Oregon Term Sheet - Convertible Debt Financing

Description

How to fill out Term Sheet - Convertible Debt Financing?

US Legal Forms - among the largest libraries of legitimate kinds in the USA - offers a wide array of legitimate papers layouts it is possible to acquire or print out. While using website, you may get 1000s of kinds for organization and personal purposes, categorized by classes, claims, or keywords and phrases.You will discover the most recent types of kinds just like the Oregon Term Sheet - Convertible Debt Financing in seconds.

If you currently have a registration, log in and acquire Oregon Term Sheet - Convertible Debt Financing in the US Legal Forms local library. The Obtain switch will show up on each and every kind you see. You gain access to all formerly delivered electronically kinds in the My Forms tab of your bank account.

If you want to use US Legal Forms the first time, listed here are straightforward instructions to obtain started out:

- Make sure you have picked the correct kind for your town/region. Click the Review switch to check the form`s information. Browse the kind explanation to actually have chosen the right kind.

- If the kind doesn`t fit your needs, use the Research industry at the top of the monitor to get the one who does.

- Should you be content with the form, confirm your selection by clicking the Purchase now switch. Then, pick the prices program you prefer and give your credentials to sign up to have an bank account.

- Method the transaction. Make use of your bank card or PayPal bank account to perform the transaction.

- Find the formatting and acquire the form on your own product.

- Make modifications. Complete, revise and print out and signal the delivered electronically Oregon Term Sheet - Convertible Debt Financing.

Every template you included with your money does not have an expiration date and is the one you have forever. So, if you wish to acquire or print out yet another duplicate, just go to the My Forms portion and then click in the kind you require.

Obtain access to the Oregon Term Sheet - Convertible Debt Financing with US Legal Forms, the most considerable local library of legitimate papers layouts. Use 1000s of skilled and condition-certain layouts that meet your organization or personal requires and needs.

Form popularity

FAQ

Share. Convertible debt definition. With convertible debt, a business borrows money from a lender or investor where both parties enter the agreement with the intent (from the outset) to repay all (or part) of the loan by converting it into a certain number of its preferred or common shares at some point in the future.

A convertible note is a short-term debt agreement that converts into equity at a future date. Usually, this happens when one of these events takes place: The company raises enough capital to reach a pre-determined benchmark. The term of the loan expires.

A convertible note should be classified as a Long Term Liability that then converts to Equity as stipulated from the contract (usually a new fundraising round).

Typical terms of convertible notes are: interest rate, maturity date, conversion provisions, a conversion discount, and a valuation cap.

Usually 12?24 months. A mandatory conversion paragraph. Specifies the minimum size of the round that the company must close in the future (a qualified financing) to cause the debt to automatically convert into equity of the company. An optional conversion paragraph.

A term sheet is usually a non-binding agreement outlining the basic terms and conditions of the investment. It serves as a template for the convertible note for both parties.

A convertible note is a short-term debt that converts into equity. Any business can sell convertible notes, but it's common for a startup to do so before receiving its first valuation and Series A funding.

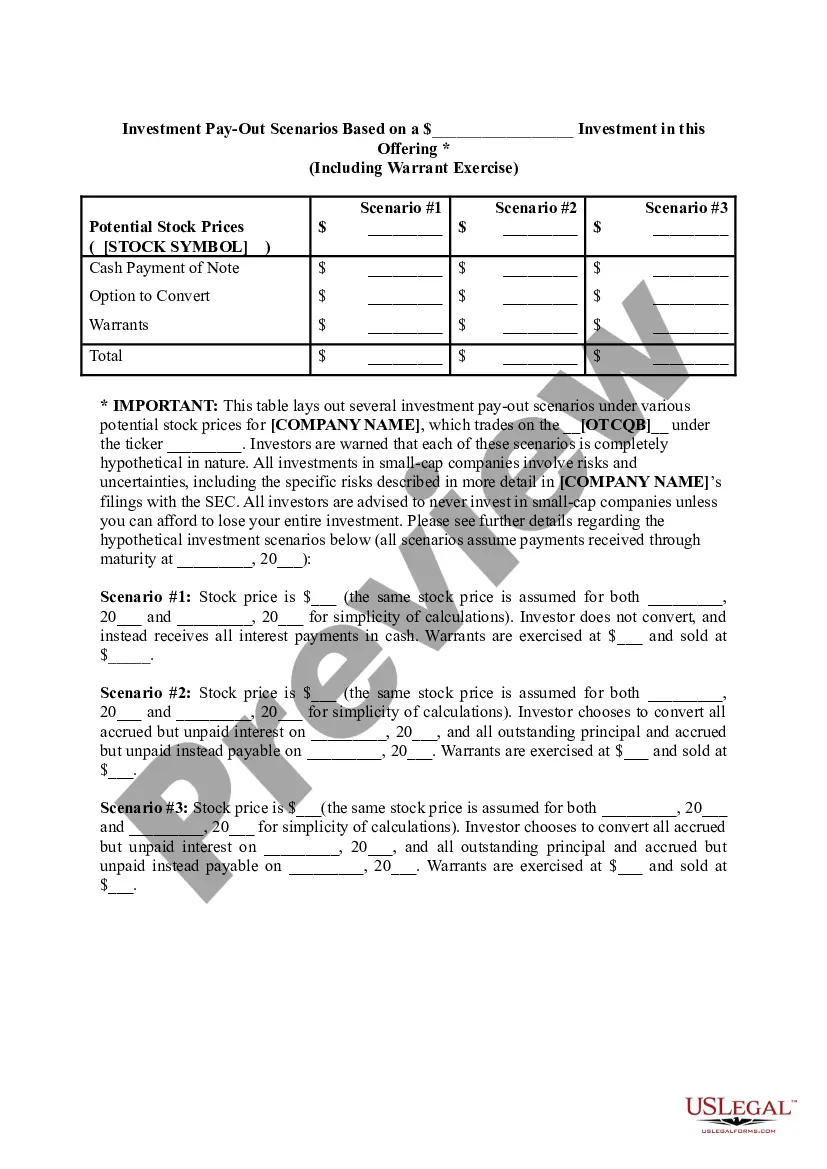

Terms of Convertible Debt The interest rate. Usually somewhere between 4% and 8%. The maturity date. Usually 12?24 months. A mandatory conversion paragraph. ... An optional conversion paragraph. ... A change of control provision. ... A conversion discount. ... A valuation cap. ... An amendment provision.

A term sheet is a written document the parties exchange containing the important terms and conditions of the deal. The document summarizes the main points of the deal agreements and sorts out the differences before actually executing the legal agreements and starting off with the time-consuming due diligence.

Typical terms of convertible notes are: interest rate, maturity date, conversion provisions, a conversion discount, and a valuation cap.