal information. The first step is filling out your name, address and Social Security number.Step 2: Multiple jobs or spouse works.Step 3: Claim dependents.Step 4: Factor in additional income and deductions.Step 5: Sign and file with your employer.

How to Fill Out The Personal Allowances Worksheet (W-4 Worksheet) for 2019. As you may know, Form W-4 is used to determine your withholding allowances based on your unique situation so that your employer can withhold the correct federal income tax from your pay.

A: An allowance represents a portion of your income that is exempt from tax. On your Oregon tax return, this portion can take the form of a credit against tax, a deduction, or a subtraction. The more allowances you claim on Form OR-W-4, the less tax your employer will withhold.

How Many Allowances Should I Claim if I'm Single? If you are single and have one job, you can claim 1 allowance. There's also the option of requesting 2 allowances if you are single and have one job.

Add your combined income, adjustments, deductions, exemptions and credits to figure your federal withholding allowances. You can divide your total allowances whichever way you prefer, but you can't claim an allowance that your spouse claims too.

How to Fill Out The Personal Allowances Worksheet (W-4 Worksheet) for 2019. As you may know, Form W-4 is used to determine your withholding allowances based on your unique situation so that your employer can withhold the correct federal income tax from your pay.

Worksheet A is used if a parent has less than 25% of the annual overnights with the child or children and Worksheet B is used if a parent has 25% or more of annual overnights with the child or children. Worksheet B modifies child support downward.

A single filer with no children should claim a maximum of 1 allowance, while a married couple with one source of income should file a joint return with 2 allowances. You can also claim your children as dependents if you support them financially and they're not past the age of 19.

Use Worksheet B to determine whether your expected estimated deductions may entitle you to claim one or more additional withholding allowances.

Form 132 is filed with Form OQ on a quarterly basis. Oregon Combined Quarterly Report- Form OQUse this form to determine how much tax is due each quarter for state unemployment insurance, withholding, Tri-Met & Lane Transit excise taxes, and the Workers' Benefit Fund.