Oregon Private Trust Company, often referred to as Oregon PTC, is a specialized financial institution that offers trust and fiduciary services to individuals and families seeking greater control over the management and distribution of their assets. Unlike traditional trust companies, an Oregon PTC allows individuals to establish and maintain their own trust company, providing them with unparalleled flexibility and autonomy in managing their wealth. The primary advantage of establishing an Oregon Private Trust Company lies in the ability to maintain control over family assets without the need for external trustees or administrators. By acting as the trustee of their personal trust, individuals can directly oversee the investment decisions, distribution planning, and administrative functions associated with their estate. This level of control ensures that the individual's unique goals, values, and preferences are incorporated into all aspects of wealth management and inheritance planning. There are several types of Oregon Private Trust Companies, each catering to different needs and objectives: 1. Family Private Trust Company: This type of Oregon PTC is specifically designed for families looking to preserve and pass on their wealth to future generations. It allows multiple family members to actively participate in trust administration, ensuring continuity and a long-term vision for the family's assets. 2. Corporate Private Trust Company: Targeting business owners and entrepreneurs, a Corporate PTC provides a platform for managing both personal wealth and business assets within a single entity. This type of PTC can facilitate seamless coordination between estate planning and business succession strategies. 3. Charitable Private Trust Company: This variant of an Oregon PTC focuses on philanthropic endeavors. Individuals can establish a Charitable PTC to consolidate their charitable giving and oversee the management of various charitable trusts or foundations, ensuring their philanthropic goals are efficiently met. Establishing an Oregon Private Trust Company requires compliance with state statutory guidelines and regulatory frameworks. A professional team, including legal advisors, accountants, and wealth management experts, can assist individuals in navigating the complexities of forming and operating an Oregon PTC. In summary, an Oregon Private Trust Company empowers individuals and families with comprehensive control and autonomy over their wealth management decisions. By offering various types of PCs, tailored to the specific needs and objectives of different individuals, Oregon PTC provides a flexible and efficient way to preserve, grow, and distribute assets while aligning with personal values and long-term objectives.

Oregon Private Trust Company

Description

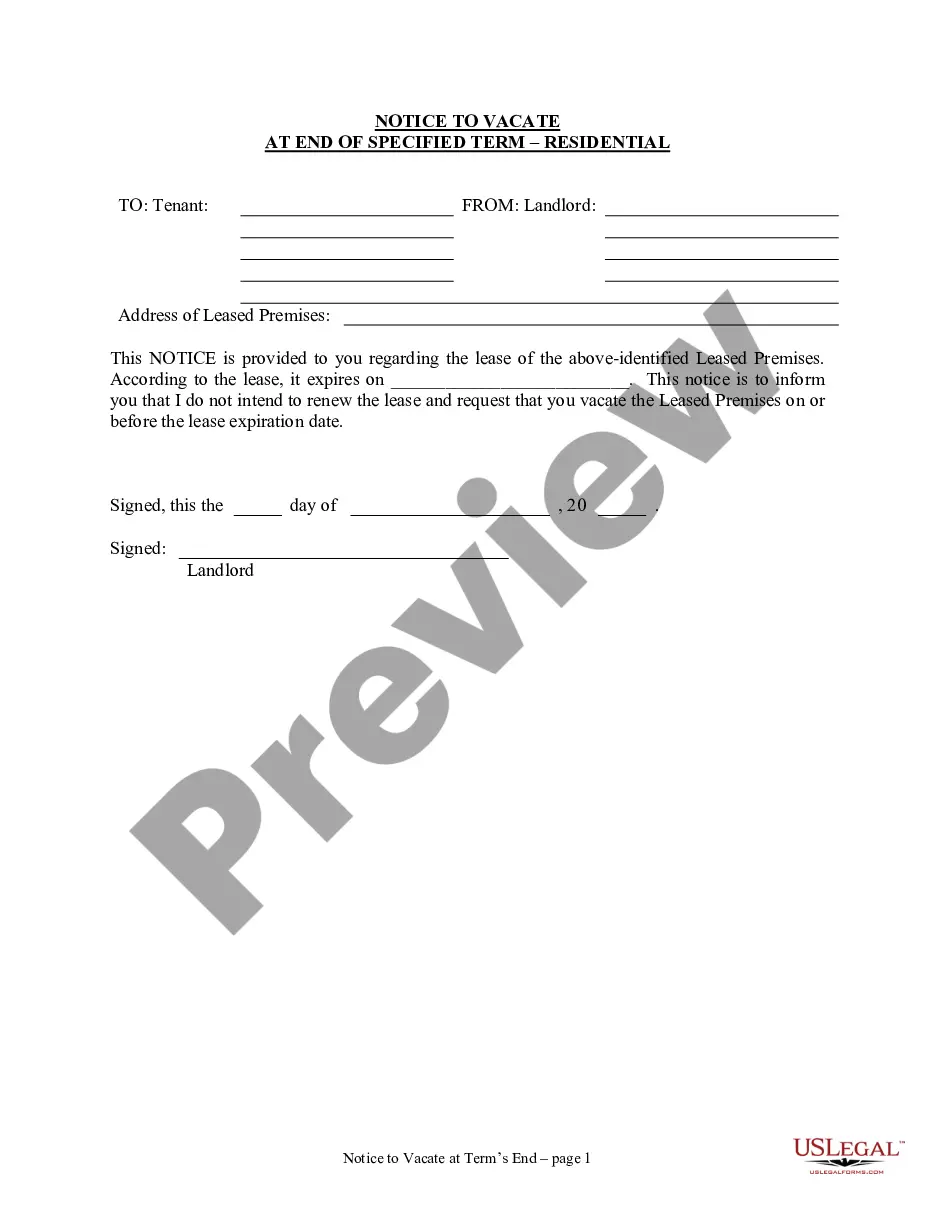

How to fill out Private Trust Company?

US Legal Forms - one of the biggest libraries of legitimate kinds in the States - provides a variety of legitimate document themes it is possible to acquire or produce. While using site, you can find thousands of kinds for company and individual functions, sorted by categories, says, or keywords and phrases.You can find the most recent versions of kinds much like the Oregon Private Trust Company within minutes.

If you already possess a membership, log in and acquire Oregon Private Trust Company from the US Legal Forms library. The Down load button will show up on every single form you look at. You get access to all earlier saved kinds in the My Forms tab of your respective profile.

If you wish to use US Legal Forms for the first time, listed here are simple directions to obtain began:

- Ensure you have chosen the correct form for your personal town/state. Select the Preview button to analyze the form`s content material. Look at the form outline to ensure that you have selected the proper form.

- When the form doesn`t satisfy your specifications, take advantage of the Look for industry near the top of the screen to obtain the one who does.

- If you are pleased with the shape, affirm your decision by simply clicking the Acquire now button. Then, pick the prices program you prefer and give your credentials to sign up for the profile.

- Process the financial transaction. Utilize your charge card or PayPal profile to perform the financial transaction.

- Find the file format and acquire the shape on the device.

- Make modifications. Fill up, revise and produce and indication the saved Oregon Private Trust Company.

Every template you added to your account does not have an expiry date and is also the one you have forever. So, if you want to acquire or produce one more duplicate, just check out the My Forms area and click on around the form you want.

Obtain access to the Oregon Private Trust Company with US Legal Forms, the most substantial library of legitimate document themes. Use thousands of specialist and express-distinct themes that satisfy your organization or individual requires and specifications.

Form popularity

FAQ

How to Create a Living Trust in OregonFigure out which type of trust you need to make.Do a property inventory.Choose your trustee.Draw up the trust document.Sign the trust document in front of a notary public.Fund the trust by transferring your property into it.

Trustees. The trustees are the legal owners of the assets held in a trust. Their role is to: deal with the assets according to the settlor's wishes, as set out in the trust deed or their will.

According to independent rankings, the top states with the best trust laws are South Dakota trust law and Nevada in the US.

Private trust companies are designed to preserve ownership of family wealth, which may include business assets, real estate, alternative assets such as hedge funds or private equity. These assets are managed by the trustee in accordance with the wishes of the family.

Plus, because trusts are private arrangements, they're a great way to plan the future ownership of any family business interests while keeping your financial affairs under wraps.

Advantages of a Private Trust CompanyEnhanced privacy protection. Potential tax advantages. No need to meet SEC registration requirements. Increased flexibility with regard to decision-making and asset management.

States that recognize regulated private trust companies include:Alabama.Colorado.Delaware.Massachusetts.Nevada.New Hampshire.Pennsylvania.South Dakota.More items...

For now, note that the top states for perpetual trusts are Alaska, Delaware, Nevada, and South Dakota. These states all allow perpetual trusts and don't assess state income taxes on these trusts....Which States Allow Perpetual Trusts?Alaska.Delaware.District of Columbia.Hawaii.Idaho.Illinois.Kentucky.Maine.More items...

Because trust companies are subject to regulation substantially similar to that applicable to banks, they enjoy many of the same exemptions from securities and other laws.

A Private Trust Company (PTC) is often created to be the trustee of one or more (typically) family trusts, but is not run as a commercial trust company. PTCs are popular with ultra-high net worth families who want to retain significant control over trustee decision-making.