The Oregon Directors Stock Appreciation Rights Plan is a compensation program offered by American Annuity Group, Inc. to its directors based in Oregon. This plan allows directors to receive additional compensation in the form of stock appreciation rights (SARS). SARS is a type of equity-based incentive that gives participants the opportunity to profit from the increase in the company's stock price over a specific period. Under the Oregon Directors Stock Appreciation Rights Plan, directors are granted the right to receive a cash payment equal to the appreciation in the value of a specified number of shares of the company's common stock. This appreciation is typically measured from the date of grant to the date of exercise. The plan offers directors the flexibility to exercise their SARS at their discretion, allowing them to take advantage of favorable market conditions or hold onto their rights for potential future gains. One of the key benefits of the Oregon Directors Stock Appreciation Rights Plan is its ability to align the interests of directors with those of the shareholders. By providing directors with a stake in the company's stock performance, the plan encourages them to make decisions that enhance shareholder value and promote long-term growth. This can contribute to better corporate governance and decision-making. As for the different types of Oregon Directors Stock Appreciation Rights Plans of American Annuity Group, Inc., there may be variations based on specific terms and conditions. Some possible variations could include: 1. Performance-based SARS: These are SARS that are subject to specific performance goals or targets, such as achieving a certain level of revenue growth, market share increase, or profitability. This type of plan incentivizes directors to drive the company's financial success while aligning their compensation with performance outcomes. 2. Time-based SARS: This SARS has a predetermined vesting period, after which directors can exercise their rights. This type of plan rewards directors for their continued service and commitment to the company over a specific time frame. 3. Restricted SARS: This type of SAR grants directors the right to receive cash payments only if certain conditions are met. For example, the SARS may be contingent upon the company achieving a specific financial milestone or a successful merger or acquisition. It's important to note that the specific details and variations of the Oregon Directors Stock Appreciation Rights Plan can vary from company to company. Therefore, directors and potential participants should carefully review the plan's terms and consult with professionals to fully understand the intricacies involved.

Oregon Directors Stock Appreciation Rights Plan of American Annuity Group, Inc.

Description

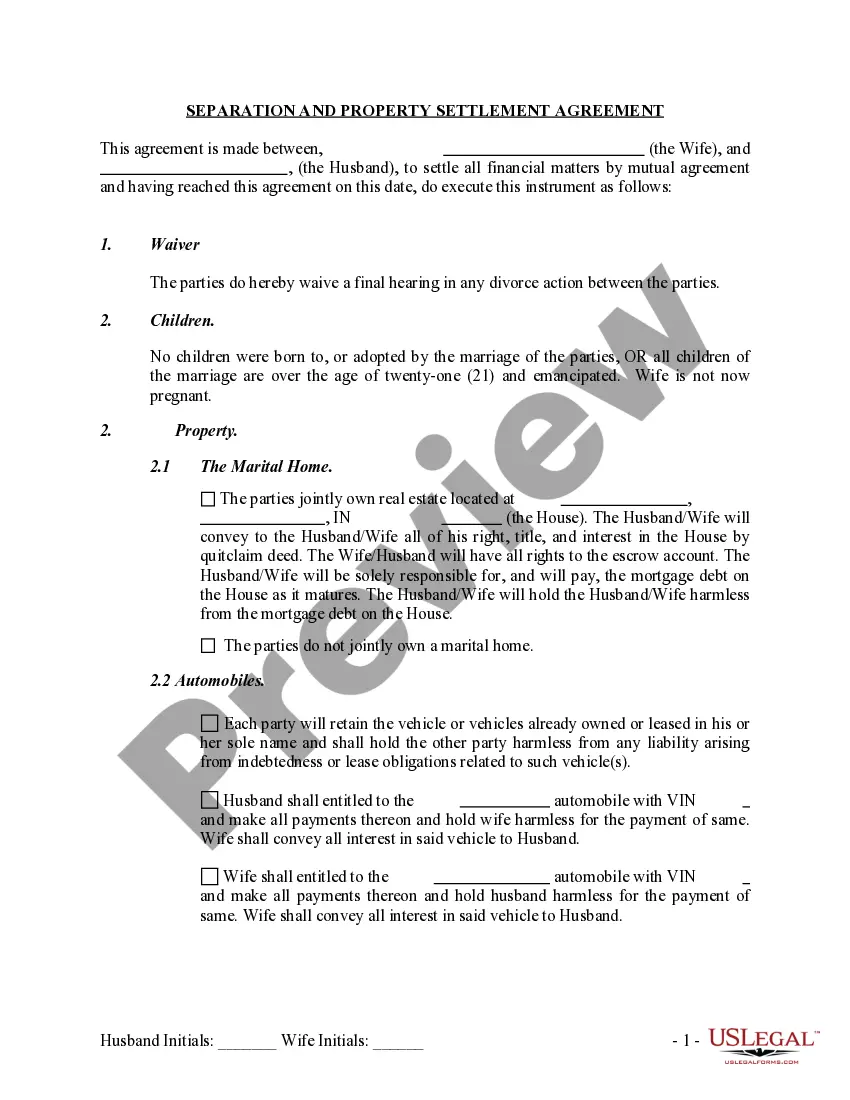

How to fill out Directors Stock Appreciation Rights Plan Of American Annuity Group, Inc.?

Have you been within a position that you need to have files for possibly enterprise or individual functions almost every working day? There are a lot of lawful file web templates available on the net, but locating versions you can depend on is not straightforward. US Legal Forms delivers thousands of kind web templates, much like the Oregon Directors Stock Appreciation Rights Plan of American Annuity Group, Inc., which are written to meet federal and state specifications.

Should you be presently familiar with US Legal Forms website and get your account, merely log in. After that, you may down load the Oregon Directors Stock Appreciation Rights Plan of American Annuity Group, Inc. web template.

Unless you provide an bank account and need to begin using US Legal Forms, follow these steps:

- Obtain the kind you require and make sure it is for that appropriate metropolis/county.

- Take advantage of the Review option to analyze the form.

- Browse the description to actually have chosen the proper kind.

- In case the kind is not what you are seeking, make use of the Research industry to discover the kind that meets your requirements and specifications.

- Once you discover the appropriate kind, simply click Purchase now.

- Opt for the rates prepare you need, complete the required information and facts to generate your account, and purchase the order using your PayPal or bank card.

- Select a handy data file file format and down load your backup.

Locate each of the file web templates you have purchased in the My Forms menu. You can get a further backup of Oregon Directors Stock Appreciation Rights Plan of American Annuity Group, Inc. at any time, if required. Just click on the essential kind to down load or produce the file web template.

Use US Legal Forms, probably the most comprehensive variety of lawful kinds, to conserve time as well as prevent faults. The service delivers professionally created lawful file web templates that you can use for a variety of functions. Create your account on US Legal Forms and commence producing your life a little easier.

Form popularity

FAQ

However, when a stock appreciation right is exercised, the employee does not have to pay to acquire the underlying security. Instead, the employee receives the appreciation in value of the underlying security, which would equal the current market value less the grant price.

Stock Appreciation Right (SAR) entitles an employee, who is a shareholder in a company, to a cash payment proportionate to the appreciation of stock traded on a public exchange market. SAR programs provide companies with the flexibility to structure the compensation scheme in a way that suits their beneficiaries.

A SAR is very similar to a stock option, but with a key difference. When a stock option is exercised, an employee has to pay the grant price and acquire the underlying security. However, when a SAR is exercised, the employee does not have to pay to acquire the underlying security.

A ?Stock Appreciation Right? is the right to receive a payment from the Company in an amount equal to the ?Spread,? which is defined as the excess of the Fair Market Value (as defined in Plan) of one share of common stock, $1.00 par value (the ?Stock?) of the Company at the Exercise Date (as defined below) over a ...

Stock Appreciation Rights plans do not result in equity dilution because actual shares are not being transferred to the employee. Participants do not become owners. Instead, they are potential cash beneficiaries in the appreciation of the underlying company value.

Stock Appreciation Right (SAR) entitles an employee, who is a shareholder in a company, to a cash payment proportionate to the appreciation of stock traded on a public exchange market. SAR programs provide companies with the flexibility to structure the compensation scheme in a way that suits their beneficiaries.