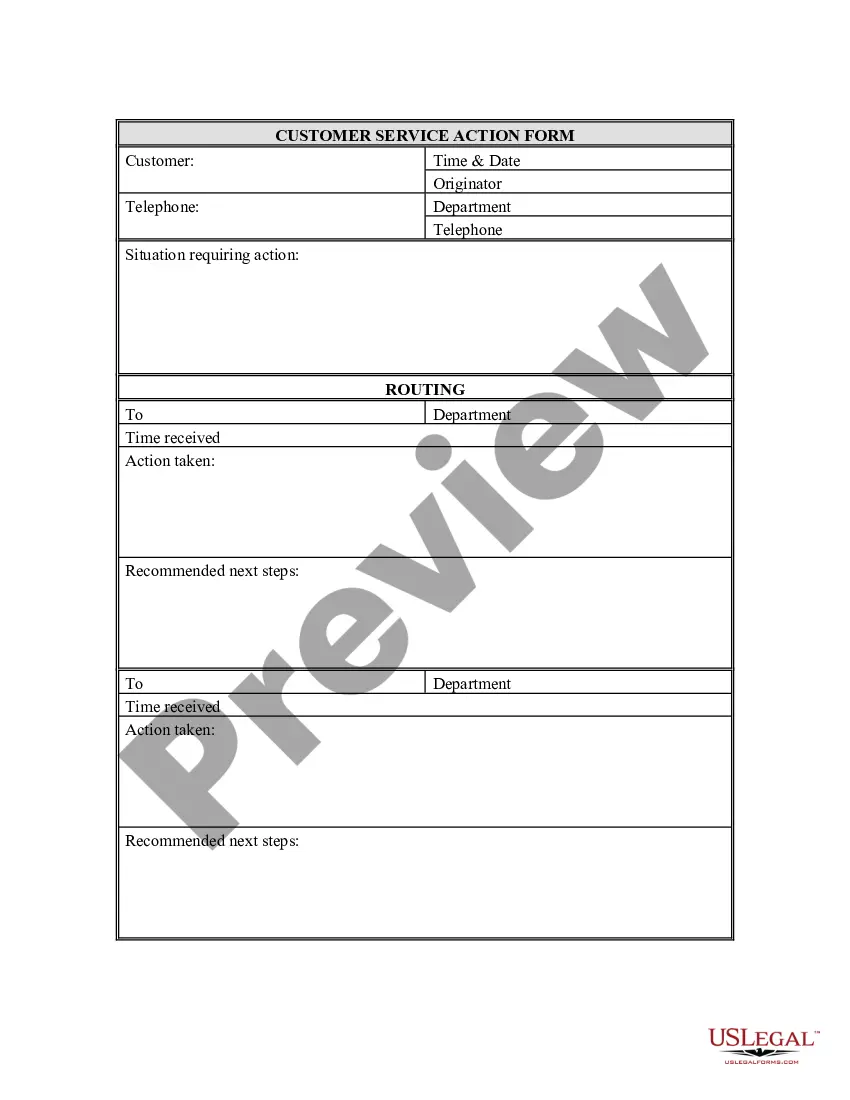

Oregon Customer Service Action Form

Description

How to fill out Customer Service Action Form?

You can spend time on the web trying to locate the valid document template that fulfills the local and national requirements you desire.

US Legal Forms offers thousands of valid forms that are vetted by professionals.

It's easy to download or print the Oregon Customer Service Action Form from our services.

If available, utilize the Preview button to review the document template as well.

- If you already have a US Legal Forms account, you can Log In and then click the Acquire button.

- After that, you can fill out, modify, print, or sign the Oregon Customer Service Action Form.

- Each valid document template you obtain is yours permanently.

- To get another copy of any previously acquired form, visit the My documents tab and click the relevant button.

- If you're using the US Legal Forms website for the first time, follow the basic instructions below.

- First, ensure you have selected the appropriate document template for the area of your choice.

- Review the form description to ensure you have chosen the correct form.

Form popularity

FAQ

Requirements and penalties Required 1099s are the 1099-G, 1099-K, 1099-NEC, 1099-MISC, 1099-R, and W-2G. Other 1099s, including 1099-DIV and 1099-INT, are not required.

File Form OR-WR on Revenue Online at . Mail your Form OR-WR separately from your 2018 4th quarter Form OQ and 4th quarter statewide transit tax form. If you amend Form OR-WR, you will also need to amend Form OQ and 4th quarter statewide transit tax form. Make a copy for your records.

The Oregon Department of Revenue does not provide tax forms or booklets for the library to distribute. Options for obtaining State tax forms and instructions: Download forms from the Oregon Department of Revenue website . Order forms by calling 1-800-356-4222.

You may file a complaint with any of the following agencies:Your local Equal Opportunity Coordinator.The State of Oregon Equal Opportunity Officer (1-800-237-3710 ext. 17692)The Civil Rights Center, US Department of Labor, 200 Constitution Avenue NW, Room N-4123, Washington DC 202 10.

Oregon Department of Revenue. 2020 Form OR-40. Oregon Individual Income Tax Return for Full-year Residents.

Choose a quarterly report filing method:Oregon Payroll Reporting System (OPRS) electronic filing.Combined Payroll Tax Reports Form OQ.Interactive voice response system, call 503-378-3981. Use only to report quarters with no payroll or no hours worked.

Oregon Form 40 is used by full-year residents to file their state income tax return. The purpose of Form 40 is to determine your tax liability for the state of Oregon. Nonresident and part-year resident filers will complete Oregon Form OR-40-N or Form OR-40-P instead.

To file the Form WR electronically, as required under ORS 316.202 and ORS 314.360, you must do so using Department of Revenue's system, Revenue Online by going to this link: .

Form 1040 is used by U.S. taxpayers to file an annual income tax return.