Statutory Guidelines [Appendix A(5) Tres. Regs 1.46B and 1.46B-1 to B-5] regarding designated settlement funds and qualified settlement funds.

Oregon Designated Settlement Funds Treasury Regulations 1.468 and 1.468B.1 through 1.468B.5

Description

How to fill out Designated Settlement Funds Treasury Regulations 1.468 And 1.468B.1 Through 1.468B.5?

Choosing the best authorized record design could be a have a problem. Obviously, there are a lot of templates available online, but how do you find the authorized type you want? Make use of the US Legal Forms web site. The services offers a huge number of templates, including the Oregon Designated Settlement Funds Treasury Regulations 1.468 and 1.468B.1 through 1.468B.5, that can be used for enterprise and private requirements. Each of the forms are checked by experts and fulfill state and federal specifications.

In case you are previously listed, log in in your account and click on the Obtain switch to get the Oregon Designated Settlement Funds Treasury Regulations 1.468 and 1.468B.1 through 1.468B.5. Use your account to check with the authorized forms you might have purchased previously. Proceed to the My Forms tab of the account and acquire one more duplicate of your record you want.

In case you are a whole new consumer of US Legal Forms, here are straightforward guidelines so that you can adhere to:

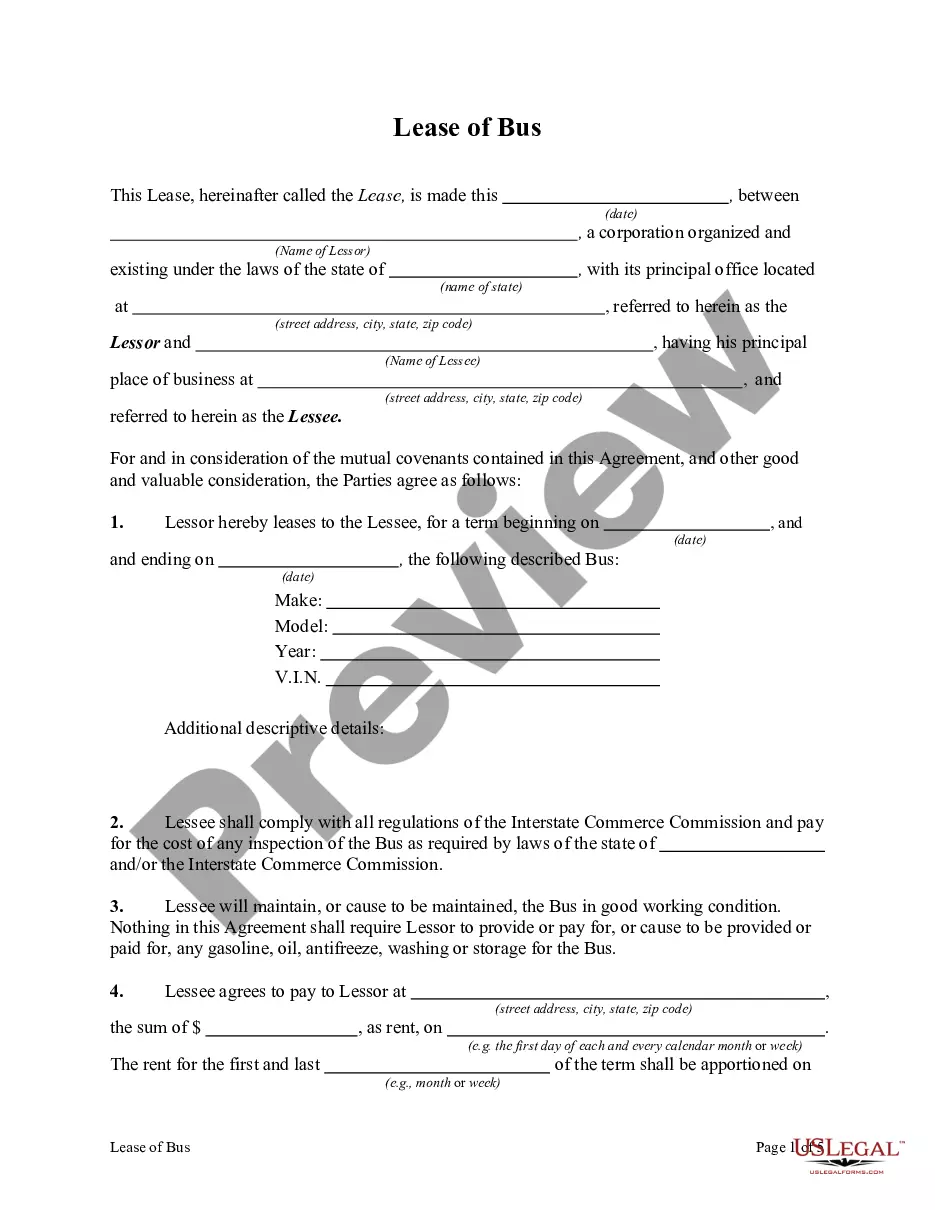

- Very first, be sure you have chosen the proper type to your metropolis/county. You can look through the form utilizing the Preview switch and study the form information to ensure it is the right one for you.

- In case the type does not fulfill your requirements, utilize the Seach field to discover the right type.

- When you are sure that the form is proper, click the Purchase now switch to get the type.

- Select the pricing prepare you would like and enter the required information and facts. Create your account and purchase your order with your PayPal account or bank card.

- Choose the submit file format and obtain the authorized record design in your gadget.

- Full, edit and printing and signal the acquired Oregon Designated Settlement Funds Treasury Regulations 1.468 and 1.468B.1 through 1.468B.5.

US Legal Forms will be the greatest library of authorized forms for which you will find a variety of record templates. Make use of the company to obtain appropriately-manufactured documents that adhere to status specifications.

Form popularity

FAQ

The tax treatment of QSFs is uncomplicated. A QSF is assigned its own Employer Identification Number from the IRS. A QSF is taxed on its modified gross income[v] (which does not include the initial deposit of money), at a maximum rate of 35%.

The general rule regarding taxability of amounts received from settlement of lawsuits and other legal remedies is Internal Revenue Code (IRC) Section 61. This section states all income is taxable from whatever source derived, unless exempted by another section of the code. Tax Implications of Settlements and Judgments - IRS IRS (.gov) ? government-entities ? tax-implic... IRS (.gov) ? government-entities ? tax-implic...

The designated settlement fund concept was created in 1986 under Section 468B of the IRC to enable defendants to deduct amounts paid to settle multi-plaintiff lawsuits before it was agreed how these amounts would be allocated.

The benefits of a QSF for an attorney include: More time to plan for contingency fees using attorney fee deferral. Affording clients extra time to implement settlement planning strategies and comply with government benefits income thresholds. 468b Qualified Settlement Fund Administrator - Milestone Consulting milestoneseventh.com ? qualified-settlement-funds milestoneseventh.com ? qualified-settlement-funds

§ 1.468B?1 Qualified settlement funds. If a fund, account, or trust that is a qualified settlement fund could be classified as a trust within the meaning of §301.7701?4 of this chapter, it is classified as a qualified settlement fund for all purposes of the Internal Revenue Code (Code).

The general rule is that lawsuit settlements are taxable, except in cases that involve an actual, physical injury (?observable bodily harm?) or illness that you suffered. In other words: personal injury settlements usually aren't taxable, while other types of settlements usually are. Do I Have to Pay Taxes on a Lawsuit Settlement? - SH Block Tax Services mdtaxattorney.com ? resources ? do-i-have-... mdtaxattorney.com ? resources ? do-i-have-...

How do law firms establish qualified settlement funds? Be established pursuant to a court order and is subject to continuing jurisdiction of the court (26 CFR § 1.468B(c)). Resolve one or more contested claims arising out of a tort, breach of contract, or violation of law. A trust under applicable state law.

If you receive a settlement for physical injuries sustained as a result of someone else's negligence, the settlement is typically not considered taxable income in California. This includes settlements for medical expenses, lost wages, and other related damages. Are Lawsuit Settlements Taxable in California? westcoasttriallawyers.com ? lawsuit-settlements-tax... westcoasttriallawyers.com ? lawsuit-settlements-tax...