Oregon Indemnification Agreement establishing Escrow Reserve

Description

How to fill out Indemnification Agreement Establishing Escrow Reserve?

Finding the right legitimate record template could be a have a problem. Naturally, there are a variety of web templates available on the Internet, but how would you discover the legitimate type you require? Take advantage of the US Legal Forms web site. The assistance delivers a huge number of web templates, such as the Oregon Indemnification Agreement establishing Escrow Reserve, that you can use for business and personal demands. Each of the kinds are examined by experts and meet federal and state requirements.

If you are presently authorized, log in to the bank account and click the Obtain switch to get the Oregon Indemnification Agreement establishing Escrow Reserve. Utilize your bank account to check from the legitimate kinds you might have bought previously. Proceed to the My Forms tab of the bank account and have one more copy from the record you require.

If you are a brand new end user of US Legal Forms, listed below are easy guidelines so that you can stick to:

- First, make sure you have selected the right type for your personal area/region. You can look over the shape using the Review switch and read the shape information to guarantee this is basically the right one for you.

- When the type fails to meet your expectations, take advantage of the Seach field to get the correct type.

- When you are certain the shape would work, select the Acquire now switch to get the type.

- Opt for the pricing strategy you desire and type in the needed information and facts. Create your bank account and pay for the order using your PayPal bank account or bank card.

- Opt for the document structure and download the legitimate record template to the product.

- Full, modify and printing and sign the received Oregon Indemnification Agreement establishing Escrow Reserve.

US Legal Forms may be the largest local library of legitimate kinds that you can find a variety of record web templates. Take advantage of the company to download expertly-produced documents that stick to status requirements.

Form popularity

FAQ

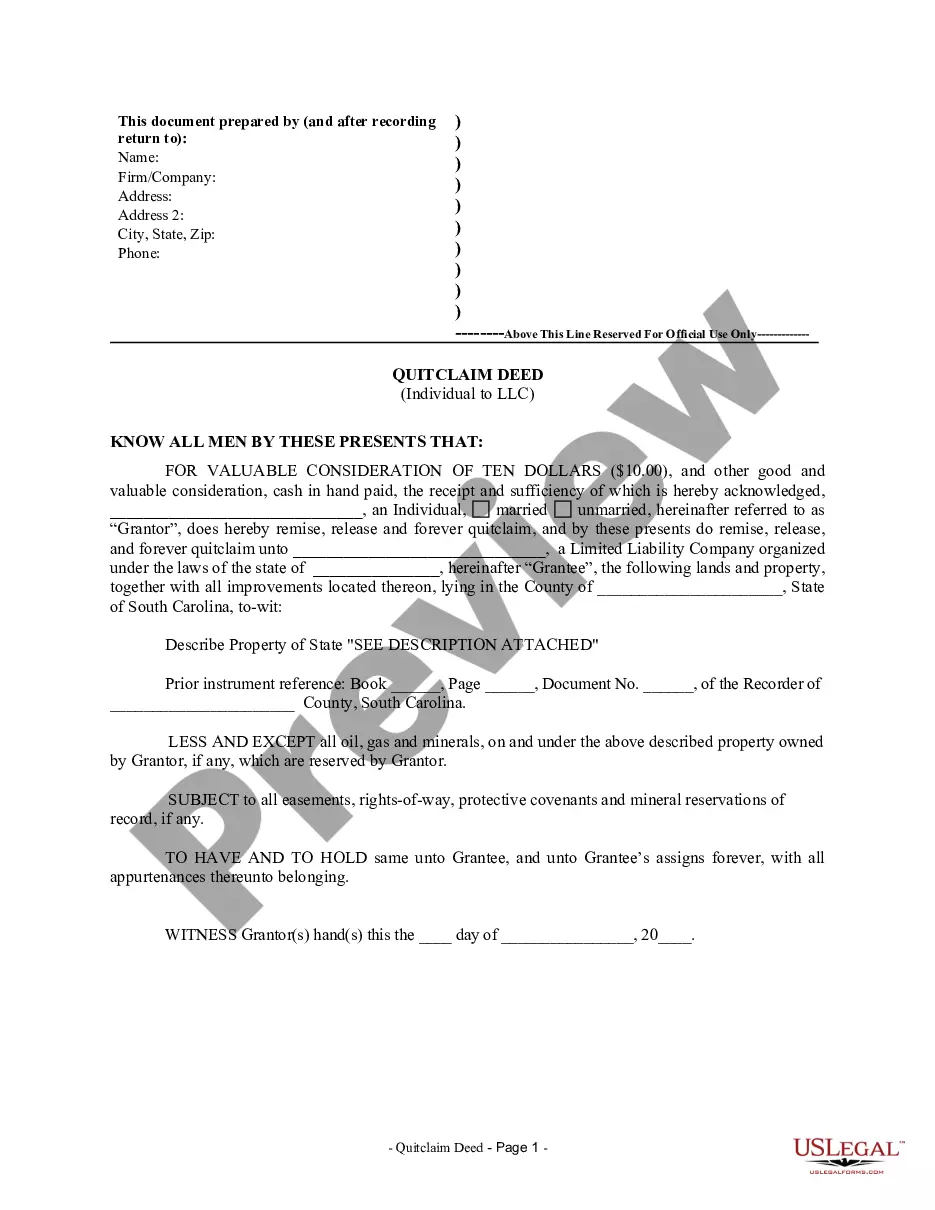

In general terms, the escrow agreement should include: The identity of the escrow agent. The duties of both the escrow agent and the parties to the escrow agreement. The beneficiary of the escrow, which is commonly one of the parties entering the escrow agreement.

The Escrow Parties jointly and severally agree to indemnify the Escrow Agent for, and to hold it harmless against, any and all claims, suits, actions, proceedings, investigations, judgments, deficiencies, damages, settlements, liabilities and expenses (including reasonable legal fees and expenses of attorneys chosen by ...

The escrow company acts as a neutral third party to collect the required funds and documents involved in the closing process, including the initial earnest money check, the loan documents, and the signed deed.

The two essential elements for a valid sale escrow are a binding contract/agreement between buyer and seller and the conditional delivery to a neutral third party of something of value, as defined, which typically includes written instruments of conveyance (grant deed) or encumbrance (deed of trust) and related ...