Oregon Employee Evaluation Form for Sole Trader

Description

How to fill out Oregon Employee Evaluation Form For Sole Trader?

If you want to complete, down load, or printing legitimate file web templates, use US Legal Forms, the largest variety of legitimate forms, which can be found on the web. Use the site`s easy and convenient research to get the documents you want. Different web templates for enterprise and specific purposes are sorted by classes and says, or search phrases. Use US Legal Forms to get the Oregon Employee Evaluation Form for Sole Trader within a couple of click throughs.

If you are already a US Legal Forms consumer, log in for your account and click the Down load switch to find the Oregon Employee Evaluation Form for Sole Trader. You can also gain access to forms you previously saved inside the My Forms tab of the account.

If you work with US Legal Forms the very first time, refer to the instructions beneath:

- Step 1. Be sure you have chosen the shape for the correct town/nation.

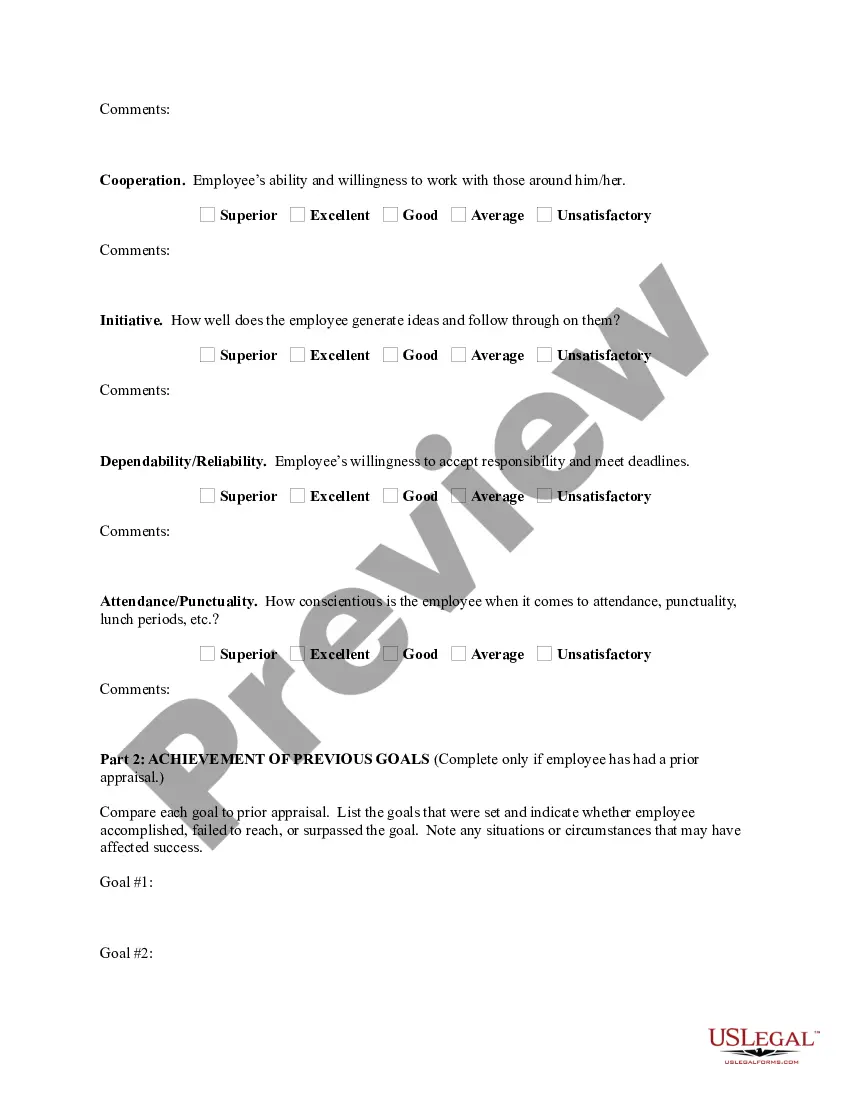

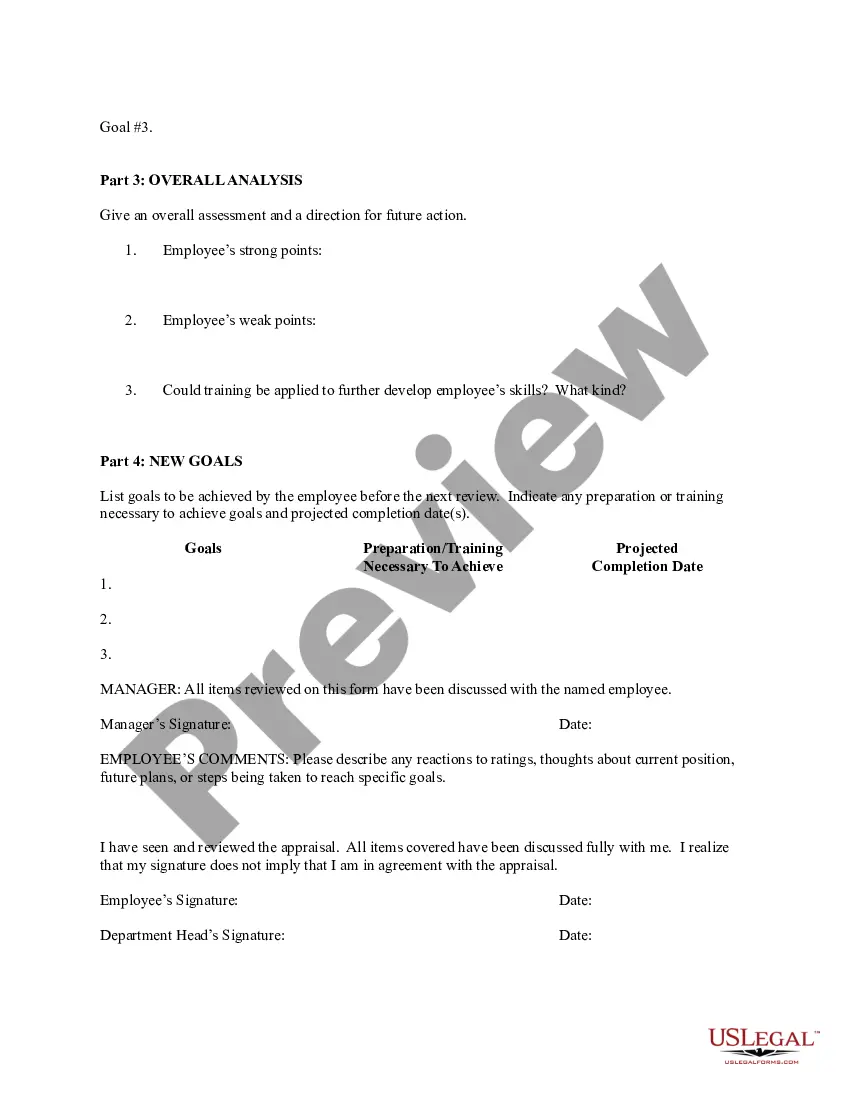

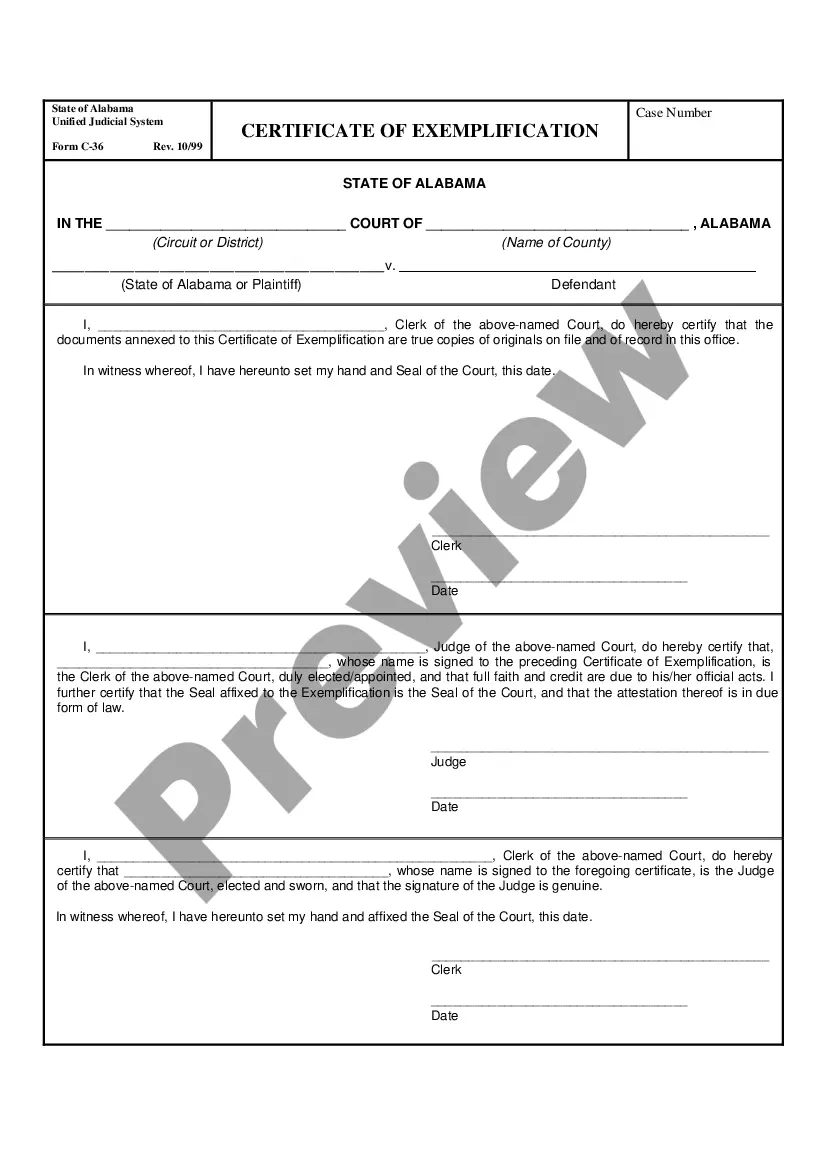

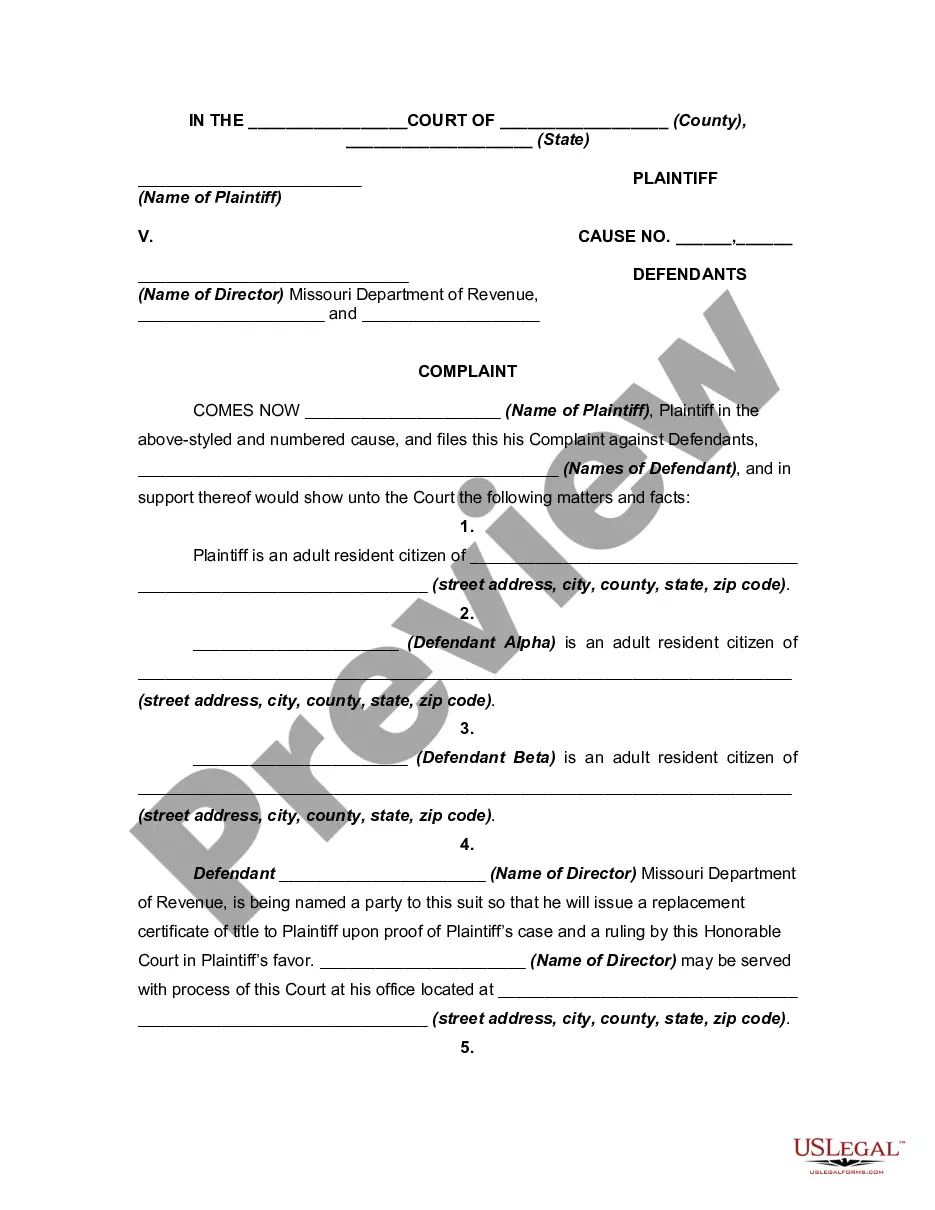

- Step 2. Make use of the Preview option to check out the form`s information. Do not forget to read through the description.

- Step 3. If you are unhappy with the kind, utilize the Search discipline near the top of the screen to locate other variations of your legitimate kind design.

- Step 4. When you have located the shape you want, select the Get now switch. Choose the rates program you choose and add your references to sign up on an account.

- Step 5. Method the transaction. You may use your charge card or PayPal account to complete the transaction.

- Step 6. Pick the structure of your legitimate kind and down load it in your system.

- Step 7. Comprehensive, modify and printing or sign the Oregon Employee Evaluation Form for Sole Trader.

Every single legitimate file design you buy is your own property eternally. You might have acces to each and every kind you saved with your acccount. Click on the My Forms portion and decide on a kind to printing or down load once more.

Remain competitive and down load, and printing the Oregon Employee Evaluation Form for Sole Trader with US Legal Forms. There are thousands of skilled and express-particular forms you can utilize for your enterprise or specific requirements.

Form popularity

FAQ

Choose a quarterly report filing method:Oregon Payroll Reporting System (OPRS) electronic filing.Combined Payroll Tax Reports Form OQ.Interactive voice response system, call 503-378-3981. Use only to report quarters with no payroll or no hours worked.

Form 132 is filed with Form OQ on a quarterly basis. Oregon Combined Quarterly Report- Form OQUse this form to determine how much tax is due each quarter for state unemployment insurance, withholding, Tri-Met & Lane Transit excise taxes, and the Workers' Benefit Fund.

Qualifications for EUC:Your base year wages must equal or exceed 40 times your weekly benefit amount. (If your claim pays 26 weeks of benefits, you have met this qualification.) Your most recent claim must have tired regular benefits or be expired.

All Oregon employers who have an income tax with- holding and statewide transit tax account open with the Oregon Department of Revenue must file Form OR-WR, Oregon Annual Withholding Tax Reconciliation Report. The 2018 form is due January 31, 2019.

Newly hired employees must complete and sign Section 1 of Form I-9 no later than the first day of employment. Generally, only unexpired, original documentation is acceptable (i.e., driver license or passport). The only exception is that an employee may present a certified copy of a birth certification.

Oregon employers should provide each new employee with a federal Form W-4 and a Form OR-W-4 for tax withholding purposes. See Employee Withholding Forms. Oregon employers must provide new employees with a notice of the right to pregnancy accommodations.

Definitions as they pertain to Oregon Employment Department Law. An employer is subject to unemployment insurance taxes when the employer pays wages of $1,000 or more in a calendar quarter, or employs one or more individuals in any part of 18 separate weeks during any calendar year.

Make sure you and new hires complete employment forms required by law.W-4 form (or W-9 for contractors)I-9 Employment Eligibility Verification form.State Tax Withholding form.Direct Deposit form.E-Verify system: This is not a form, but a way to verify employee eligibility in the U.S.

Required Employment Forms in OregonSigned Job Offer Letter.W2 Tax Form.I-9 Form and Supporting Documents.Direct Deposit Authorization Form (Template)Federal W-4 Form.Employee Personal Data Form (Template)Company Worker's Compensation Insurance Policy Forms.Company Health Insurance Policy Forms.More items...?

To file the Form WR electronically, as required under ORS 316.202 and ORS 314.360, you must do so using Department of Revenue's system, Revenue Online by going to this link: .