Oregon Deed and Assignment from Trustee to Trust Beneficiaries is a legal instrument that transfers ownership of property held in a trust to the beneficiaries named in the trust agreement. This process involves the trustee, who is the legal holder of the property, conveying the property to the beneficiaries who are entitled to receive it. There are several types of Oregon Deed and Assignment from Trustee to Trust Beneficiaries, each with its specific purpose: 1. Warranty Deed from Trustee to Trust Beneficiaries: This type of deed guarantees that the property being transferred is free from any encumbrances or adverse claims, providing the beneficiaries with full and clear ownership of the property. 2. Quitclaim Deed from Trustee to Trust Beneficiaries: Unlike a warranty deed, a quitclaim deed does not offer any guarantees regarding the title status of the property. It simply transfers the trustee's interests in the property to the beneficiaries. This type of deed is commonly used when the beneficiaries are already aware of any potential title issues or when transferring property between family members. 3. Inter vivos Deed from Trustee to Trust Beneficiaries: An inter vivos deed, also known as a living trust deed, is used when the trustee wishes to transfer property to the trust beneficiaries while they are still alive. This allows the beneficiaries to avoid the probate process, ensuring a smooth transfer of ownership upon the trustee's death. 4. Testamentary Deed from Trustee to Trust Beneficiaries: This type of deed is executed after the death of the trustee and transfers property according to the instructions specified in their will or trust agreement. Testamentary deeds are typically used to distribute assets to beneficiaries as part of an estate plan and are subject to the probate process. The Oregon Deed and Assignment from Trustee to Trust Beneficiaries is a crucial legal document that ensures a seamless transfer of property ownership from the trustee to the beneficiaries. It is essential to consult with an experienced attorney to determine the appropriate deed type and to oversee the entire process to comply with Oregon state laws and regulations.

Oregon Deed and Assignment from Trustee to Trust Beneficiaries

Description

How to fill out Oregon Deed And Assignment From Trustee To Trust Beneficiaries?

You may devote time online attempting to find the legal document template that suits the state and federal requirements you need. US Legal Forms provides 1000s of legal kinds that are evaluated by professionals. It is possible to down load or produce the Oregon Deed and Assignment from Trustee to Trust Beneficiaries from my service.

If you already possess a US Legal Forms bank account, you are able to log in and then click the Download option. Next, you are able to full, change, produce, or signal the Oregon Deed and Assignment from Trustee to Trust Beneficiaries. Every single legal document template you buy is your own property permanently. To have an additional duplicate for any obtained kind, go to the My Forms tab and then click the corresponding option.

Should you use the US Legal Forms internet site for the first time, stick to the easy guidelines under:

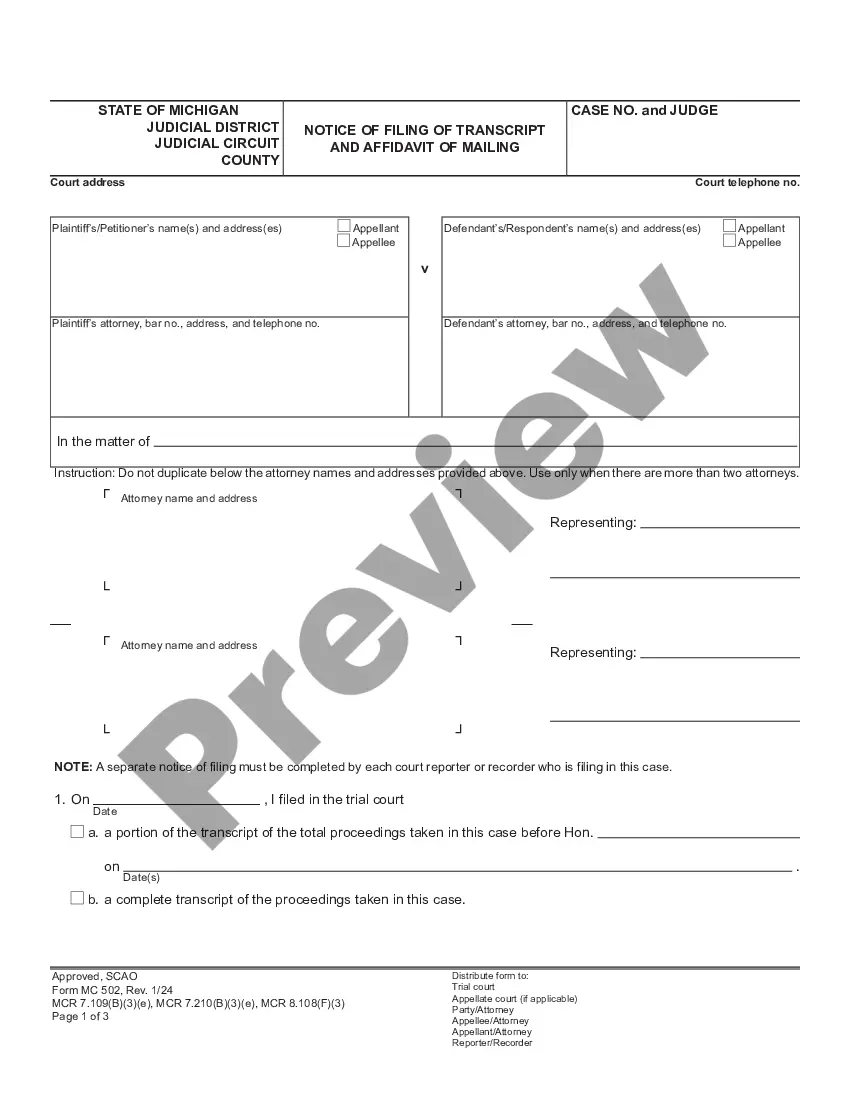

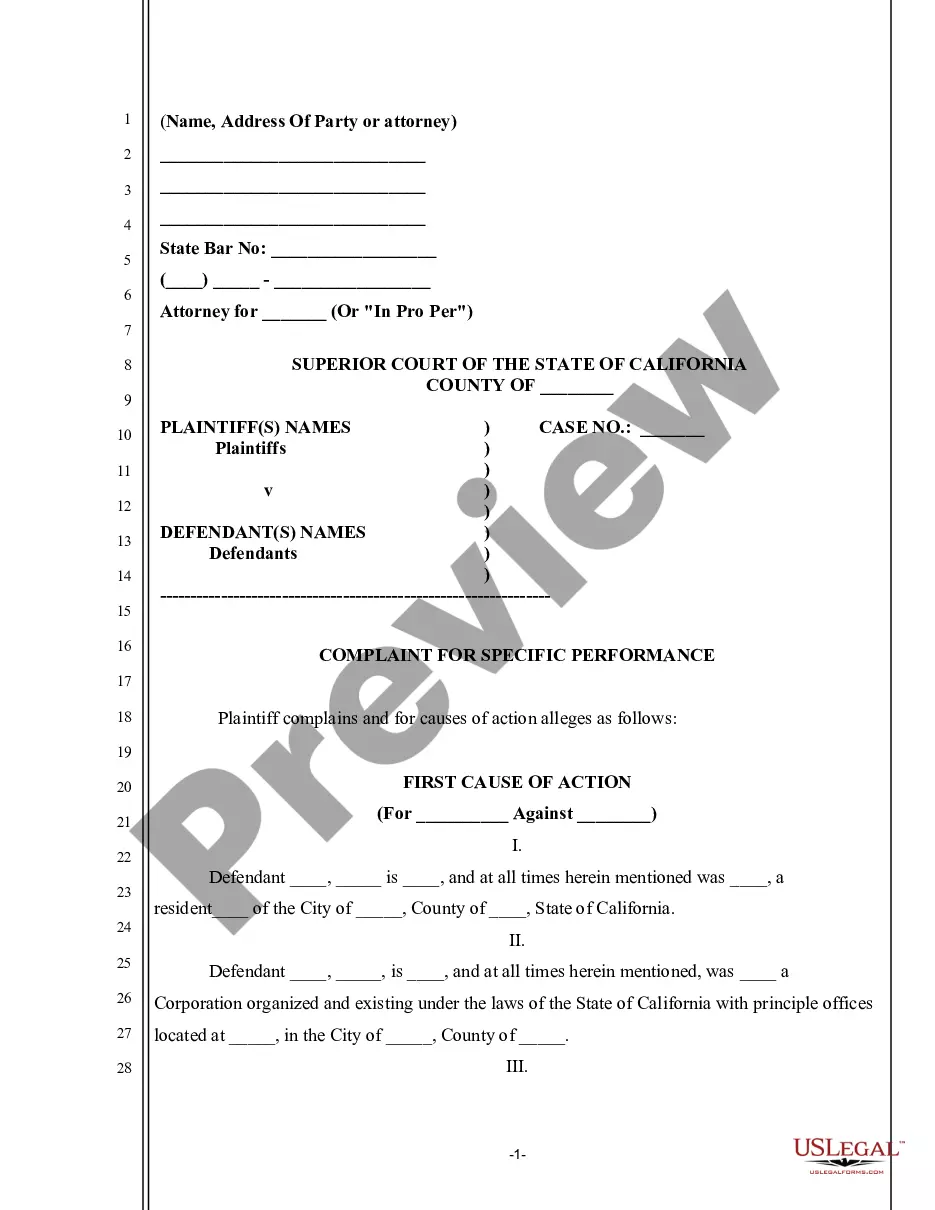

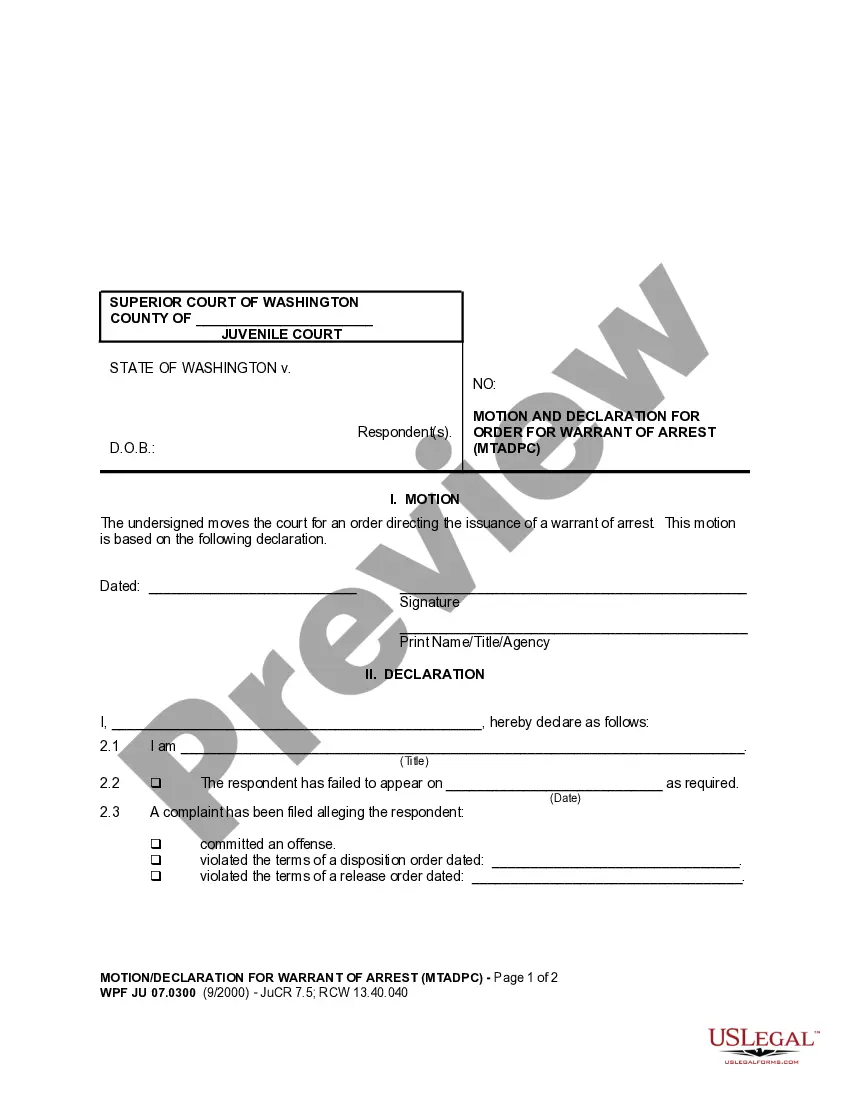

- Initial, make certain you have chosen the right document template to the region/city of your liking. Browse the kind outline to make sure you have chosen the proper kind. If readily available, use the Review option to appear through the document template also.

- If you would like find an additional version of the kind, use the Search area to get the template that suits you and requirements.

- Once you have discovered the template you desire, just click Acquire now to proceed.

- Select the pricing strategy you desire, key in your qualifications, and register for an account on US Legal Forms.

- Total the financial transaction. You may use your charge card or PayPal bank account to fund the legal kind.

- Select the format of the document and down load it to the device.

- Make adjustments to the document if needed. You may full, change and signal and produce Oregon Deed and Assignment from Trustee to Trust Beneficiaries.

Download and produce 1000s of document templates making use of the US Legal Forms Internet site, that provides the largest assortment of legal kinds. Use expert and status-distinct templates to deal with your business or specific requires.

Form popularity

FAQ

The Oregon Trust Deed Act allows the lender to assigns a deed to a third-party (trustee). The trustee must be one of the following: An attorney under the Oregon State Bar. A law firm under the Oregon State Bar.

The transferee must have been a beneficiary of the trust when the property was acquired and became an asset of the trust (i.e. the relevant time). There must be no consideration for the transfer and the transfer of property from trustee to beneficiary must not be part of a sale or other arrangement.

Most counties charge a flat fee of between $95.00 and $110.00, plus an additional $5.00 for each page of the deed. A clerk may charge a $20.00 penalty fee if the clerk accepts for filing a deed that does not comply with Oregon's formatting requirements or omits necessary information from the deed's first page.

In real estate law, "assignment" is simply the transfer of a deed of trust from one party to another. This usually happens when the beneficiary of a trust deed sells their loan to another lender.

The key disadvantages of placing a house in a trust include the following: Extra paperwork: Moving property in a trust requires the house owner to transfer the asset's legal title. This involves preparing and signing an additional deed, and some people may consider this cumbersome.

This transfer doesn't usually lead to an immediate tax obligation, meaning no tax is levied for merely changing the ownership. However, the trust, which now owns the stock, may become liable for taxes on dividends and capital gains from the stock.

To transfer real property into your Trust, a new deed reflecting the name of the Trust must be executed, notarized and recorded with the County Recorder in the County where the property is located. Care must be taken that the exact legal description in the existing deed appears on the new deed.

?You'll need to file a quit claim deed and a change of ownership form that transfers title from your name to the trust," said Banuelos. ?If you own several commercial investment properties, you might own each of the properties through an individual LLC to limit your liability.