Oregon Notice of Violation of Fair Debt Act - Unlawful Contact by Postcard

Description

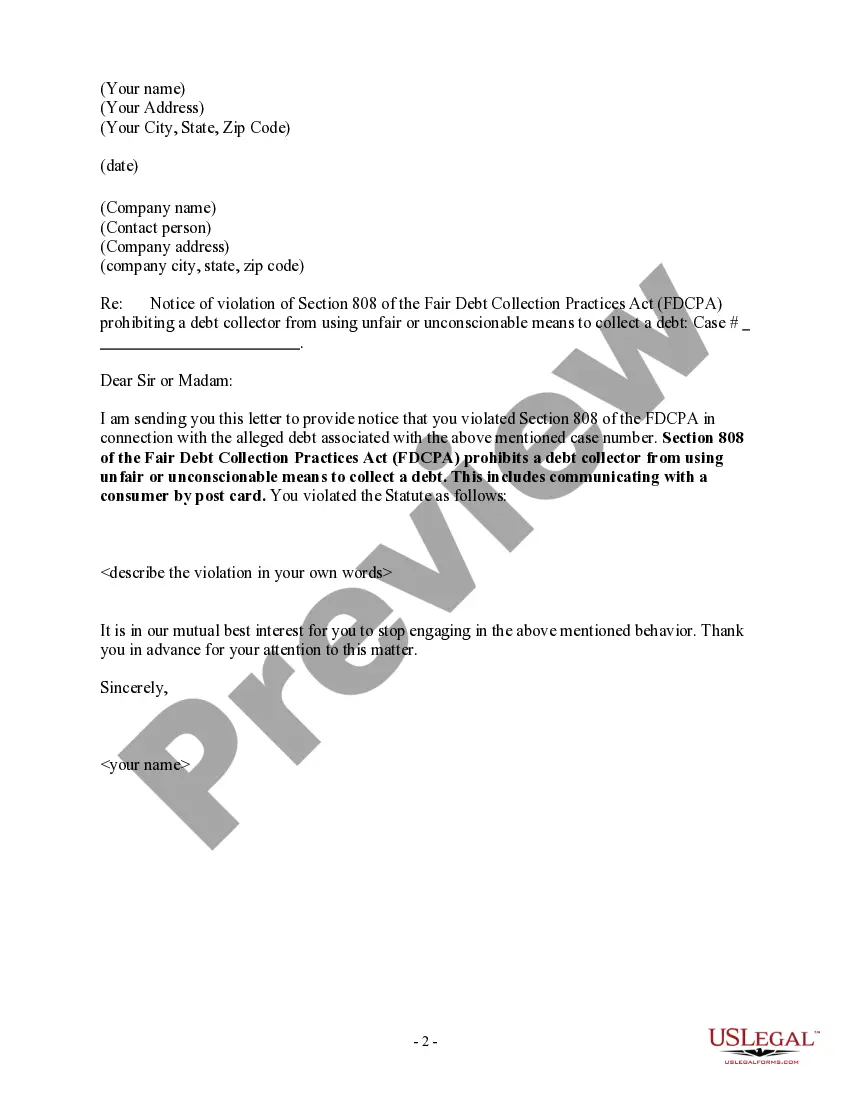

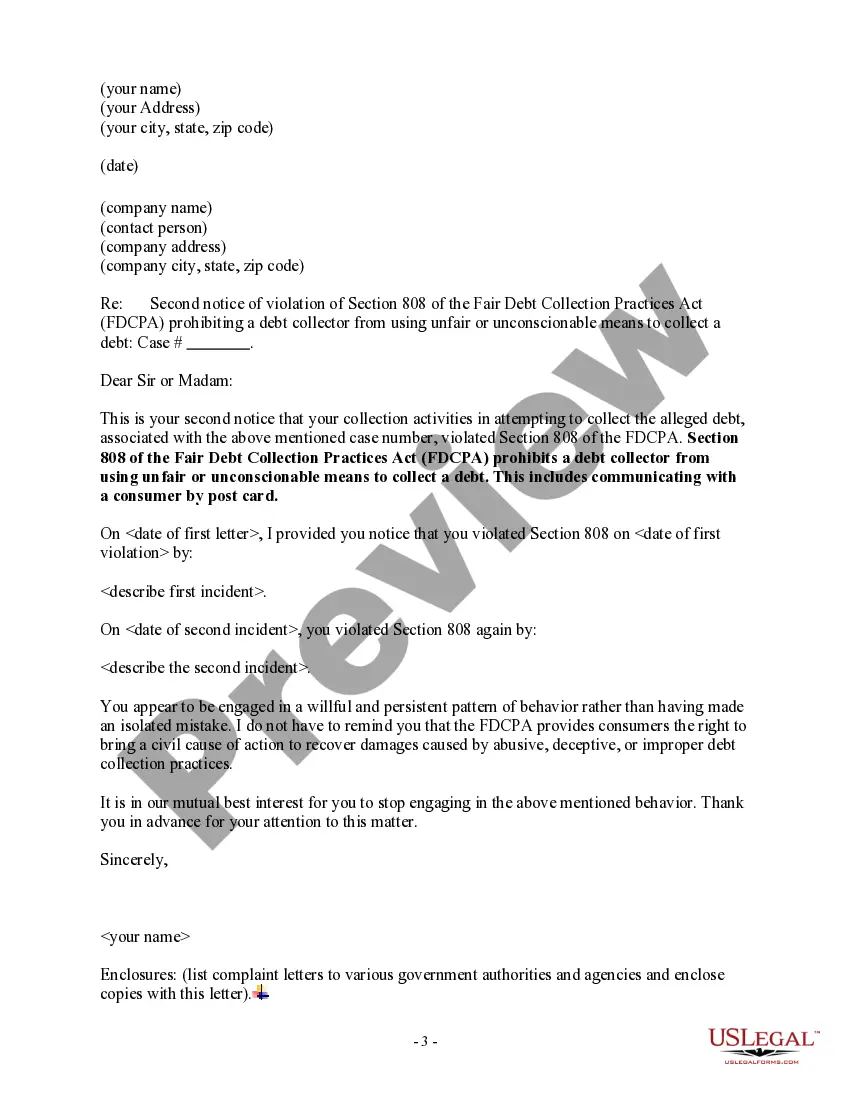

How to fill out Oregon Notice Of Violation Of Fair Debt Act - Unlawful Contact By Postcard?

If you have to full, down load, or produce legitimate document layouts, use US Legal Forms, the greatest variety of legitimate varieties, that can be found on the Internet. Take advantage of the site`s basic and handy lookup to get the files you want. Numerous layouts for enterprise and specific reasons are sorted by groups and suggests, or keywords. Use US Legal Forms to get the Oregon Notice of Violation of Fair Debt Act - Unlawful Contact by Postcard within a few click throughs.

In case you are previously a US Legal Forms client, log in in your accounts and click the Down load button to obtain the Oregon Notice of Violation of Fair Debt Act - Unlawful Contact by Postcard. Also you can access varieties you earlier downloaded from the My Forms tab of your accounts.

If you work with US Legal Forms the first time, refer to the instructions listed below:

- Step 1. Ensure you have chosen the form to the appropriate area/region.

- Step 2. Utilize the Preview method to look through the form`s information. Never overlook to learn the explanation.

- Step 3. In case you are not satisfied with the develop, use the Search field near the top of the display screen to find other types of the legitimate develop format.

- Step 4. After you have discovered the form you want, click the Acquire now button. Select the prices prepare you prefer and include your references to sign up to have an accounts.

- Step 5. Procedure the purchase. You can use your bank card or PayPal accounts to accomplish the purchase.

- Step 6. Choose the format of the legitimate develop and down load it on the gadget.

- Step 7. Comprehensive, edit and produce or signal the Oregon Notice of Violation of Fair Debt Act - Unlawful Contact by Postcard.

Each legitimate document format you buy is your own forever. You might have acces to each and every develop you downloaded in your acccount. Go through the My Forms portion and choose a develop to produce or down load once more.

Be competitive and down load, and produce the Oregon Notice of Violation of Fair Debt Act - Unlawful Contact by Postcard with US Legal Forms. There are thousands of professional and status-certain varieties you may use to your enterprise or specific needs.

Form popularity

FAQ

As of Nov. 30, 2021, debt collectors have new options for how they may communicate with you about debts they're trying to collect. Now they can text you. Text messages, along with emailing and direct messages on social media, are allowed as part of an update to the Fair Debt Collection Practices Act (FDCPA).

7 Most Common FDCPA ViolationsContinued attempts to collect debt not owed.Illegal or unethical communication tactics.Disclosure verification of debt.Taking or threatening illegal action.False statements or false representation.Improper contact or sharing of info.Excessive phone calls.

The law makes it illegal for debt collectors to harass debtors in other ways, including threats of bodily harm or arrest. They also cannot lie or use profane or obscene language. Additionally, debt collectors cannot threaten to sue a debtor unless they truly intend to take that debtor to court.

Debt collectors cannot harass or abuse you. They cannot swear, threaten to illegally harm you or your property, threaten you with illegal actions, or falsely threaten you with actions they do not intend to take. They also cannot make repeated calls over a short period to annoy or harass you.

Debt collectors must be truthful The Fair Debt Collection Practices Act states that debt collectors cannot use any false, deceptive or misleading representation to collect the debt. Along with other restrictions, debt collectors cannot misrepresent: The amount of the debt. Whether it's past the statute of limitations.

If a debt collector violates the FDCPA, you may sue that collector in state or federal court. You can even sue in small claims court. You must do this within one year from the date on which the violation occurred.

7 Most Common FDCPA ViolationsContinued attempts to collect debt not owed.Illegal or unethical communication tactics.Disclosure verification of debt.Taking or threatening illegal action.False statements or false representation.Improper contact or sharing of info.Excessive phone calls.16 Sept 2020

Deceptive And Unfair Practices Calling you collect so that you have to pay to accept the call is an example of an unfair practice. Engaging in any practice that forces you to pay additional money other than the debt you owe is considered an FDCPA violation.

Don't be surprised if debt collectors slide into your DMs. A new rule allows debt collectors to contact you on social media, text or email not just by phone. The rule, which was approved last year by the Consumer Financial Protection Bureau's former president Kathleen L.

Debt collectors cannot harass or abuse you. They cannot swear, threaten to illegally harm you or your property, threaten you with illegal actions, or falsely threaten you with actions they do not intend to take. They also cannot make repeated calls over a short period to annoy or harass you.