Oregon Correction Assignment of Overriding Royalty Interest Correcting Lease Description

Description

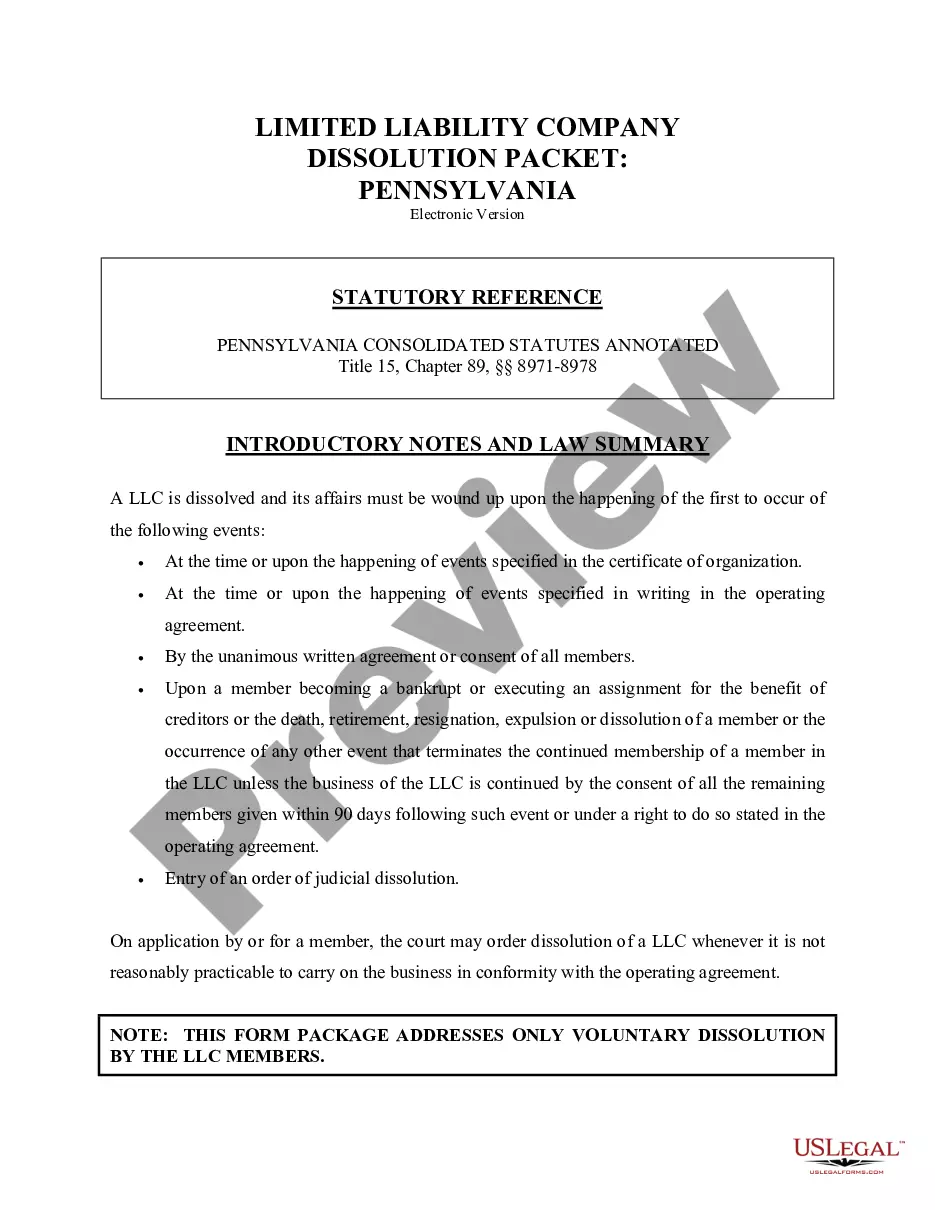

How to fill out Correction Assignment Of Overriding Royalty Interest Correcting Lease Description?

US Legal Forms - one of many largest libraries of lawful forms in the United States - gives a variety of lawful papers themes it is possible to download or produce. Using the web site, you may get thousands of forms for enterprise and specific uses, sorted by groups, states, or key phrases.You can find the most recent variations of forms such as the Oregon Correction Assignment of Overriding Royalty Interest Correcting Lease Description in seconds.

If you have a subscription, log in and download Oregon Correction Assignment of Overriding Royalty Interest Correcting Lease Description from your US Legal Forms collection. The Down load option will appear on each and every develop you perspective. You gain access to all earlier delivered electronically forms within the My Forms tab of your own bank account.

If you want to use US Legal Forms the very first time, listed here are simple directions to get you started off:

- Ensure you have picked the correct develop for the city/county. Select the Review option to check the form`s information. Browse the develop description to ensure that you have selected the appropriate develop.

- If the develop doesn`t match your specifications, make use of the Look for area towards the top of the display to obtain the one who does.

- In case you are pleased with the shape, confirm your selection by clicking on the Get now option. Then, select the costs strategy you favor and give your references to sign up for an bank account.

- Process the purchase. Make use of your bank card or PayPal bank account to accomplish the purchase.

- Find the structure and download the shape on your own system.

- Make alterations. Fill out, edit and produce and indication the delivered electronically Oregon Correction Assignment of Overriding Royalty Interest Correcting Lease Description.

Every single format you included with your bank account lacks an expiry day which is the one you have eternally. So, if you wish to download or produce another duplicate, just visit the My Forms portion and then click around the develop you require.

Obtain access to the Oregon Correction Assignment of Overriding Royalty Interest Correcting Lease Description with US Legal Forms, by far the most substantial collection of lawful papers themes. Use thousands of expert and condition-specific themes that satisfy your organization or specific requires and specifications.

Form popularity

FAQ

Overriding royalty interest: Unlike mineral and royalty interests, an overriding royalty interest runs with a lease and not with the land. Therefore, they only remain in effect for as long as a lease is in effect and they expire when a lease expires.

How to calculate the overriding royalty interest? ORRI = NRI * 5 percent. $750,000 * 0.005 = $3,750.

Royalty interest in the oil and gas industry refers to ownership of a portion of a resource or the revenue it produces. A company or person that owns a royalty interest does not bear any operational costs needed to produce the resource, yet they still own a portion of the resource or revenue it produces.

There are three main types of royalty interests: Overriding royalty interest: Unlike mineral and royalty interests, an overriding royalty interest runs with a lease and not with the land. Therefore, they only remain in effect for as long as a lease is in effect and they expire when a lease expires.

An overriding royalty interest (ORRI) is an interest carved out of a working interest. It is: A percentage of gross production that is not charged with any expenses of exploring, developing, producing, and operating a well.

Overriding Royalty Interest Conveyance means an assignment, in form and substance acceptable to Lender, pursuant to which Borrower grants in favor of Lender an overriding royalty interest equal to six and one-fourth percent (6.25%) of Hydrocarbons produced, saved and sold or used off the premises of the relevant Lease, ...

Overriding Royalty Interest: A given interest severed out of the record title interest or lessee's share of the oil, and not charged with any of the cost or expense of developing or operation. The interest provides no control over the operations of the lease, only revenue from lease production.

What Determines the Value of an Overriding Royalty Interest? Mineral interest location. One in a shale basin with high production is worth more. Producing oil and gas wells. Wells currently producing are valued more. ... Production reserves and levels. ... Prices.