Oregon Employment Verification Request Letter

Description

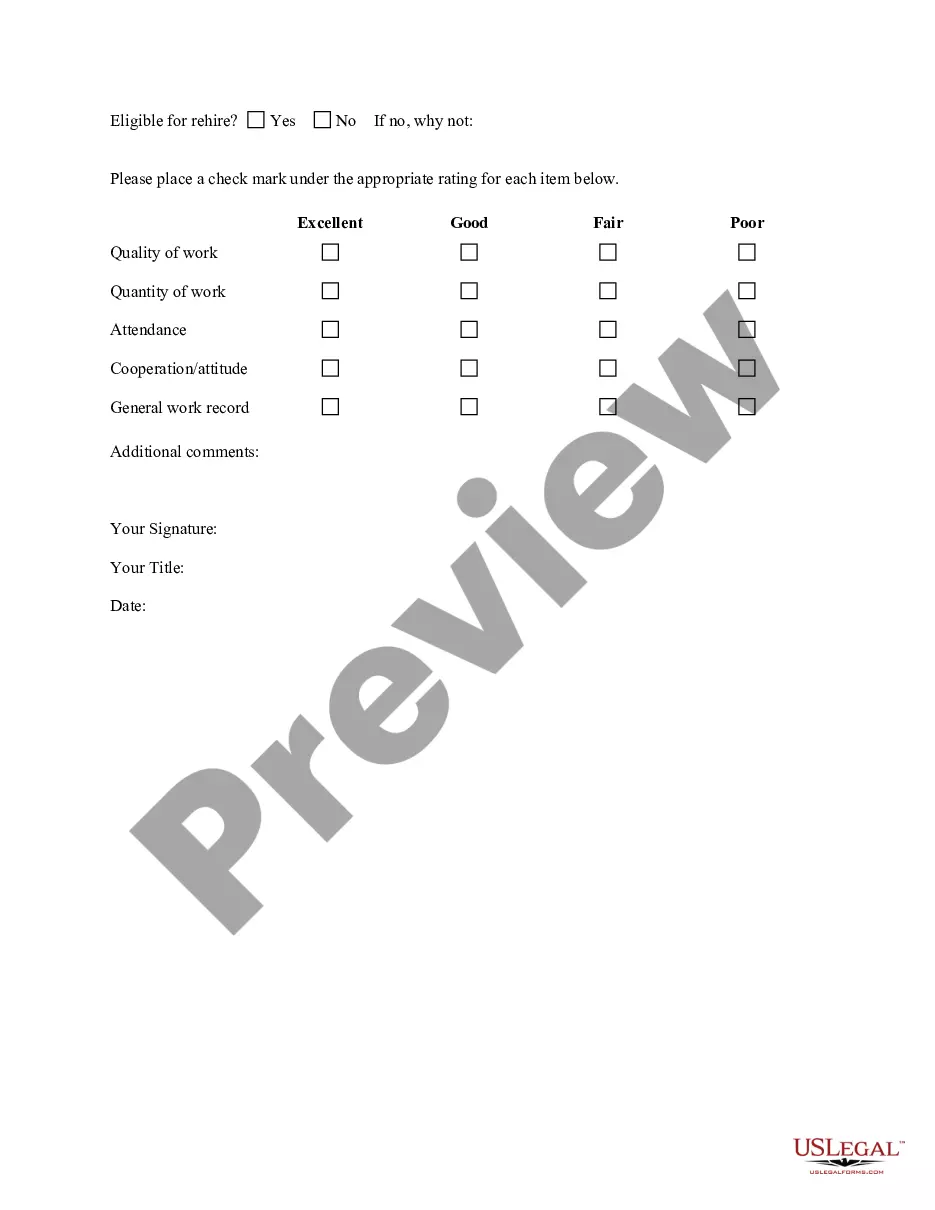

How to fill out Employment Verification Request Letter?

If you need to compile, retrieve, or create valid document templates, utilize US Legal Forms, the foremost collection of legal forms available online.

Take advantage of the site’s simple and user-friendly search feature to locate the documents you require.

A range of templates for business and personal purposes are categorized by categories and jurisdictions, or by keywords.

Step 4. Once you have found the form you need, click the Get now button. Choose the pricing plan you prefer and enter your details to register for an account.

Step 5. Complete the payment. You can use your credit card or PayPal account to finalize the transaction.

- Utilize US Legal Forms to obtain the Oregon Employment Verification Request Letter with just a few clicks.

- If you are an existing US Legal Forms user, Log In to your account and click the Download button to find the Oregon Employment Verification Request Letter.

- You can also access forms you previously downloaded in the My documents section of your account.

- If this is your first time using US Legal Forms, follow the steps below.

- Step 1. Ensure you have selected the form for the correct city/state.

- Step 2. Use the Review option to examine the form's content. Be sure to read the description.

- Step 3. If you are not satisfied with the form, use the Search area at the top of the screen to find other forms within the legal template category.

Form popularity

FAQ

To email the Oregon Employment Department, start by locating their official contact email on their website. Make sure to include clear subject lines, such as 'Request for Employment Verification'. If you use your Oregon Employment Verification Request Letter, it can provide the department with the context they need to assist you effectively.

Type the letter, do not supply a handwritten note. Include your contact information. Include the recipient's contact information if you have it. Include a formal business salutation.

How to Request the LetterAsk your supervisor or manager. This is often the easiest way to request the letter.Contact Human Resources.Get a template from the company or organization requesting the letter.Use an employment verification service.

Employment verification letters are both requested and sent from two parties. For example, an outside agency may writer an employment verification letter to validate employment. And a company or HR department will write employment verification letters to confirm employment. Then send that letter to the agency.

Form 132 is filed with Form OQ on a quarterly basis. Oregon Combined Quarterly Report- Form OQUse this form to determine how much tax is due each quarter for state unemployment insurance, withholding, Tri-Met & Lane Transit excise taxes, and the Workers' Benefit Fund.

Often, human resource employees and management professionals write these letters, but in some cases, an employee might write their own letter.

How to Write an Income Verification Letter for Self-Employed?Introduce yourself and indicate the purpose of this statement.Confirm you are self-employed.Provide a breakdown of your income.Add your contact details - the recipient may want to verify certain information you have shared.More items...

Those requesting employment or salary verification may access THE WORK NUMBER® online at using DOL's code: 10915. You may also contact the service directly via phone at: 1-800-367-5690.

While the majority of employment verifications can be completed in less than 72 hours, there are several reasons it may take longer. There may be difficulty identifying what we at Clarifacts call the Established Verifying Contact (EVC). This is the person or department that has the employment records available to them.

Dear Recipient name, This letter is to verify the employment of Employee name as Job Title/Role within our organization. He/she started work on Employee start date and is current state of employment. Employee's name current title is Job title.