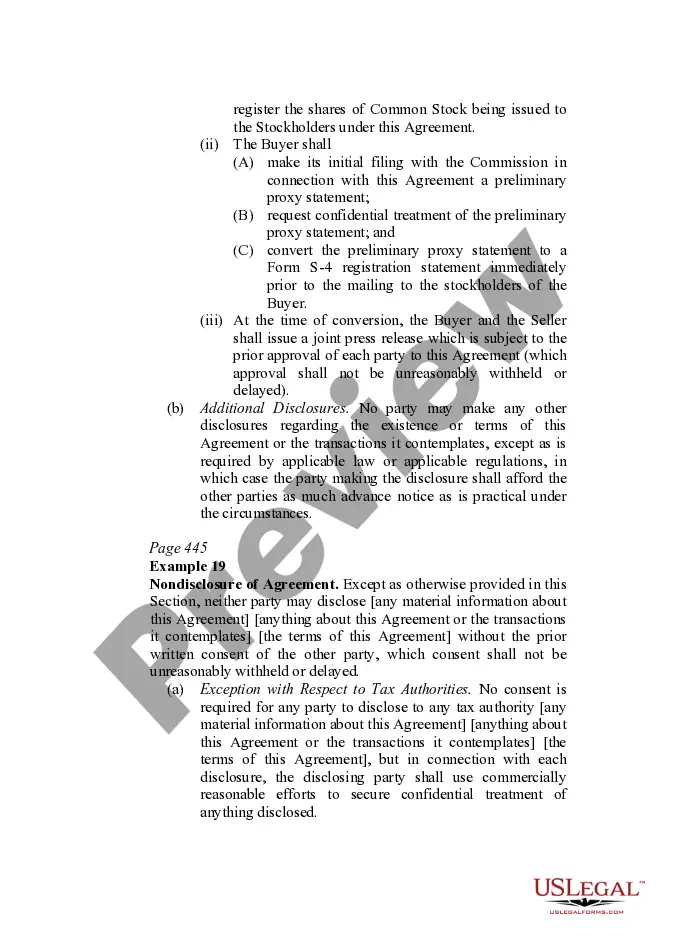

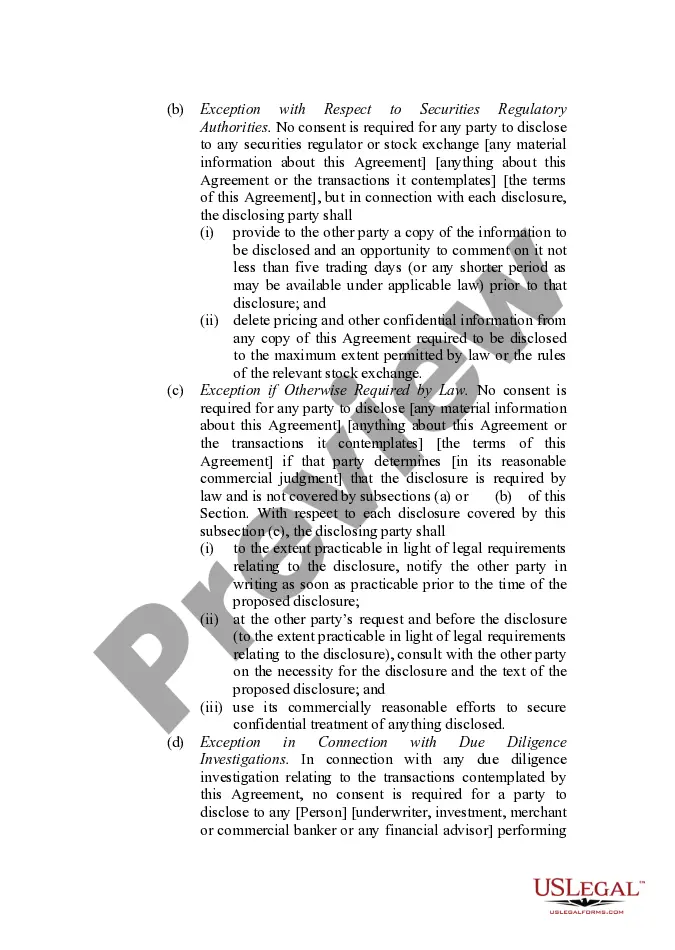

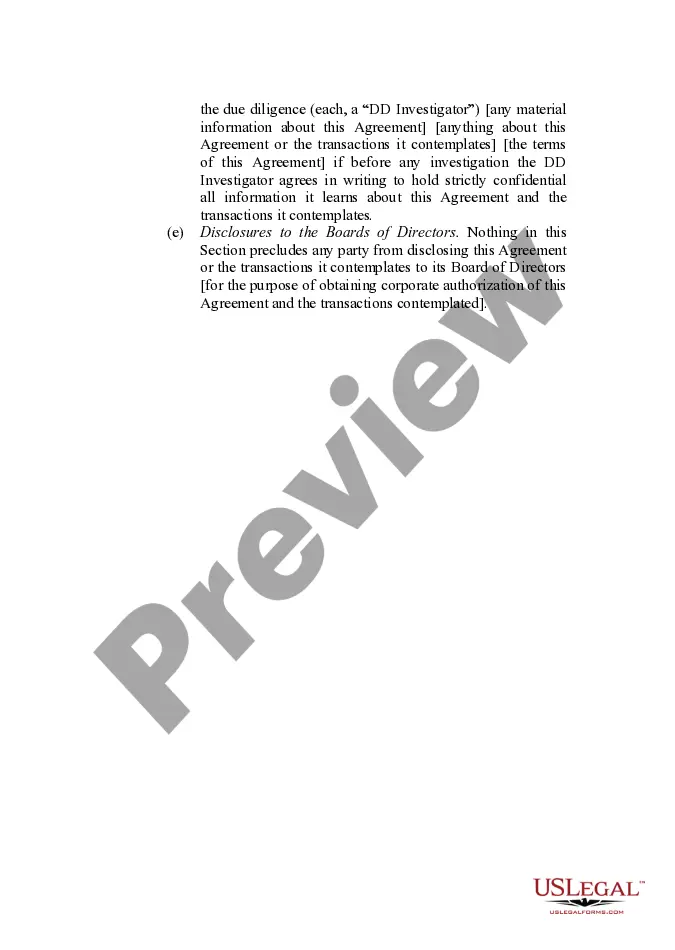

This form provides boilerplate contract clauses that outline the obligations of nondisclosure and the restrictions that apply to public announcements regarding the existence or terms of the contract agreement. Several different language options representing various levels of restriction are included to suit individual needs and circumstances.

Oregon Announcement Provisions in the Transactional Context: A Comprehensive Overview In the realm of corporate transactions, Oregon Announcement Provisions are an important legal mechanism designed to regulate and guide the disclosure of material information during the course of mergers, acquisitions, and other significant business transactions. These provisions play a critical role in maintaining transparency, protecting stakeholders, and ensuring fair and efficient markets. This article aims to provide a detailed description of Oregon Announcement Provisions in the transactional context, shedding light on their purpose, types, and key considerations. Oregon Announcement Provisions — Purpose and Key Function: Oregon Announcement Provisions are typically included in transactional agreements to govern the public announcement and dissemination of material information related to the contemplated transaction. The ultimate goal is to ensure that all stakeholders receive accurate information simultaneously, preventing any unfair advantage or market manipulation. Types of Oregon Announcement Provisions: 1. Standstill Provisions: These provisions restrict the parties involved in a transaction from disclosing or discussing certain sensitive information prior to the public announcement. Standstill provisions generally aim to preserve the confidentiality of non-public information and prevent premature market speculation. 2. Confidentiality Provisions: As the name suggests, confidentiality provisions govern the treatment of sensitive information shared between parties during the transactional process. These provisions often outline the responsibilities of the parties in safeguarding confidential information and limiting its disclosure to only those directly involved in the transaction. 3. Timetable Provisions: Timetable provisions regulate the timing and sequence of announcement and disclosure events. They ensure that all relevant parties, including employees, shareholders, and regulators, are informed at the appropriate stages, preventing any selective or improper release of information. 4. Materiality Threshold Provisions: Materiality threshold provisions define the criteria that determine whether information is considered material, and hence, subject to disclosure. These provisions are crucial in assisting parties to identify and disclose information that is necessary for making informed decisions. Considerations for Oregon Announcement Provisions: 1. Legal Compliance: It is vital to ensure that Oregon Announcement Provisions adhere to applicable securities laws, including the regulations set forth by the Securities and Exchange Commission (SEC), the Oregon Securities Division, and other relevant regulatory bodies. 2. Negotiation and Drafting: When incorporating Oregon Announcement Provisions into transactional agreements, parties should engage in a comprehensive negotiation process to strike a balance between transparency and confidentiality. Skilled legal counsel can assist in drafting precise provisions that meet the specific needs and goals of all parties involved. 3. Enforcement and Remedies: Transactional agreements typically include provisions outlining the consequences of breaching Oregon Announcement Provisions. Remedies may include monetary damages, injunctive relief, termination of the transaction, or other appropriate legal remedies. In conclusion, Oregon Announcement Provisions are vital tools in regulating the disclosure of material information and promoting transparency in corporate transactions. By understanding the different types of provisions and considering key factors during negotiation and drafting, parties can ensure compliance with regulations, protect the interests of stakeholders, and facilitate successful transactions in the state of Oregon.