Oregon Reorganization of corporation as a Massachusetts business trust with plan of reorganization

Description

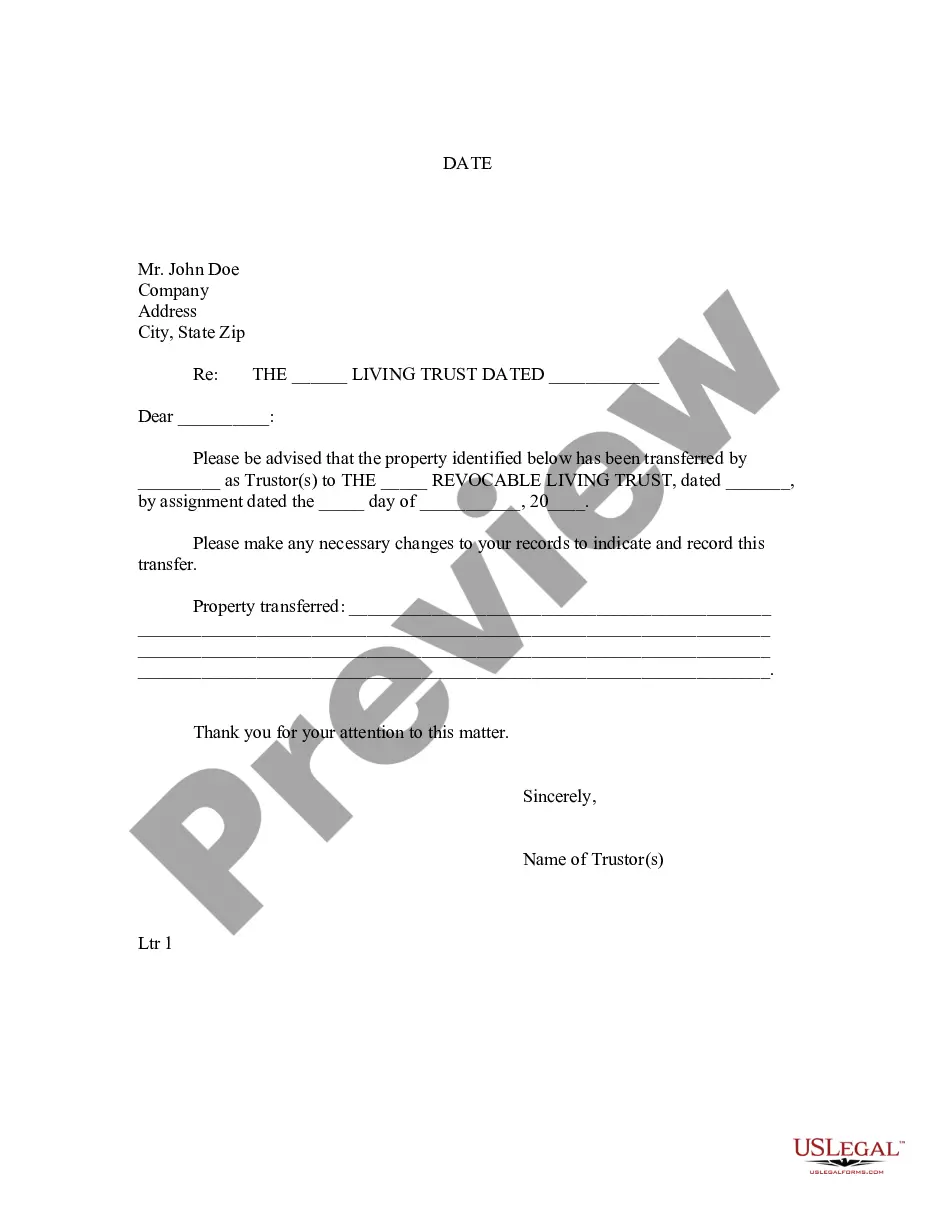

How to fill out Reorganization Of Corporation As A Massachusetts Business Trust With Plan Of Reorganization?

US Legal Forms - among the biggest libraries of authorized forms in the United States - provides a wide range of authorized document web templates you are able to acquire or printing. While using web site, you can find a huge number of forms for organization and specific functions, categorized by types, claims, or key phrases.You can get the most up-to-date models of forms much like the Oregon Reorganization of corporation as a Massachusetts business trust with plan of reorganization in seconds.

If you already have a registration, log in and acquire Oregon Reorganization of corporation as a Massachusetts business trust with plan of reorganization from the US Legal Forms catalogue. The Obtain option will show up on every single type you perspective. You have access to all in the past delivered electronically forms inside the My Forms tab of your respective accounts.

If you would like use US Legal Forms initially, allow me to share easy guidelines to get you started:

- Ensure you have selected the correct type for the metropolis/county. Click the Review option to examine the form`s content. Read the type outline to ensure that you have chosen the proper type.

- If the type doesn`t suit your requirements, make use of the Look for discipline towards the top of the display to discover the one who does.

- When you are pleased with the shape, validate your decision by clicking on the Buy now option. Then, select the rates program you want and offer your credentials to sign up to have an accounts.

- Procedure the financial transaction. Use your Visa or Mastercard or PayPal accounts to accomplish the financial transaction.

- Select the format and acquire the shape on the system.

- Make adjustments. Fill out, edit and printing and indication the delivered electronically Oregon Reorganization of corporation as a Massachusetts business trust with plan of reorganization.

Each format you included in your money lacks an expiration time and it is your own forever. So, in order to acquire or printing an additional version, just go to the My Forms section and click in the type you want.

Gain access to the Oregon Reorganization of corporation as a Massachusetts business trust with plan of reorganization with US Legal Forms, by far the most substantial catalogue of authorized document web templates. Use a huge number of specialist and state-distinct web templates that satisfy your company or specific needs and requirements.

Form popularity

FAQ

Section 1182(1)(B)(i) provides that in order to proceed under Subchapter V, the debts of all affiliated debtors must be less than or equal to $7.5 million. The court denied the plaintiff's motion to revoke the Subchapter V election, holding that eligibility is measured as of the debtor's petition date only.

The subchapter V debtor shall file a plan not later than 90 days after the petition date, except that the court may extend the period ?if the need for the extension is attributable to circumstances for which the debtor should not justly be held accountable.? 11 U.S.C.

The subchapter went into effect in 2020. It gives small businesses that are earning a profit, but having trouble paying their obligations, a simplified process for paying down their debt. Businesses that file under Subchapter 5 can force creditors to accept court-approved repayment plans of three to five years.

You will need to work in conjunction with the lawyer or firm to prepare your petition by completing a list of all of your company's assets, debts, income, and expenses with a summary of your finances. When ready, the petition can be filed with the bankruptcy clerk's office.

With Subchapter 5, businesses can file a bankruptcy plan that is subject to court approval, without the need for creditors to approve the plan. Lower Cost Another significant benefit of Subchapter 5 bankruptcy is its lower cost compared to traditional bankruptcy options.

The discharge received by an individual debtor in a Chapter 11 case discharges the debtor from all pre-confirmation debts except those that would not be dischargeable in a Chapter 7 case filed by the same debtor.

It's important to note that an individual's personal assets may be used to pay creditors in a Chapter 11 bankruptcy case. Owners of corporations do not have to worry about having their assets included in the case, but sole proprietors or partners in a partnership may have their assets included in the filing.

Subchapter V allows debtors to spread their debt over 3 to 5 years. During this time, the debtor must devote their disposable income toward the debt. This model usually aids both parties involved. The debtors have time to pay their debts and can spread them across a more extended period to avoid large sums.