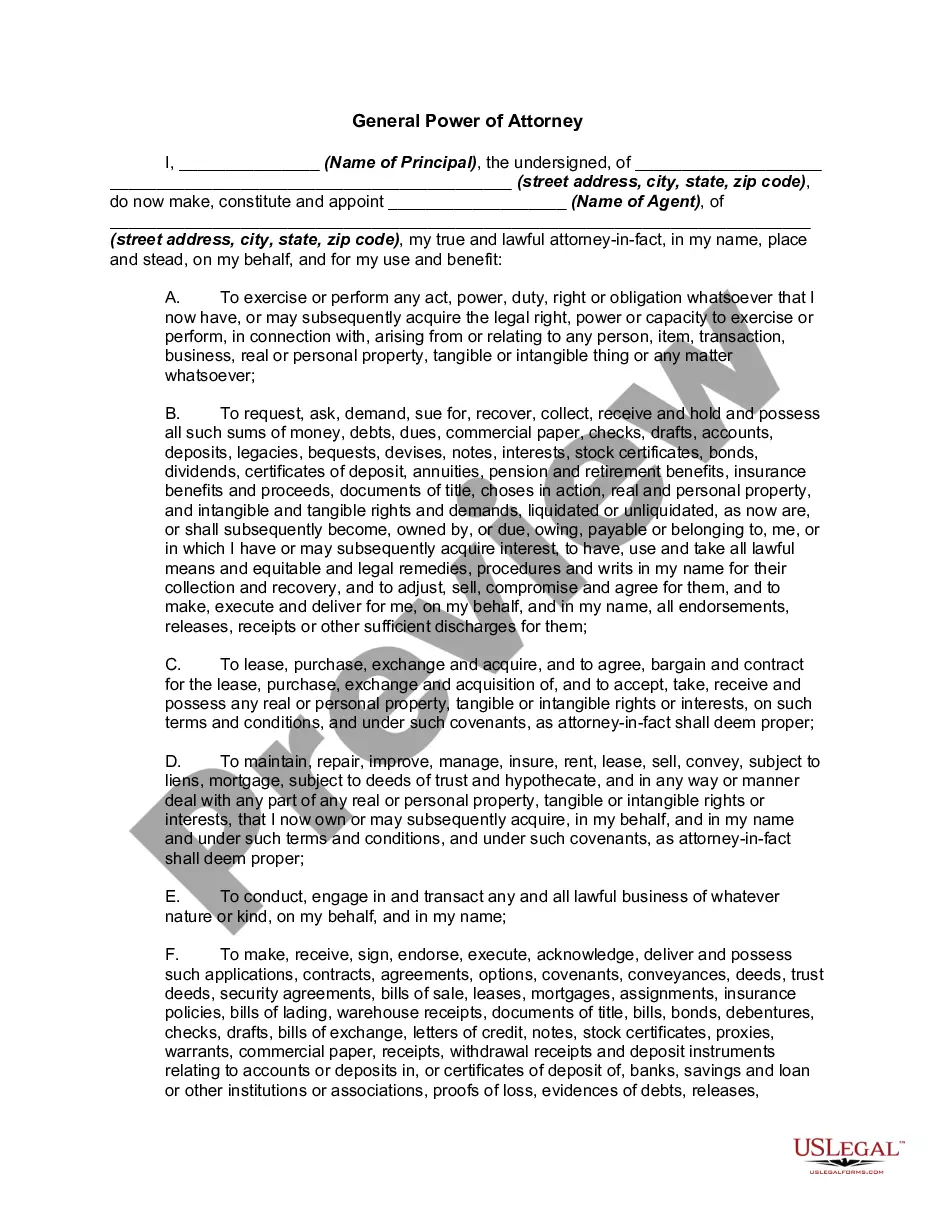

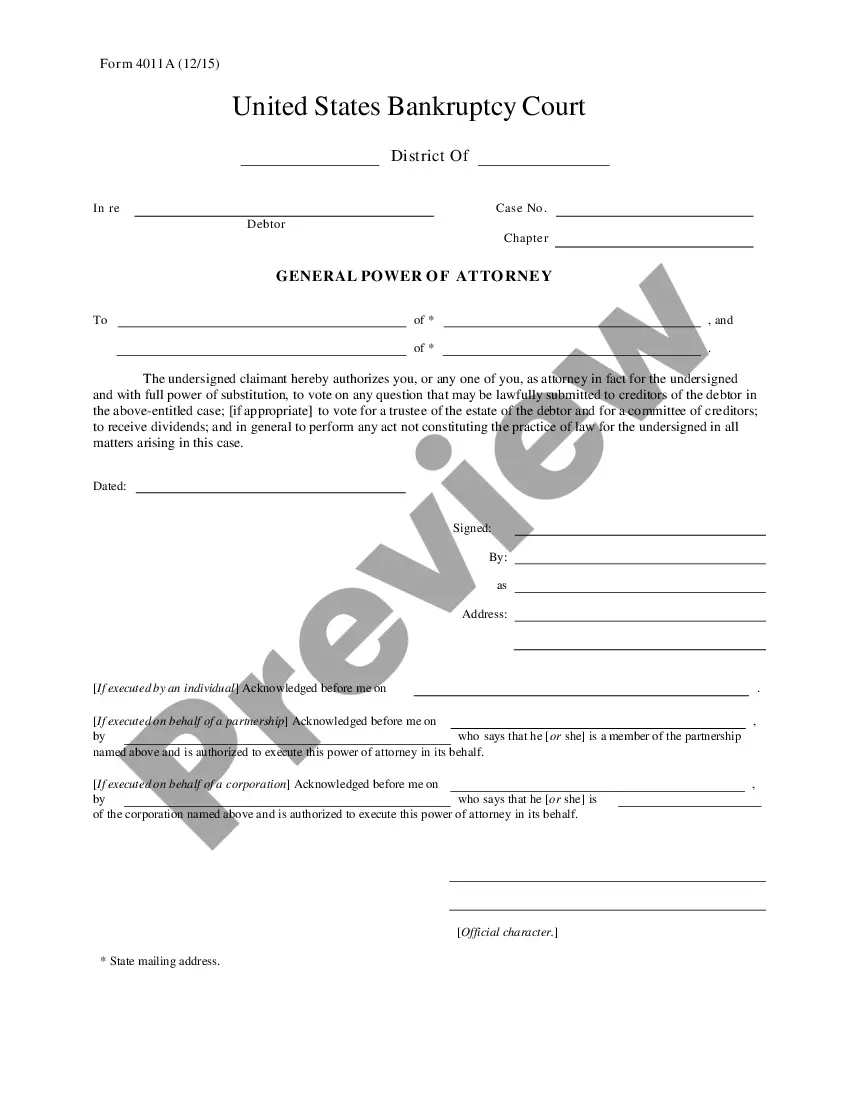

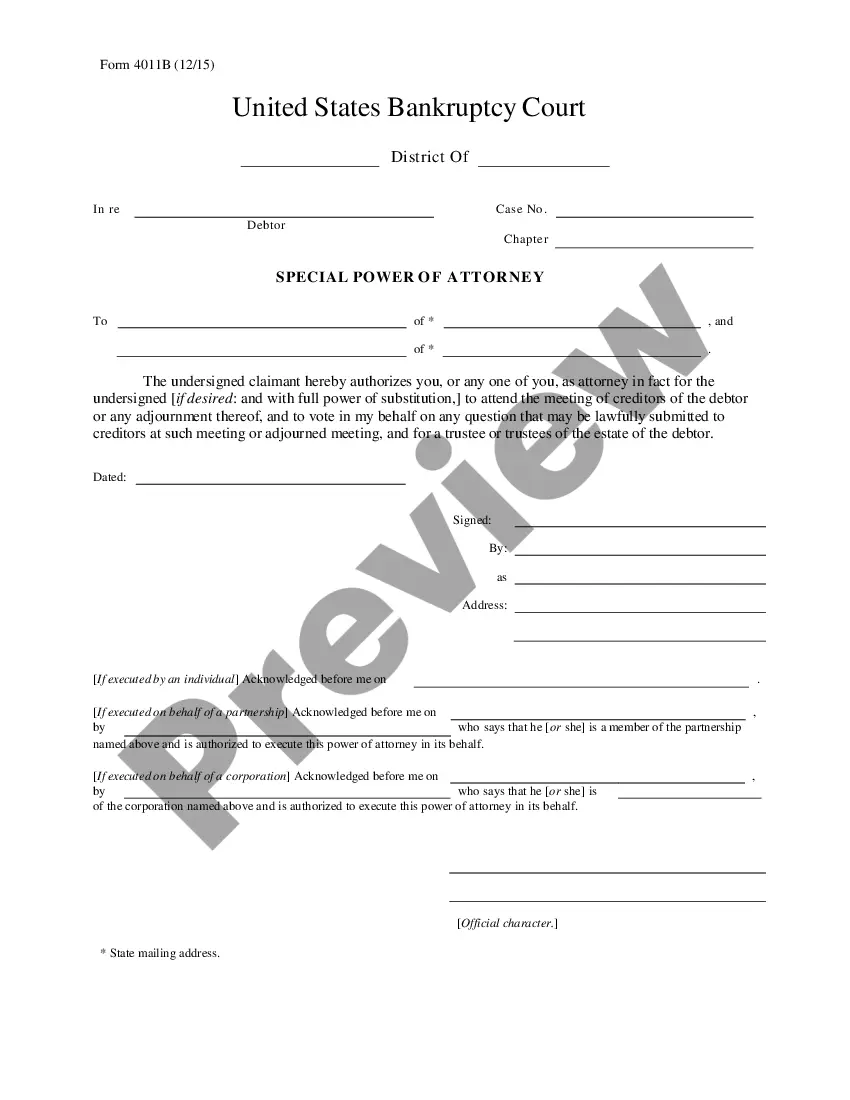

Oregon Special Power of Attorney - Form 11B - Pre and Post 2005 Act

Description

How to fill out Special Power Of Attorney - Form 11B - Pre And Post 2005 Act?

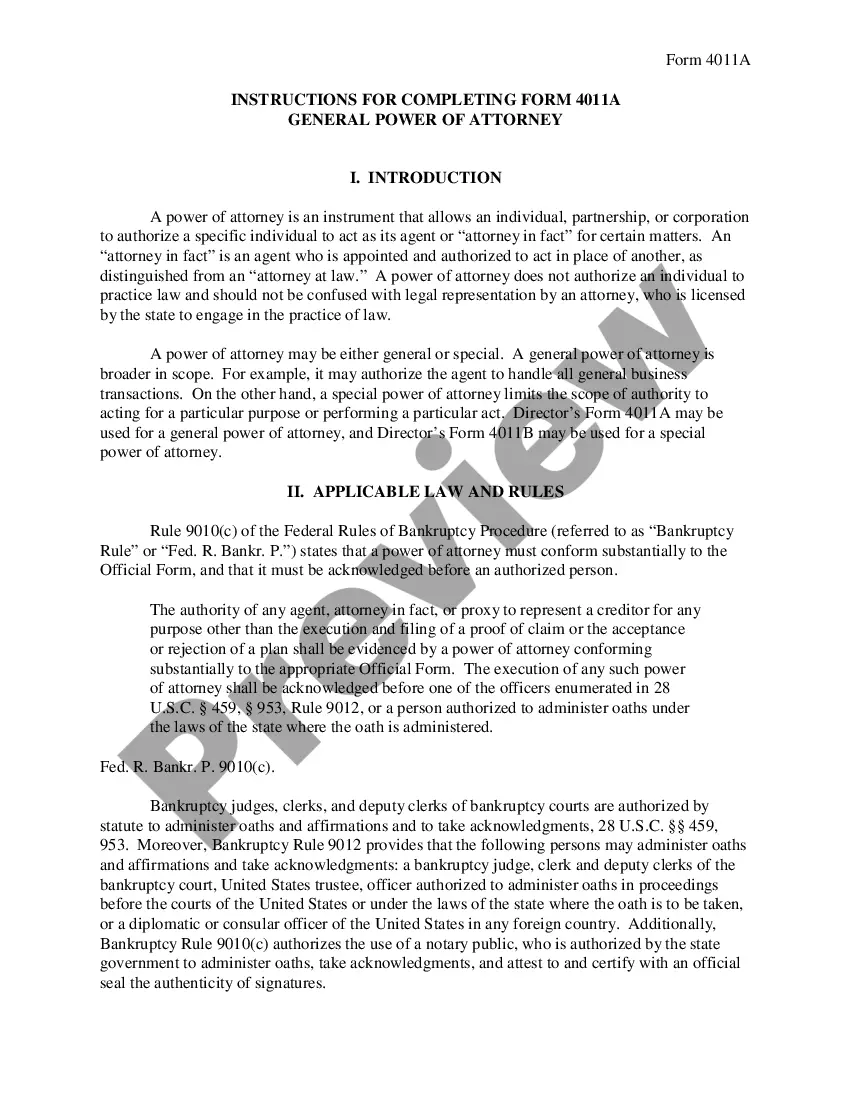

US Legal Forms - one of the greatest libraries of authorized types in the States - delivers a variety of authorized record layouts it is possible to down load or produce. Utilizing the internet site, you will get thousands of types for organization and specific purposes, categorized by classes, says, or key phrases.You can find the most recent variations of types like the Oregon Special Power of Attorney - Form 11B - Pre and Post 2005 Act within minutes.

If you already possess a subscription, log in and down load Oregon Special Power of Attorney - Form 11B - Pre and Post 2005 Act from the US Legal Forms local library. The Down load option can look on every single form you look at. You get access to all in the past acquired types in the My Forms tab of your own accounts.

If you want to use US Legal Forms for the first time, listed below are straightforward directions to obtain started out:

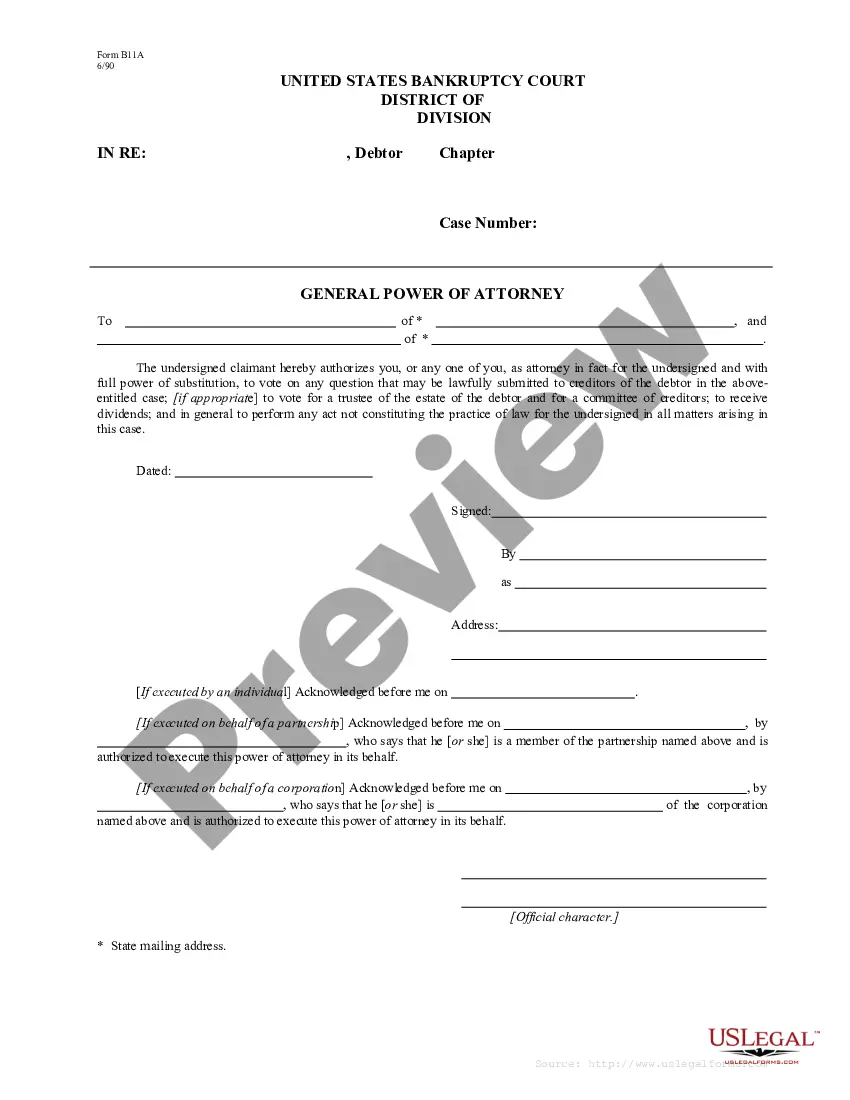

- Be sure you have picked the correct form for your area/state. Select the Review option to examine the form`s information. Browse the form information to ensure that you have selected the proper form.

- If the form does not match your requirements, use the Look for industry on top of the screen to obtain the one which does.

- In case you are happy with the form, validate your decision by simply clicking the Acquire now option. Then, choose the costs strategy you favor and offer your credentials to sign up to have an accounts.

- Approach the financial transaction. Make use of charge card or PayPal accounts to accomplish the financial transaction.

- Pick the file format and down load the form on your device.

- Make alterations. Complete, modify and produce and sign the acquired Oregon Special Power of Attorney - Form 11B - Pre and Post 2005 Act.

Each and every web template you put into your money lacks an expiration day and it is yours forever. So, if you would like down load or produce one more copy, just visit the My Forms segment and then click in the form you require.

Gain access to the Oregon Special Power of Attorney - Form 11B - Pre and Post 2005 Act with US Legal Forms, the most substantial local library of authorized record layouts. Use thousands of professional and state-certain layouts that fulfill your small business or specific demands and requirements.

Form popularity

FAQ

In Oregon, a power of attorney needs to be written and signed in front of two witnesses and notarized. Agreements, accounts, and other legal documents for the estate plan must be under the principal's name (the individual who signed a power of attorney).

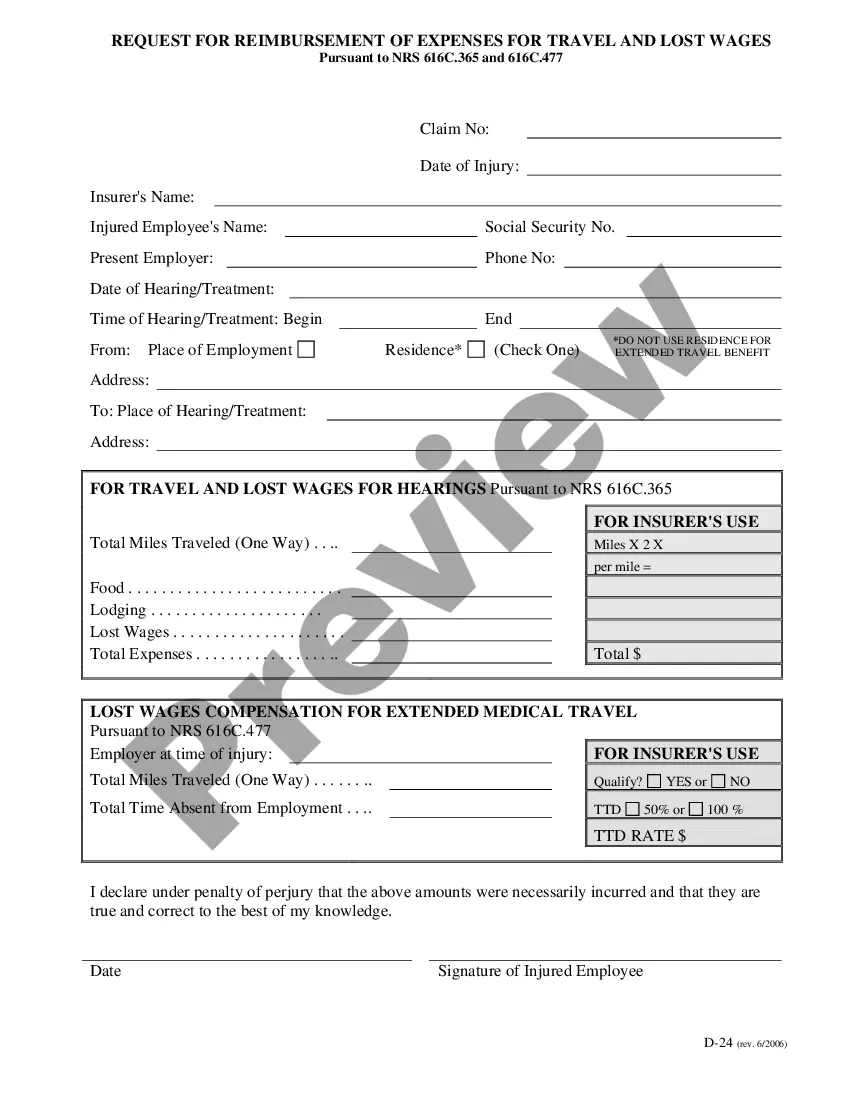

Power of Attorney for the Oregon Department of Revenue Download the Oregon DOR POA found at the bottom of this page. Complete the top section regarding your business information. The taxpayer will need to sign at the bottom of the form. Email your completed Power of Attorney form hello@onpay.com.

Contact list Director's Office. ???????????Betsy Imholt??? ... Amusement Device Tax. ??Phone: 503-?945-8120. ... Business & Corporate Tax. ? ??Phone: 503-378-4988. ... Cigarette & Tobacco Tax. ? ?Phone: 503-947-2560. ... Corporate Activity Tax. ... Electronic Funds Transfer (EFT) ... Emergency Communications (E911) ... Heavy Equipment Rental Tax (HERT)

Visit .oregon.gov/dor to complete this form using Revenue Online. If this tax information authorization or power of attorney form is not signed, it will be returned. Power of attorney forms submitted with Revenue Online will be signed electronically.

An Oregon tax power of attorney (Form 150-800-005) is the document you must use to appoint an agent with the principal authority to represent you before the Oregon Department of Revenue.

This document gives the person(s) you designate the power to make any and all decisions for PERS-related matters on your behalf. This Power of Attorney takes effect on the date signed and supersedes any other POA on file with PERS.

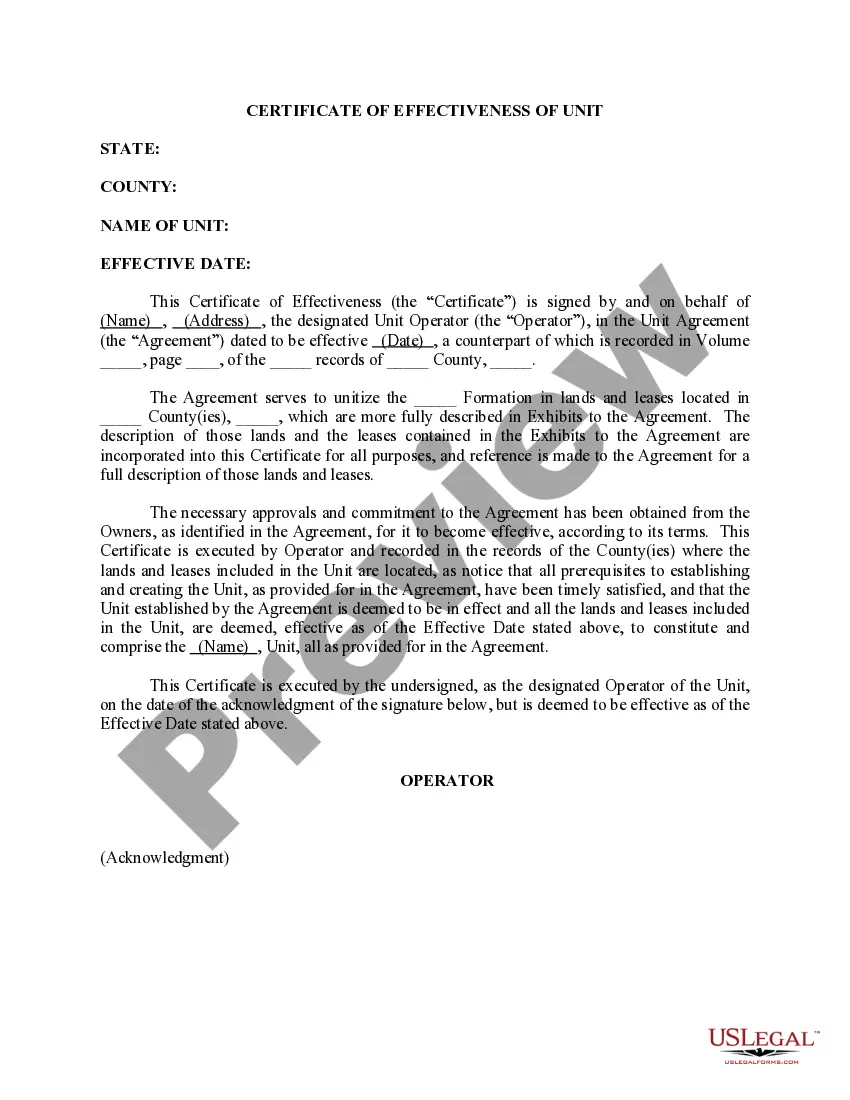

The Power of Attorney must be registered in the office of the register of deeds in order for it to be effective after the principal becomes incompetent.

File a Copy With the Recorder's Office If you gave your agent the power to conduct transactions with real estate, you should also file a copy of your POA in the land records office (called the recorder's office in Oregon) in the county or counties where you own real estate.