Oregon Plan of Merger between Food Lion, Inc., Hannaford Brothers Company and FL Acquisition Sub, Inc.

Description

How to fill out Plan Of Merger Between Food Lion, Inc., Hannaford Brothers Company And FL Acquisition Sub, Inc.?

Finding the right legal papers template can be quite a have a problem. Of course, there are a lot of layouts accessible on the Internet, but how can you find the legal form you will need? Use the US Legal Forms website. The service provides a huge number of layouts, such as the Oregon Plan of Merger between Food Lion, Inc., Hannaford Brothers Company and FL Acquisition Sub, Inc., that can be used for organization and private requirements. All of the types are examined by experts and satisfy state and federal requirements.

If you are already signed up, log in to the profile and click on the Acquire switch to get the Oregon Plan of Merger between Food Lion, Inc., Hannaford Brothers Company and FL Acquisition Sub, Inc.. Use your profile to look from the legal types you possess purchased formerly. Visit the My Forms tab of the profile and obtain one more copy of your papers you will need.

If you are a new consumer of US Legal Forms, listed here are basic directions for you to stick to:

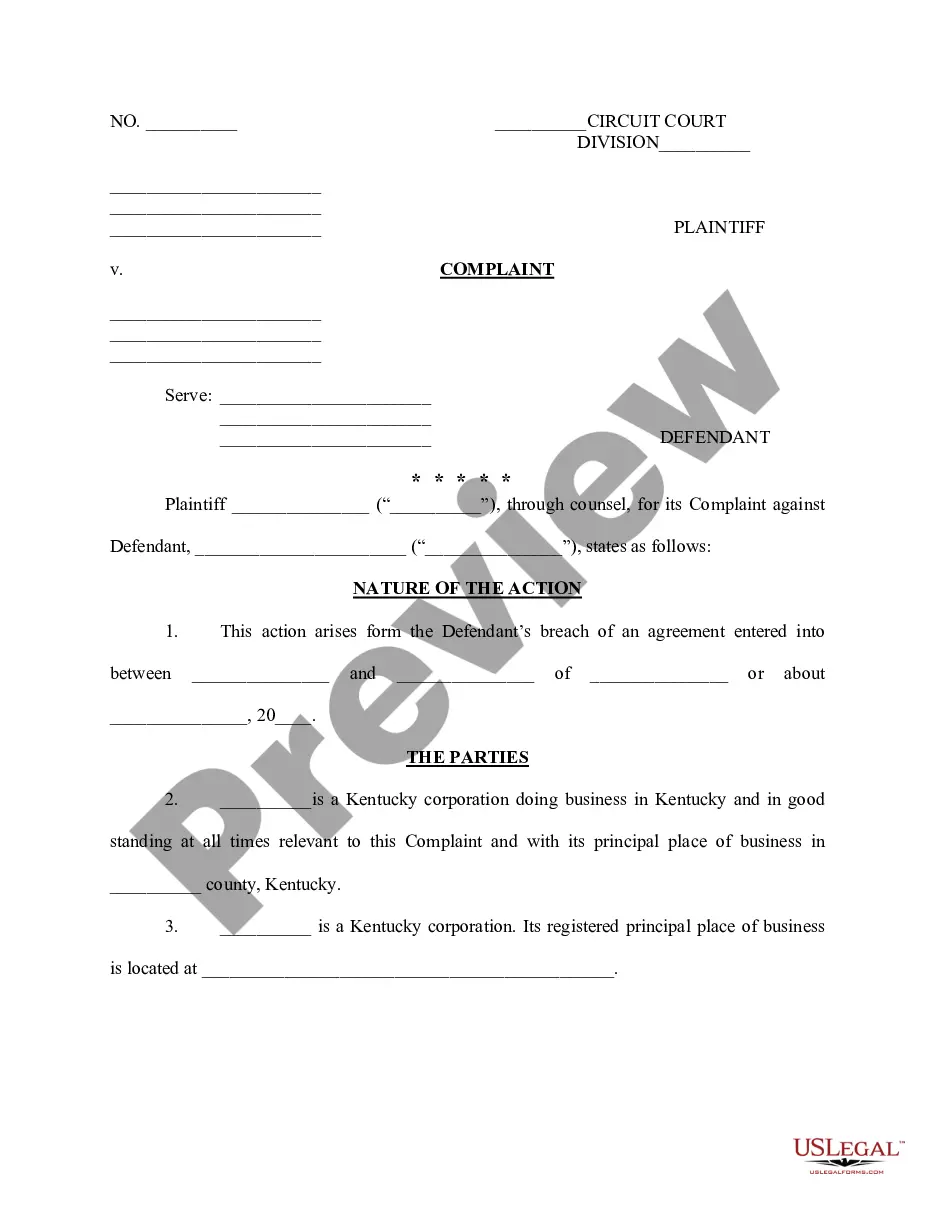

- First, ensure you have chosen the correct form for your area/region. You are able to look through the form using the Preview switch and look at the form information to make sure it will be the right one for you.

- In case the form does not satisfy your needs, make use of the Seach industry to get the appropriate form.

- When you are certain that the form is acceptable, click on the Buy now switch to get the form.

- Pick the prices strategy you would like and enter in the necessary info. Build your profile and pay money for the order using your PayPal profile or bank card.

- Select the document formatting and download the legal papers template to the product.

- Complete, change and print and sign the received Oregon Plan of Merger between Food Lion, Inc., Hannaford Brothers Company and FL Acquisition Sub, Inc..

US Legal Forms will be the most significant local library of legal types that you can see numerous papers layouts. Use the service to download professionally-produced files that stick to status requirements.