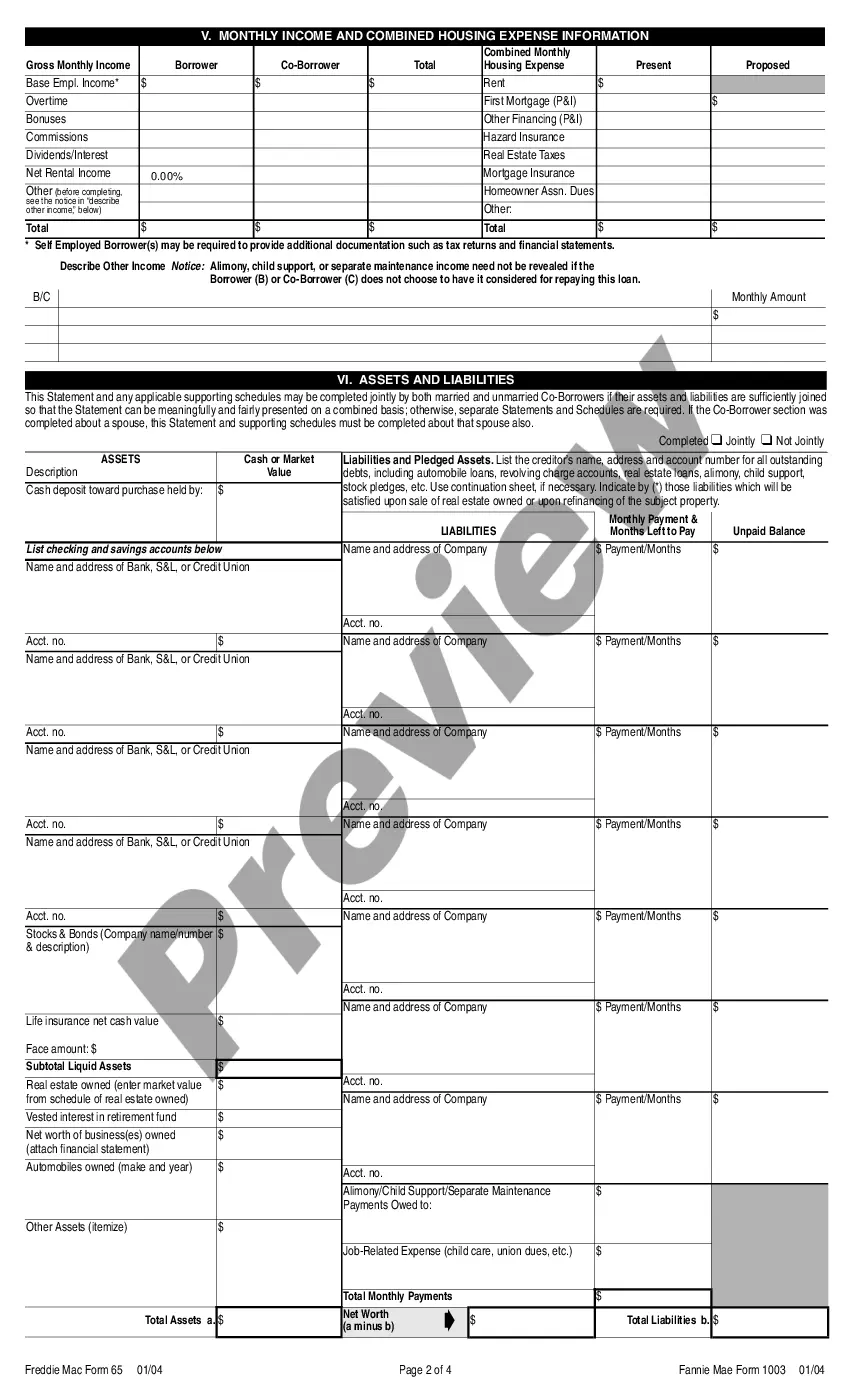

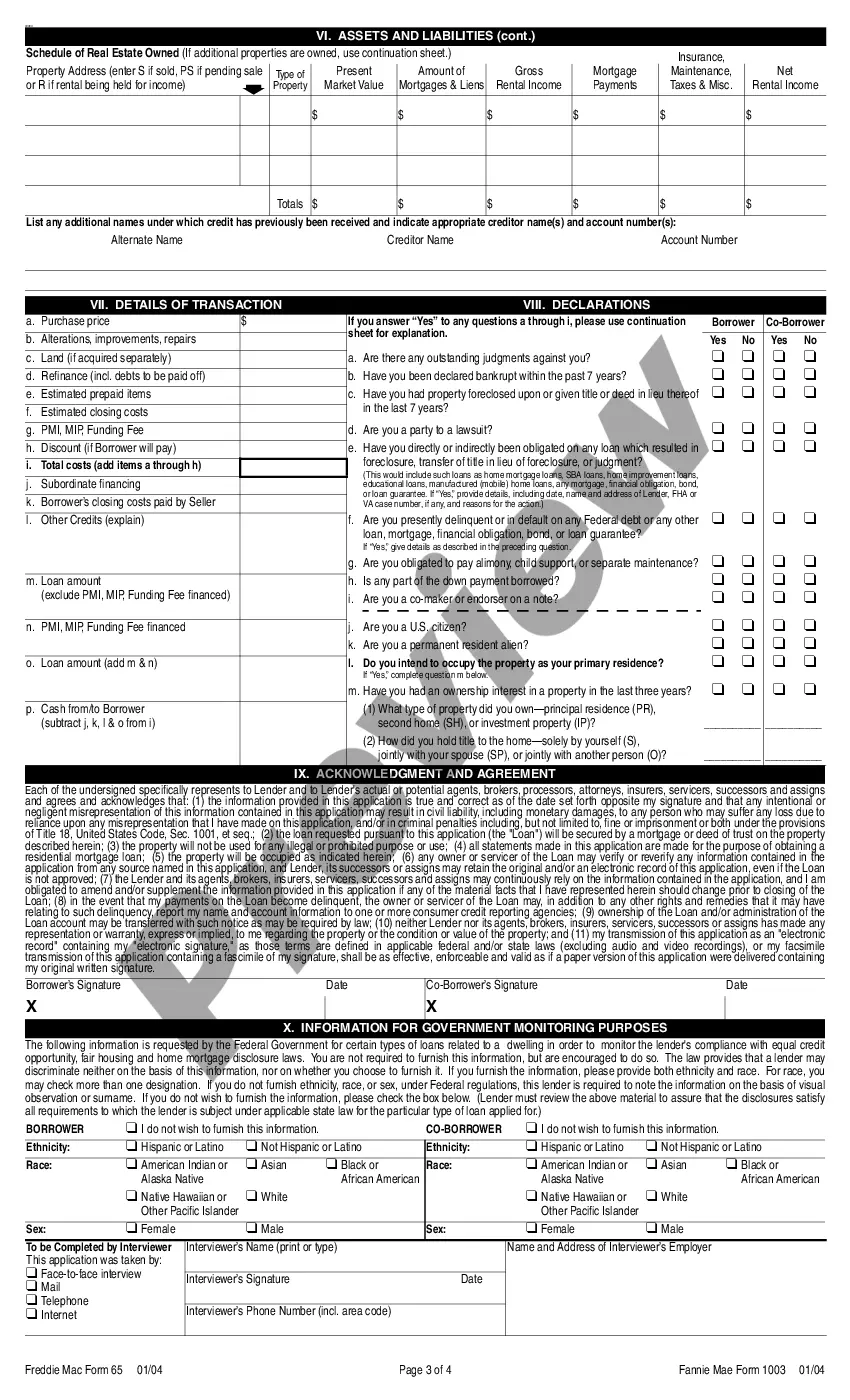

The Oregon Uniform Residential Loan Application (UCLA) is a standardized form that is used by mortgage lenders to collect essential information about borrowers. It is a key component of the mortgage loan application process in the state of Oregon. The Oregon UCLA captures pertinent details needed to evaluate and underwrite a loan, assisting lenders in making informed decisions regarding mortgage approval. The Oregon UCLA consists of multiple sections, each focusing on different aspects of the borrower's financial and personal information. Key sections include: 1. Borrower Information: This section requires the borrowers to provide their names, contact details, social security numbers, and other identifying information. 2. Employment Information: Here, applicants are required to provide comprehensive details about their current and past employment, including employers' names, addresses, positions held, and duration of employment. 3. Income and Assets: This section requests information about the borrowers' income sources, such as employment, self-employment, rental income, retirement benefits, and other sources. Additionally, assets like bank accounts, investments, and real estate holdings are also reported. 4. Monthly Expenses: Borrowers must list their monthly expenses, including housing costs, debts, utilities, insurance premiums, and other obligations. This section helps lenders assess the applicant's ability to manage their finances and fulfill mortgage payments. 5. Liabilities and Debts: Here, borrowers must disclose their outstanding debts, including credit card balances, student loans, auto loans, and any other financial obligations. 6. Details about the Property: This section collects information about the property being financed, such as the address, property type, intended use, and estimated value. 7. Declaration and Authorization: Borrowers must acknowledge that all the information provided in the application is true and allow the lender to verify the details. It is important to note that the Oregon Uniform Residential Loan Application may have variations or supplementary forms based on the specific requirements of different lenders or loan programs. These may include additional disclosures, supplementary information requests, or federally mandated forms like the Mortgage Loan Disclosure Statement or Truth-In-Lending Act (TILL) disclosures. In summary, the Oregon Uniform Residential Loan Application is a standardized form used by mortgage lenders in Oregon to collect detailed information about borrowers, their financial status, employment history, assets, liabilities, and the property being financed. By providing this comprehensive information, borrowers help lenders assess their eligibility for mortgage loans and enable the underwriting and approval process.

Oregon Uniform Residential Loan Application

Description

How to fill out Oregon Uniform Residential Loan Application?

You are able to invest hours on the web attempting to find the legitimate papers web template that suits the state and federal needs you want. US Legal Forms provides thousands of legitimate types which can be evaluated by pros. You can easily obtain or print the Oregon Uniform Residential Loan Application from my support.

If you already possess a US Legal Forms account, you may log in and click on the Download option. Afterward, you may full, edit, print, or signal the Oregon Uniform Residential Loan Application. Every legitimate papers web template you acquire is yours permanently. To obtain another duplicate associated with a bought form, go to the My Forms tab and click on the related option.

If you are using the US Legal Forms site the first time, keep to the straightforward directions beneath:

- First, be sure that you have chosen the proper papers web template for your county/town of your choice. See the form description to make sure you have selected the right form. If accessible, utilize the Review option to look throughout the papers web template as well.

- If you wish to locate another version of your form, utilize the Lookup industry to obtain the web template that meets your requirements and needs.

- After you have found the web template you would like, simply click Purchase now to move forward.

- Choose the rates prepare you would like, type your credentials, and register for a free account on US Legal Forms.

- Comprehensive the purchase. You should use your bank card or PayPal account to purchase the legitimate form.

- Choose the formatting of your papers and obtain it for your product.

- Make modifications for your papers if possible. You are able to full, edit and signal and print Oregon Uniform Residential Loan Application.

Download and print thousands of papers templates while using US Legal Forms website, which provides the largest variety of legitimate types. Use expert and condition-particular templates to handle your company or personal demands.

Form popularity

FAQ

The Oregon Bond Residential Loan program offers a selection of low-rate mortgages ? including conventional, FHA, VA and USDA loans ? with two assistance options for first-time homebuyers: Cash Advantage. Rate Advantage.

With a flex loan, you'll have access to a credit line that you can repeatedly draw on and pay off. You only pay interest on the actual amount you borrow with a flex like, and you'll have to make a minimum payment each month until you pay it off ? similar to a credit card.

Creating Equitable Pathways to Homeownership The Flex Lending Program provides a fixed-rate first mortgage in combination with a second mortgage in the form of either a silent forgivable second lien or an amortizing repayable second lien.

OHCS Bond Residential Loan Program It offers qualifying borrowers a 30-year fixed-rate mortgage (conventional, FHA, VA, or USDA) with two assistance options: With the ?Cash Advantage? option, borrowers get a competitive interest rate along with cash equal to 3% of their loan amount to help pay for home-buying expenses.

What is the Uniform Residential Loan Application? The URLA (also known as the Freddie Mac Form 65 / Fannie Mae Form 1003) is a standardized document used by borrowers to apply for a mortgage. The URLA is jointly published by the GSEs and has been in use for more than 40 years in all U.S. States and Territories.

Why doesn't Alex's lender send a pre-approval? Most often, information is missing or not completed. A pre-approval letter can only be issued once the borrower's financials have been reviewed. If there is missing information, the lender cannot complete their pre-approval process.

Creating Equitable Pathways to Homeownership The Flex Lending Program provides a fixed-rate first mortgage in combination with a second mortgage in the form of either a silent forgivable second lien or an amortizing repayable second lien.

Because flex loans tend not to require a credit check, it tends to be an attractive option for those who lack a credit history or have a limited credit history. However, interest rates can be high, so it's a good idea to compare lenders, rates, and terms.