Title: Understanding the Oregon Agreement for Sale of Assets of Corporation Keywords: Oregon agreement for sale of assets of corporation, assets transfer, corporation acquisition, purchase agreement, legal documentation, types of agreements Introduction: The Oregon Agreement for Sale of Assets of Corporation is a legally binding document that facilitates the transfer and acquisition of assets between corporations based in the state of Oregon. This agreement outlines the terms and conditions agreed upon by the buyer and the seller, ensuring a smooth and lawful transaction. There are several types of Oregon Agreements for Sale of Assets of Corporation, each serving unique purposes depending on the specific nature of the transaction. 1. General Oregon Agreement for Sale of Assets of Corporation: The general agreement serves as a comprehensive document that encompasses various elements of the asset purchase. It covers essential information such as the identification of assets being sold, purchase price, payment terms, representations and warranties, conditions for closing, and allocation of liabilities. This type of agreement is suitable for standard asset sales between corporations. 2. Oregon Agreement for Sale of Tangible Assets of Corporation: This type of agreement specifies the transfer of tangible assets, such as machinery, equipment, or inventory, from one corporation to another. It outlines the condition, quantity, and detailed description of each asset, along with any warranties offered, ensuring transparency and agreement between the buyer and the seller. 3. Oregon Agreement for Sale of Intellectual Property of Corporation: In cases where a corporation intends to sell its intellectual property (IP) assets, this agreement is employed. It includes a detailed description of the specific IP being transferred, such as patents, trademarks, copyrights, or trade secrets, along with any limitations, encumbrances, or licensing arrangements associated with such assets. 4. Oregon Agreement for Sale of Real Estate Assets of Corporation: For corporations involved in the sale or purchase of real estate assets, this agreement regulates the transfer. It includes a complete description of the property, its legal status, any encumbrances, zoning restrictions, and environmental considerations. The agreement ensures compliance with local real estate laws and safeguards both the buyer and the seller. Conclusion: The Oregon Agreement for Sale of Assets of Corporation provides a critical framework for legal, seamless, and well-documented transfer of assets between corporations in Oregon. By utilizing different types of agreements, corporations can ensure the specific terms and conditions surrounding the sale are accurately reflected, covering areas such as general assets, tangible assets, intellectual property assets, or real estate assets. These agreements serve to protect the interests of both parties involved in the transaction and contribute to a successful business transfer process.

Oregon Agreement for Sale of Assets of Corporation

Description

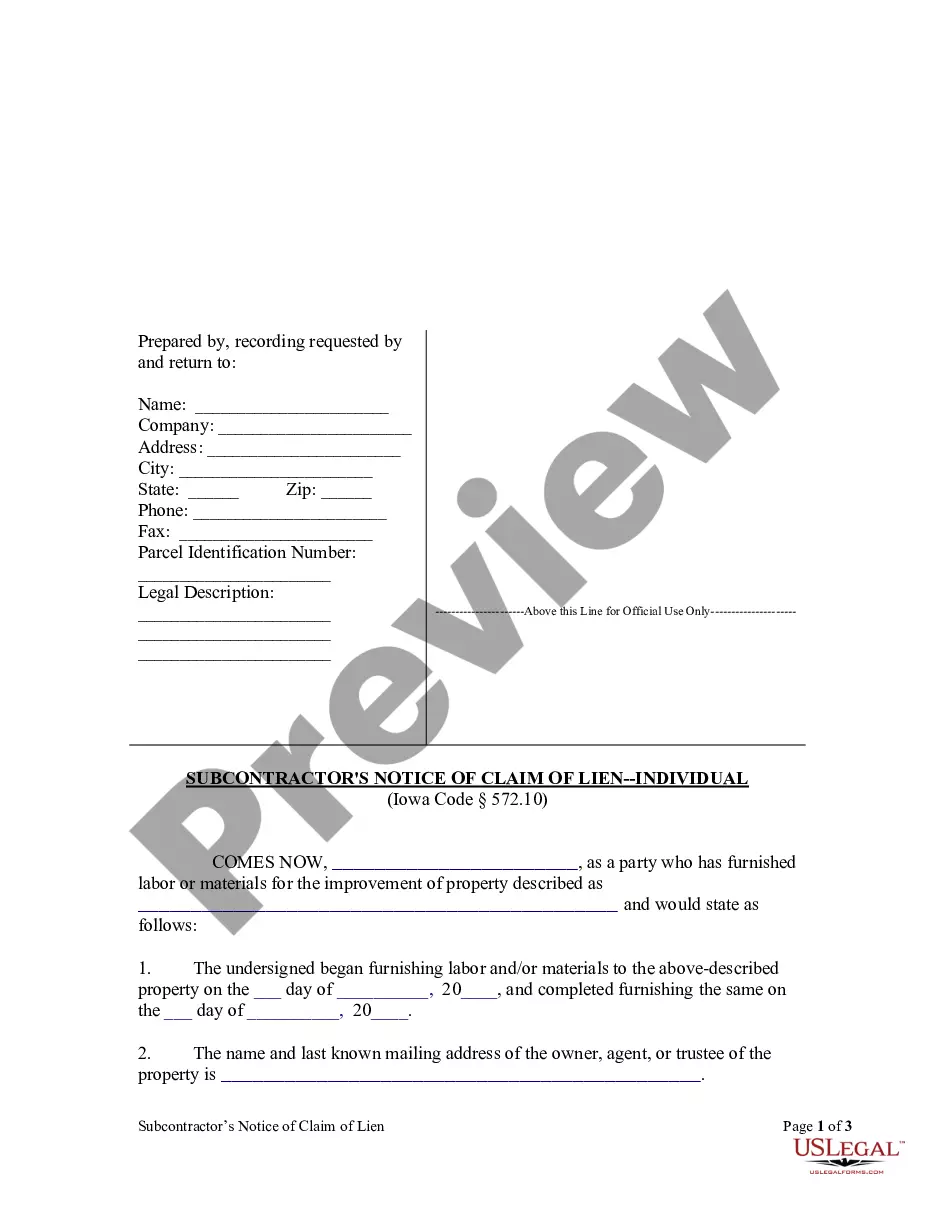

How to fill out Oregon Agreement For Sale Of Assets Of Corporation?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a broad selection of legal template designs that you can download or print. While navigating the site, you can discover a vast array of forms for business and personal purposes, organized by categories, states, or keywords. You can obtain the latest editions of documents such as the Oregon Agreement for Sale of Assets of Corporation in just moments.

If you already have an account, Log In to acquire the Oregon Agreement for Sale of Assets of Corporation from the US Legal Forms repository. The Download button will appear on every form you review. You can access all previously acquired forms in the My documents section of your profile.

To utilize US Legal Forms for the first time, here are some simple instructions to get you started: Ensure that you have selected the correct form for your city/county. Click the Review button to examine the form's content. Review the form details to confirm that you have chosen the right document. If the form does not meet your requirements, use the Search box at the top of the screen to find the suitable one. If you are content with the form, confirm your selection by clicking the Buy now button. Then, choose the pricing plan you prefer and provide your credentials to register for an account.

- Process the payment. Use your credit card or PayPal account to finalize the transaction.

- Select the format and download the document to your device.

- Edit the document. Complete, modify, print, and sign the downloaded Oregon Agreement for Sale of Assets of Corporation.

- Every template stored in your account does not expire and belongs to you indefinitely.

- If you wish to download or print another copy, simply navigate to the My documents section and click on the document you need.

- Access the Oregon Agreement for Sale of Assets of Corporation through US Legal Forms, the most comprehensive collection of legal document templates. Utilize a wide variety of professional and state-specific templates that meet your business or personal needs.

Form popularity

FAQ

While a sale of assets can be beneficial, there are potential disadvantages to consider. One key issue involves possible tax implications that may arise from the sale. Additionally, if the agreement lacks clarity, disputes can occur down the line. To mitigate these risks, using an Oregon Agreement for Sale of Assets of Corporation ensures that all parties understand their rights and responsibilities.

A business asset sale generally requires an Oregon Agreement for Sale of Assets of Corporation to formalize the transaction. In this process, the seller transfers ownership of specific assets rather than selling the entire business. Buyers typically conduct due diligence to assess asset value and potential liabilities, making it essential to have a thorough agreement in place to protect both parties.

Selling off business assets involves creating an Oregon Agreement for Sale of Assets of Corporation. Begin by identifying the assets you want to sell. Then, conduct a valuation to determine their fair market value. Finally, negotiate the terms with potential buyers, ensuring you draft a legally binding agreement that outlines the sale conditions.

Yes, you can write your own contract agreement, including an Oregon Agreement for Sale of Assets of Corporation. However, it is crucial to understand the legal elements that must be included to make the agreement enforceable. To simplify this process, consider using uslegalforms, which provides templates and guidance tailored for your specific needs, ensuring accuracy and compliance with local laws.

The sale of business assets agreement is a legal document that outlines the terms of transferring ownership of a corporation's assets. This agreement includes details regarding the assets being sold, the payment terms, and any conditions that must be met before the sale is finalized. Utilizing an Oregon Agreement for Sale of Assets of Corporation can help ensure that you address key legal requirements and protect your interests during the sale process.

In an asset purchase, the buyer will only buy certain assets of the seller's company. The seller will continue to own the assets that were not included in the purchase agreement with the buyer. The transfer of ownership of certain assets may need to be confirmed with filings, such as titles to transfer real estate.

Confidentiality agreements, sometimes called secrecy or nondisclosure agreements, are contracts entered into by two or more parties in which some or all of the parties agree that certain types of information that pass from one party to the other or that are created by one of the parties will remain confidential.

The bill of sale is typically delivered as an ancillary document in an asset purchase to transfer title to tangible personal property. It does not cover intangible property (such as intellectual property rights or contract rights) or real property.

The asset purchase agreement is often drafted up towards the end of the negotiation stage, so that the parties can have a final record of their agreement. The document essentially operates as a contract, creating legally binding duties on each of the parties involved.

While buyer's counsel typically prepares the first draft of an asset purchase agreement, there may be circumstances (such as an auction) when seller's counsel prepares the first draft.

More info

Information regarding assets purchased is not a guarantee that they will be the same as the same property that the Company is purchasing. All such information is subject to change. This Listing of assets purchased does not represent or constitute an offer to sell our property at this time. You may consider taking a visit to. This listing is available at no cost to you. Assets Purchased The Company has intended to use this Agreement to disclose what We have acquired and what We have purchased as well as what Our future plan is for this acquisition and what Our future plan is. This Statement is for general information purposes only and is not guaranteed by The Company and may be modified for further information to further protect the interests of The Company. Information regarding assets purchased is not a guarantee that they will be the same as the same property that the Company is purchasing. All such information is subject to change.