The Oregon Approval of Company Stock Award Plan is a legislative requirement that outlines the procedures and criteria for companies seeking to award stock options or other stock-based compensation to their employees within the state. This plan ensures that the company's actions align with the guidelines set by the state of Oregon and helps protect the rights and interests of both the employees and the company. The Oregon Approval of Company Stock Award Plan incorporates various aspects of stock-based compensation, including stock options, restricted stock units (RSS), performance shares, and phantom stock. Each type of stock award has its own unique characteristics and requirements, ensuring flexibility and accommodating different company structures and employee needs. In the case of stock options, employees are granted the right to purchase company stock at a predetermined price, with certain vesting conditions and expiration periods. This type of award allows employees to benefit from the rising stock price and incentivizes them to contribute to the company's growth and success. Restricted stock units (RSS), on the other hand, grant employees the right to receive company stock at a future date, usually following a vesting period. RSS help retain employees as they encourage loyalty and commitment to the organization since the value of the award depends on the company's performance. Performance shares are a type of stock award that links the shares' value to the company's performance. These awards are typically contingent upon achieving specific financial or operational targets, providing an extra incentive for employees to drive the company's success and align their interests with shareholders. Phantom stock is a synthetic equity instrument that does not involve actual ownership of company stock but represents a similar economic value. It mirrors the price movement of real company shares, providing employees with a sense of ownership and potential financial rewards. The Oregon Approval of Company Stock Award Plan requires companies to submit documentation to the appropriate state authorities, outlining the proposed stock-based compensation program, including the type of awards to be granted, the eligibility criteria, vesting schedule, and any limitations or restrictions in place. Compliance with the Oregon Approval of Company Stock Award Plan is crucial for companies operating in the state as it ensures transparency, fairness, and adherence to state regulations. It also protects employees' rights and provides a clear framework for companies to award stock options and other stock-based compensation, fostering employee motivation and retention. Therefore, companies need to carefully design and implement their stock award plans while considering the various types of awards available. This enables them to attract and retain top talent, align employee interests with company goals, and ultimately drive the organization's success in Oregon.

Oregon Approval of Company Stock Award Plan

Description

How to fill out Oregon Approval Of Company Stock Award Plan?

If you want to total, down load, or produce authorized file themes, use US Legal Forms, the greatest variety of authorized varieties, which can be found on-line. Take advantage of the site`s basic and handy lookup to get the paperwork you want. A variety of themes for business and individual uses are sorted by groups and says, or search phrases. Use US Legal Forms to get the Oregon Approval of Company Stock Award Plan within a handful of click throughs.

Should you be currently a US Legal Forms client, log in to the profile and then click the Obtain button to find the Oregon Approval of Company Stock Award Plan. You can also gain access to varieties you previously downloaded in the My Forms tab of your respective profile.

Should you use US Legal Forms for the first time, follow the instructions beneath:

- Step 1. Be sure you have selected the form for that right town/region.

- Step 2. Use the Preview solution to examine the form`s information. Do not neglect to read the description.

- Step 3. Should you be unhappy with all the develop, take advantage of the Search area at the top of the monitor to find other models in the authorized develop template.

- Step 4. Once you have located the form you want, click on the Purchase now button. Choose the pricing program you favor and add your credentials to register on an profile.

- Step 5. Method the financial transaction. You may use your charge card or PayPal profile to finish the financial transaction.

- Step 6. Find the formatting in the authorized develop and down load it on the gadget.

- Step 7. Total, modify and produce or sign the Oregon Approval of Company Stock Award Plan.

Every authorized file template you get is your own forever. You have acces to every single develop you downloaded with your acccount. Go through the My Forms area and choose a develop to produce or down load yet again.

Compete and down load, and produce the Oregon Approval of Company Stock Award Plan with US Legal Forms. There are millions of specialist and status-certain varieties you can use for your personal business or individual requirements.

Form popularity

FAQ

Restricted stock awards represent actual ownership of stock and come with conditions on the timing of their sale. An employee benefits from stock options when they buy the stock at the exercise price and then sell it at a higher price.

A stock grant is the issuance of stock in exchange for non-cash consideration, such as services performed. For startups, stock grants are commonly used to compensate employees through stock incentive plans.

Stock awards provide corporations a way to pay their executives based on company performance so their compensation aligns with the expectations of the shareholders. Companies may also grant stock awards to lower-level employees to incentivize them to take ownership of the company's performance and retain their loyalty.

A restricted stock award is when a company grants someone stock as a form of compensation. The stock awarded has additional conditions on it, including a vesting schedule, so is called restricted stock. Restricted stock awards may also be called simply stock awards or stock grants.

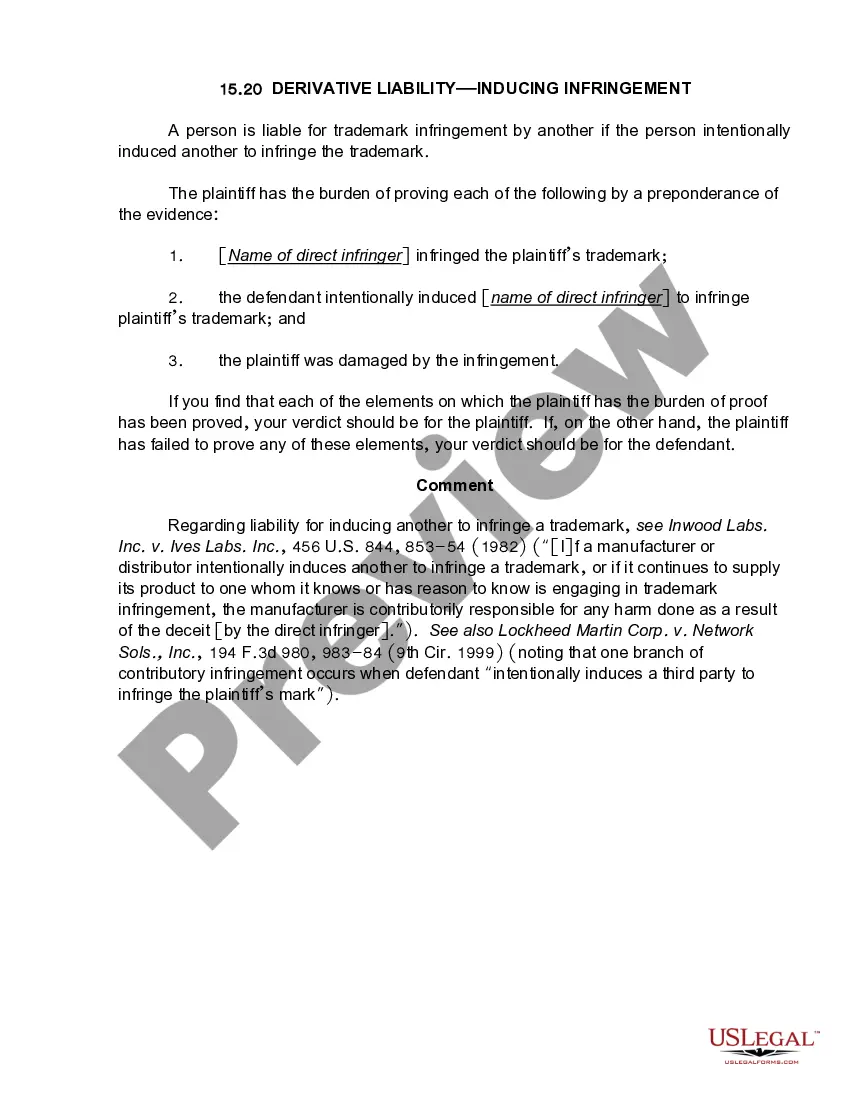

The US federal tax laws do not generally address the level of approval required for equity awards, but the tax rules that govern the qualification of so-called incentive stock options require that the options be granted under a shareholder-approved plan.

Employee stock options are offered by companies to their employees as equity compensation plans. These grants come in the form of regular call options and give an employee the right to buy the company's stock at a specified price for a finite period of time.

Companies often offer stock options as part of your compensation package so you can share in the company's success. Stock options aren't actual shares of stock?they're the right to buy a set number of company shares at a fixed price, usually called a grant price, strike price, or exercise price.

A stock option is the right to buy a specific number of shares of company stock at a pre-set price, known as the ?exercise? or ?strike price.? You take actual ownership of granted options over a fixed period of time called the ?vesting period.? When options vest, it means you've ?earned? them, though you still need to ...

When you receive an RSU, you don't have any immediate tax liability. You only have to pay taxes when your RSU vests and you receive an actual payout of stock shares. At that point, you have to report income based on the fair market value of the stock.

A stock grant occurs when a company issues shares of its stock in exchange for non-cash consideration, typically the performance of services. By compensating with stocks, the employer aims to motivate employees to stay at the company and keep them invested in its ongoing success.