Oregon Agreement to Sell Partnership Interest to Third Party

Description

How to fill out Agreement To Sell Partnership Interest To Third Party?

Are you currently in a situation where you constantly need documents for either professional or personal purposes.

There are numerous legal document templates accessible online, but finding ones you can trust isn't straightforward.

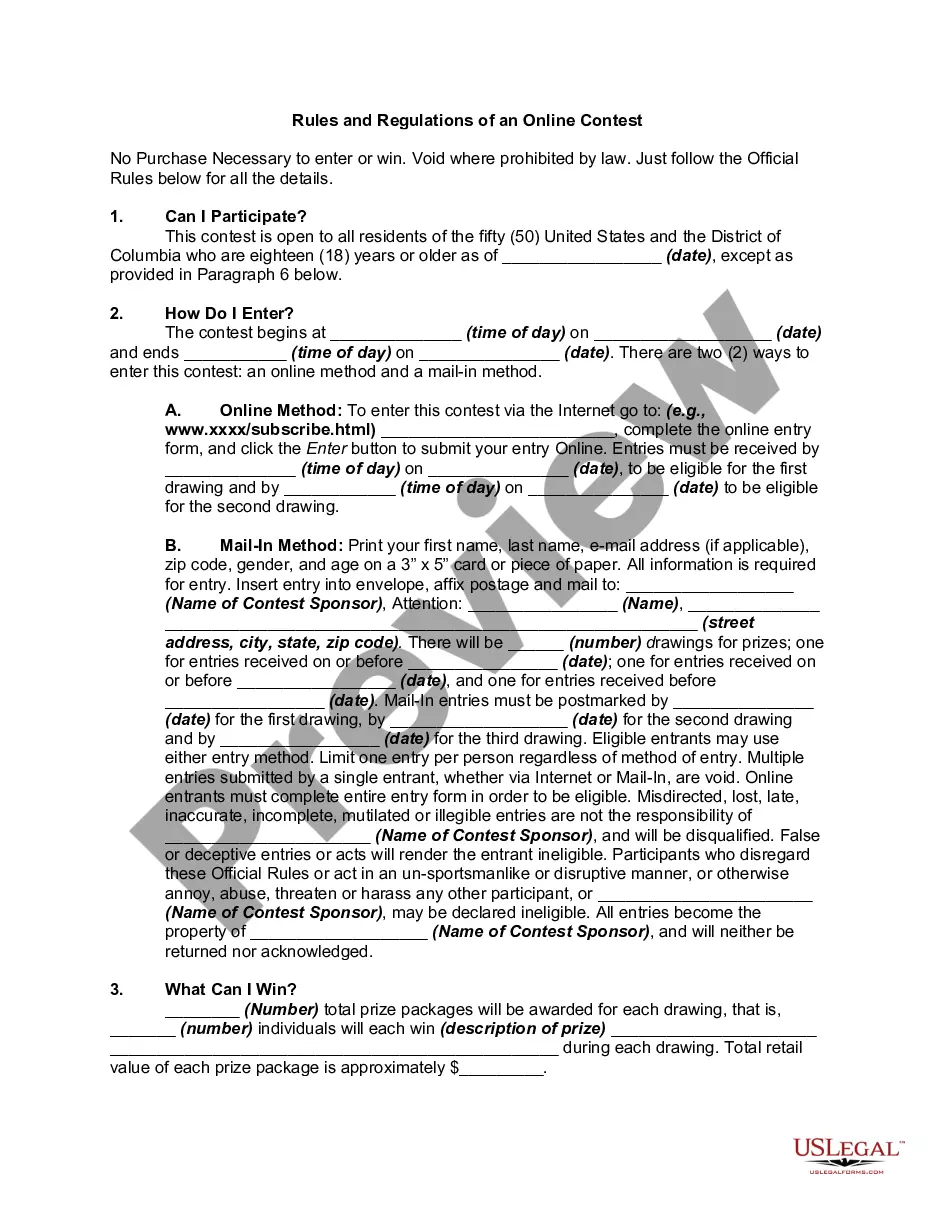

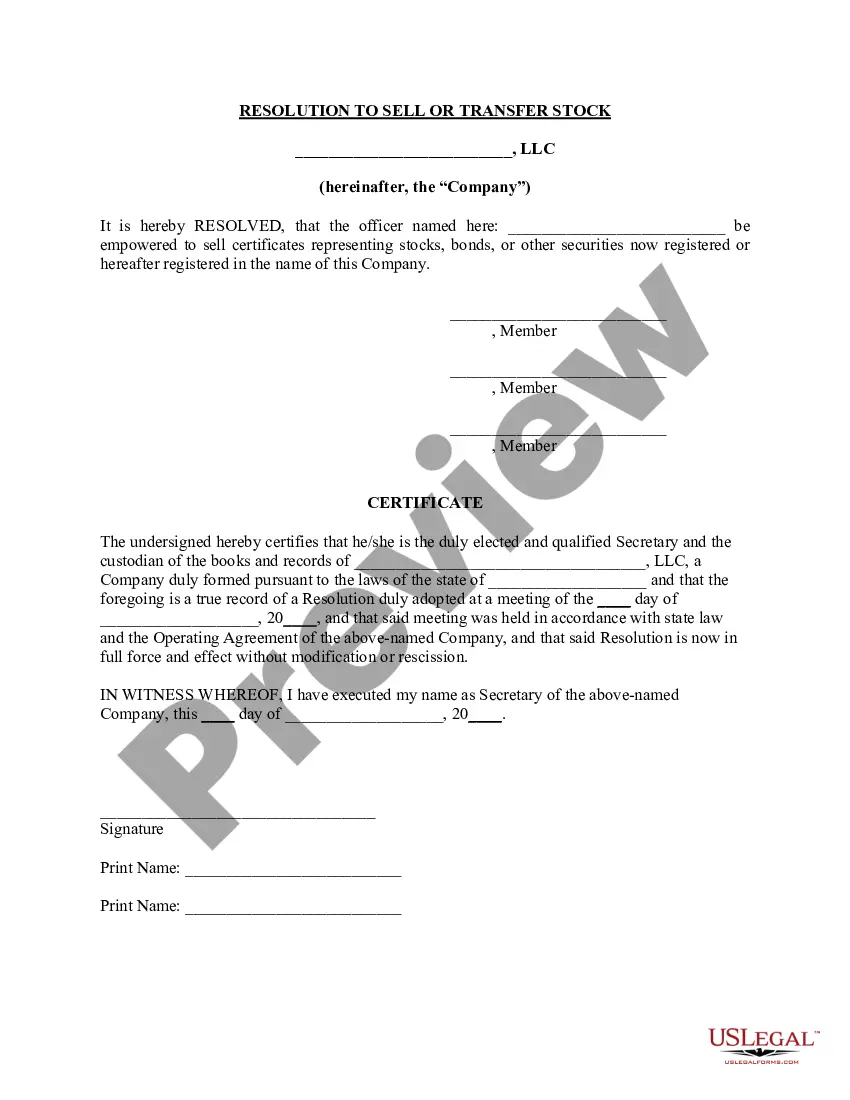

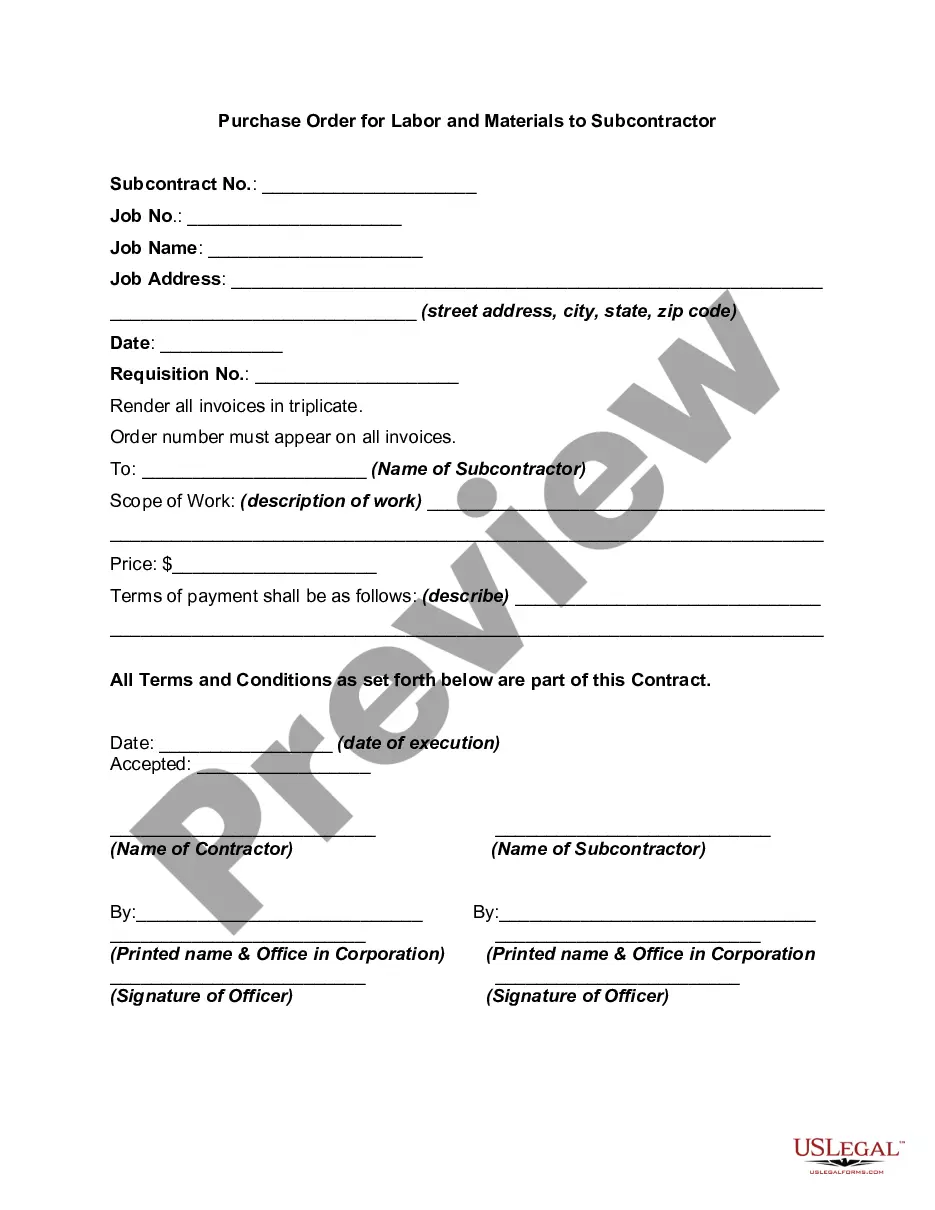

US Legal Forms offers a vast array of templates, such as the Oregon Agreement to Sell Partnership Interest to Third Party, which are designed to comply with federal and state regulations.

Once you find the appropriate form, click on Purchase Now.

Choose the pricing plan you want, enter the necessary details to create your account, and pay for the transaction using PayPal or a credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- After that, you can download the Oregon Agreement to Sell Partnership Interest to Third Party template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Select the form you need and ensure it is for the correct state/region.

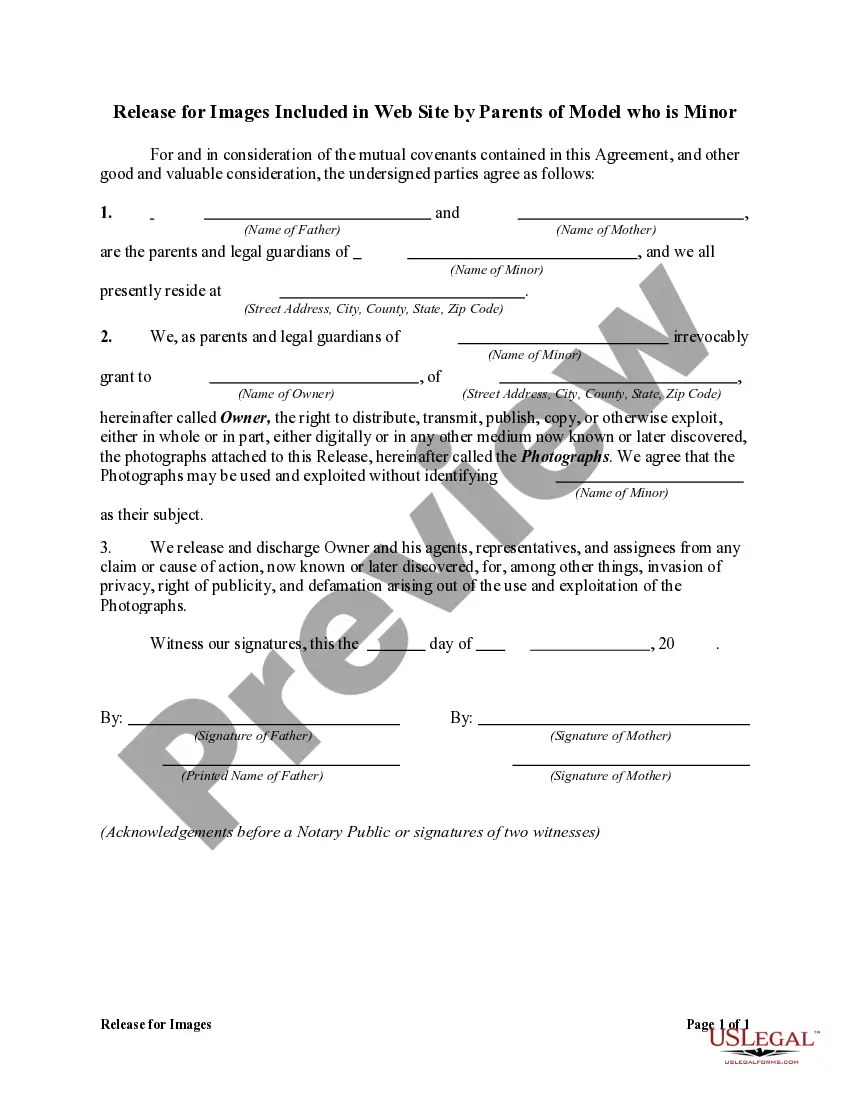

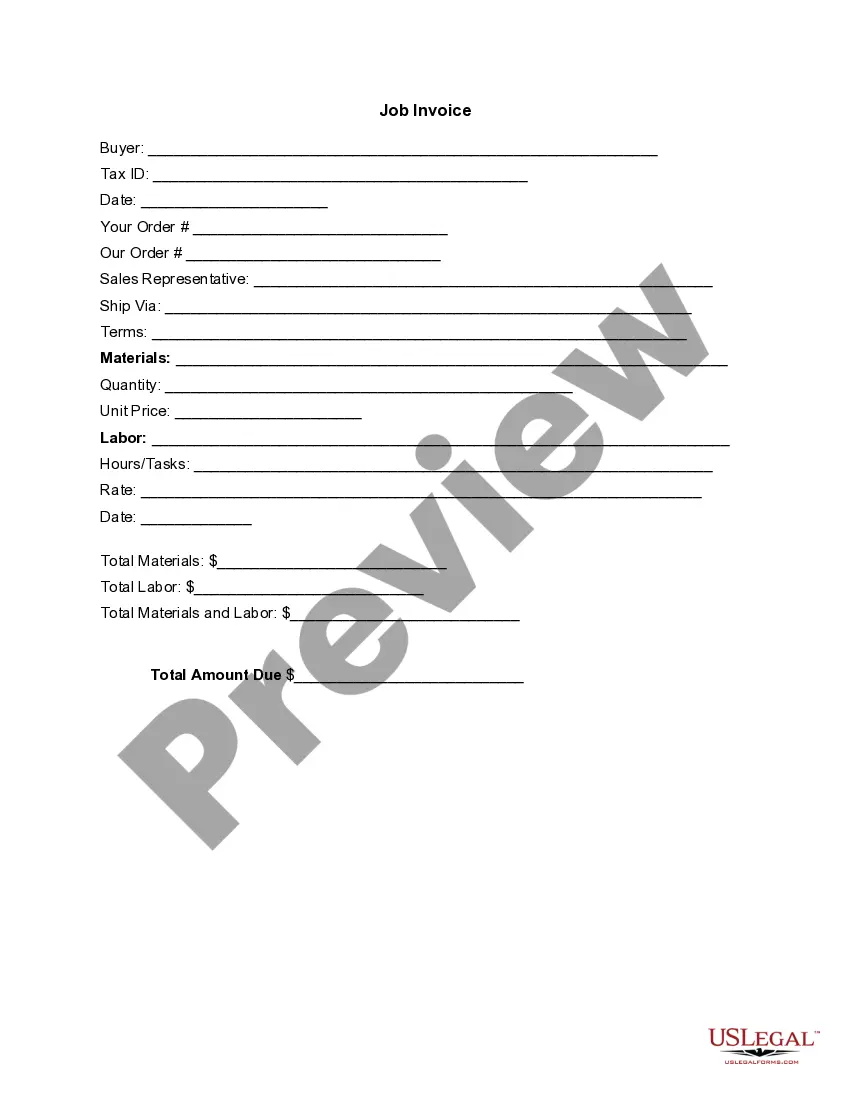

- Use the Preview option to review the form.

- Read the description to confirm that you have selected the correct form.

- If the form isn't what you're looking for, use the Search area to find the form that meets your needs.

Form popularity

FAQ

A sale of a partnership interest occurs when one partner sells their ownership interest to another person or entity. The partnership is generally not involved in the transaction. However, the buyer and seller will notify the partnership of the transaction.

Under the purchase scenario, one or more remaining partners may buy out the terminating partner's interest for fair market value (FMV) plus any relief of debt realized by the partner.

The transfer of a partner's economic interest in a partnership is determined by the partnership agreement, or by statute if there is no partnership agreement. Unless permitted by the partnership agreement, no person may become a partner without the consent of all the other partners.

Because tax law views a partnership both as an entity and as an aggregate of partners, the sale of a partnership interest may result either in a capital gain or loss or all or a portion of the gain may be taxed as ordinary income.

Because tax law views a partnership both as an entity and as an aggregate of partners, the sale of a partnership interest may result either in a capital gain or loss or all or a portion of the gain may be taxed as ordinary income.

Transfer of limited partnership interest is allowed as long as the general partner consents to the arrangement and it is done in concert with the established partnership agreement. A common example of a limited partnership is the family limited partnership, which is often created to administer a family business.

A partner's interest in the partnership may be assigned by the partner. However, the assignee does not become a partner without the consent of the other partners.

In general, as noted earlier, the transferee of a partnership interest must withhold a tax equal to 10% of the amount realized by the transferor on any transfer of a partnership interest unless an applicable exception applies (as discussed below).

Ownership interests in a limited partnership can generally be freely assigned. Absent a contrary provision in the partnership agreement, both general and limited partners can generally assign their partnership interests to another (called an assignee) without restriction.

The sale of a partnership interest is generally treated as a sale of a capital asset, resulting in capital gain or loss for the selling partner.