Oregon Stock Option Agreement of Ichargeit.Com, Inc.

Description

How to fill out Stock Option Agreement Of Ichargeit.Com, Inc.?

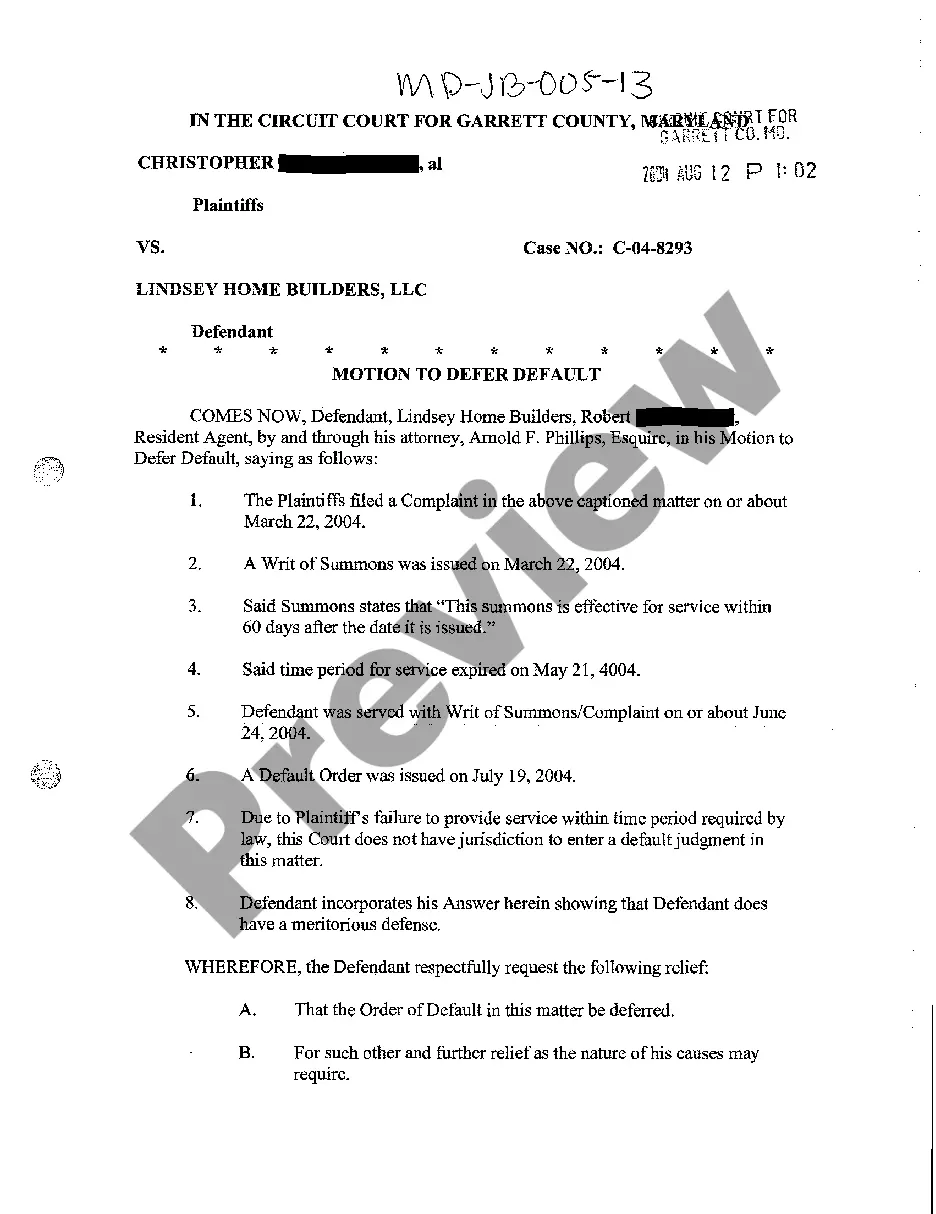

If you need to full, acquire, or printing legal document themes, use US Legal Forms, the most important variety of legal types, which can be found on the Internet. Use the site`s basic and practical lookup to find the files you need. Different themes for enterprise and person functions are categorized by types and claims, or keywords. Use US Legal Forms to find the Oregon Stock Option Agreement of Ichargeit.Com, Inc. in just a number of clicks.

In case you are already a US Legal Forms buyer, log in in your accounts and click on the Obtain option to have the Oregon Stock Option Agreement of Ichargeit.Com, Inc.. Also you can accessibility types you earlier saved inside the My Forms tab of the accounts.

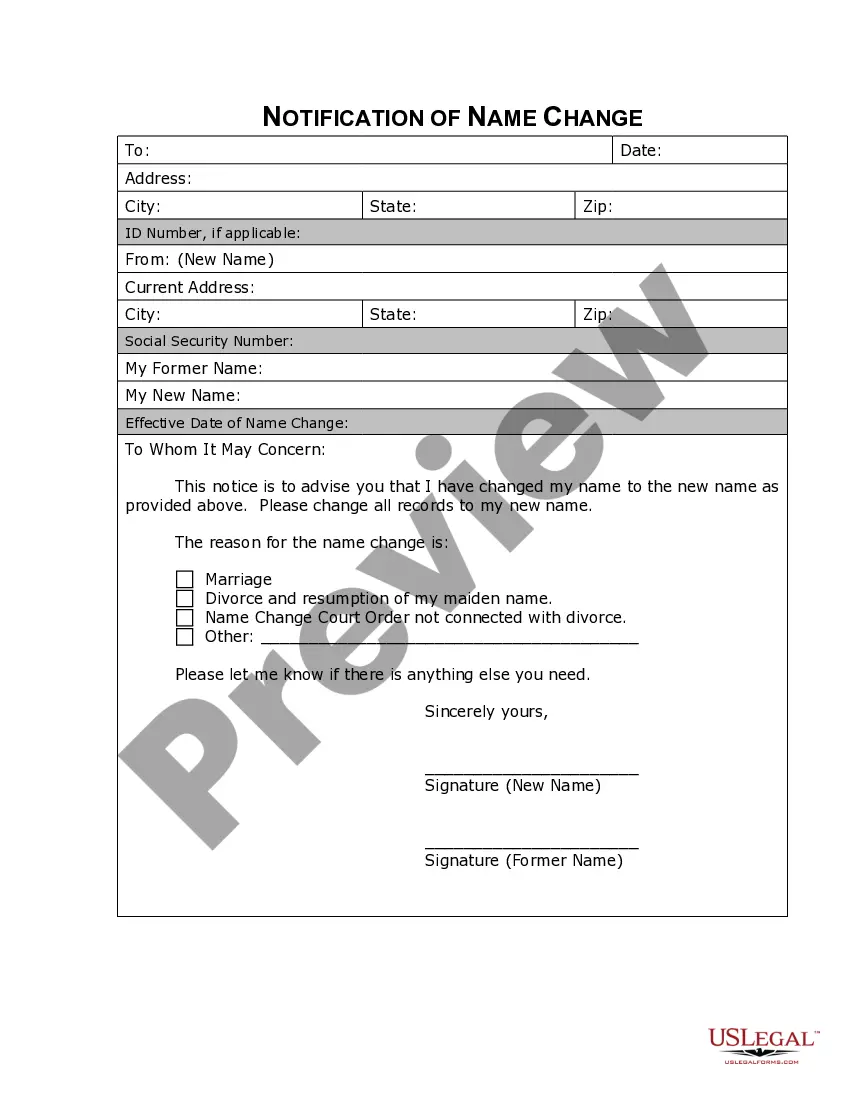

If you work with US Legal Forms for the first time, follow the instructions below:

- Step 1. Make sure you have selected the shape for the appropriate area/country.

- Step 2. Utilize the Preview choice to examine the form`s content material. Do not overlook to learn the information.

- Step 3. In case you are unhappy using the form, take advantage of the Lookup field on top of the monitor to get other versions of your legal form template.

- Step 4. When you have identified the shape you need, click the Buy now option. Choose the costs plan you like and include your credentials to register for the accounts.

- Step 5. Process the financial transaction. You should use your bank card or PayPal accounts to perform the financial transaction.

- Step 6. Select the format of your legal form and acquire it in your product.

- Step 7. Total, revise and printing or sign the Oregon Stock Option Agreement of Ichargeit.Com, Inc..

Each and every legal document template you acquire is the one you have permanently. You might have acces to every single form you saved within your acccount. Select the My Forms portion and select a form to printing or acquire again.

Compete and acquire, and printing the Oregon Stock Option Agreement of Ichargeit.Com, Inc. with US Legal Forms. There are many professional and state-particular types you may use for the enterprise or person needs.

Form popularity

FAQ

A stock option provides an employee with the opportunity to purchase a set number of shares of company stock at a certain price within a certain period of time. The price is called the ?grant price? or ?strike price.? This price is usually based on a discounted price of the stock at the time of hire.

Stock options allow you to save cash instead of spending money on high salaries. It can also motivate employees to stay and make your company a success so that it will eventually be acquired or have an initial public offering, which will provide value to their shares.

What Is an Example of an ESOP? Consider an employee who has worked at a large tech firm for five years. Under the company's ESOP, they have the right to receive 20 shares after the first year, and 100 shares total after five years. When the employee retires, they will receive the share value in cash.

For example, you may be granted the right to buy 1,000 shares, with the options vesting 25% per year over four years with a term of 10 years. So 25% of the ESOs, conferring the right to buy 250 shares would vest in one year from the option grant date, another 25% would vest two years from the grant date, and so on.

Holders of share purchase rights may or may not buy an agreed number of shares of stock at a pre-determined price, but only if they are an existing stockholder. Options, on the other hand, are the right to buy or sell stocks at a pre-set price called the strike price.

Stock options allow employees to buy a piece of your company at a discount in exchange for their dedication and commitment. As a small business, you can consider offering stock options as a great way to compensate employees and help build a hardworking and innovative staff. What are stock options?

A stock option is the right to buy a specific number of shares of company stock at a pre-set price, known as the ?exercise? or ?strike price.? You take actual ownership of granted options over a fixed period of time called the ?vesting period.? When options vest, it means you've ?earned? them, though you still need to ...

Stock options are granted in ance with the terms of a company's stock option plan. A stock option plan sets out the general terms that the company will set for Consultants to potentially receive option agreements, and sets out the company's intention to give Consultants options.