Title: Oregon Letter Requesting Transfer of Property to Trust: A Comprehensive Guide for Property Owners Introduction: In this article, we will provide a detailed description of what an Oregon Letter Requesting Transfer of Property to Trust entails. Whether you're a property owner in Oregon or a professional assisting clients with trust establishment, understanding the intricacies of this process is vital. We will explore various aspects of this letter, different types of trusts, and the key elements involved in the transfer of property to a trust in Oregon. I. Understanding the Oregon Letter Requesting Transfer of Property to Trust: 1. Definition and Purpose: — Clarifying the purpose of the letter: transferring a property to a trust for legal and financial protection. — Recognizing the importance of a formal request to execute the transfer according to Oregon law. 2. Key Components and Format: — Explanation of the critical elements to be included in the letter. — Ensuring the letter follows a professional and business-oriented format. — Suggested structure and tone to convey the request clearly and effectively. 3. Legal Considerations: — Compliance with Oregon laws governing property transfers to trusts. — Potential tax implications and exemptions related to the transfer process. — Importance of consulting with an attorney or estate planner for legal advice. II. Types of Oregon Letters Requesting Transfer of Property to Trust: 1. Revocable Living Trust: — Definition and advantages of a revocable living trust. — Explanation of the transfer process to a revocable living trust. — Examples of scenarios where this type of trust is beneficial. 2. Irrevocable Trust: — Understanding the characteristics and benefits of an irrevocable trust in Oregon. — Highlighting the key differences between revocable and irrevocable trusts. — Emphasizing the importance of careful consideration, as an irrevocable trust cannot be easily modified. 3. Testamentary Trust: — Defining a testamentary trust and its purpose within estate planning. — Explaining the specific conditions that activate a testamentary trust. — Outlining the transfer process for property into a testamentary trust. III. Step-by-Step Guide for Writing an Oregon Letter Requesting Transfer of Property to Trust: 1. Gathering Relevant Information: — Detailed checklist of essential information required for an effective letter. — Identifying the trust's legal title, property information, and any related documentation. 2. Crafting a Clear and Comprehensive Letter: — Step-by-step guidance on composing the letter. — Highlighting the need for precision, brevity, and clarity in communication. — Providing sample sentences and phrases to aid in conveying the request professionally. 3. Finalizing the Letter: — Reviewing the completed letter for accuracy and completeness. — Encouraging property owners to seek professional review before final submission. — Offering tips on maintaining a copy of the letter for personal records. Conclusion: Writing an Oregon Letter Requesting Transfer of Property to Trust is a crucial step towards securing property within a legal framework. By understanding the different types of trusts and the process involved, property owners can ensure their assets are protected. Remember to consult with legal professionals to ensure compliance with Oregon laws and regulations.

Employment Transfer Letter

Description

How to fill out Oregon Letter Requesting Transfer Of Property To Trust?

Are you presently within a situation the place you need papers for possibly enterprise or person uses nearly every working day? There are tons of legitimate record layouts available on the Internet, but discovering kinds you can trust is not easy. US Legal Forms delivers thousands of develop layouts, like the Oregon Letter Requesting Transfer of Property to Trust, which can be composed to fulfill state and federal specifications.

Should you be previously informed about US Legal Forms site and possess an account, just log in. Following that, you are able to download the Oregon Letter Requesting Transfer of Property to Trust format.

If you do not offer an bank account and wish to begin to use US Legal Forms, abide by these steps:

- Find the develop you want and ensure it is for your proper metropolis/state.

- Utilize the Preview option to check the form.

- See the description to actually have chosen the right develop.

- If the develop is not what you`re searching for, utilize the Search area to get the develop that suits you and specifications.

- Once you obtain the proper develop, click on Acquire now.

- Choose the costs plan you need, submit the necessary information and facts to create your money, and buy an order utilizing your PayPal or credit card.

- Choose a convenient file format and download your duplicate.

Get each of the record layouts you may have bought in the My Forms menu. You can aquire a further duplicate of Oregon Letter Requesting Transfer of Property to Trust anytime, if necessary. Just click the essential develop to download or print out the record format.

Use US Legal Forms, by far the most substantial selection of legitimate varieties, to save time and stay away from faults. The services delivers professionally made legitimate record layouts which you can use for a range of uses. Produce an account on US Legal Forms and begin producing your daily life a little easier.

Form popularity

FAQ

A grantor may place a mortgaged home in a living trust by signing a warranty or quitclaim deed from the current owners to the trust. In this case, the deed would name the living trust as grantee and would be and recorded just like any other property transfer.

Since your house has a title, you need to change the title to show that the property is now owned by the trust. To do this you need to prepare and sign a new deed to transfer ownership to you as trustee of the trust.

Property is often transferred into a trust as part of inheritance tax planning however the trust needs to meet certain conditions and to be set up correctly by a solicitor. By putting a property into trust rather than making an outright gift, you are able to control how the property is used after it is given away.

A swap power is also called a power to substitute. It is a special right reserved to you (or someone else) in a trust you create while you are alive. This right gives you the power to swap an asset of yours, say cash, for an asset held in the trust you created.

To transfer cash or securities, the trustee will open an account in the trust's name, and the grantor will instruct his or her bank or broker to move the funds from his or her account to the trust's account. For real estate, a deed is used to transfer legal title of the property from the grantor to the trust.

Gifting Property To Family Trust The first option you can choose when transferring the property title is to gift it to the trustee. The trustee and the trust will have to sign a gift deed, which establishes that the ownership of the property is being transferred without payment.

To transfer real property into your Trust, a new deed reflecting the name of the Trust must be executed, notarized and recorded with the County Recorder in the County where the property is located. Care must be taken that the exact legal description in the existing deed appears on the new deed.

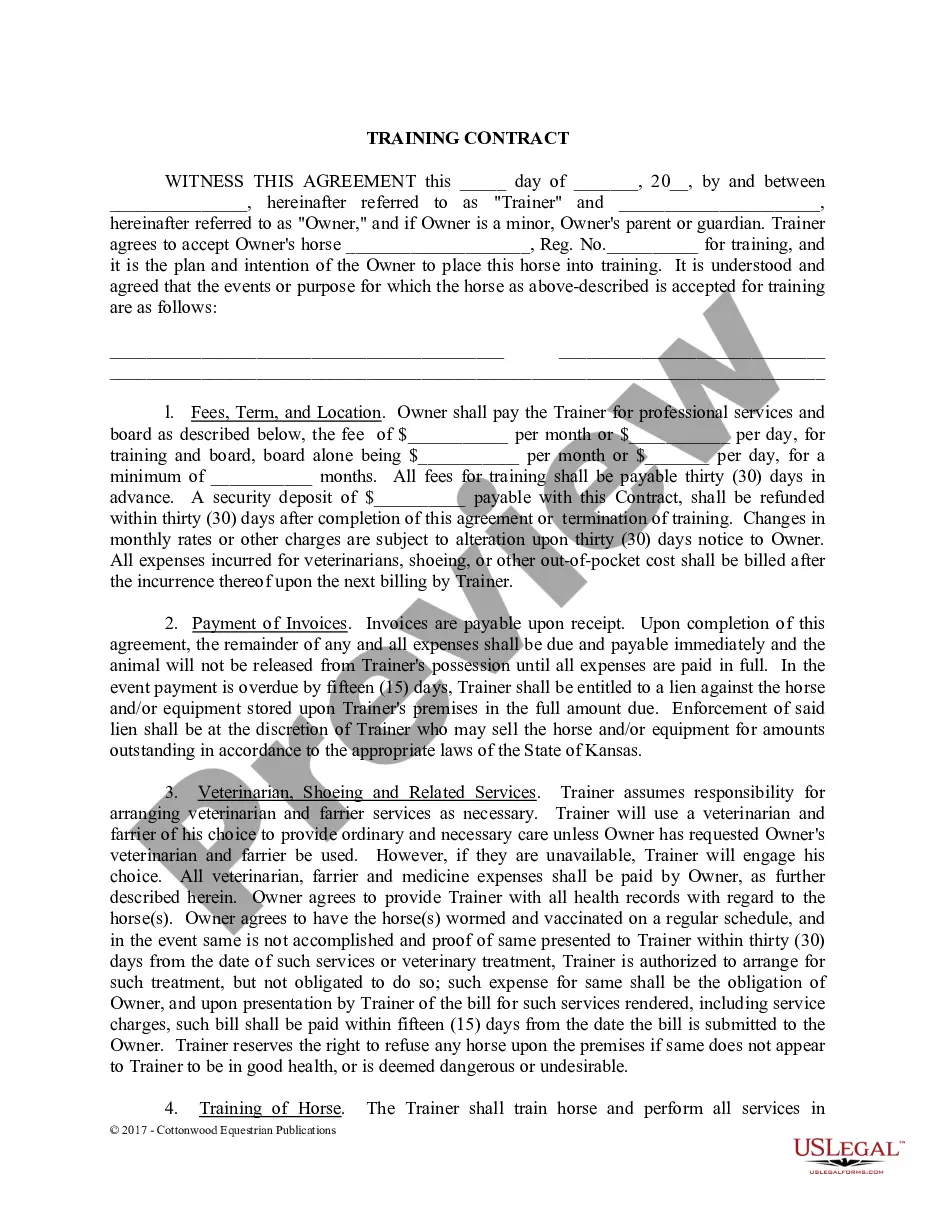

How to Create a Living Trust in OregonFigure out which type of trust you need to make.Do a property inventory.Choose your trustee.Draw up the trust document.Sign the trust document in front of a notary public.Fund the trust by transferring your property into it.

To make a living trust in Oregon, you:Choose whether to make an individual or shared trust.Decide what property to include in the trust.Choose a successor trustee.Decide who will be the trust's beneficiariesthat is, who will get the trust property.Create the trust document.More items...

How to Transfer Assets Into an Irrevocable TrustIdentify Your Assets. Review your assets and determine which ones you would like to place in your trust.Obtain a Trust Tax Identification Number.Transfer Ownership of Your Assets.Purchase a Life Insurance Policy.