Oregon Complex Guaranty Agreement to Lender

Description

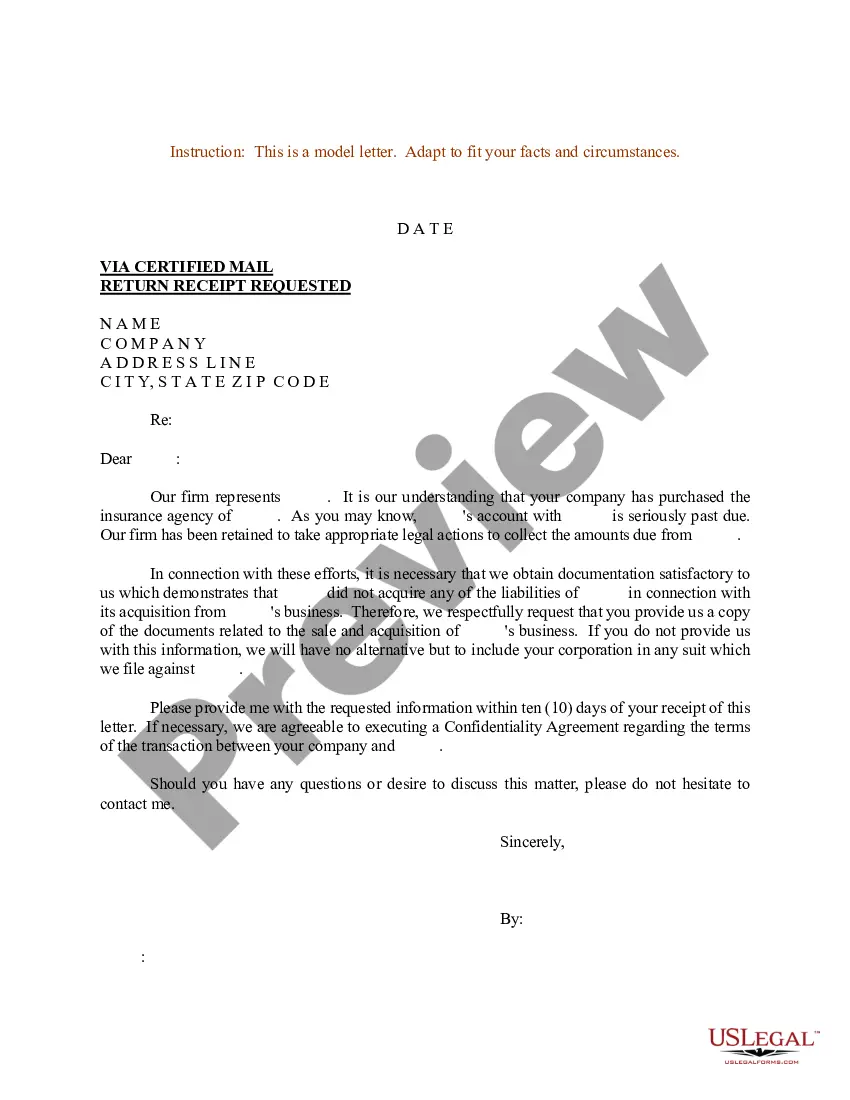

How to fill out Complex Guaranty Agreement To Lender?

It is possible to devote hrs on the Internet searching for the authorized papers format that meets the state and federal requirements you need. US Legal Forms offers 1000s of authorized varieties which are evaluated by professionals. You can actually obtain or produce the Oregon Complex Guaranty Agreement to Lender from our assistance.

If you already have a US Legal Forms accounts, you can log in and then click the Acquire key. Following that, you can total, modify, produce, or sign the Oregon Complex Guaranty Agreement to Lender. Each and every authorized papers format you get is the one you have for a long time. To have another version of the acquired type, go to the My Forms tab and then click the corresponding key.

If you work with the US Legal Forms site the very first time, follow the straightforward recommendations listed below:

- Initial, make certain you have selected the proper papers format for the area/metropolis of your choice. Browse the type explanation to ensure you have picked the correct type. If available, utilize the Review key to search from the papers format at the same time.

- If you would like find another variation of the type, utilize the Search industry to get the format that meets your requirements and requirements.

- Once you have found the format you desire, just click Purchase now to carry on.

- Find the rates plan you desire, type in your references, and sign up for an account on US Legal Forms.

- Full the financial transaction. You can use your charge card or PayPal accounts to fund the authorized type.

- Find the structure of the papers and obtain it to your gadget.

- Make modifications to your papers if needed. It is possible to total, modify and sign and produce Oregon Complex Guaranty Agreement to Lender.

Acquire and produce 1000s of papers templates making use of the US Legal Forms web site, that provides the largest variety of authorized varieties. Use professional and express-particular templates to handle your organization or person demands.

Form popularity

FAQ

Guarantor agrees to the provisions of this Guaranty, and hereby waives notice of (a) any loans or advances made by Lender to Borrower, (b) acceptance of this Guaranty, (c) any amendment or extension of the Note, the Loan Agreement or of any other Loan Documents, (d) the execution and delivery by Borrower and Lender of ...

Hear this out loud PauseA guaranty agreement, in the realm of commercial insurance, refers to a legally binding contract where one party, known as the guarantor, promises to be responsible for the obligations or debts of another party, known as the debtor, if they fail to fulfill their financial commitments.

Hear this out loud PauseA guarantee agreement is an agreement of a third party, called a guarantor, to provide assurance of payment in the event the party involved in the transaction fails to live up to their end of the bargain. They are common in real estate and financial transactions.

In order for a guaranty agreement to be enforceable, it has to be in writing, the writing has to be signed by the guarantor, and the writing has to contain each of the following essential elements: 1. the identity of the lender; 2. the identity of the primary obligor; 3.

The Guarantor agrees that, if any of the Obligations are not paid when due, the Guarantor will, upon demand by the Bank, forthwith pay such Obligations, or if the maturity thereof shall have been accelerated by the Bank, the Guarantor will forthwith pay all Obligations of the Borrower.

Hear this out loud PauseA guarantee is presumed not to be enforceable unless all the named guarantors sign the guarantee (or the terms of the guarantee provide that the guarantee is enforceable on a signed party irrespective of whether other named parties sign).

At law, the giver of a guarantee is called the surety or the "guarantor". The person to whom the guarantee is given is the creditor or the "obligee"; while the person whose payment or performance is secured thereby is termed "the obligor", "the principal debtor", or simply "the principal".

Hear this out loud PauseThe person who gives the guarantee is called the "surety": the person in respect of whose default the guarantee is given is called the "principal debtor", and the person to whom the guarantee is given is called the "creditor".