Oregon Issuance of Common Stock in Connection with Acquisition

Description

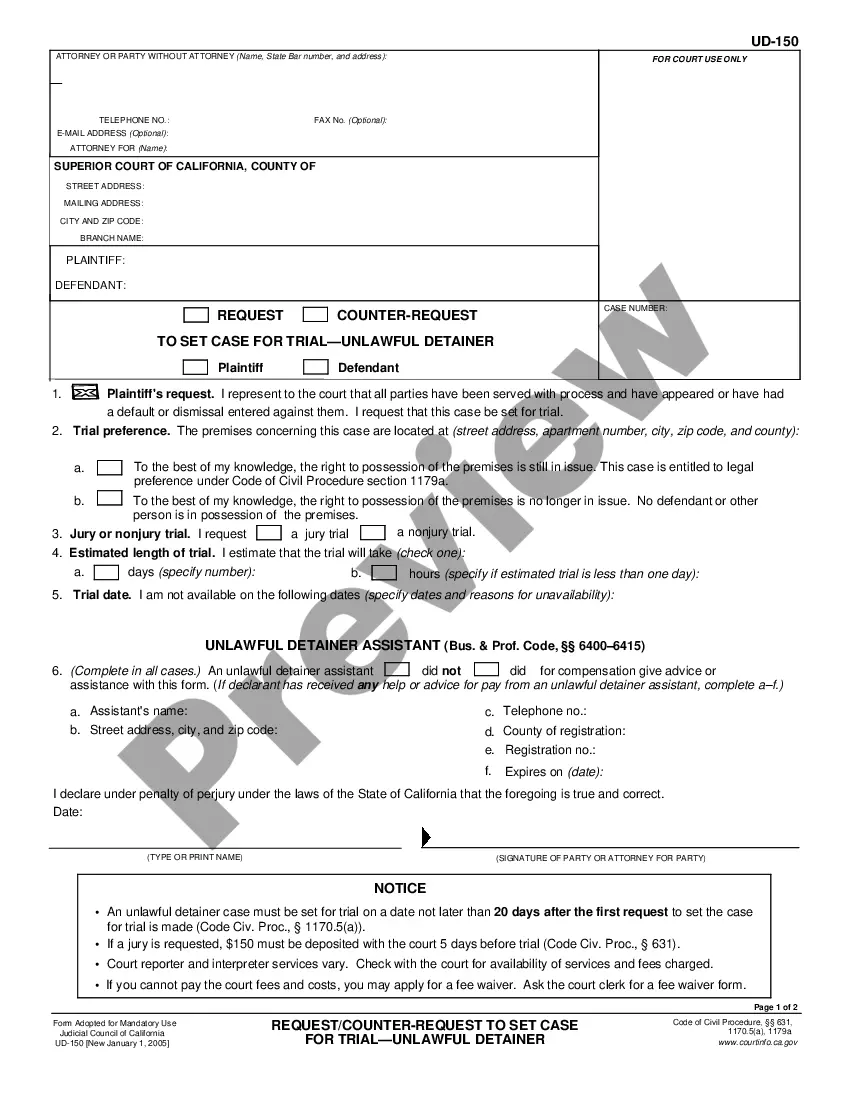

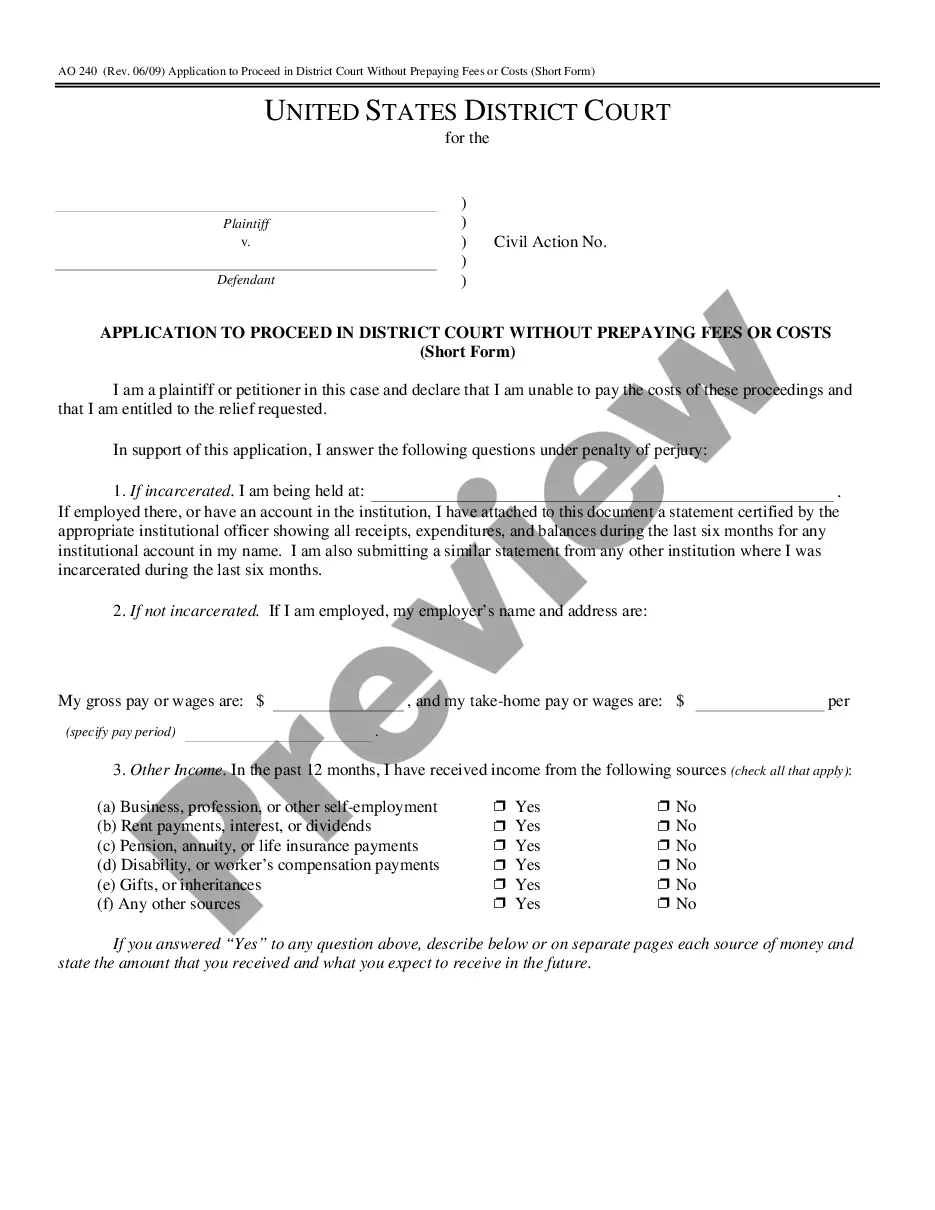

How to fill out Issuance Of Common Stock In Connection With Acquisition?

US Legal Forms - one of several largest libraries of authorized kinds in the States - provides a variety of authorized file layouts you may acquire or print. While using internet site, you will get thousands of kinds for enterprise and personal reasons, categorized by classes, claims, or key phrases.You will discover the newest models of kinds like the Oregon Issuance of Common Stock in Connection with Acquisition in seconds.

If you already have a registration, log in and acquire Oregon Issuance of Common Stock in Connection with Acquisition through the US Legal Forms library. The Obtain option can look on each develop you view. You have accessibility to all earlier delivered electronically kinds within the My Forms tab of the bank account.

If you want to use US Legal Forms initially, listed below are easy guidelines to get you started:

- Make sure you have picked out the correct develop to your city/region. Go through the Review option to analyze the form`s information. Browse the develop information to ensure that you have selected the appropriate develop.

- In case the develop does not satisfy your demands, make use of the Search field on top of the display to get the one that does.

- When you are content with the shape, validate your decision by clicking on the Buy now option. Then, select the costs prepare you like and offer your references to register on an bank account.

- Method the transaction. Make use of your Visa or Mastercard or PayPal bank account to finish the transaction.

- Find the format and acquire the shape on your gadget.

- Make changes. Load, revise and print and indicator the delivered electronically Oregon Issuance of Common Stock in Connection with Acquisition.

Each template you added to your money lacks an expiry date which is the one you have permanently. So, if you want to acquire or print another duplicate, just go to the My Forms area and click on the develop you need.

Get access to the Oregon Issuance of Common Stock in Connection with Acquisition with US Legal Forms, probably the most considerable library of authorized file layouts. Use thousands of skilled and express-distinct layouts that satisfy your small business or personal requires and demands.

Form popularity

FAQ

The Oregon Limited Liability Company Act allows companies to enjoy the taxation that partnerships do as well as the personal liability that corporations enjoy.

Do bylaws need to be signed? Technically, it's possible for a board of directors to adopt bylaws without signing them. However, signing your bylaws demonstrates that everyone is on the same page about how your corporation will function.

Corporate bylaws are legally required in Oregon. § 60.061, corporate bylaws shall be adopted by the incorporators or the corporation's board of directors. Bylaws are usually adopted by your corporation's directors at their first board meeting.

Benefits of a Corporation The Oregon Business Corporation Act includes laws and regulations for corporations doing business in the state of Oregon. By forming a corporation, the owner's personal assets aren't at risk for legal or financial issues relating to the business.