Oregon List of Creditors Holding 20 Largest Secured Claims — Not needed for Chapter 7 or 1— - Form 4 — Post 2005 In Oregon, when filing for bankruptcy under Chapter 7 or Chapter 13 after 2005, debtors may be required to submit Form 4: List of Creditors Holding 20 Largest Secured Claims. This form serves as a comprehensive inventory of the debtor's creditors who hold the largest secured claims against their assets. While the specific names of the different types of this Oregon list may vary, the purpose remains the same — to disclose significant secured creditors and provide crucial information regarding the debtor's financial obligations. Secured claims are debts in which the creditor holds a legal interest or collateral in the debtor's property. The inclusion of "20 largest" indicates that the debtor must prioritize the creditors based on the value or size of the secured claims. By identifying the top 20 creditors, the bankruptcy court gains insight into the debtor's financial situation and can take appropriate actions accordingly. Form 4, as required under Oregon jurisdiction, obliges the debtor to provide precise details about each creditor holding a significant secured claim. This comprehensive information collected on Form 4 includes, but is not limited to: 1. Creditor Name: The full legal name of the creditor or the company they represent. 2. Mailing Address: The complete postal address where the creditor receives correspondence. 3. Secured Claim Amount: The specific dollar amount representing the size of each creditor's secured claim against the debtor's assets. 4. Collateral Description: A detailed description of the collateral or property securing each creditor's claim. This description should be sufficiently comprehensive to avoid confusion or ambiguity. 5. Outstanding Balance: The remaining balance of the secured claim owed to each creditor at the time of filing. 6. Nature of Debt: A brief explanation outlining the nature of the debt owed to the creditor. For example, it could indicate a mortgage, car loan, or any other type of property-specific debt. 7. Status on Filing Date: A statement indicating whether the debt was solely personal or jointly acquired with another party. This information clarifies whether both debtors share responsibility or only one party is liable. 8. Priority: The priority level assigned to each creditor. Higher-priority creditors may be entitled to receive payment before lower-priority ones during the bankruptcy process. It is essential for debtors filing for bankruptcy in Oregon to understand the significance of accurately completing the List of Creditors Holding 20 Largest Secured Claims. Omitting or providing incomplete information can result in delays, legal complications, or even denial of bankruptcy discharge. Note: The specific name or format of the Oregon List of Creditors Holding 20 Largest Secured Claims may differ across different jurisdictions within the state. Debtors are advised to consult with a bankruptcy attorney or refer to local regulations to ensure compliance with the correct form.

Oregon List of creditors holding 20 largest secured claims - Not needed for Chapter 7 or 13 - Form 4 - Post 2005

Description

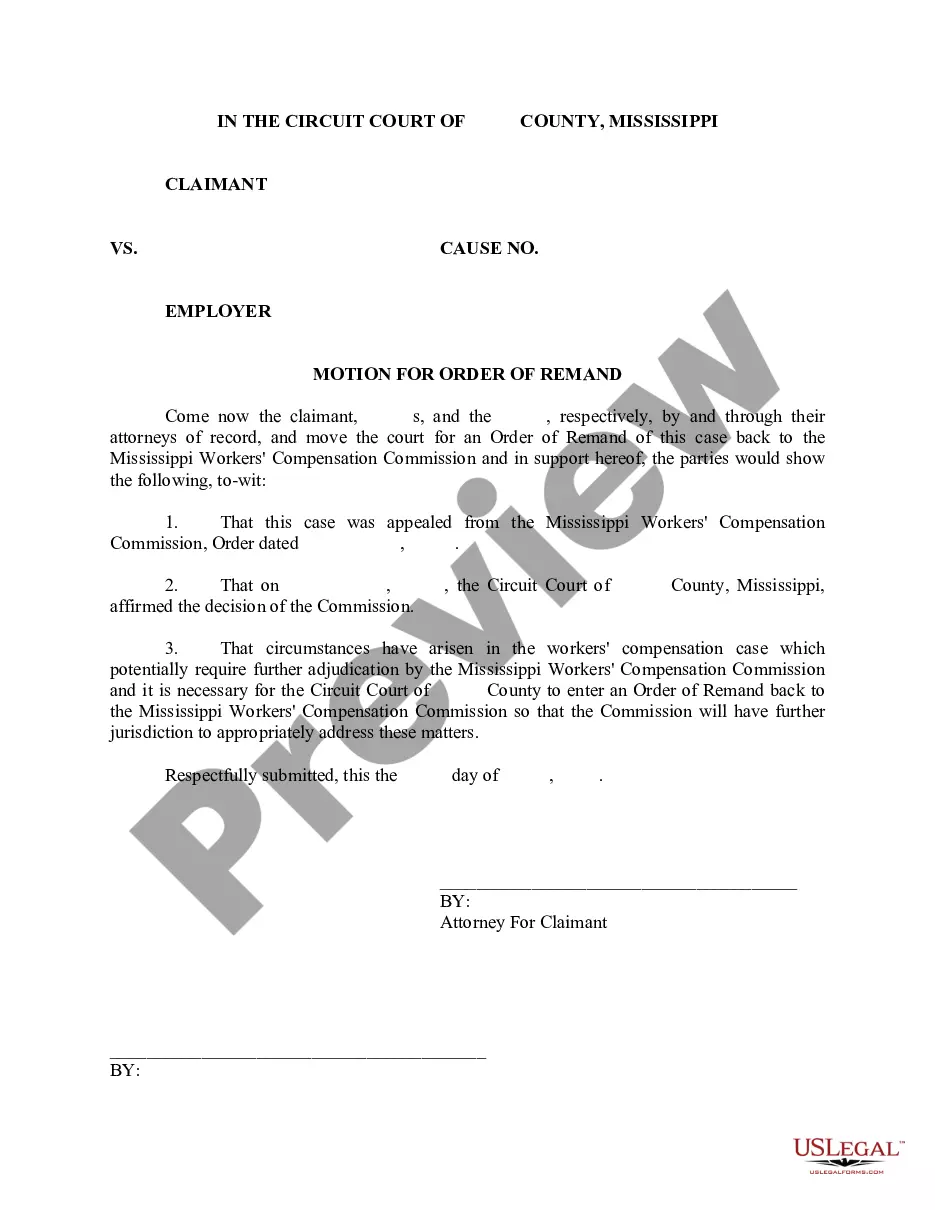

How to fill out Oregon List Of Creditors Holding 20 Largest Secured Claims - Not Needed For Chapter 7 Or 13 - Form 4 - Post 2005?

Are you currently inside a place that you require paperwork for sometimes enterprise or person functions almost every day time? There are plenty of legitimate document web templates accessible on the Internet, but locating versions you can rely on isn`t straightforward. US Legal Forms gives 1000s of form web templates, like the Oregon List of creditors holding 20 largest secured claims - Not needed for Chapter 7 or 13 - Form 4 - Post 2005, that are published in order to meet state and federal demands.

If you are presently informed about US Legal Forms internet site and possess your account, simply log in. Afterward, you can down load the Oregon List of creditors holding 20 largest secured claims - Not needed for Chapter 7 or 13 - Form 4 - Post 2005 web template.

Should you not come with an account and need to begin using US Legal Forms, adopt these measures:

- Obtain the form you require and make sure it is to the proper city/state.

- Use the Preview option to review the form.

- Browse the outline to actually have selected the proper form.

- If the form isn`t what you are trying to find, make use of the Look for area to get the form that meets your needs and demands.

- If you find the proper form, simply click Acquire now.

- Opt for the costs program you need, fill out the specified info to produce your bank account, and buy the order using your PayPal or charge card.

- Pick a hassle-free file file format and down load your version.

Discover every one of the document web templates you possess bought in the My Forms menus. You may get a additional version of Oregon List of creditors holding 20 largest secured claims - Not needed for Chapter 7 or 13 - Form 4 - Post 2005 any time, if necessary. Just click on the required form to down load or produce the document web template.

Use US Legal Forms, probably the most extensive assortment of legitimate kinds, to conserve time and prevent faults. The service gives professionally created legitimate document web templates that can be used for a selection of functions. Make your account on US Legal Forms and commence generating your way of life a little easier.

Form popularity

FAQ

Some of the most common types of unsecured creditors include credit card companies, utilities, landlords, hospitals and doctor's offices, and lenders that issue personal or student loans (though education loans carry a special exception that prevents them from being discharged).

However, each of your creditors must file a proof of claim (described below) within a certain time to prove how much you owe. If a creditor fails to do so, then the bankruptcy trustee will not make any payments to that creditor. In some cases, lack of a proof of claim may benefit you.

What Will Happen to My Home and Car If I File Bankruptcy in Oregon? In most cases you will not lose your home or car during your bankruptcy case as long as your equity in the property is fully exempt.

Does the debtor have the right to a discharge or can creditors object to the discharge? In chapter 7 cases, the debtor does not have an absolute right to a discharge. An objection to the debtor's discharge may be filed by a creditor, by the trustee in the case, or by the U.S. trustee.

A credit card issuer can object to a bankruptcy discharge of the debt in question by asserting that the information on the credit application was false. The debtor may have overstated income and/or understated expenses. A creditor can also challenge a discharge based on a fraudulent statement of a source of income.

Creditors rarely show up. Credit card and medical debt collectors basically never appear. In 1% to 3% of the hearings, a bank representative who loaned you money (e.g., for a business or a car), a former business partner, or an ex-spouse may attend the hearing.

Instead, they process the bankruptcy notice along with the thousands of others they get each year without an ounce of emotion about it. So if you are sitting at home and wondering what creditors think when you file bankruptcy, they don't think much about it.

Miss just one and your case may be dismissed. The good news is that if you ? or the attorney you hire ? gets the paperwork right and the case moves through the court to the point where debt discharge is determined, the U.S. Bankruptcy Courts says that 99% of Chapter 7 cases succeed.