Oregon Investment Management Agreement between Fund, Asia Management and NICAM

Description

How to fill out Investment Management Agreement Between Fund, Asia Management And NICAM?

Are you currently within a place that you need papers for possibly organization or personal purposes almost every day time? There are a lot of authorized file templates available on the Internet, but finding kinds you can rely on is not simple. US Legal Forms gives a huge number of type templates, such as the Oregon Investment Management Agreement between Fund, Asia Management and NICAM, that are published to satisfy state and federal specifications.

Should you be currently informed about US Legal Forms web site and also have an account, just log in. Following that, you may obtain the Oregon Investment Management Agreement between Fund, Asia Management and NICAM web template.

If you do not have an accounts and would like to begin using US Legal Forms, abide by these steps:

- Find the type you want and make sure it is for the appropriate town/state.

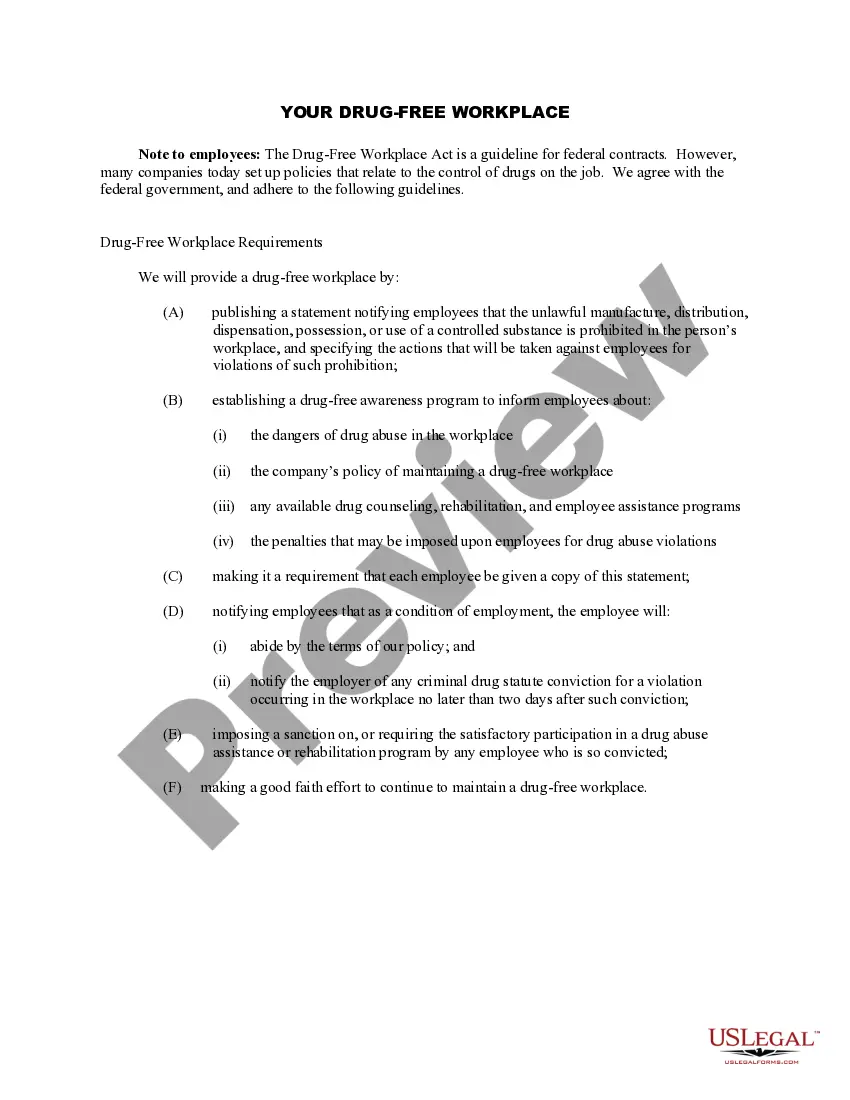

- Use the Preview switch to check the form.

- Read the outline to actually have selected the right type.

- If the type is not what you are seeking, use the Research discipline to discover the type that suits you and specifications.

- Once you obtain the appropriate type, click Acquire now.

- Pick the pricing plan you need, fill in the necessary details to create your account, and purchase the transaction using your PayPal or credit card.

- Decide on a handy document structure and obtain your copy.

Get each of the file templates you might have bought in the My Forms menu. You may get a further copy of Oregon Investment Management Agreement between Fund, Asia Management and NICAM at any time, if necessary. Just go through the needed type to obtain or printing the file web template.

Use US Legal Forms, one of the most substantial selection of authorized kinds, in order to save efforts and stay away from mistakes. The services gives appropriately produced authorized file templates that you can use for a selection of purposes. Produce an account on US Legal Forms and initiate creating your lifestyle a little easier.

Form popularity

FAQ

The key components of an IMA include identification of parties, scope of services, investment objectives and guidelines, investment restrictions, fees and expenses, performance measurement and reporting, risk management, confidentiality and data protection, termination and dispute resolution, and compliance with ...

What Is Funds Management? Funds management is the overseeing and handling of a financial institution's cash flow. The fund manager ensures that the maturity schedules of the deposits coincide with the demand for loans.

The management agreement is a binding legal agreement, generally between the fund's general partner on behalf of the fund and the fund's investment manager. This form management agreement provides an example of how to document the management fee and other elements of the fund and manager relationship.

An Individually Managed Account or IMA is a discretionary management agreement whereby clients delegate the day to day investment decisions and implementation of their chosen investment strategy to PPM while retaining the full beneficial ownership of their investments.

An investment management agreement to be used in connection with a private equity fund's appointment of an investment manager. This agreement sets out the terms and conditions by which a fund vehicle agrees to pay advisory and management services fees and out-of-pocket expenses to an investment manager entity.

In the financial world, the term "fund management" ultimately describes people and institutions that manage investments on behalf of investors. An example would be investment managers who fix the assets of pension funds for pension investors.

A funding agreement is an agreement between an issuer and an investor. While the investor provides a lump sum of money, the issuer guarantees a fixed rate of return over a time period. Funding agreements are popular with high-net-worth and institutional investors due to their low-risk, fixed-income nature.

Investment management agreements (IMAs) are legal documents that give investment managers the authority to manage capital on behalf of investors. They detail the terms and conditions under which a client will invest in a shared vehicle while agreeing to pay investment management service fees and direct expenses.