Title: Understanding Oregon Notice Regarding Introduction of Restricted Share-Based Remuneration Plan Introduction: In the state of Oregon, employers are required to comply with certain regulations concerning the introduction of a Restricted Share-Based Remuneration Plan. This detailed description will provide you with a comprehensive understanding of such plans and their variations in Oregon, including relevant keywords to enhance your knowledge on the subject. Keywords: Oregon, Notice, Introduction, Restricted Share-Based Remuneration Plan, regulations, compliance, variations I. Definition of a Restricted Share-Based Remuneration Plan: A Restricted Share-Based Remuneration Plan is a compensation scheme offered by employers that provides a form of incentive or reward to employees through the issuance of company stock or shares. These plans typically have specific restrictions on when, how, and under what conditions employees can access or sell their shares. II. Purpose of the Oregon Notice: The Oregon Notice Regarding Introduction of Restricted Share-Based Remuneration Plan aims to ensure employers comply with specific state regulations regarding the implementation and communication of such plans to employees. This notice serves to inform employees about the terms, conditions, and potential restrictions associated with participating in a share-based remuneration plan. III. Compliance with Oregon Regulations: Employers in Oregon must adhere to specific regulations when introducing a Restricted Share-Based Remuneration Plan. These regulations primarily focus on providing transparency, protecting employee rights, and ensuring fair treatment in relation to stock-based compensation. Employers are required to issue a notice informing employees of the plan's introduction and its associated terms, conditions, restrictions, and key details. IV. Different Types of Oregon Notice Regarding Restricted Share-Based Remuneration Plan: 1. Basic Notice: This variation of the Oregon Notice outlines the fundamental elements of the Restricted Share-Based Remuneration Plan, including eligibility requirements, vesting periods, potential tax implications, transfer restrictions, and the overall purpose and benefits of participating in the plan. 2. Advanced Notice: This type of Oregon Notice provides a more comprehensive and detailed explanation of the Restricted Share-Based Remuneration Plan. It includes additional information such as specific rights and privileges granted to plan participants, potential voting rights, dividend distributions, performance-based conditions, and any unique terms or provisions that apply. V. Key Considerations for Employers: Employers introducing a Restricted Share-Based Remuneration Plan in Oregon should consider the following: — Ensuring compliance with all relevant state regulations and deadlines for issuing the notice. — Clearly outlining eligibility criteria, including the classes of participants that may be eligible. — Specifying the vesting schedule and any applicable restrictions on transferring or selling the shares. — Thoroughly explaining any performance-based conditions associated with the plan. — Addressing potential tax implications and whether participants should consult with a tax specialist. — Detailing the steps to be taken by employees upon termination or leaving the company, including forfeiture or retention of stock-based compensation. Conclusion: Understanding the Oregon Notice Regarding Introduction of Restricted Share-Based Remuneration Plan is crucial for both employers and employees in Oregon. By effectively communicating and complying with the regulations, employers can ensure transparency, fair treatment, and the overall success of these compensation schemes.

Oregon Notice Regarding Introduction of Restricted Share-Based Remuneration Plan

Description

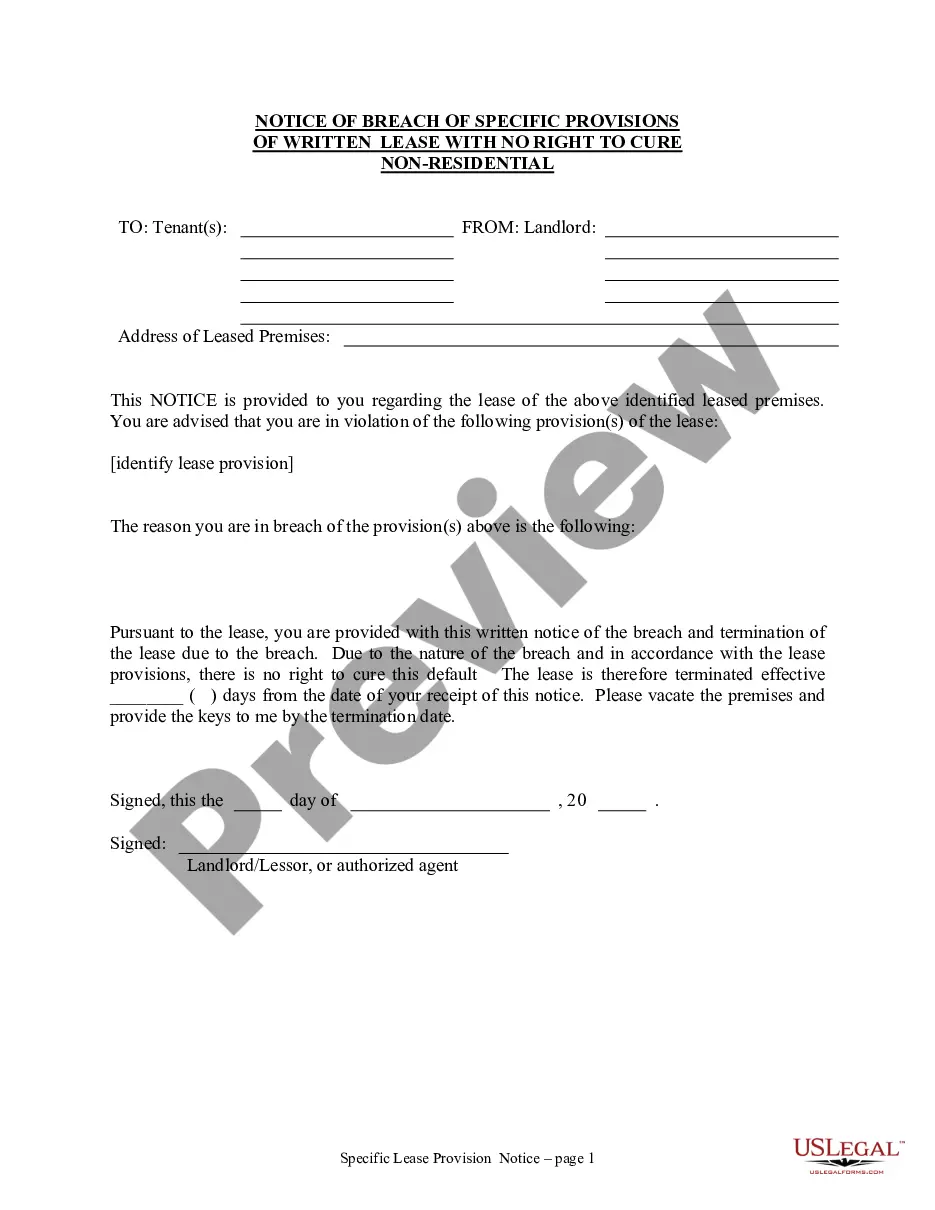

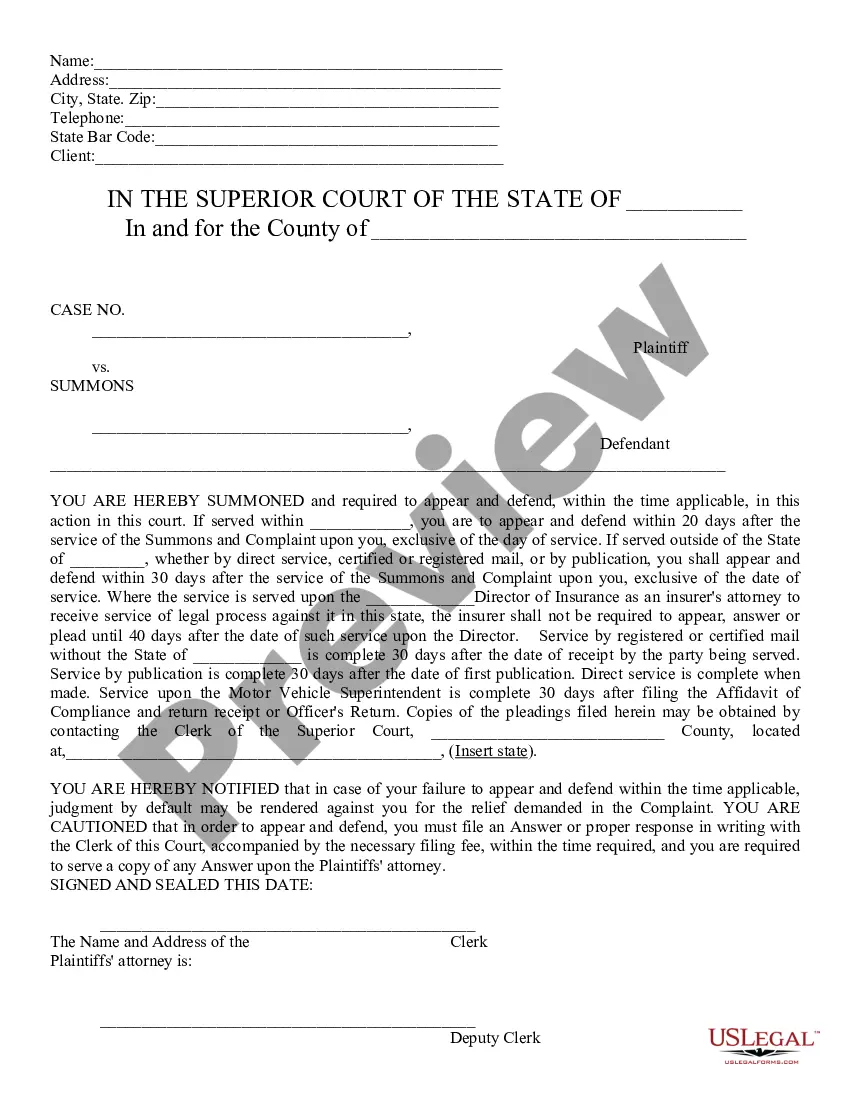

How to fill out Oregon Notice Regarding Introduction Of Restricted Share-Based Remuneration Plan?

US Legal Forms - one of the most significant libraries of authorized varieties in the United States - delivers an array of authorized document templates you can obtain or printing. While using internet site, you may get a huge number of varieties for organization and personal purposes, categorized by types, claims, or keywords.You will find the most recent models of varieties just like the Oregon Notice Regarding Introduction of Restricted Share-Based Remuneration Plan within minutes.

If you already possess a subscription, log in and obtain Oregon Notice Regarding Introduction of Restricted Share-Based Remuneration Plan through the US Legal Forms local library. The Obtain switch can look on each develop you see. You have accessibility to all earlier downloaded varieties in the My Forms tab of your respective account.

If you would like use US Legal Forms initially, allow me to share simple instructions to help you started off:

- Be sure to have picked the proper develop for your personal town/area. Select the Preview switch to examine the form`s information. Read the develop information to actually have selected the correct develop.

- When the develop does not satisfy your requirements, make use of the Research industry near the top of the display to discover the the one that does.

- When you are happy with the form, confirm your option by clicking the Buy now switch. Then, pick the costs plan you favor and provide your references to sign up for an account.

- Process the deal. Make use of your Visa or Mastercard or PayPal account to perform the deal.

- Pick the structure and obtain the form on your device.

- Make modifications. Fill out, modify and printing and signal the downloaded Oregon Notice Regarding Introduction of Restricted Share-Based Remuneration Plan.

Every web template you put into your account does not have an expiry time which is your own property eternally. So, if you wish to obtain or printing an additional version, just proceed to the My Forms portion and click on the develop you want.

Get access to the Oregon Notice Regarding Introduction of Restricted Share-Based Remuneration Plan with US Legal Forms, by far the most comprehensive local library of authorized document templates. Use a huge number of specialist and express-certain templates that meet your organization or personal demands and requirements.