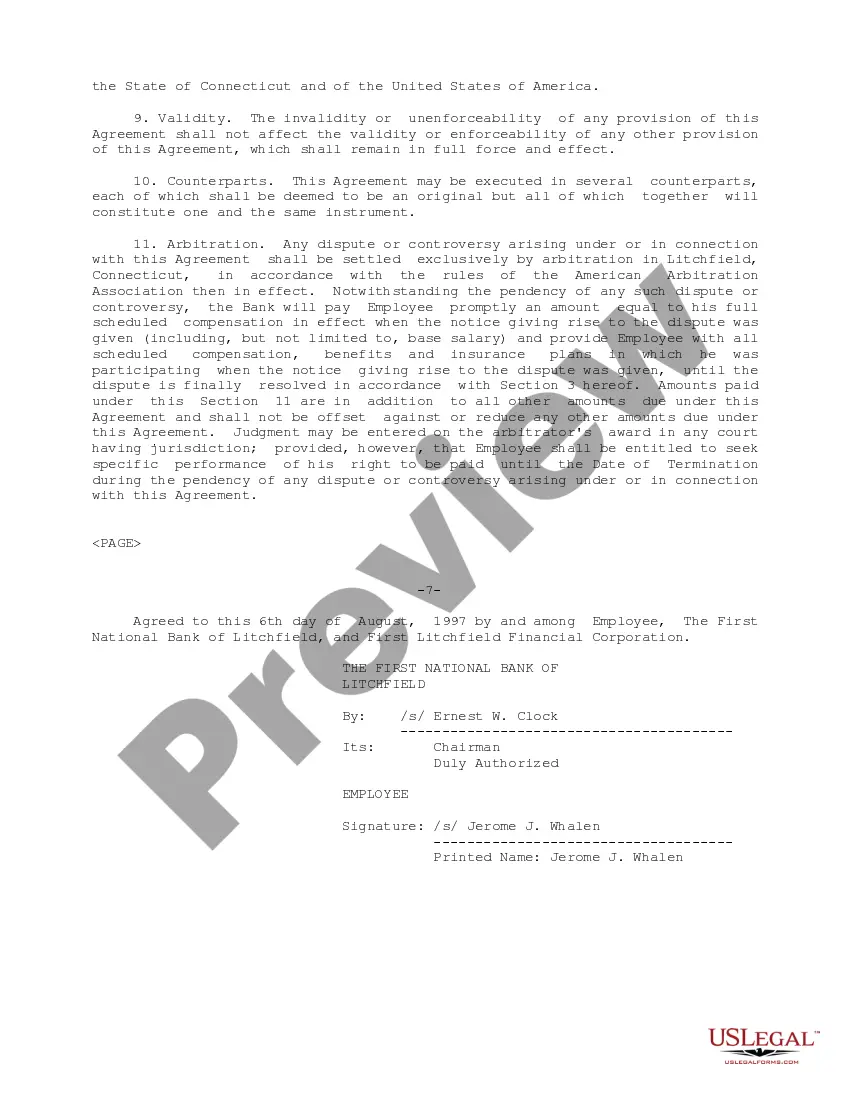

Oregon Executive Change in Control Agreement for The First National Bank of Litchfield

Description

How to fill out Executive Change In Control Agreement For The First National Bank Of Litchfield?

If you wish to total, download, or produce legitimate record layouts, use US Legal Forms, the greatest variety of legitimate forms, which can be found on-line. Utilize the site`s simple and practical search to obtain the documents you need. Numerous layouts for enterprise and personal uses are sorted by types and suggests, or keywords. Use US Legal Forms to obtain the Oregon Executive Change in Control Agreement for The First National Bank of Litchfield within a number of mouse clicks.

When you are already a US Legal Forms client, log in in your accounts and click the Obtain button to get the Oregon Executive Change in Control Agreement for The First National Bank of Litchfield. Also you can access forms you in the past delivered electronically from the My Forms tab of your own accounts.

If you use US Legal Forms the first time, refer to the instructions under:

- Step 1. Make sure you have chosen the form for the right city/country.

- Step 2. Make use of the Review method to examine the form`s content material. Don`t overlook to read through the explanation.

- Step 3. When you are unhappy with the type, use the Lookup industry on top of the display to discover other models in the legitimate type design.

- Step 4. Once you have located the form you need, click on the Purchase now button. Select the prices strategy you favor and add your credentials to sign up for an accounts.

- Step 5. Procedure the purchase. You may use your charge card or PayPal accounts to complete the purchase.

- Step 6. Pick the file format in the legitimate type and download it on your gadget.

- Step 7. Total, edit and produce or indicator the Oregon Executive Change in Control Agreement for The First National Bank of Litchfield.

Every legitimate record design you buy is your own property for a long time. You might have acces to each type you delivered electronically in your acccount. Select the My Forms portion and decide on a type to produce or download once again.

Remain competitive and download, and produce the Oregon Executive Change in Control Agreement for The First National Bank of Litchfield with US Legal Forms. There are thousands of expert and express-specific forms you can utilize for the enterprise or personal demands.