Oregon Farm Lease or Rental — Short is a legally binding agreement between a landowner and a tenant, typically a farmer or agricultural producer, for the rental of farmland in Oregon for a limited period. This type of lease is specifically designed for short-term agreements, typically lasting for one year or less, although the exact duration may vary depending on the requirements and preferences of the parties involved. The Oregon Farm Lease or Rental — Short provides a comprehensive framework for land-use and outlines the rights, responsibilities, and obligations of both the landowner and the tenant. It covers various aspects related to the farmland, including cultivation practices, lease term, renewal options, rental payment terms, maintenance responsibilities, and any additional terms or conditions agreed upon by both parties. Types of Oregon Farm Lease or Rental — Short: 1. Crop-Share Lease: This type of lease arrangement involves a sharing of the agricultural production or proceeds between the landowner and the tenant. The tenant provides the labor, inputs, and equipment while the landowner contributes the land and often receives a predetermined percentage of the crop or revenue as rent. 2. Cash Rent Lease: In this type of lease, the tenant pays a fixed cash amount as rent to the landowner for the use of the farmland. The tenant assumes full responsibility for the agricultural operation, including bearing the costs of inputs, labor, and machinery. 3. Custom Farming Agreement: This agreement allows landowners to hire a tenant to carry out specific farming activities on their behalf. The landowner compensates the tenant for providing services like plowing, planting, harvesting, or other agreed-upon tasks, without involving any rental payment or sharing of proceeds. 4. Seasonal Lease: This type of lease applies when the land is specifically utilized for a particular growing season or crop cycle. It outlines the precise duration and terms for the utilization of the farmland during a specific time frame, typically lasting less than a year. 5. Pasture/ Livestock Lease: This lease agreement is tailored for landowners who want to rent out their pastures or grazing land specifically for livestock farming purposes. It outlines the terms and conditions related to grazing, animal management, water supply, fencing responsibilities, and any specific requirements related to the livestock operation. When entering into an Oregon Farm Lease or Rental — Short, both parties are strongly advised to consult legal professionals to ensure compliance with state laws, clarify specific terms, and protect their interests. It is important to meticulously draft the lease agreement to address all potential contingencies and avoid future disputes.

Oregon Farm Lease or Rental - Short

Description

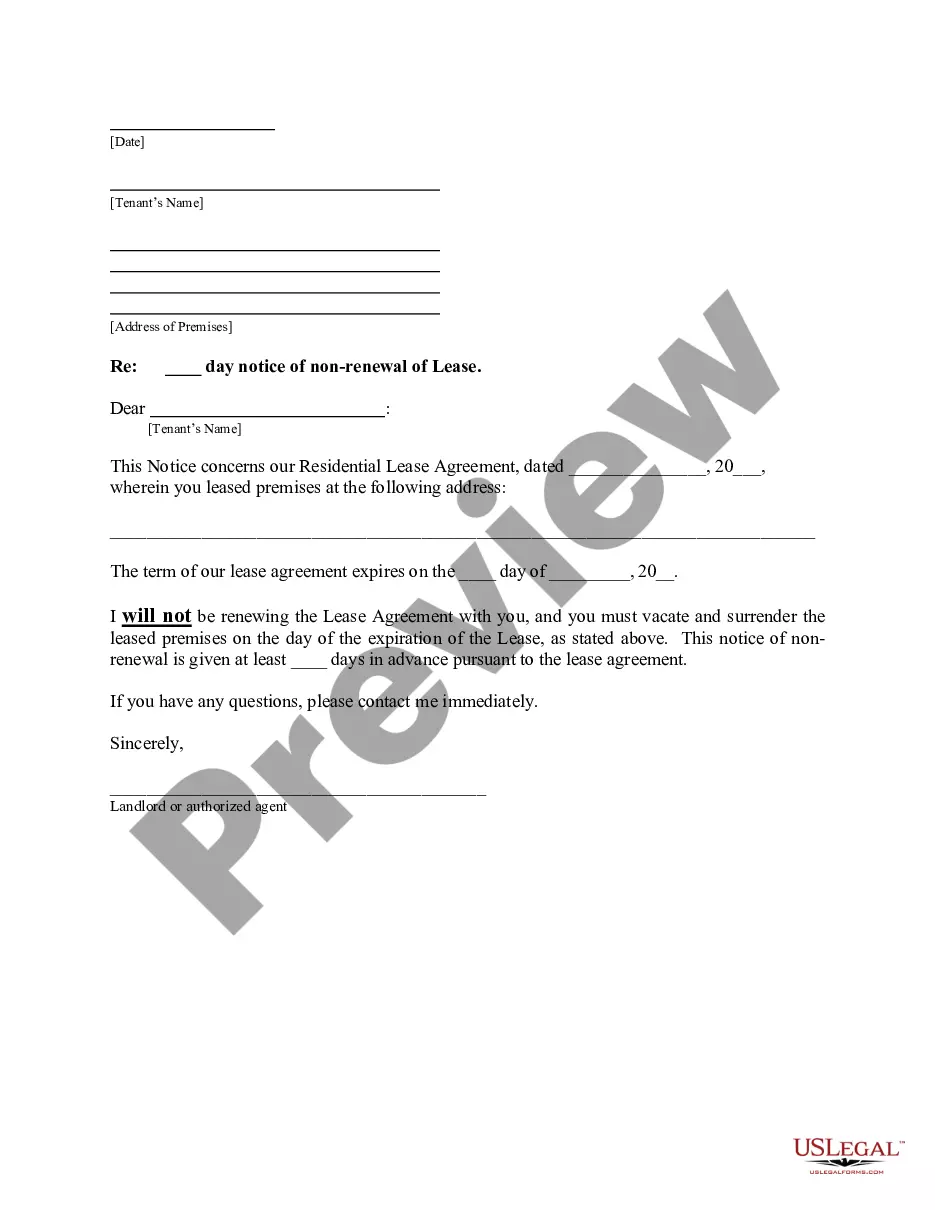

How to fill out Farm Lease Or Rental - Short?

It is possible to commit several hours on the Internet searching for the legitimate file template that fits the federal and state requirements you want. US Legal Forms offers a large number of legitimate forms which are analyzed by professionals. You can actually down load or print the Oregon Farm Lease or Rental - Short from our service.

If you already have a US Legal Forms bank account, you can log in and then click the Acquire key. Afterward, you can complete, modify, print, or sign the Oregon Farm Lease or Rental - Short. Every legitimate file template you acquire is the one you have eternally. To obtain one more duplicate of any purchased type, check out the My Forms tab and then click the corresponding key.

If you work with the US Legal Forms website for the first time, keep to the simple guidelines under:

- Initial, make certain you have chosen the right file template for your state/city of your choosing. Browse the type outline to make sure you have chosen the appropriate type. If readily available, use the Preview key to appear through the file template at the same time.

- If you want to get one more model of the type, use the Look for discipline to obtain the template that fits your needs and requirements.

- Upon having discovered the template you desire, simply click Acquire now to proceed.

- Pick the costs plan you desire, enter your qualifications, and register for an account on US Legal Forms.

- Total the financial transaction. You can use your Visa or Mastercard or PayPal bank account to purchase the legitimate type.

- Pick the format of the file and down load it to the gadget.

- Make changes to the file if needed. It is possible to complete, modify and sign and print Oregon Farm Lease or Rental - Short.

Acquire and print a large number of file templates utilizing the US Legal Forms site, which offers the largest assortment of legitimate forms. Use specialist and express-certain templates to take on your company or personal needs.

Form popularity

FAQ

Oregon Farmland Prices Over the last 20 years, the price of farmland per acre in oregon has risen by an average of 3.7% per year to $3,120 per acre as of 2019. This represents an increase of $1,520 per acre of farmland over this time period.

With a land lease agreement (also known as a ground lease), you purchase the home but rent the land. One of the main advantages is the lower price of this unique arrangement. One of the main disadvantages is that you will not be able to build valuable equity in the land on which you live.

Farmland has historically been a good investment. Unfortunately, not many investors have been able to benefit from this asset class, given the high upfront costs of buying farmland.

Over the last 20 years, farmland rental rates per acre in oregon have risen from an average of $160 per acre in 2019 to $160 per acre in 2019. This represents an increase of $0 over this time period with an average implied capitalization rate of 5.4%.

Find land for lease in Oregon including private land, empty lots for rent, vacant rent to own land, farm land for lease, and cheap lot leases. The 3 matching Oregon properties for lease have an average rate of $1,700.

Farmland can serve as a cornerstone of a balanced investment portfolio. Commodity prices, including the cost of food, tend to rise with inflation. This strong correlation allows agricultural investing to protect against inflation, especially compared to high-volatility assets.

Leasing presents tenants with an opportunity to engage in the business of farming without the high capital expense of land ownership. It therefore allows an entry point or expansion for a farming venture which might otherwise be impossible due to the large capital cost of a land acquisition.

But leasing could be used much more and the supply of land for leasing could rise with better agreements between the landowner and lessee. More equitable agreements are expected to deliver greater stability and hence sustainability in leasing as a farm business model, he says.