The Oregon Trust Agreement between Van Kampen Foods, Inc., American Portfolio Evaluation Services, Van Kampen Investment Advisory Corp., and The Bank of New York is a legally binding document that outlines the various terms, conditions, and responsibilities of the parties involved in managing and administering trusts in the state of Oregon. This agreement serves as a comprehensive guide and establishes a framework for the proper handling of trust assets and investments. One type of Oregon Trust Agreement between these entities is the Revocable Living Trust. This trust allows the granter, in this case, Van Kampen Foods, Inc., to retain control over their assets during their lifetime while specifying how these assets should be managed and distributed upon their death. The American Portfolio Evaluation Services may be responsible for evaluating the performance and value of the assets held by the trust, with Van Kampen Investment Advisory Corp. providing advice on investment strategies and portfolio management. Another type of Oregon Trust Agreement could be an Irrevocable Trust. Unlike a revocable trust, this agreement cannot be modified or terminated without the consent of all parties involved, including The Bank of New York. This type of trust may be used for asset protection, estate planning, or tax planning purposes. The Oregon Trust Agreement typically includes provisions regarding the appointment of a trustee, which might be The Bank of New York. The trustee is entrusted with the fiduciary duty of managing the trust assets in accordance with the terms outlined in the agreement. The trustee may also have the authority to make investment decisions, distribute income or principal, and handle administrative tasks related to the trust. American Portfolio Evaluation Services and Van Kampen Investment Advisory Corp. may have roles in assisting with investment evaluations and providing advice to the trustee. Additionally, the Oregon Trust Agreement may define the beneficiaries of the trust, which can include individuals, organizations, or even charitable entities. The agreement establishes how and when the trust assets will be distributed to the beneficiaries, whether it be through lump sum payments, staggered distributions, or income-generating arrangements. The Bank of New York may play a crucial role in ensuring these distributions are executed properly and in compliance with the trust's provisions. Overall, the Oregon Trust Agreement between Van Kampen Foods, Inc., American Portfolio Evaluation Services, Van Kampen Investment Advisory Corp., and The Bank of New York is a crucial legal arrangement that governs the management, administration, and distribution of trust assets in the state of Oregon. With the expertise and involvement of the various parties, this agreement ensures the proper handling of assets and the fulfillment of the intentions and wishes of the trust's granter and beneficiaries.

Oregon Trust Agreement between Van Kampen Foods, Inc., American Portfolio Evaluation Services, Van Kampen Investment Advisory Corp., and The Bank of New York

Description

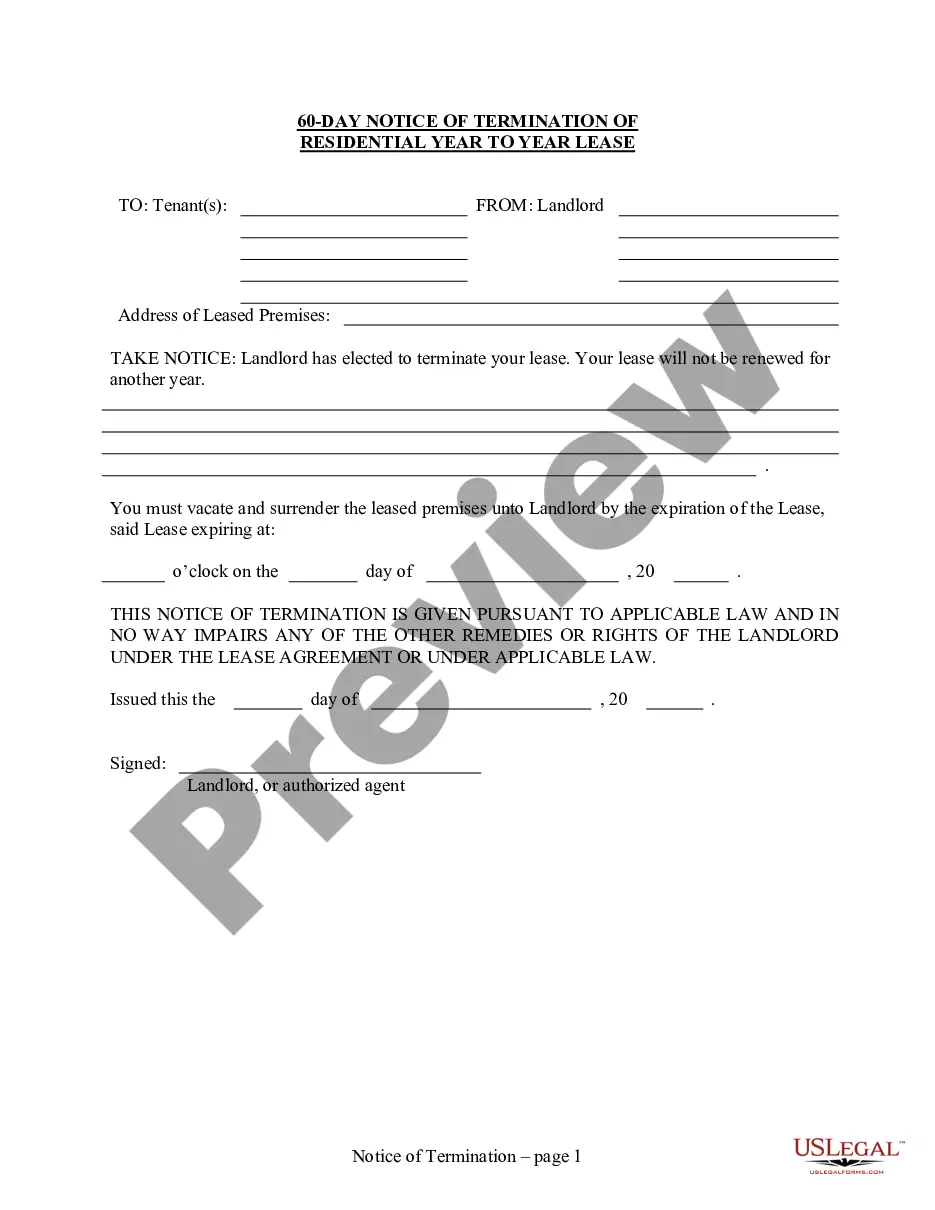

How to fill out Trust Agreement Between Van Kampen Foods, Inc., American Portfolio Evaluation Services, Van Kampen Investment Advisory Corp., And The Bank Of New York?

US Legal Forms - among the most significant libraries of legitimate forms in the USA - offers an array of legitimate papers themes you can down load or print out. While using web site, you can get thousands of forms for enterprise and specific reasons, sorted by categories, says, or search phrases.You will discover the most up-to-date versions of forms much like the Oregon Trust Agreement between Van Kampen Foods, Inc., American Portfolio Evaluation Services, Van Kampen Investment Advisory Corp., and The Bank of New York in seconds.

If you already possess a registration, log in and down load Oregon Trust Agreement between Van Kampen Foods, Inc., American Portfolio Evaluation Services, Van Kampen Investment Advisory Corp., and The Bank of New York through the US Legal Forms catalogue. The Down load option will show up on every single type you see. You have access to all previously delivered electronically forms from the My Forms tab of the account.

If you would like use US Legal Forms for the first time, listed below are straightforward instructions to obtain started:

- Be sure you have chosen the proper type for the city/state. Go through the Preview option to check the form`s articles. Browse the type description to ensure that you have selected the right type.

- In the event the type does not satisfy your needs, make use of the Lookup industry towards the top of the display to discover the one that does.

- When you are content with the form, verify your choice by clicking on the Acquire now option. Then, choose the prices prepare you like and offer your references to register to have an account.

- Procedure the deal. Use your Visa or Mastercard or PayPal account to perform the deal.

- Choose the structure and down load the form on your system.

- Make changes. Fill up, change and print out and sign the delivered electronically Oregon Trust Agreement between Van Kampen Foods, Inc., American Portfolio Evaluation Services, Van Kampen Investment Advisory Corp., and The Bank of New York.

Every single web template you added to your account lacks an expiration time and is the one you have eternally. So, in order to down load or print out one more version, just visit the My Forms segment and click around the type you require.

Obtain access to the Oregon Trust Agreement between Van Kampen Foods, Inc., American Portfolio Evaluation Services, Van Kampen Investment Advisory Corp., and The Bank of New York with US Legal Forms, the most extensive catalogue of legitimate papers themes. Use thousands of expert and status-particular themes that meet your small business or specific demands and needs.