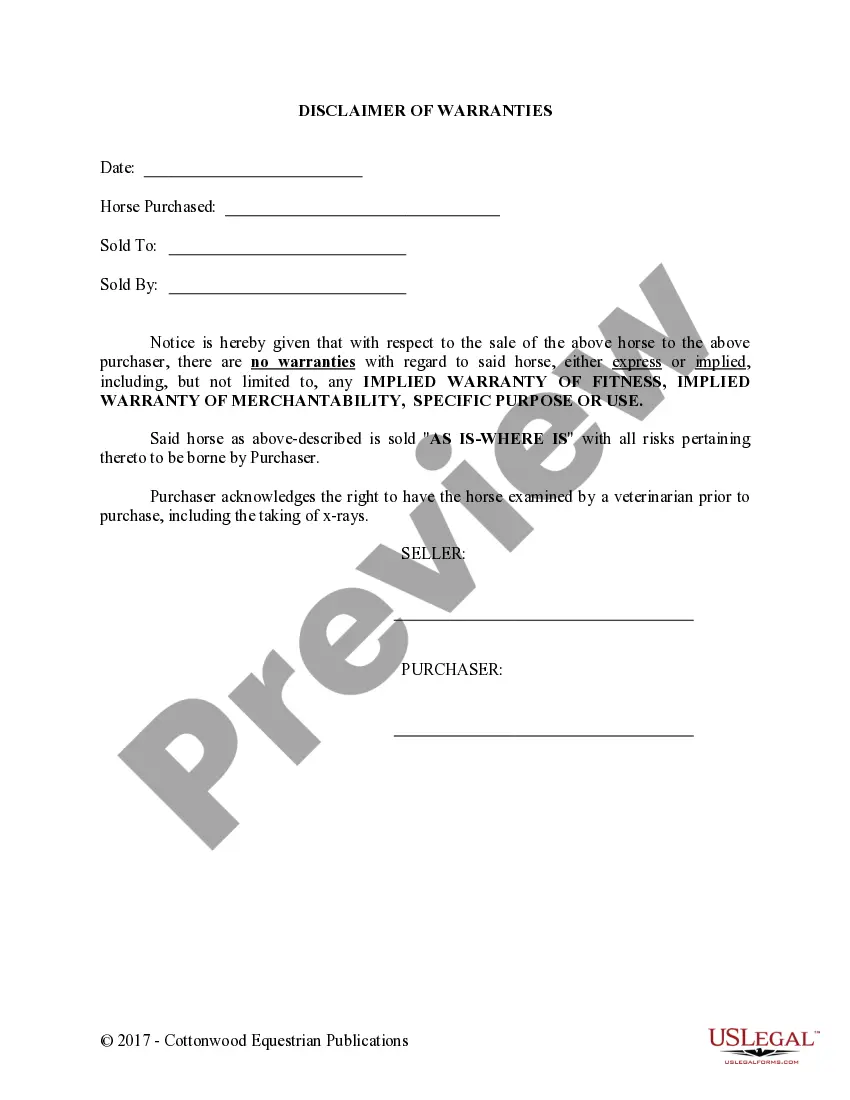

The Oregon Accounting Agreement — Self-Employed Independent Contractor is a legally binding document that governs the financial arrangement between an individual or business acting as an independent contractor and their client in the state of Oregon. This agreement outlines the terms and conditions under which the independent contractor will provide accounting services to their client. It ensures clarity and understanding regarding the scope of work, payment terms, deliverables, confidentiality, and other essential aspects of the working relationship. Keywords: 1. Oregon: Refers to the state in which the agreement is applicable. 2. Accounting Agreement: Denotes the contract that establishes the terms between the independent contractor and their client for accounting services. 3. Self-Employed: Indicates that the contractor is working for themselves and not as an employee of the client. 4. Independent Contractor: Describes the provider of accounting services who operates as an independent entity, responsible for their own taxes, insurance, and business expenses. Different types of Oregon Accounting Agreement — Self-Employed Independent Contractor may include: 1. Basic Accounting Agreement: Covers general accounting services such as bookkeeping, financial statement preparation, and tax advisory. 2. Tax Preparation Agreement: Specifically focuses on tax-related services like tax return preparation, tax planning, and IRS representation. 3. Financial Consulting Agreement: Encompasses broader financial consulting services, including budgeting, forecasting, cash flow management, and strategic financial advice. 4. Forensic Accounting Agreement: Pertains to investigative or litigation-related accounting services, such as fraud examination, expert witness testimony, and damage calculations. 5. Payroll Services Agreement: Concentrates on payroll processing, compliance, and reporting responsibilities. Each type of agreement may have unique clauses and provisions tailored to the specific services provided by the independent contractor, ensuring that the agreement aligns with the particular accounting needs of the client.

Oregon Accounting Agreement - Self-Employed Independent Contractor

Description

How to fill out Oregon Accounting Agreement - Self-Employed Independent Contractor?

Have you been within a placement that you need to have files for either business or specific functions just about every day time? There are a lot of authorized record web templates available on the net, but getting types you can depend on isn`t effortless. US Legal Forms gives a huge number of kind web templates, much like the Oregon Accounting Agreement - Self-Employed Independent Contractor, which can be written to satisfy federal and state demands.

Should you be already informed about US Legal Forms website and get a merchant account, basically log in. Following that, it is possible to download the Oregon Accounting Agreement - Self-Employed Independent Contractor template.

Unless you offer an account and would like to start using US Legal Forms, abide by these steps:

- Get the kind you will need and ensure it is for that appropriate city/area.

- Take advantage of the Preview key to analyze the shape.

- Look at the outline to ensure that you have chosen the appropriate kind.

- When the kind isn`t what you are searching for, use the Lookup area to discover the kind that suits you and demands.

- If you obtain the appropriate kind, click Get now.

- Choose the rates program you desire, complete the required information and facts to create your money, and purchase the transaction making use of your PayPal or charge card.

- Decide on a convenient document file format and download your version.

Find each of the record web templates you may have bought in the My Forms menus. You can obtain a extra version of Oregon Accounting Agreement - Self-Employed Independent Contractor whenever, if required. Just go through the needed kind to download or produce the record template.

Use US Legal Forms, probably the most comprehensive collection of authorized forms, to save time as well as avoid errors. The service gives professionally made authorized record web templates that you can use for a selection of functions. Make a merchant account on US Legal Forms and commence making your life easier.

Form popularity

FAQ

What is an independent contractor? Under Oregon law, an independent contractor must be: free from direction and control over the means and manner of providing the services, subject only to the right to specify the desired results; is customarily engaged in an independently established business; and.

Who Needs a Contractors License? The Oregon Construction Contractors Board states specifically that anyone who works for compensation in any construction activity involving improvements to real property needs a license. Common construction roles include: Roofing.

The IRS says that someone is self-employed if they meet one of these conditions:Someone who carries on a trade or business as a sole proprietor or independent contractor,A member of a partnership that carries on a trade or business, or.Someone who is otherwise in business for themselves, including part-time business.

Becoming an independent contractor is one of the many ways to be classified as self-employed. By definition, an independent contractor provides work or services on a contractual basis, whereas, self-employment is simply the act of earning money without operating within an employee-employer relationship.

The law does not require you to complete a contract with your self-employed or freelance workers - a verbal contract can exist even when there is nothing in writing.

Becoming an independent contractor is one of the many ways to be classified as self-employed. By definition, an independent contractor provides work or services on a contractual basis, whereas, self-employment is simply the act of earning money without operating within an employee-employer relationship.

No, Oregon does not issue an independent contractor license. Although various trades and professional occupations may have licensure requirements, merely holding such a license does not make anyone into an independent contractor.

How do I create an Independent Contractor Agreement?State the location.Describe the type of service required.Provide the contractor's and client's details.Outline compensation details.State the agreement's terms.Include any additional clauses.State the signing details.

The threshold for performing certain work without a contractor license increased from $500 to $1,000. To qualify for the exemption, a contractor must perform work that is casual, minor or inconsequential. This means that the work cannot: Be structural in nature.

Every independent contractor is a business owner. You run a business even if you are your only employee and you don't have a company name. There are significant differences, however, between a business that's just you as an independent contractor and running a company with employees and a registered name.