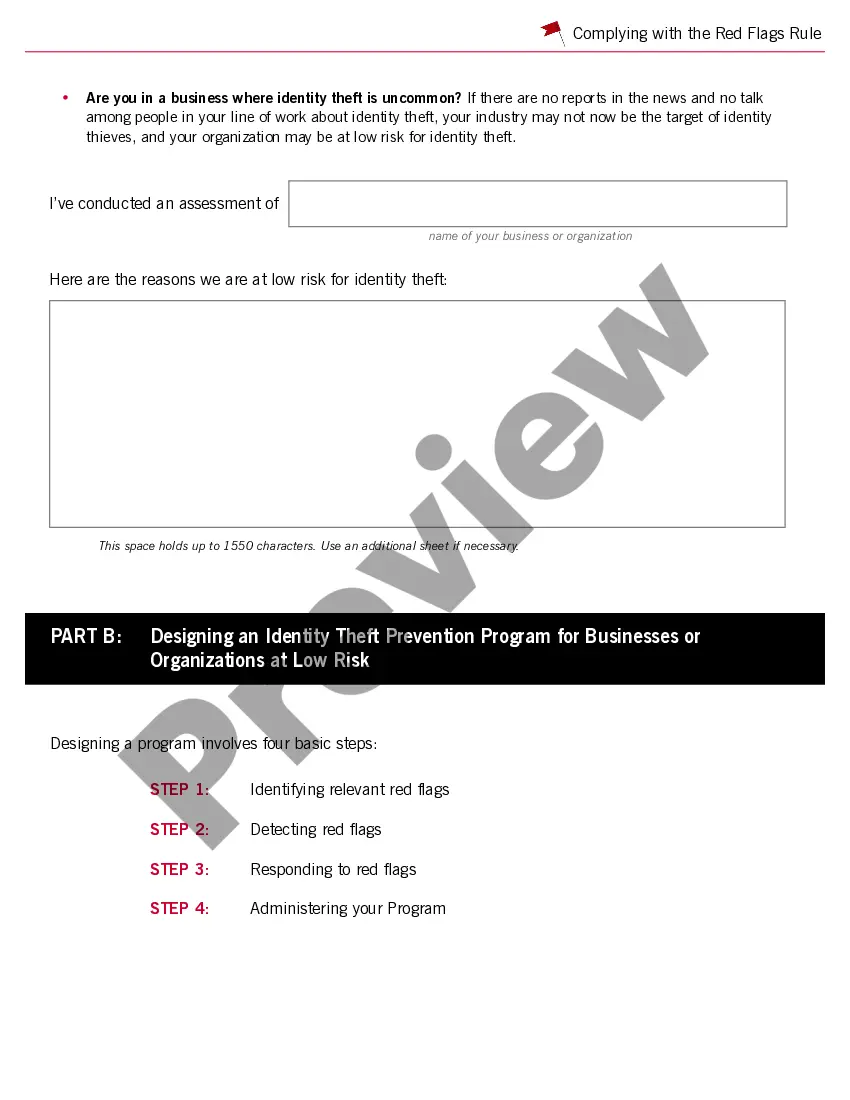

This guide has two parts: Part A to help you determine whether your business or organization is at low risk, and Part B to help you design your written Identity Theft Prevention Program if your business is in the low risk category.

Note: The preview only shows the 1st page of the document.

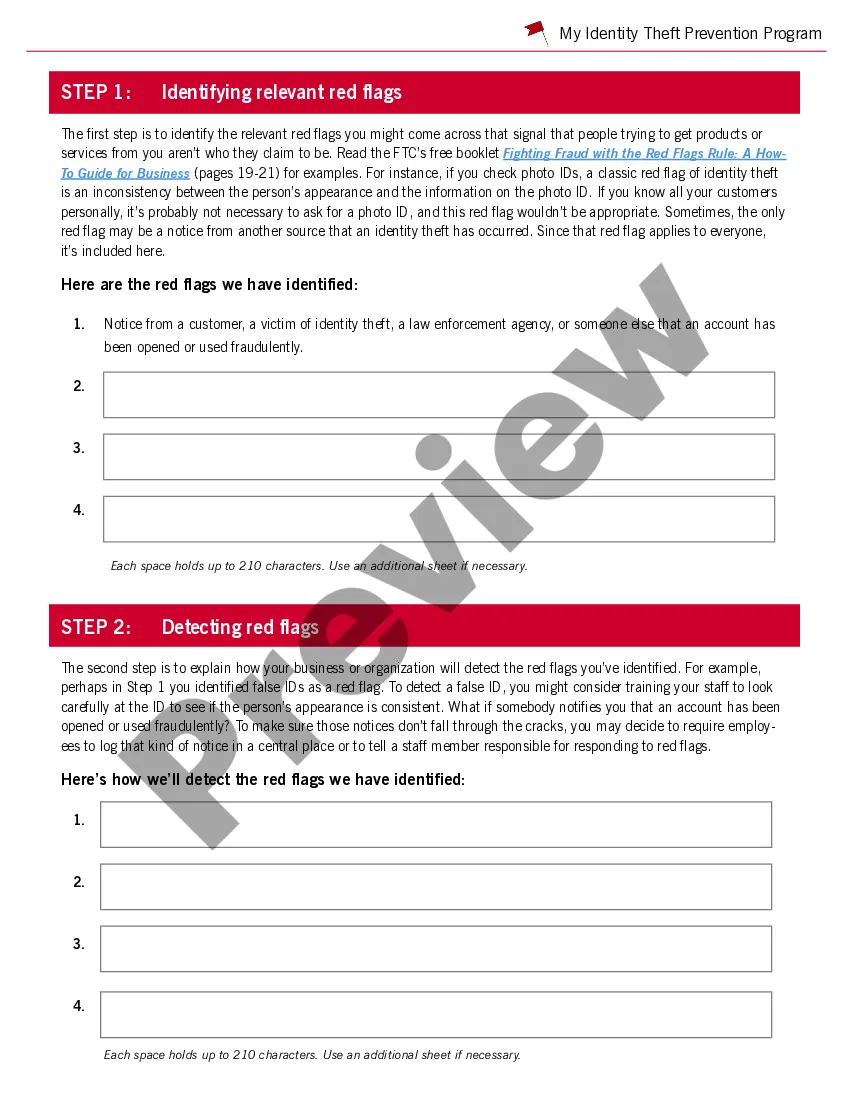

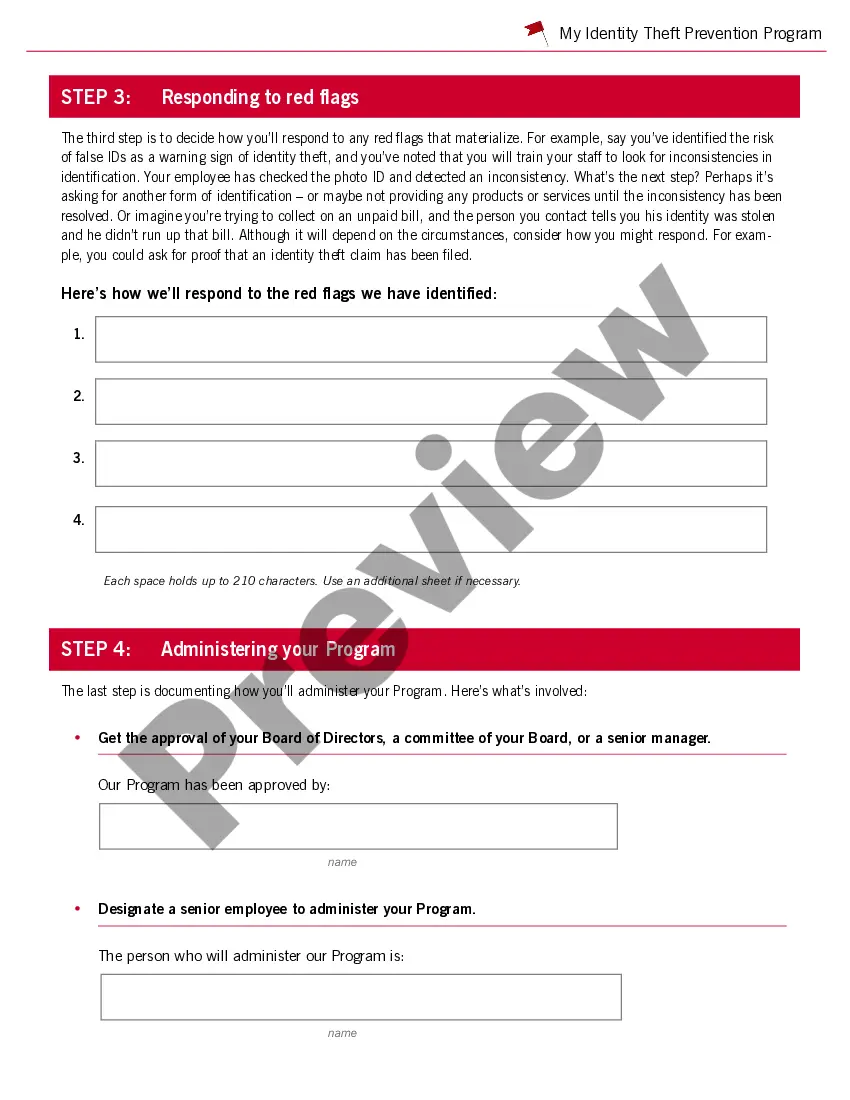

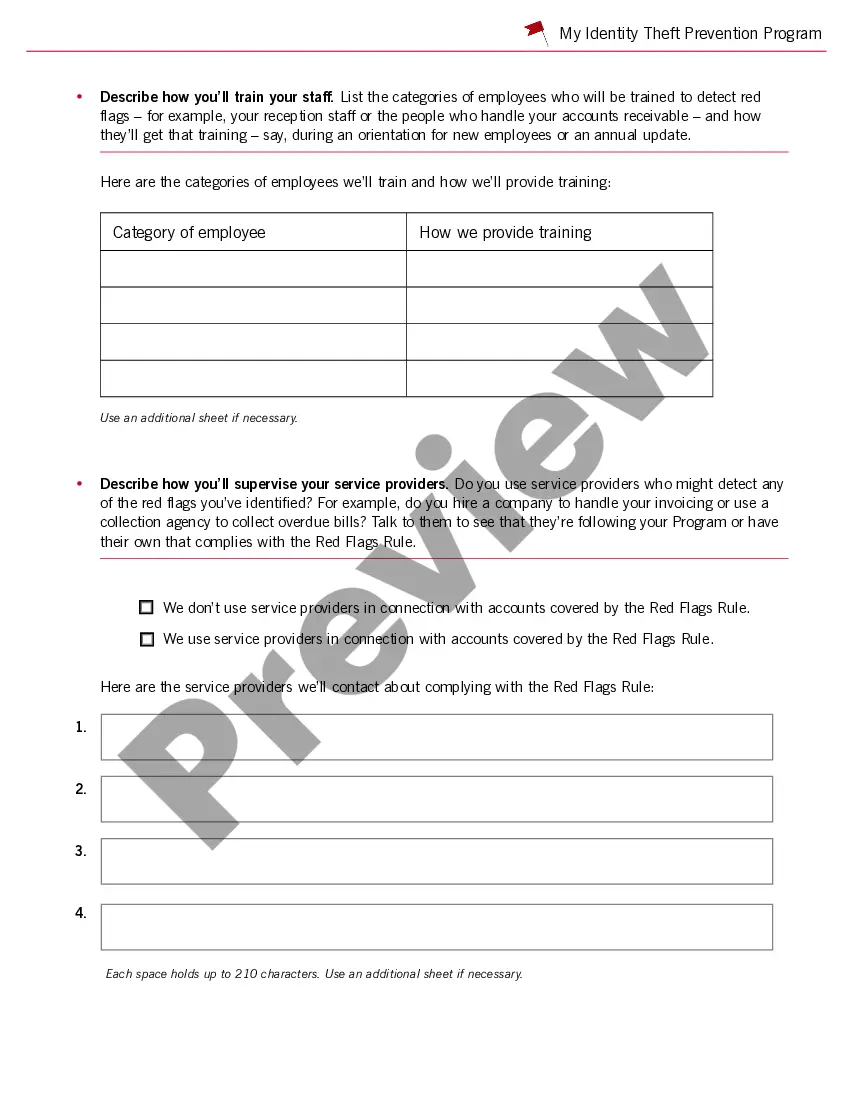

Title: Navigating Oregon's Guide to Complying with the Red Flags Rule under FCRA and FACT Introduction: The Red Flags Rule, implemented under the Fair Credit Reporting Act (FCRA) and the Fair and Accurate Credit Transactions Act (FACT), serves as a crucial tool for safeguarding consumers against identity theft and fraud. This comprehensive guide aims to provide a detailed description of Oregon's approach to complying with the Red Flags Rule. By exploring key concepts, legal requirements, and types of compliance, businesses and organizations can effectively prevent fraudulent activities and protect their customers' sensitive information. I. Understanding the Red Flags Rule: The Red Flags Rule requires certain entities, particularly those in the financial and credit sectors, to develop and implement an Identity Theft Prevention Program (IPP). This segment explains the fundamental aspects of the rule, including its purpose, scope, and applicability to different types of businesses. II. The Role of Oregon in Red Flags Compliance: To ensure consistent and effective enforcement of the Red Flags Rule, Oregon has created a specific guideline addressing compliance. This section explores Oregon's distinctive approach to complying with the rule, highlighting its particular nuances and requirements. III. Key Components of Oregon's Red Flags Compliance: Oregon's guide to complying with the Red Flags Rule comprises several essential components. By examining each component in detail, businesses can gain a comprehensive understanding of their obligations and implement appropriate measures. These components may include: 1. Identifying Red Flags: Enumerating the potential warning signs or indicators of identity theft and fraudulent activities specific to Oregon businesses. 2. Developing an Identity Theft Prevention Program (IPP): Outlining the necessary steps and guidelines for creating a comprehensive IPP, tailored to the unique needs of Oregon businesses. 3. Establishing Procedures for Detecting Red Flags: Outlining the processes and procedures for identifying and responding to red flags promptly. 4. Responding to Red Flags: Describing the appropriate actions to take when detecting red flags, including notification, assessment, and mitigation strategies. 5. Staff Training and Compliance Oversight: Detailing the importance of robust staff training programs and establishing internal oversight mechanisms to ensure ongoing compliance. IV. Different Types of Oregon Guides: To cater to the diverse range of industries and entities covered under the Red Flags Rule, Oregon's guide may offer specific adaptations or separate sections for various sectors. These can include: 1. Financial Institutions: A dedicated section addressing red flag compliance for banks, credit unions, and other financial institutions operating in Oregon. 2. Healthcare Organizations: Sector-specific guidelines covering healthcare providers, insurance companies, and medical facilities, detailing how the Red Flags Rule intersects with patient privacy regulations (such as HIPAA). 3. Government Agencies: Unique compliance requirements and considerations for government bodies, agencies, and departments within Oregon. Conclusion: Understanding and complying with Oregon's guide to the Red Flags Rule under FCRA and FACT is crucial for businesses aiming to protect their customers' sensitive information from identity theft and fraud. Adhering to the outlined guidelines, businesses can develop robust identity theft prevention programs and establish effective practices to promptly detect and mitigate potential red flags. By staying vigilant and informed, organizations can safeguard their reputation, finances, and most importantly, their customers' trust.