Oregon Notice of Assignment of Accounts

Category:

State:

Multi-State

Control #:

US-1340711BG

Format:

Word;

Rich Text

Instant download

Description

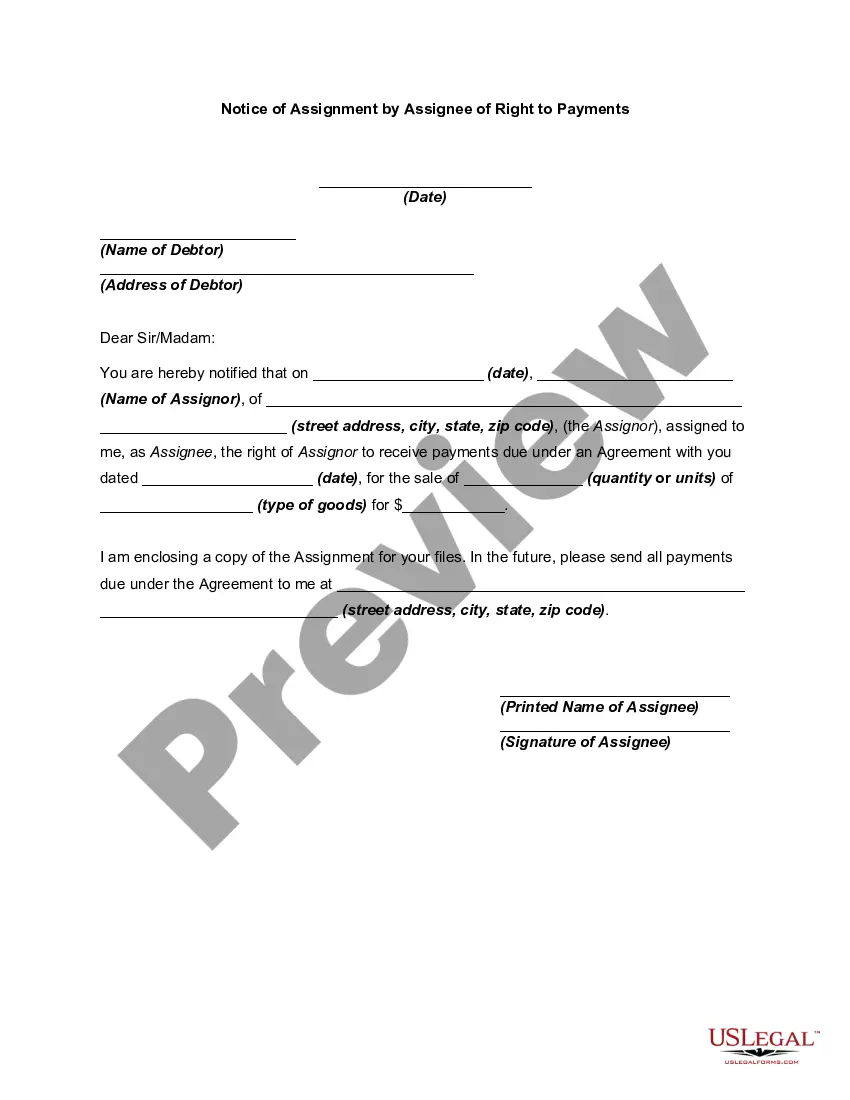

Assignment is the act of transferring power or rights to another, such as contractual rights.

How to fill out Notice Of Assignment Of Accounts?

You can dedicate multiple hours online searching for the legal document template that complies with the state and federal requirements you require.

US Legal Forms offers a vast array of legal forms that are reviewed by experts.

You can obtain or print the Oregon Notice of Assignment of Accounts from the service.

If available, use the Preview button to view the document template as well.

- If you already possess a US Legal Forms account, you may Log In and click on the Obtain button.

- Subsequently, you can complete, edit, print, or sign the Oregon Notice of Assignment of Accounts.

- Every legal document template you purchase is yours indefinitely.

- To obtain another copy of any purchased form, visit the My documents tab and click on the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the straightforward instructions below.

- First, ensure that you have selected the correct document template for the state/city of your preference.

- Review the form details to confirm that you have chosen the appropriate form.

Form popularity

FAQ

In Oregon, judgments can remain on your record for up to ten years if not renewed. However, they can sometimes become dormant, meaning they are no longer actively pursued. Understanding the implications of the Oregon Notice of Assignment of Accounts can help you manage judgments effectively, as they directly relate to your credit standing.