Oregon Credit Application

Category:

State:

Multi-State

Control #:

US-134-AZ

Format:

Word;

PDF;

Rich Text

Instant download

Description

This form is a business type form that is formatted to allow you to complete the form using Adobe Acrobat or Word. The word files have been formatted to allow completion by entry into fields. Some of the forms under this category are rather simple while others are more complex. The formatting is worth the small cost.

How to fill out Credit Application?

Are you currently in a situation where you require documentation for either business or personal purposes on a regular basis.

There are numerous legitimate document templates accessible online, but finding reliable ones can be challenging.

US Legal Forms offers a vast collection of form templates, including the Oregon Credit Application, designed to meet federal and state requirements.

Once you identify the correct form, click Purchase now.

Choose the pricing plan you prefer, fill out the necessary details to create your account, and make your payment using PayPal or credit card.

- If you’re already acquainted with the US Legal Forms site and have an account, simply Log In.

- Then, you can download the Oregon Credit Application template.

- If you do not have an account and wish to use US Legal Forms, follow these steps.

- Select the form you need and ensure it is for the correct state/region.

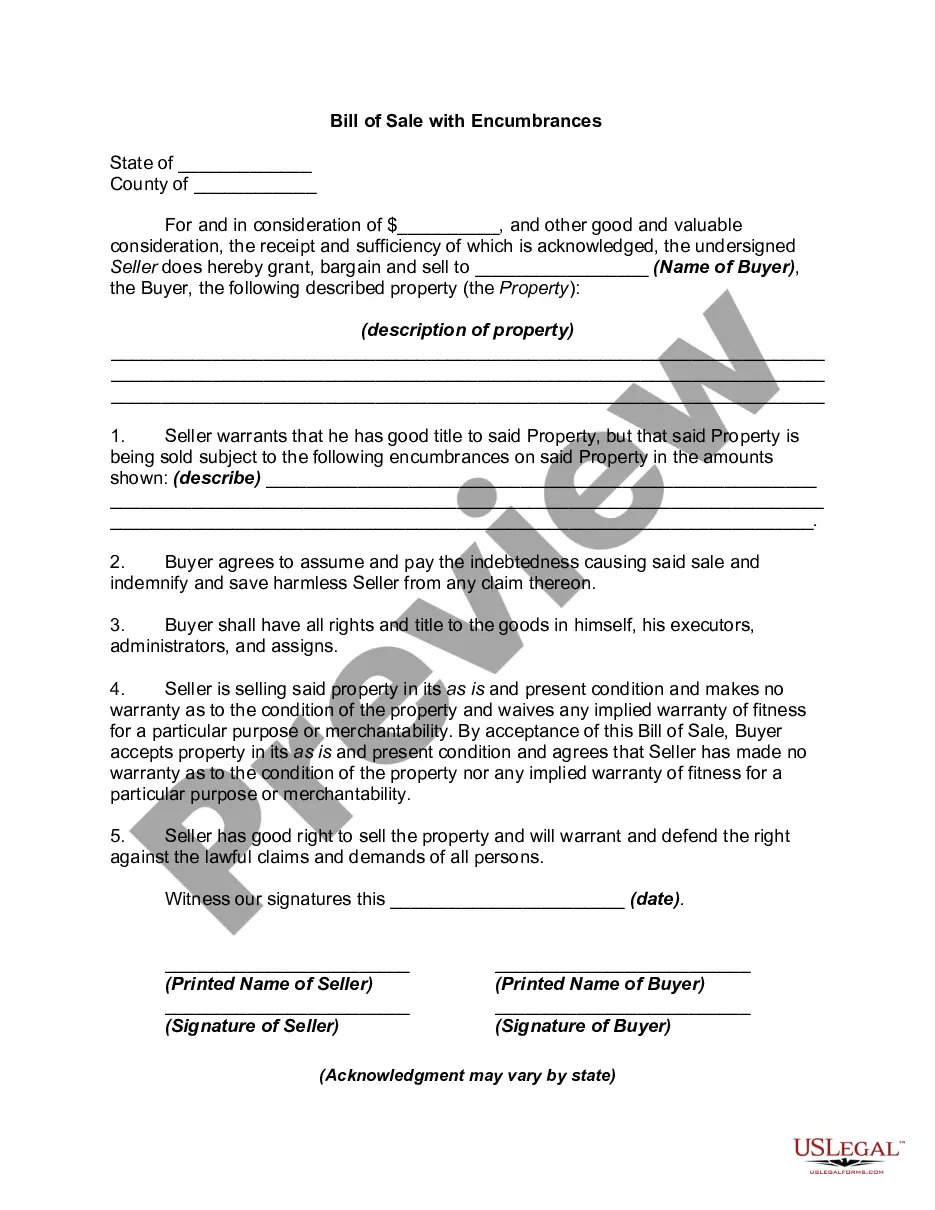

- Utilize the Preview button to review the form.

- Read the description to confirm you have selected the right template.

- If the form is not what you're looking for, use the Search field to find the form that fits your needs.