Oregon Self-Employed Independent Contractor Employment Agreement - commission for new business

Description

How to fill out Self-Employed Independent Contractor Employment Agreement - Commission For New Business?

Choosing the best authorized papers template can be quite a have difficulties. Of course, there are plenty of templates available on the net, but how can you find the authorized type you want? Utilize the US Legal Forms web site. The support provides 1000s of templates, such as the Oregon Self-Employed Independent Contractor Employment Agreement - commission for new business, which you can use for enterprise and personal requires. All of the varieties are examined by specialists and satisfy state and federal needs.

In case you are already signed up, log in to the bank account and then click the Obtain button to find the Oregon Self-Employed Independent Contractor Employment Agreement - commission for new business. Utilize your bank account to check from the authorized varieties you have ordered in the past. Visit the My Forms tab of your bank account and get an additional version of your papers you want.

In case you are a brand new end user of US Legal Forms, listed here are straightforward instructions so that you can stick to:

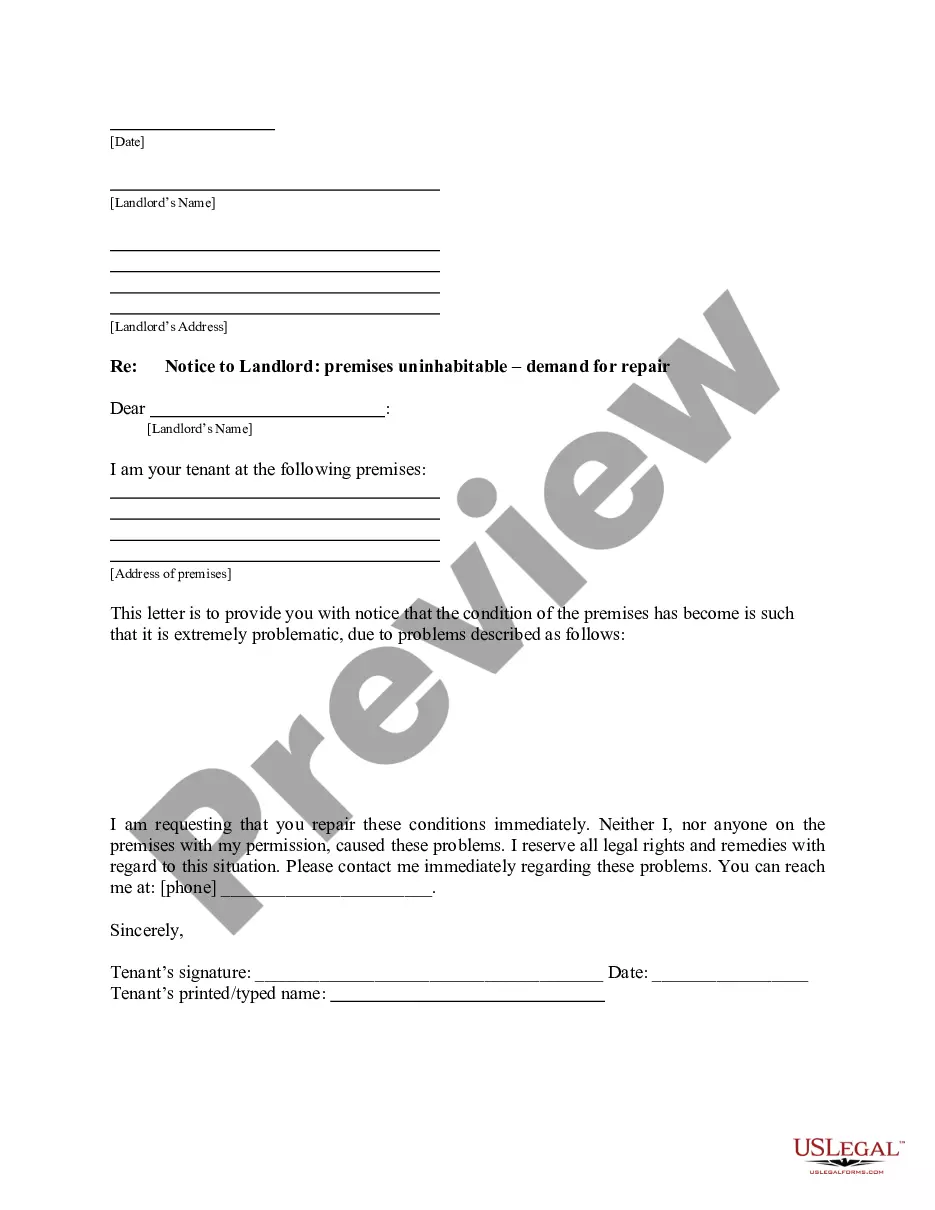

- Initially, be sure you have selected the appropriate type for your personal city/region. It is possible to examine the shape making use of the Review button and study the shape outline to make sure this is the best for you.

- In the event the type is not going to satisfy your requirements, utilize the Seach discipline to obtain the proper type.

- When you are sure that the shape is proper, click on the Get now button to find the type.

- Opt for the prices prepare you desire and type in the required information. Build your bank account and pay money for your order utilizing your PayPal bank account or Visa or Mastercard.

- Pick the document file format and down load the authorized papers template to the product.

- Full, revise and produce and signal the received Oregon Self-Employed Independent Contractor Employment Agreement - commission for new business.

US Legal Forms is the greatest local library of authorized varieties that you can find a variety of papers templates. Utilize the company to down load appropriately-manufactured papers that stick to express needs.

Form popularity

FAQ

Who Needs a Contractors License? The Oregon Construction Contractors Board states specifically that anyone who works for compensation in any construction activity involving improvements to real property needs a license. Common construction roles include: Roofing.

No, Oregon does not issue an independent contractor license. Although various trades and professional occupations may have licensure requirements, merely holding such a license does not make anyone into an independent contractor.

What is an independent contractor? Under Oregon law, an independent contractor must be: free from direction and control over the means and manner of providing the services, subject only to the right to specify the desired results; is customarily engaged in an independently established business; and.

The main pieces of employment legislation, chief among which are the Labour Relations Act 66 of 1995 (LRA) the Basic Conditions of Employment Act 75 of 1997 (BCEA) and the Employment Equity Act 55 of 1998 (EEA), apply to employees and not independent contractors.

Employees in South Africa are entitled to certain minimum employment benefits, while independent contractors are not. Subject to some exclusions, all employees are entitled to a number of statutory minimum entitlements and basic conditions of employment.

The threshold for performing certain work without a contractor license increased from $500 to $1,000. To qualify for the exemption, a contractor must perform work that is casual, minor or inconsequential. This means that the work cannot: Be structural in nature.

Independent contractors are self-employed workers who provide services for an organisation under a contract for services. Independent contractors are not employees and are typically highly skilled, providing their clients with specialist skills or additional capacity on an as needed basis.

Often Independent Contractors are completely unaware that they are not Employees as defined in South African labour legislation and therefore unprotected by labour legislation.

Becoming an independent contractor is one of the many ways to be classified as self-employed. By definition, an independent contractor provides work or services on a contractual basis, whereas, self-employment is simply the act of earning money without operating within an employee-employer relationship.

Every independent contractor is a business owner. You run a business even if you are your only employee and you don't have a company name. There are significant differences, however, between a business that's just you as an independent contractor and running a company with employees and a registered name.