Keywords: Oregon Resolution of Meeting, LLC Members, Authorize Expense Accounts Title: Understanding the Oregon Resolution of Meeting of LLC Members to Authorize Expense Accounts Introduction: The Oregon Resolution of Meeting of LLC Members to Authorize Expense Accounts is a crucial document that allows limited liability company (LLC) members to approve expense accounts for authorized individuals or specific purposes. This resolution highlights the importance of maintaining financial transparency and ensuring that expenses are in line with the LLC's goals and objectives. In the state of Oregon, there are several types of resolutions related to authorizing expense accounts, including: 1. Regular Expense Account Authorization Resolution: A regular expense account authorization resolution is the most common type used by LLC members to establish general guidelines and parameters regarding expense accounts. It outlines the criteria for approving expenses, the process for submitting expense reports, and the individuals responsible for reviewing and approving them. 2. Specific Expense Account Authorization Resolution: In certain situations, LLC members may need to pass a resolution to authorize specific expenses that fall outside the scope of regular expenses. This resolution details the specific purpose, amount, and timeline for the authorized expense. It ensures that members are fully aware of the proposed expenditure and have an opportunity to discuss and vote on it during a meeting. 3. Individual Expense Account Authorization Resolution: LLC members may also pass a resolution to authorize an individual member or officer to have an expense account for specific business-related purposes. This resolution outlines the responsibilities, limitations, and reporting requirements for the approved individual. It ensures that there is accountability and transparency when it comes to individual expense accounts. 4. Expense Account Authorization Resolution for Capital Expenditures: LLC members may need to pass a resolution specifically related to authorizing expense accounts for capital expenditures. Capital expenditures typically involve significant investments in assets or property that will provide long-term benefits to the LLC. This resolution outlines the approval process, financial limits, and any reporting requirements for capital expense accounts. Conclusion: In summary, the Oregon Resolution of Meeting of LLC Members to Authorize Expense Accounts is an essential tool for LLC members to establish guidelines and approve expense accounts. It ensures financial transparency and accountability within the company. Depending on the circumstances, different types of resolutions may be required, including regular expense account authorization, specific expense account authorization, individual expense account authorization, or expense account authorization for capital expenditures. Understanding and properly executing these resolutions is vital for the effective management of an LLC's finances.

Oregon Resolution of Meeting of LLC Members to Authorize Expense Accounts

Description

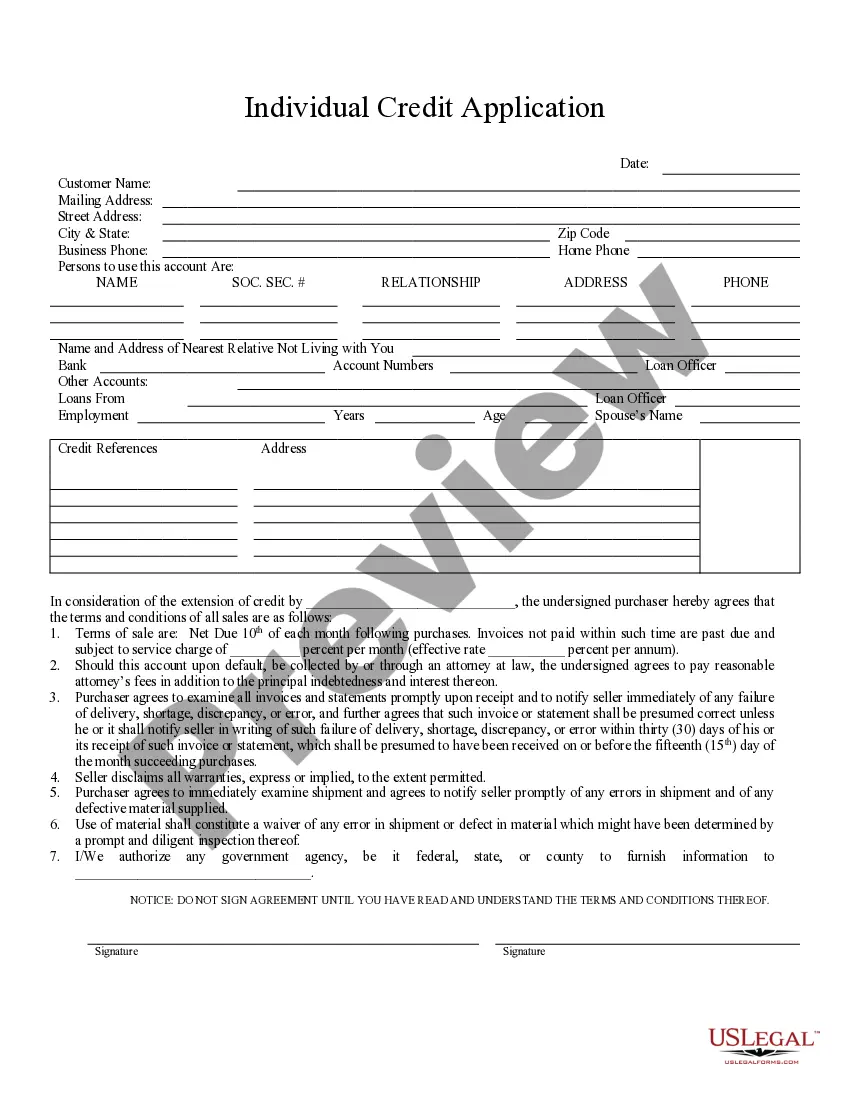

How to fill out Oregon Resolution Of Meeting Of LLC Members To Authorize Expense Accounts?

US Legal Forms - one of several largest libraries of legitimate kinds in America - delivers a wide range of legitimate document web templates you may down load or produce. While using internet site, you may get a huge number of kinds for organization and person reasons, categorized by categories, states, or search phrases.You will find the most recent types of kinds much like the Oregon Resolution of Meeting of LLC Members to Authorize Expense Accounts within minutes.

If you have a membership, log in and down load Oregon Resolution of Meeting of LLC Members to Authorize Expense Accounts from your US Legal Forms library. The Obtain switch will appear on every type you view. You have access to all formerly acquired kinds within the My Forms tab of your own accounts.

If you would like use US Legal Forms the first time, here are straightforward directions to help you started out:

- Be sure to have picked the best type for your town/region. Click on the Review switch to examine the form`s content. Look at the type description to actually have selected the right type.

- In case the type does not suit your requirements, use the Look for industry towards the top of the monitor to find the one that does.

- If you are content with the shape, verify your option by visiting the Acquire now switch. Then, choose the pricing program you favor and offer your qualifications to register on an accounts.

- Procedure the financial transaction. Make use of your bank card or PayPal accounts to accomplish the financial transaction.

- Pick the formatting and down load the shape on the device.

- Make adjustments. Load, modify and produce and indication the acquired Oregon Resolution of Meeting of LLC Members to Authorize Expense Accounts.

Every single template you added to your account does not have an expiration date and is also your own property forever. So, if you wish to down load or produce an additional duplicate, just check out the My Forms segment and click on about the type you want.

Get access to the Oregon Resolution of Meeting of LLC Members to Authorize Expense Accounts with US Legal Forms, the most considerable library of legitimate document web templates. Use a huge number of specialist and express-specific web templates that meet your small business or person needs and requirements.

Form popularity

FAQ

An LLC does not have to make resolutions, but there are times it could be useful: An LLC member makes a decision regarding the business's organization. A member must establish their authority to open a bank account for the LLC. Members must prove their authority to sign a loan on the LLC's behalf.

How to Write a ResolutionFormat the resolution by putting the date and resolution number at the top.Form a title of the resolution that speaks to the issue that you want to document.Use formal language in the body of the resolution, beginning each new paragraph with the word, whereas.More items...?

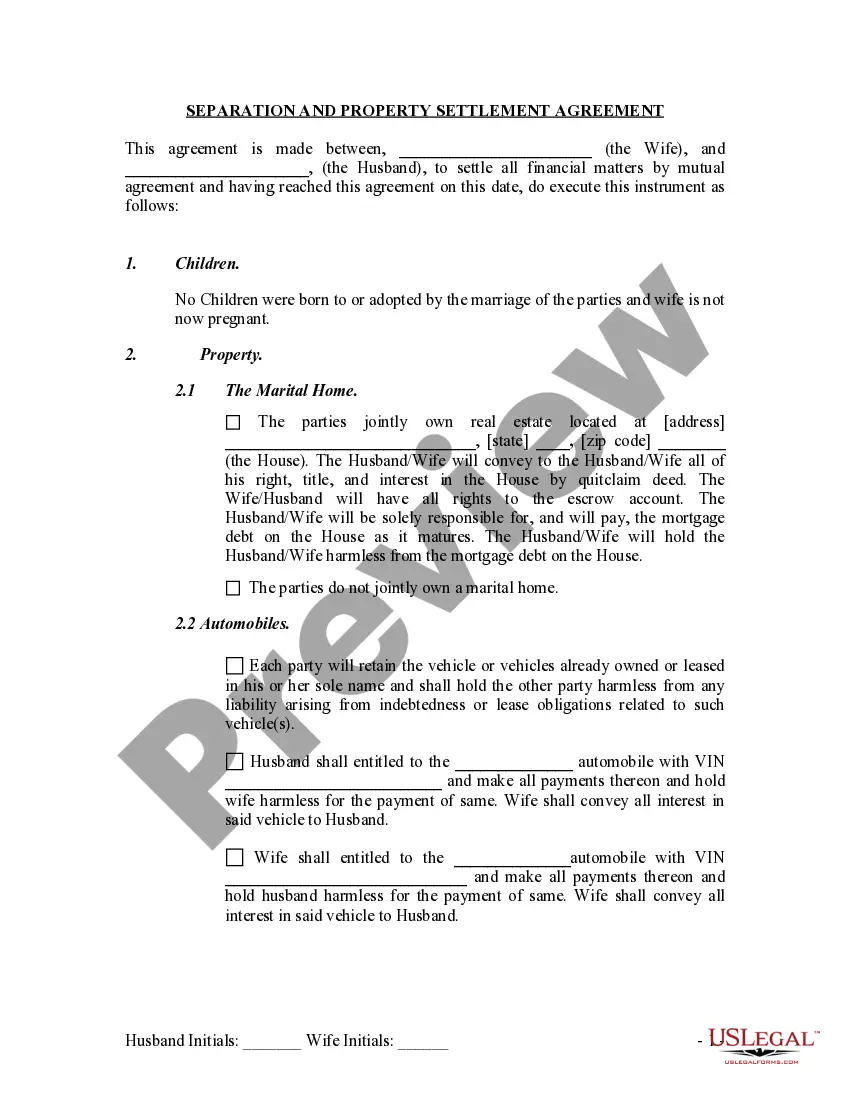

Most LLC Resolutions include the following sections:Date, time, and place of the meeting.Owners or members present.The nature of business or resolution to discuss, including members added or removed, loans made, new contracts written, or changes in business scope or method.More items...

With a SMLLC, you'd only use a resolution to document the most important business matters or actions such as: buying or selling real estate. getting a loan, establishing a bank account, or otherwise working with a financial institution. amending the articles of organization or operating agreement.

An LLC Corporate Resolution Form is a document that describes the management and decision-making processes of the LLC. While LLCs are generally not required to draft a resolution form, it is highly beneficial and important for all businesses to draft corporate resolutions.

Most LLC Resolutions include the following sections:Date, time, and place of the meeting.Owners or members present.The nature of business or resolution to discuss, including members added or removed, loans made, new contracts written, or changes in business scope or method.More items...

An LLC resolution is a written record of important decisions made by members that describes an action taken by the company and confirms that members were informed about it and agreed to it.

Unlike LLCs, corporations are required to make resolutions. Therefore, they are used to preparing them when shareholders or the board of directors make decisions. Although an LLC is not required to make resolutions, there are many reasons for getting in the habit of maintaining resolutions.

An LLC does not have to make resolutions, but there are times it could be useful: An LLC member makes a decision regarding the business's organization. A member must establish their authority to open a bank account for the LLC. Members must prove their authority to sign a loan on the LLC's behalf.