Oregon Personal Guaranty is a legal document that serves as a guarantee of contract for the lease and purchase of real estate. It is designed to protect the interests of landlords, property owners, and lenders by providing assurance that the tenant or buyer will fulfill their contractual obligations. This type of guaranty is commonly used in various real estate transactions, including commercial leases, residential lease agreements, and property purchase agreements. It acts as a security measure to ensure that the landlord or lender will be compensated in case the tenant or buyer defaults on their payments or breaches any terms of the contract. The Oregon Personal Guaranty typically includes essential details such as the names of the parties involved, the property description, the terms and conditions of the lease or purchase agreement, and the obligations and responsibilities of the guarantor. The guarantor, also known as the cosigner, is usually an individual or entity who agrees to be personally liable for the tenant or buyer's obligations in case of default or non-compliance. There are different types of Oregon Personal Guaranty, depending on the specific circumstances and nature of the real estate transaction. Some common variations include: 1. Commercial Lease Guaranty: This type of personal guaranty is used in commercial leasing agreements, where a business entity agrees to be personally liable for the obligations of the tenant. The guarantor may be the owner of the business or another third-party entity. 2. Residential Lease Guaranty: For residential lease agreements, a guarantor may be required, especially when the tenant has a limited credit history or insufficient income. The guarantor typically provides assurance that they will cover the rent or any damages caused by the tenant. 3. Purchase Agreement Guaranty: In real estate purchase agreements, a guarantor may be required to secure the buyer's obligations, such as the down payment, mortgage payments, or other financial commitments. This offers additional protection to the seller or lender. 4. Construction Loan Guaranty: When obtaining a loan for construction purposes, a guarantor may be needed to ensure that the borrower follows through with the construction plans and meets the financial obligations associated with the loan. Overall, Oregon Personal Guaranty plays a crucial role in safeguarding the interests of parties involved in real estate transactions. It ensures that the contractual obligations are fulfilled, provides financial security, and mitigates the risks associated with default or non-compliance.

Oregon Personal Guaranty - Guarantee of Contract for the Lease and Purchase of Real Estate

Description

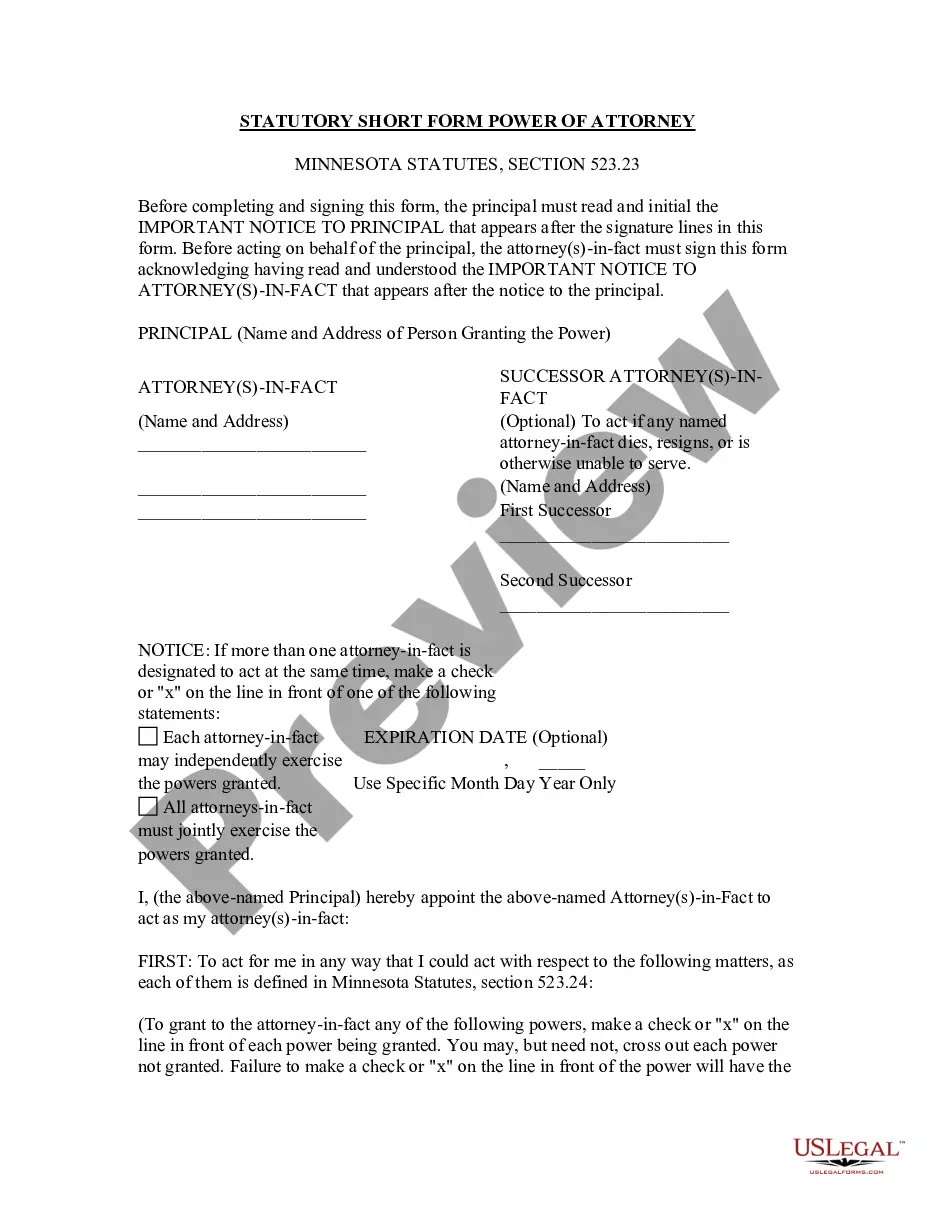

How to fill out Oregon Personal Guaranty - Guarantee Of Contract For The Lease And Purchase Of Real Estate?

Are you in the place the place you will need paperwork for either business or person reasons virtually every day? There are a lot of legitimate file web templates accessible on the Internet, but getting kinds you can rely on isn`t effortless. US Legal Forms delivers a large number of develop web templates, like the Oregon Personal Guaranty - Guarantee of Contract for the Lease and Purchase of Real Estate, which are created in order to meet federal and state demands.

When you are presently informed about US Legal Forms web site and have your account, simply log in. Afterward, you are able to down load the Oregon Personal Guaranty - Guarantee of Contract for the Lease and Purchase of Real Estate format.

Unless you provide an profile and wish to start using US Legal Forms, adopt these measures:

- Get the develop you want and make sure it is for that right metropolis/area.

- Take advantage of the Review option to check the form.

- See the outline to ensure that you have chosen the correct develop.

- If the develop isn`t what you`re trying to find, use the Look for discipline to find the develop that suits you and demands.

- When you discover the right develop, just click Acquire now.

- Choose the rates strategy you need, complete the specified information to generate your money, and pay money for an order using your PayPal or charge card.

- Select a hassle-free document file format and down load your backup.

Find each of the file web templates you may have purchased in the My Forms menu. You may get a extra backup of Oregon Personal Guaranty - Guarantee of Contract for the Lease and Purchase of Real Estate anytime, if possible. Just go through the required develop to down load or printing the file format.

Use US Legal Forms, one of the most extensive assortment of legitimate varieties, to save lots of some time and stay away from blunders. The services delivers expertly created legitimate file web templates which you can use for a selection of reasons. Generate your account on US Legal Forms and start generating your lifestyle easier.

Form popularity

FAQ

A personal guaranty is not enforceable without consideration A contract is an enforceable promise. The enforceability of a contract comes from one party's giving of consideration to the other party. Here, the bank gives a loan (the consideration) in exchange for the guarantor's promise to repay it.

If you sign a personal guarantee, you are personally liable for the loan balance or a portion thereof. If your business later defaults on the loan, anyone who signed the personal guarantee can be held responsible for the remaining balance, even after the lender forecloses on the loan collateral.

An otherwise valid and enforceable personal guarantee can be revoked later in several different ways. A guaranty, much like any other contract, can be revoked later if both the guarantor and the lender agree in writing. Some debts owed by personal guarantors can also be discharged in bankruptcy.

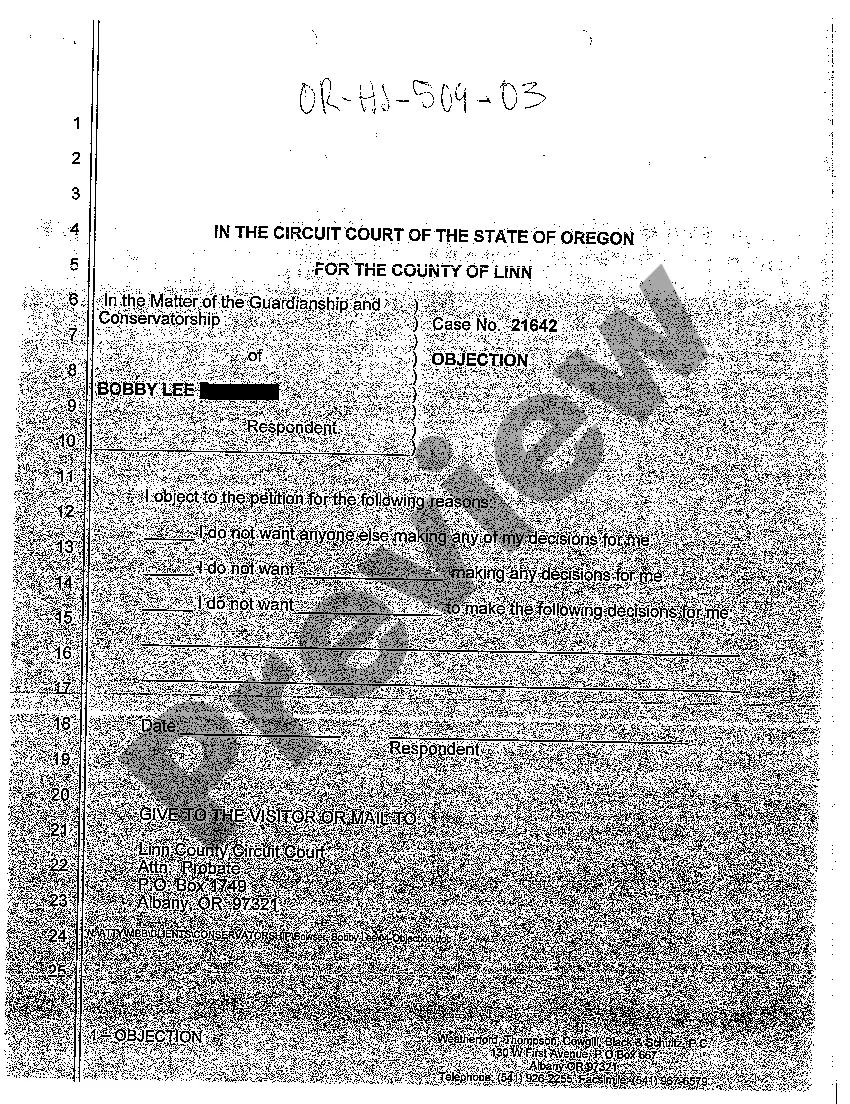

A lease guarantee is a contract signed by the tenant, landlord and the third party. It stipulates the financial obligations of all the parties involved and safeguards them from future risks.

The term personal guarantee refers to an individual's legal promise to repay credit issued to a business for which they serve as an executive or partner. Providing a personal guarantee means that if the business becomes unable to repay the debt, the individual assumes personal responsibility for the balance.

In writing The guarantee must be evidenced in writing to be enforceable. Signed The document must be signed by the guarantor or their authorised agent. Their name can be written or printed. Secondary liability The document must establish that the guarantor has secondary liability for the debt.

A guarantee agreement definition is common in real estate and financial transactions. It concerns the agreement of a third party, called a guarantor, to provide assurance of payment in the event the party involved in the transaction fails to live up to their end of the bargain.

Providing a personal guarantee means that if the business becomes unable to repay the debt, the individual assumes personal responsibility for the balance. Personal guarantees provide an extra level of protection to credit issuers who want to make sure they will be repaid.

A business owner will often sign a personal guarantee if a company needs to make a purchase on credit for things such as real estate, inventory, supplies, or services. By signing the agreement, the owner commits to paying the debt with personal (nonbusiness) funds if the company can't satisfy the obligation.