Oregon Liquidation of Partnership with Authority, Rights and Obligations during Liquidation

Description

How to fill out Liquidation Of Partnership With Authority, Rights And Obligations During Liquidation?

If you desire to total, acquire, or print legal document templates, utilize US Legal Forms, the largest assortment of legal forms, accessible online.

Utilize the site's simple and user-friendly search to find the documents you require.

Numerous templates for business and personal purposes are categorized by groups and states, or keywords.

Every legal document template you obtain is your property permanently. You have access to every form you downloaded in your account. Click the My documents section and select a form to print or download again.

Stay competitive and obtain and print the Oregon Liquidation of Partnership with Authority, Rights and Obligations during Liquidation with US Legal Forms. There are millions of professional and state-specific forms you can use for your business or personal needs.

- Utilize US Legal Forms to obtain the Oregon Liquidation of Partnership with Authority, Rights and Obligations during Liquidation in just a few clicks.

- If you are already a US Legal Forms customer, Log In to your account and click the Download button to obtain the Oregon Liquidation of Partnership with Authority, Rights and Obligations during Liquidation.

- You can also access forms you previously downloaded from the My documents tab in your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for the correct state/region.

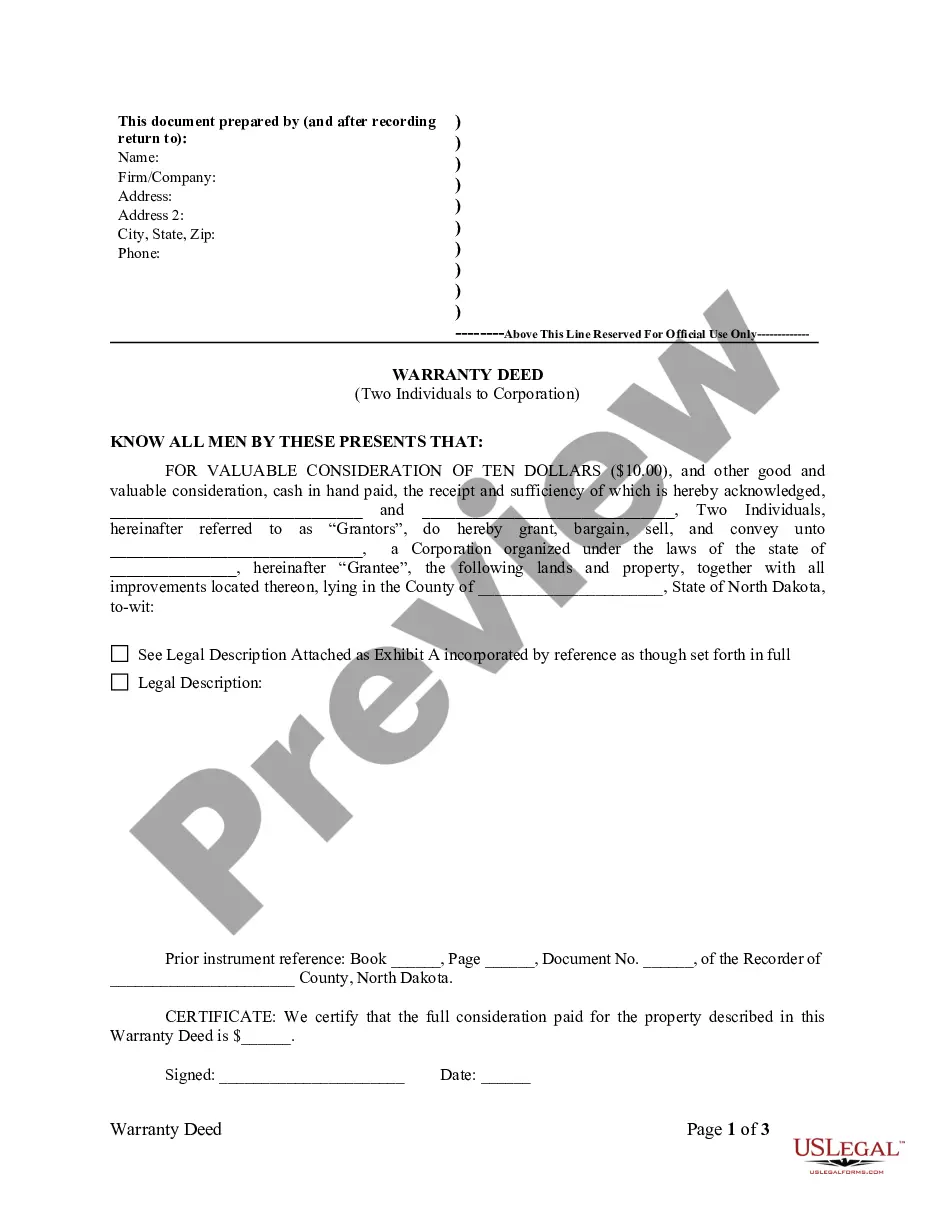

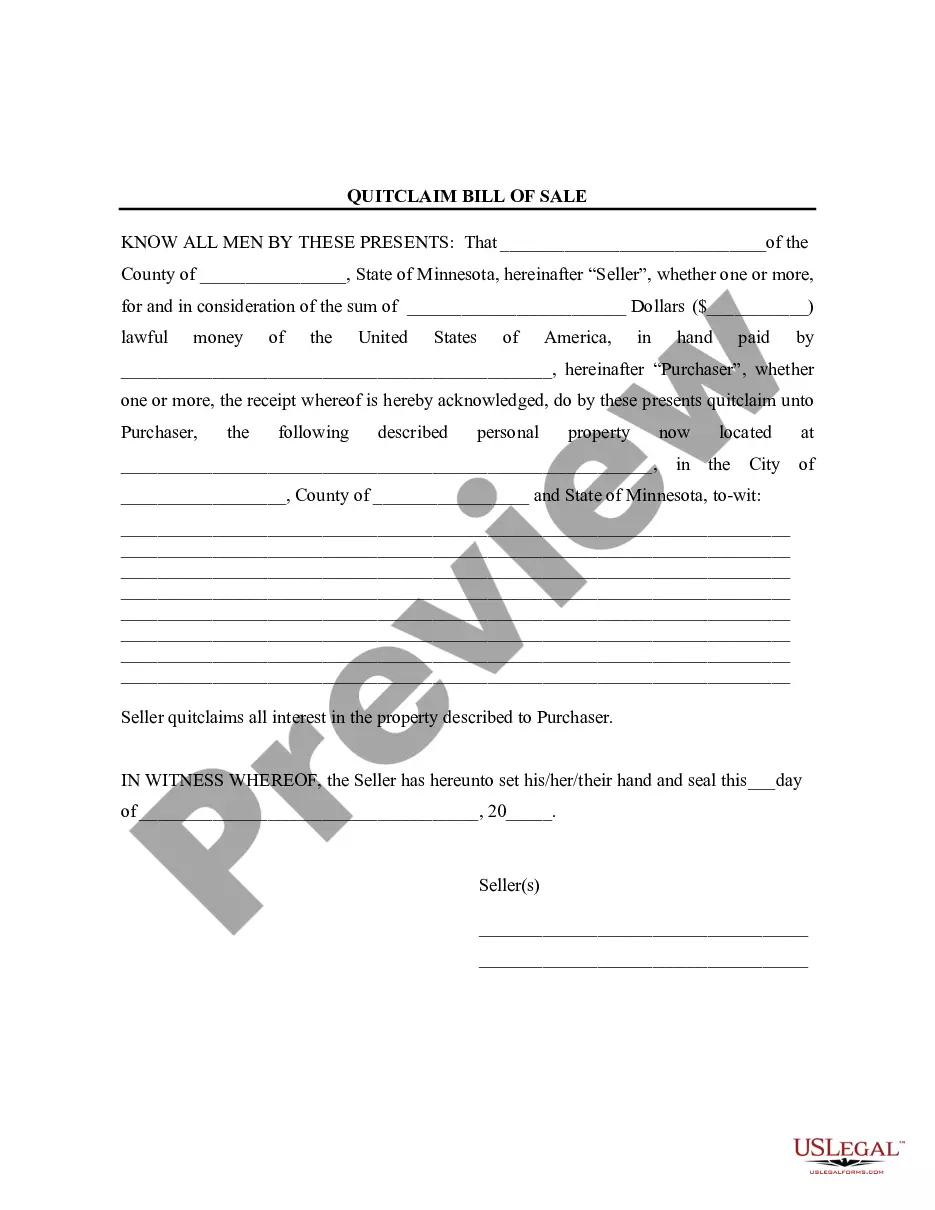

- Step 2. Use the Preview option to review the form's content. Don't forget to read the description.

- Step 3. If you are not satisfied with the form, use the Search section at the top of the screen to find alternative versions in the legal form template.

- Step 4. Once you have found the form you require, select the Get now button. Choose the pricing plan you prefer and enter your information to register for an account.

- Step 5. Process the payment. You can use your credit card or PayPal account to complete the transaction.

- Step 6. Choose the format of the legal form and download it to your device.

- Step 7. Complete, edit, and print or sign the Oregon Liquidation of Partnership with Authority, Rights and Obligations during Liquidation.

Form popularity

FAQ

When partners choose to liquidate the partnership, they must adhere to the terms outlined in their partnership agreement and state laws. This process involves selling off assets, paying debts, and distributing remaining funds to partners. Utilizing the Oregon Liquidation of Partnership with Authority, Rights and Obligations during Liquidation ensures that you follow the correct procedures and uphold your legal rights.

All partners will share profits and losses equally, unless otherwise agreed. one partner cannot be expelled by the other partners unless otherwise agreed. a partner is only responsible for partnership debts and liabilities that arise after the person becomes a partner.

Liability for General and Limited Partners Limited partners cannot incur obligations on behalf of the partnership, participate in daily operations, or manage the operation. Because limited partners do not manage the business, they are not personally liable for the partnership's debts.

Partners are bound to carry on the business of the firm to greatest common advantage, to be just and faithful to each other, and to render true accounts and full information of all things affecting the firm to any partner, his heir or legal representative. Section10 DUTY TO INDEMNIFY FOR LOSS CAUSED BY FRAUD.

11 Important Duties of Partners in a PartnershipTo Observe Good Faith.To Indemnify for Loss.To Attend to his Duties Diligently.Not to Claim Remuneration.To Indemnify for Willful Neglect.To Share Losses.To Hold and Use Property of the Firm.To Account for Private Profits.More items...

A general partnership is an unincorporated business with two or more owners who share business responsibilities. Each general partner has unlimited personal liability for the debts and obligations of the business. Each partner reports their share of business profits and losses on their personal tax return.

Right to access books and accounts: Each partner can inspect and copy books of accounts of the business. This right is applicable equally to active and dormant partners. Right to share profits: Partners generally describe in their deed the proportion in which they will share profits of the firm.

OBLIGATIONS OF PARTNERS AMONG THEMSELVES (Part I)A partnership begins at the moment of the execution of the contract.Every partner is a debtor to the partnership.Every partner is responsible to the partnership for damages suffered by it through his fault.27-Apr-2021

In a general partnership, each partner has unlimited personal liability. Partnership rules usually dictate that whatever debts are incurred by the business, it is the legal responsibility of all partners to pay them off.

How to Dissolve a PartnershipReview and Follow Your Partnership Agreement.Vote on Dissolution and Document Your Decision.Send Notifications and Cancel Business Registrations.Pay Outstanding Debts, Liquidate, and Distribute Assets.File Final Tax Return and Cancel Tax Accounts.Limiting Your Future Liability.