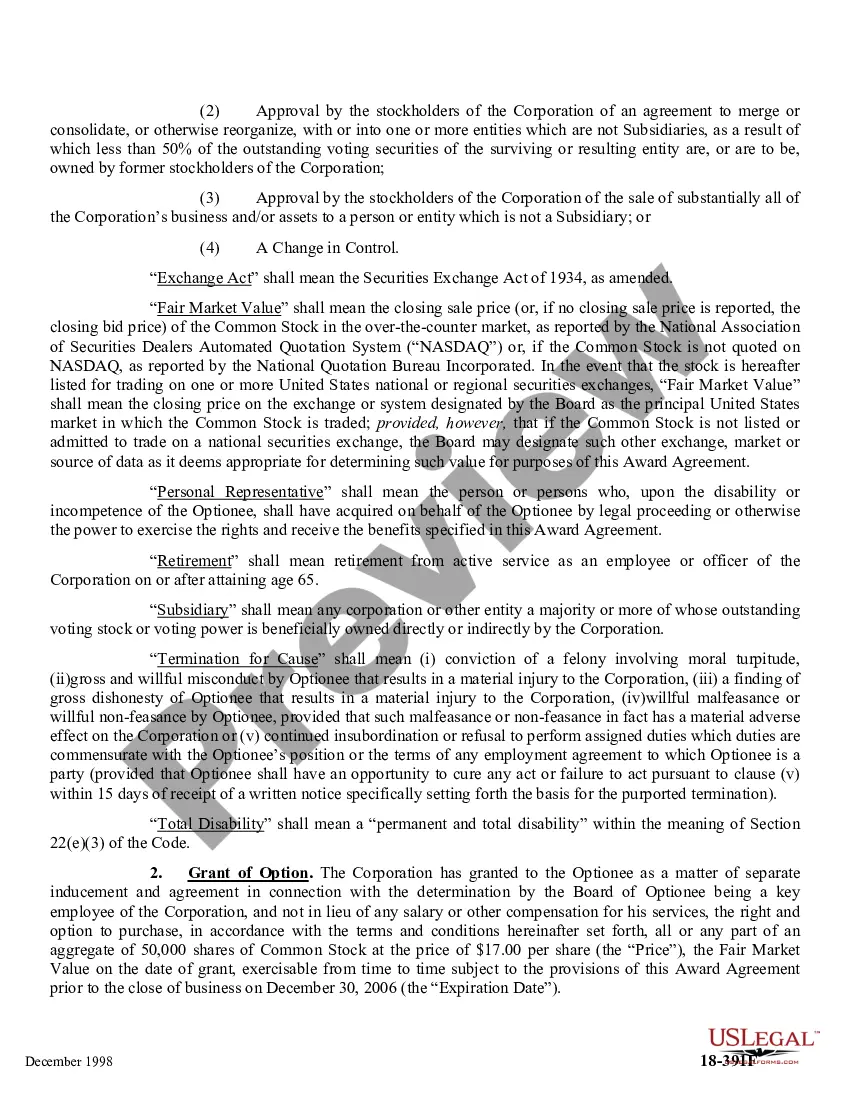

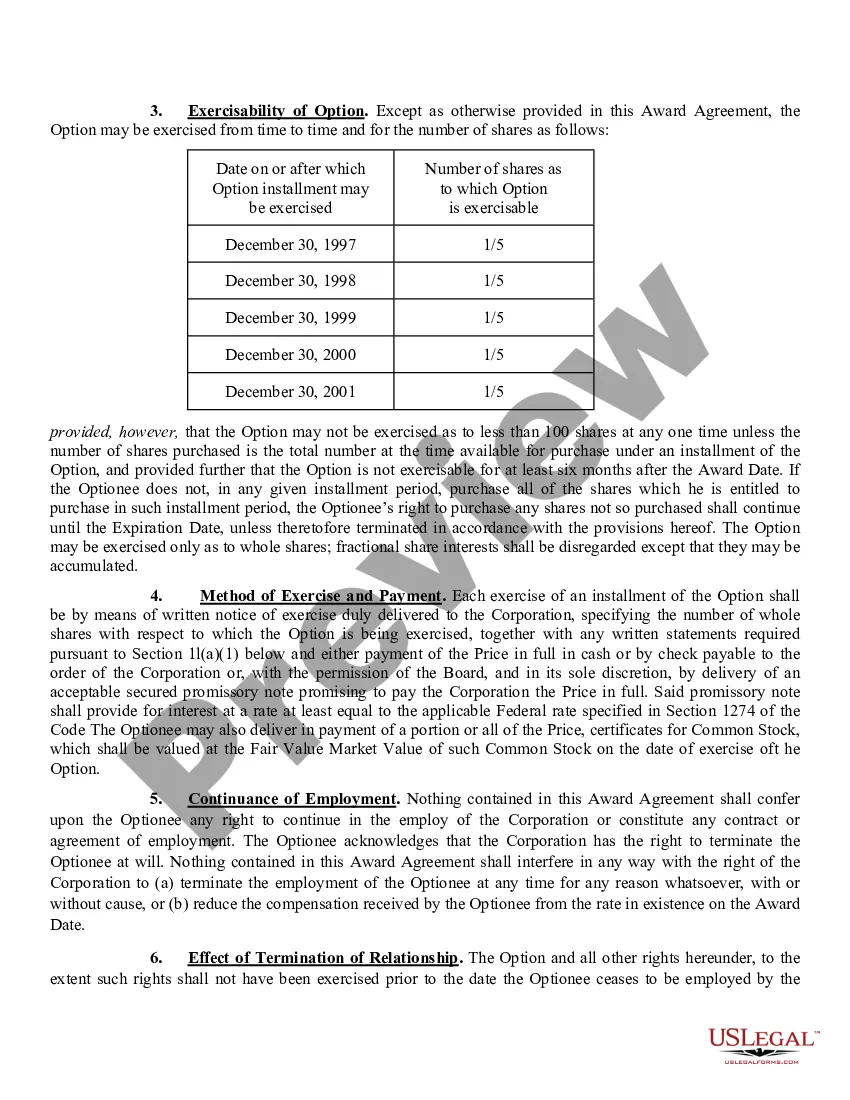

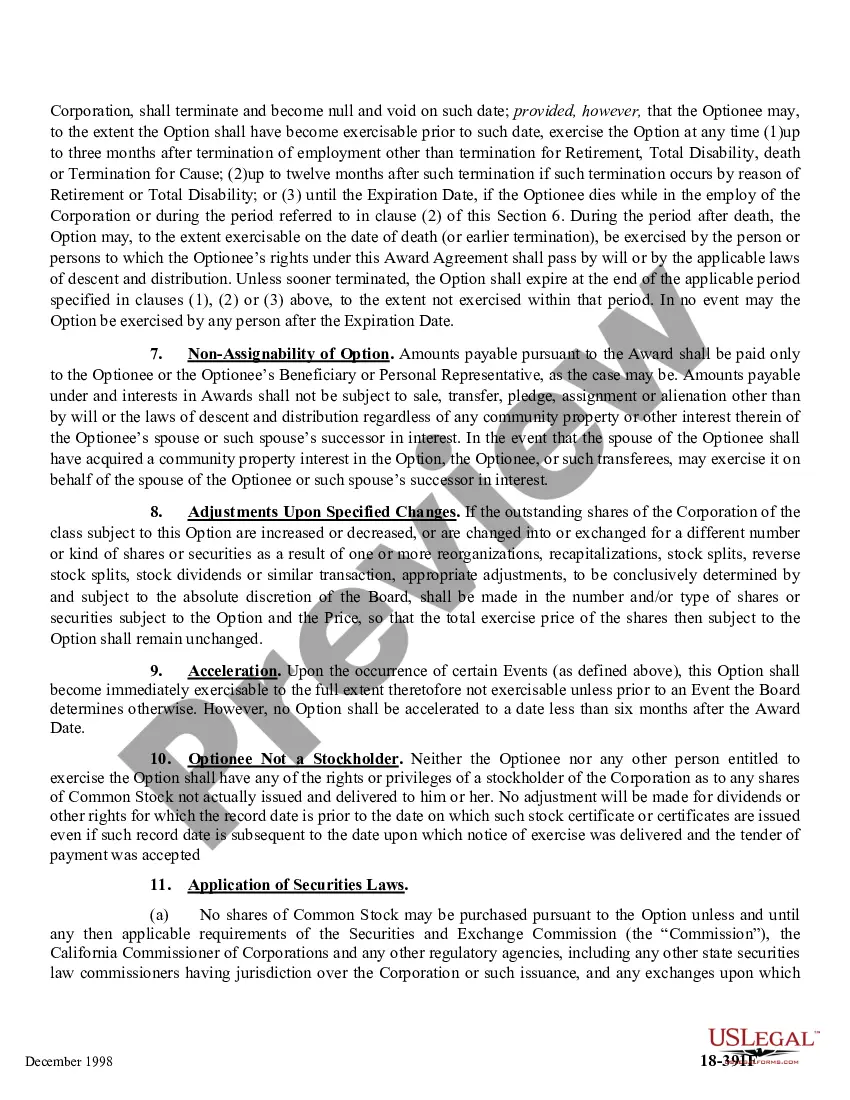

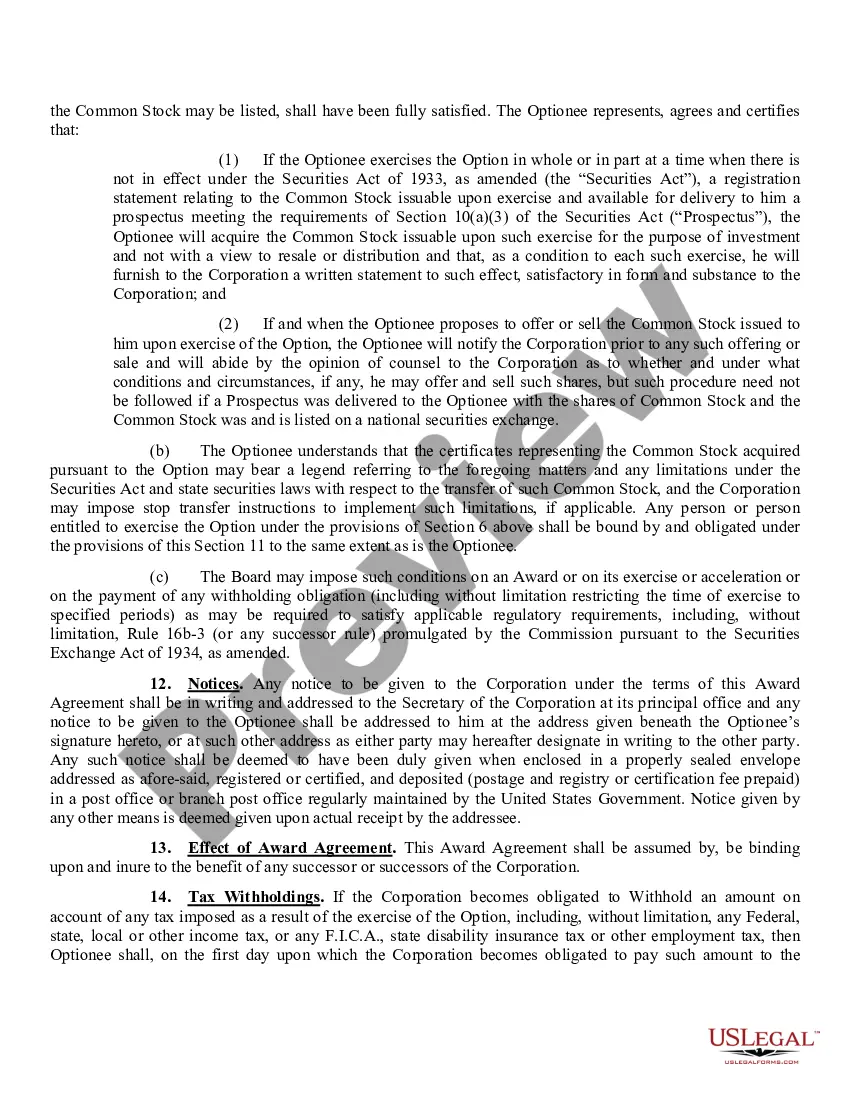

The Oregon Key Employee Stock Option Award Agreement is a legally binding document that outlines the terms and conditions under which a key employee of a company in Oregon will receive stock options as part of their compensation package. This agreement is designed to reward and incentivize key employees who play a crucial role in the success of the company. By offering stock options, the employer provides employees with the opportunity to share in the company's growth and financial success. Some key elements typically included in the Oregon Key Employee Stock Option Award Agreement include: 1. Grant of Options: This section specifies the number of stock options being awarded to the key employee, along with the exercise price or strike price, which is the predetermined price at which the employee can purchase the shares. 2. Vesting Schedule: The agreement usually outlines a vesting schedule, which determines when the employee's stock options become exercisable. Vesting schedules can vary, but they often include a specific timeframe or milestone-based criteria. 3. Exercise Period: This section specifies the duration during which the employee can exercise their stock options after they become vested. The exercise period is typically set to a specific period after the vesting schedule completion, such as 3 to 10 years. 4. Tax Implications: The agreement may address the tax treatment of the stock options and any associated tax obligations that the employee may incur upon exercise or sale of the shares. This can include details about the issuance of Form 1099 or other tax-related documentation. 5. Termination and Change in Control: The agreement may outline the conditions under which the stock options may be terminated or modified in the event of the key employee's termination, resignation, retirement, or a change in control of the company. In Oregon, there can be various types of Key Employee Stock Option Award Agreements, depending on the specifics of the company and its compensation practices. Some common variations include: 1. Incentive Stock Options (SOS): These are stock options that receive special tax treatment, where employees may be eligible for favorable tax rates upon the sale of the shares, subject to certain criteria established by the Internal Revenue Service (IRS). 2. Non-Qualified Stock Options (Nests): Unlike SOS, Nests do not qualify for the same tax benefits. However, they offer more flexibility in terms of eligibility and may have less strict criteria to meet. 3. Restricted Stock Units (RSS): RSS are a form of equity-based compensation where employees receive units that can be converted into company shares upon vesting. RSS typically have a vesting schedule and may be subject to specific conditions. 4. Performance Stock Options: These stock options have performance-based criteria that employees must meet to become eligible for exercising the options. Such criteria may include achieving certain financial targets, reaching specific sales goals, or meeting other predetermined objectives. It is essential for both employers and key employees in Oregon to carefully review and understand the terms and conditions specified in the Key Employee Stock Option Award Agreement before signing it. Additionally, seeking legal and tax advice is advisable to ensure compliance with local laws and regulations.

Oregon Key Employee Stock Option Award Agreement

Description

How to fill out Oregon Key Employee Stock Option Award Agreement?

You may devote hours on-line searching for the authorized record web template that meets the state and federal demands you will need. US Legal Forms supplies a huge number of authorized varieties that happen to be analyzed by pros. It is simple to download or produce the Oregon Key Employee Stock Option Award Agreement from your assistance.

If you already have a US Legal Forms account, you can log in and then click the Download key. Following that, you can complete, edit, produce, or sign the Oregon Key Employee Stock Option Award Agreement. Each authorized record web template you buy is the one you have eternally. To have one more backup of the bought form, go to the My Forms tab and then click the related key.

Should you use the US Legal Forms website the first time, keep to the straightforward instructions below:

- First, make certain you have selected the right record web template for that area/town that you pick. Read the form information to ensure you have picked the right form. If available, make use of the Review key to look throughout the record web template too.

- If you want to get one more edition from the form, make use of the Research area to find the web template that fits your needs and demands.

- When you have discovered the web template you need, just click Buy now to proceed.

- Select the costs program you need, key in your accreditations, and sign up for a merchant account on US Legal Forms.

- Complete the transaction. You can utilize your bank card or PayPal account to fund the authorized form.

- Select the formatting from the record and download it for your product.

- Make changes for your record if required. You may complete, edit and sign and produce Oregon Key Employee Stock Option Award Agreement.

Download and produce a huge number of record templates making use of the US Legal Forms Internet site, that provides the largest variety of authorized varieties. Use expert and status-particular templates to deal with your small business or individual demands.

Form popularity

FAQ

Incentive stock options (ISOs), also known as statutory or qualified options, are generally only offered to key employees and top management. They receive preferential tax treatment in many cases, as the IRS treats gains on such options as long-term capital gains.

Stock option grants are how your company awards stock options. This document usually includes details about: The type of stock options you'll receive (ISOs or NSOs) The number of shares you can purchase. Your strike price.

These options, which are contracts, give an employee the right to buy, or exercise, a set number of shares of the company stock at a preset price, also known as the grant price. This offer doesn't last forever, though. You have a set amount of time to exercise your options before they expire.

A stock grant provides the recipient with value?the corporate stock. By contrast, stock options only offer employees the opportunity to purchase something of value. They can acquire the corporate stock at a set price, but the employees receiving stock options still have to pay for those stocks if they want them.

A stock option is the right to buy a specific number of shares of company stock at a pre-set price, known as the ?exercise? or ?strike price.? You take actual ownership of granted options over a fixed period of time called the ?vesting period.? When options vest, it means you've ?earned? them, though you still need to ...

If the stock value increases, you could make significant financial gains?but only if you've exercised (purchased) your options. And you can only do that if you've accepted your grant. The earlier you understand your options and the financial implications of exercising, the sooner you can make smart financial decisions.

Restricted stock awards represent actual ownership of stock and come with conditions on the timing of their sale. An employee benefits from stock options when they buy the stock at the exercise price and then sell it at a higher price.

What are option agreements? Option grants are how companies award equity to employees. Signing an offer letter isn't enough. The option agreement outlines all the details of an employee's option grant. The option agreement is a more detailed version of an offer letter.